by Calculated Risk on 2/03/2022 11:58:00 AM

Thursday, February 03, 2022

January Employment Preview

On Friday at 8:30 AM ET, the BLS will release the employment report for January. The consensus is for 155 thousand jobs added, and for the unemployment rate to be unchanged at 3.9%.

Click on graph for larger image.

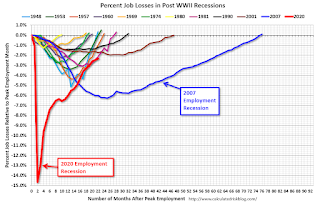

Click on graph for larger image.• First, currently there are still about 3.6 million fewer jobs than in February 2020 (before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 22 months after the onset, is now significantly better than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a loss of 301,000 private sector jobs, well below the consensus estimates of 208,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be below expectations.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased in January to 54.5%, up from 53.9% last month. This would suggest 5,000 jobs added in manufacturing employment in January. ADP showed 21,000 manufacturing jobs lost.

The ISM® Services employment index decreased in January to 52.3%, down from 54.7% last month. This would suggest a 135 thousand increase in service employment in January. Combined, the ISM indexes suggest employment slightly below the consensus estimate.

• Unemployment Claims: The weekly claims report showed a sharp increase in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 206,000 in December to 290,000 in January. This would usually suggest more layoffs in January than in December, although this might not be very useful right now. In general, weekly claims were below expectations in January.

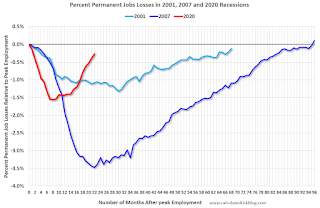

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the November report.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the November report.This data is only available back to 1994, so there is only data for three recessions. In December, the number of permanent job losers decreased to 1.703 million from 1.905 million in November.

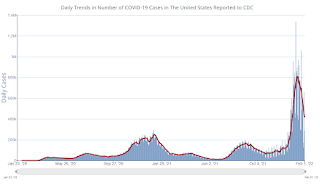

• COVID: As far as the pandemic, the number of daily cases during the reference week in January was a record 800,000, up sharply from around 120,000 in December. The current wave peaked during the January reference week, and probably had a significant impact on January hiring.

• Conclusion: There is significant pessimism concerning the January employment report due to the current COVID wave, and many analysts are expecting job losses in January. For example, from Merrill Lynch economists:

"We expect nonfarm payrolls contracted by 150k in Jan owing to the shock from the Omicron variant. The U-rate should hold at 3.9%"

ISM® Services Index Decreased to 59.9% in January

by Calculated Risk on 2/03/2022 10:03:00 AM

(Posted with permission). The December ISM® Services index was at 59.9%, down from 62.3% last month. The employment index decreased to 52.3%, from 54.7%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 59.9% January 2022 Services ISM® Report On Business®

Economic activity in the services sector grew in January for the 20th month in a row — with the Services PMI® registering 59.9 percent — say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®.The employment index decreased to 52.3%, from 54.7% the previous month.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In January, the Services PMI® registered 59.9 percent, 2.4 percentage points below December’s seasonally adjusted reading of 62.3 percent. The Business Activity Index registered 59.9 percent, a decrease of 8.4 percentage points compared to the seasonally adjusted reading of 68.3 percent in December, and the New Orders Index registered 61.7 percent, 0.4 percentage point lower than the seasonally adjusted reading of 62.1 percent reported in December.

emphasis added

Weekly Initial Unemployment Claims Decrease to 238,000

by Calculated Risk on 2/03/2022 08:34:00 AM

The DOL reported:

In the week ending January 29, the advance figure for seasonally adjusted initial claims was 238,000, a decrease of 23,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 260,000 to 261,000. The 4-week moving average was 255,000, an increase of 7,750 from the previous week's revised average. The previous week's average was revised up by 250 from 247,000 to 247,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 255,000.

The previous week was revised up.

Weekly claims were close to the consensus forecast and increased recently likely due to the current COVID wave.

Wednesday, February 02, 2022

Thursday: Unemployment Claims, ISM Services

by Calculated Risk on 2/02/2022 08:50:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for a decrease to 250 thousand from 260 thousand last week.

• At 10:00 AM, the ISM Services Index for January.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 63.8% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 212.0 | --- | ≥2321 | |

| New Cases per Day3 | 415,552 | 636,024 | ≤5,0002 | |

| Hospitalized3 | 127,329 | 143,924 | ≤3,0002 | |

| Deaths per Day3🚩 | 2,369 | 2,286 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Mike Simonsen of Altos Research and I Discuss Housing

by Calculated Risk on 2/02/2022 04:00:00 PM

Mike Simonsen of Altos Research and I discussed housing on “Top of the Mind”.

Here is webpage: Looking for Risks in the Future of the Real Estate Market

We discussed:

• Bill McBride shares why he started the Calculated Risk blog

• How Bill predicted the 2005 housing bubble

• What risks does Bill foresee in the future real estate market?

