by Calculated Risk on 2/04/2022 10:00:00 PM

Friday, February 04, 2022

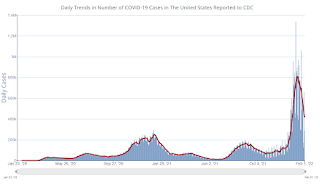

COVID Update: February 4, 2022: Falling Cases and Hospitalizations; 2,400 Deaths per Day

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 64.0% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 212.3 | --- | ≥2321 | |

| New Cases per Day3 | 343,563 | 577,975 | ≤5,0002 | |

| Hospitalized3 | 120,724 | 140,770 | ≤3,0002 | |

| Deaths per Day3🚩 | 2,371 | 2,353 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

"Mortgage Rates Leap Toward 4.0%, Highest Since October 2019"

by Calculated Risk on 2/04/2022 04:17:00 PM

Today, in the Calculated Risk Real Estate Newsletter: "Mortgage Rates Leap Toward 4.0%, Highest Since October 2019"

A brief excerpt:

With the strong employment report for January, interest rates have increased.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Mortgage News Daily reports that the most prevalent 30-year fixed rate is now at 3.85% for top tier scenarios. Matthew Graham at Mortgage News Daily wrote today: Mortgage Rates Leap Toward 4.0%, Highest Since October 2019If we disregard the once-in-a-lifetime volatility seen in March 2020 (and we absolutely should), today's mortgage rates are now in line with the highs seen in October 2019. The average lender is now quoting conventional 30yr fixed rates in the 3.75-3.875% neighborhood. That's a full eighth of a point higher than yesterday, and more than a full percentage point higher than the lowest rates in August 2021. Many less than perfect loan scenarios will see rates over 4%.With the ten-year yield at 1.93%, and based on an historical relationship, 30-year rates should currently be around 3.8%. So, mortgage rates are as expected based on the ten-year yield.

The graph shows the relationship between the monthly 10-year Treasury Yield and 30-year mortgage rates from the Freddie Mac survey.

AAR: January Rail Carloads and Intermodal Down Year-over-year

by Calculated Risk on 2/04/2022 02:46:00 PM

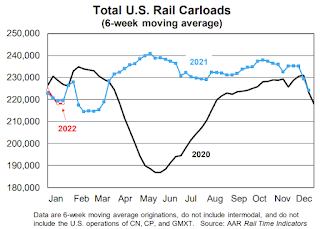

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

U.S. railroads originated 902,265 total carloads in January 2022, down 3.0% (27,861 carloads) from January 2021. It’s the fewest carloads for the first four weeks of a year since sometime before 1988, when our data begin. ...

U.S. intermodal volume was 1.00 million units in January 2022, down 14.6% from last year, but January 2021 was the second best month ever for intermodal.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2019, 2020 and 2021:

U.S. railroads originated 902,265 total carloads in January 2022, down 3.0% (27,861 carloads) from January 2021 and the fewest for the first four weeks of a year since sometime before 1988, when our data begin. ... Carloads excluding coal fell 6.0% in January 2022 from last year, their biggest year-over-year decline since February 2021 and, before that, August 2020.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2019, 2020 and 2021: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2019, 2020 and 2021: (using intermodal or shipping containers):U.S. intermodal originations totaled 1.00 million units in January 2022, down 14.6% (171,796 units) from January 2021. As with some carload commodities, the comparisons for intermodal were tough: January 2021 was the second highest volume month ever for U.S. intermodal, fractionally behind April 2021. January 2022 was the fifth best January ever for intermodal.

Hotels: Occupancy Rate Down 12% Compared to Same Week in 2019

by Calculated Risk on 2/04/2022 01:07:00 PM

U.S. hotel performance increased slightly from the previous week and showed improved comparisons against 2019, according to STR‘s latest data through Jan. 29.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Jan. 23-29, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 49.7% (-12.2%)

• Average daily rate (ADR): $122.40 (-1.9%)

• Revenue per available room (RevPAR): $60.82 (-13.9%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

Comments on January Employment Report

by Calculated Risk on 2/04/2022 09:32:00 AM

This was a strong report, and the revisions show job growth was stronger - and steadier - over the last year than originally reported.