• Why are there fewer houses for sale, and is it a problem?

• Millennial home-buying trends

• Bill’s predictions for the second half of 2022

• Real estate trends outside of the US

• Why sellers should wait for multiple offers instead of taking the first one

• What’s the next big shift in the real estate market?

• How the remote working trend is impacting the real estate market

Update: Framing Lumber Prices Up More Than Double from Two Years Ago

by Calculated Risk on 2/02/2022 01:54:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through February 2nd.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.A combination of strong demand and various supply constraints have pushed up the price of lumber.

HVS: Q4 2021 Homeownership and Vacancy Rates

by Calculated Risk on 2/02/2022 10:14:00 AM

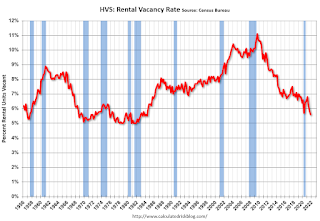

The Census Bureau released the Residential Vacancies and Homeownership report for Q4 2021.

The results of this survey were significantly distorted by the pandemic in 2020.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. Analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

National vacancy rates in the fourth quarter 2021 were 5.6 percent for rental housing and 0.9 percent for homeowner housing. The rental vacancy rate was 0.9 percentage points lower than the rate in the fourth quarter 2020 (6.5 percent) and not statistically different from the rate in the third quarter 2021 (5.8 percent).

The homeowner vacancy rate of 0.9 percent was 0.1 percentage points lower than the rate in the fourth quarter 2020 (1.0 percent) and virtually the same as the rate in the third quarter 2021 (0.9 percent).

The homeownership rate of 65.5 percent was not statistically different from the rate in the fourth quarter 2020 (65.8 percent) and not statistically different from the rate in the third quarter 2021 (65.4 percent). "

emphasis added

Click on graph for larger image.

Click on graph for larger image.The Red dots are the decennial Census homeownership rates for April 1st, 1990, 2000 and 2010. The Census Bureau will release data for 2020 soon.

The results starting in Q2 2020 were distorted by the pandemic.

The HVS homeowner vacancy was unchanged at 0.9% in Q4.

The HVS homeowner vacancy was unchanged at 0.9% in Q4. Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

ADP: Private Employment Decreased 301,000 in January

by Calculated Risk on 2/02/2022 08:19:00 AM

Private sector employment decreased by 301,000 jobs from December to January according to the January ADP® National Employment ReportTM. Broadly distributed to the public each month, free of charge, the ADP National Employment Report is produced by the ADP Research Institute® in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual data of those who are on a company’s payroll, measures the change in total nonfarm private employment each month on a seasonally-adjusted basisThis was well below the consensus forecast of 208,000 for this report.

“The labor market recovery took a step back at the start of 2022 due to the effect of the Omicron variant and its significant, though likely temporary, impact to job growth,” said Nela Richardson, chief economist, ADP. “The majority of industry sectors experienced job loss, marking the most recent decline since December 2020. Leisure and hospitality saw the largest setback after substantial gains in fourth quarter 2021, while small businesses were hit hardest by losses, erasing most of the job gains made in December 2021.”

emphasis added

The BLS report will be released Friday, and the consensus is for 155 thousand non-farm payroll jobs added in January. The ADP report has not been very useful in predicting the BLS report, but this suggests weakness in the January BLS report.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 2/02/2022 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 12.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 28, 2022.

... The Refinance Index increased 18 percent from the previous week and was 50 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index increased 12 percent compared with the previous week and was 7 percent lower than the same week one year ago.

“Most mortgage rates in MBA’s survey continued to rise, with the 30-year fixed rate reaching its highest level since March 2020 at 3.78 percent. Despite the increase in rates, refinance applications were up 18 percent, driven mainly by a 22 percent jump in conventional applications. There has likely been some recent volatility in application counts due to holiday-impacted weeks, as well as from borrowers trying to secure a refinance before rates go even higher,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications also increased in the final full week of January but remained 7 percent lower than a year ago. The average purchase loan size hit a new survey high once again at $441,100. Stubbornly low inventory levels and swift home-price growth continue to push average loan sizes higher.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 3.78 percent from 3.72 percent, with points decreasing to 0.41 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 7% year-over-year unadjusted.

According to the MBA, purchase activity is down 7% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, February 01, 2022

Wednesday: ADP Employment, Q4 Housing Vacancies and Homeownership

by Calculated Risk on 2/01/2022 08:47:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 208,000 payroll jobs added in January, down from 807,000 added in December.

• At 10:00 AM, the Q4 2021 Housing Vacancies and Homeownership from the Census Bureau.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 63.8% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 212.0 | --- | ≥2321 | |

| New Cases per Day3 | 446,355 | 696,832 | ≤5,0002 | |

| Hospitalized3 | 129,637 | 144,898 | ≤3,0002 | |

| Deaths per Day3🚩 | 2,287 | 2,197 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.