The headline jobs number in the January employment report was well above expectations, and employment for the previous two months was revised up by 709,000. The participation rate and the employment-population ratio both increased, however the unemployment rate increased to 4.0%.

In January, the year-over-year employment change was 6.61 million jobs.

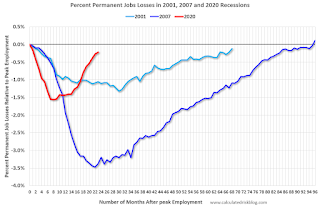

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today. (ht Joe Weisenthal at Bloomberg).

In January, the number of permanent job losers decreased to 1.630 million from 1.703 million in November.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The prime working age will be key as the economy recovers.

The 25 to 54 participation rate increased in January to 82.0% from 81.9% in December, and the 25 to 54 employment population ratio increased to 79.1% from 79.0% the previous month.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons, at 3.7 million, continued to trend down over the month. The over-the-year decline of 2.2 million brings this measure to 673,000 below its February 2020 level. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in January to 3.717 million from 3.929 million in December. This is lower than pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 7.1% from 7.3% in the previous month. This is down from the record high in April 22.9% for this measure since 1994. This measure was at 7.0% in February 2020 (pre-pandemic).

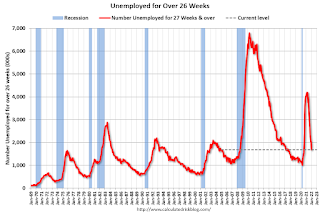

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.691 million workers who have been unemployed for more than 26 weeks and still want a job, down from 2.008 million the previous month.

This does not include all the people that left the labor force.

Summary:

The headline monthly jobs number was well above expectations; and the previous two months were revised up by 709,000 combined. With the revisions - including the benchmark revision - job growth was stronger and steadier over the last year than originally reported.

January Employment Report: 467 thousand Jobs, 4.0% Unemployment Rate

by Calculated Risk on 2/04/2022 08:47:00 AM

From the BLS:

Total nonfarm payroll employment rose by 467,000 in January, and the unemployment rate was little changed at 4.0 percent, the U.S. Bureau of Labor Statistics reported today. Employment growth continued in leisure and hospitality, in professional and business services, in retail trade, and in transportation and warehousing.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In January, the year-over-year change was 6.61 million jobs. This was up significantly year-over-year.

Total payrolls increased by 467 thousand in January. Private payrolls increased by 444 thousand, and public payrolls increased 23 thousand.

Payrolls for November and December were revised up 709 thousand, combined.

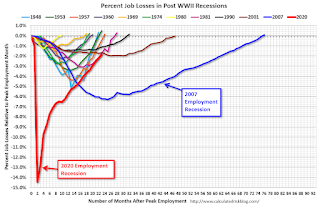

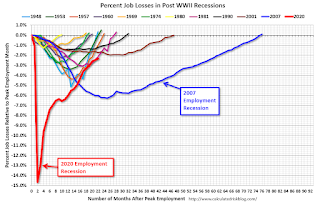

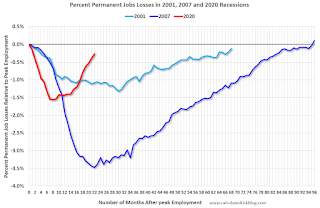

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 23 months after the onset, is now significantly better than the worst of the "Great Recession".

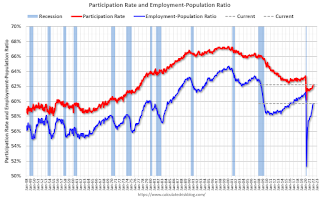

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 62.2% in January, from 61.9% in December. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 62.2% in January, from 61.9% in December. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 59.7% from 59.5% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

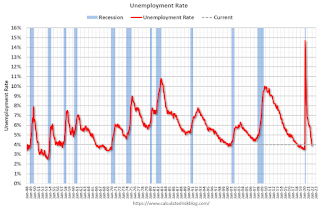

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased in January to 4.0% from 3.9% in December.

This was well above consensus expectations; and November and December payrolls were revised up by 709,000 combined.

The total nonfarm employment level for March 2021 was revised upward by 374,000. On a not seasonally adjusted basis, total nonfarm employment for March 2021 was revised downward by 7,000, or less than -0.05 percent.

Thursday, February 03, 2022

Friday: Employment Report

by Calculated Risk on 2/03/2022 10:37:00 PM

My January Employment Preview

Goldman January Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for January. The consensus is for 155 thousand jobs added, and for the unemployment rate to be unchanged at 3.9%. There were 199 thousand jobs added in December, and the unemployment rate was at 3.9%.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 63.9% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 212.1 | --- | ≥2321 | |

| New Cases per Day3 | 415,552 | 636,024 | ≤5,0002 | |

| Hospitalized3 | 124,134 | 142,482 | ≤3,0002 | |

| Deaths per Day3🚩 | 2,369 | 2,286 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Goldman January Payrolls Preview

by Calculated Risk on 2/03/2022 03:57:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls declined by 250k, 400k below consensus of +150k. Our forecast reflects a large and temporary drag from Omicron on the order of 500-1000k, as survey data indicate a surge in absenteeism during the month ... We estimate an unchanged unemployment rate of 3.9%—in line with consensus—reflecting likely declines in both household employment and labor force participation due to the virus wave.CR Note: The consensus is for 155 thousand jobs added, and for the unemployment rate to be unchanged at 3.9%.

emphasis added

Used Vehicle Wholesale Prices

by Calculated Risk on 2/03/2022 01:44:00 PM

Since the pandemic has disrupted new car production and sales, used car prices increased sharply. This pushed up inflation ("Used Cars" were up 51% annualized in December).

Here is some data on used vehicle wholesale prices. From Manheim Consulting today: Wholesale Prices Rise Further in First Half of January

Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 0.8% in the first 15 days of January compared to the month of December. This brought the Manheim Used Vehicle Value Index to 238.0, a 46.0% increase from January 2021. As was the case in each of the last three months, much of the reported increase was a result of the seasonal adjustment. The non-adjusted price was statistically unchanged from December.

Manheim Market Report (MMR) prices saw declines through the first two full weeks of January. The Three-Year-Old MMR Index, which represents the largest model year cohort at auction, experienced a 1.3% cumulative decline over the last two weeks.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

According to the BLS, "Used cars and trucks in U.S. city average, all urban consumers, seasonally adjusted" is up 55% since the low in June 2020.

January Employment Preview

by Calculated Risk on 2/03/2022 11:58:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for January. The consensus is for 155 thousand jobs added, and for the unemployment rate to be unchanged at 3.9%.

Click on graph for larger image.

Click on graph for larger image.• First, currently there are still about 3.6 million fewer jobs than in February 2020 (before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 22 months after the onset, is now significantly better than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a loss of 301,000 private sector jobs, well below the consensus estimates of 208,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be below expectations.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased in January to 54.5%, up from 53.9% last month. This would suggest 5,000 jobs added in manufacturing employment in January. ADP showed 21,000 manufacturing jobs lost.

The ISM® Services employment index decreased in January to 52.3%, down from 54.7% last month. This would suggest a 135 thousand increase in service employment in January. Combined, the ISM indexes suggest employment slightly below the consensus estimate.

• Unemployment Claims: The weekly claims report showed a sharp increase in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 206,000 in December to 290,000 in January. This would usually suggest more layoffs in January than in December, although this might not be very useful right now. In general, weekly claims were below expectations in January.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the November report.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the November report.This data is only available back to 1994, so there is only data for three recessions. In December, the number of permanent job losers decreased to 1.703 million from 1.905 million in November.

• COVID: As far as the pandemic, the number of daily cases during the reference week in January was a record 800,000, up sharply from around 120,000 in December. The current wave peaked during the January reference week, and probably had a significant impact on January hiring.

• Conclusion: There is significant pessimism concerning the January employment report due to the current COVID wave, and many analysts are expecting job losses in January. For example, from Merrill Lynch economists:

"We expect nonfarm payrolls contracted by 150k in Jan owing to the shock from the Omicron variant. The U-rate should hold at 3.9%"