by Calculated Risk on 2/10/2022 12:05:00 PM

Thursday, February 10, 2022

The Impact on Housing of Higher Mortgage Rates

Today, in the Calculated Risk Real Estate Newsletter: The Impact on Housing of Higher Mortgage Rates

A brief excerpt:

Looking back at previous periods with similar increases in mortgage rates - like in 2013 when mortgage rates increased from 3.4% to 4.5% from May to July - new home sales fell from about 440 thousand per month to about 390 thousand per month. This was a decline of about 10%.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

There was a similar decline in 1994 when rates increased from 7.2% to 8.4%, and new home sales fell from around 730 thousand to 650 thousand. And in 2018, rates increased from around 4.0% to 4.9%, and new home sales declined from around 650 thousand to 590 thousand.

There are other periods when rates increased - like in 1999 - and new home sales only declined slightly. Here is a graph of 30-year mortage rates. The arrows point to the three periods mentioned above.

...

With 4% 30-year mortgage rates, we will likely see a slowdown in both new and existing home sales (based on previous periods of rising rates). It also seems likely house price growth will slow. However, the impact on inventory is unclear.

An interesting question: Will higher mortgage rates slow investor buying? Higher rates will make buy-to-rent less attractive. Investor buying - and build-to-rent - will be areas to watch.

There is further downside risk if mortgage rates continue to increase, or if we see a significant increase in inventory (something we didn’t see in previous periods of rising mortgage rates).

Cleveland Fed: Median CPI increased 0.6% and Trimmed-mean CPI increased 0.6% in January

by Calculated Risk on 2/10/2022 11:21:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.6% in January. The 16% trimmed-mean Consumer Price Index also increased 0.6% in January. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details here: "Used Cars" were only up 19% annualized, and this will likely show declines in coming months.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

MBA: "Mortgage Delinquencies Decrease in the Fourth Quarter of 2021"

by Calculated Risk on 2/10/2022 10:44:00 AM

From the MBA: Mortgage Delinquencies Decrease in the Fourth Quarter of 2021

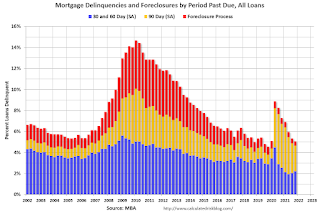

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 4.65 percent of all loans outstanding at the end of the fourth quarter of 2021, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage. The delinquency rate was down 23 basis points from the third quarter of 2021 and down 208 basis points from one year ago.

“Mortgage delinquencies descended in the final three months of 2021, reaching levels at or below MBA’s survey averages dating back to 1979,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “The fourth-quarter delinquency rate of 4.65 percent was 67 basis points lower than MBA’s survey average of 5.32 percent. Furthermore, the seriously delinquent rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 2.83 percent in the fourth quarter, close to the long-term average of 2.80 percent.”

Added Walsh, “The quarters right before the COVID-19 pandemic represented some of the lowest delinquencies ever recorded. Delinquencies are now approaching levels not seen since the first quarter of 2020, which is a testament to the strength of the U.S. labor market.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Overall delinquencies decreased in Q4.

From the MBA:

Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate increased 14 basis points to 1.65 percent, the 60-day delinquency rate increased 4 basis points to 0.56 percent, and the 90-day delinquency bucket decreased 41 basis points to 2.44 percent.This sharp increase in 2020 in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 0.42 percent, down 4 basis points from the third quarter of 2021 and 14 basis points lower than one year ago. This is the lowest foreclosure inventory rate since the third quarter of 1981. The percentage of loans on which foreclosure actions were started in the fourth quarter rose by 1 basis point to 0.04 percent, up from the survey low seen in third-quarter 2021 at 0.03 percent.

The percent of loans in the foreclosure process declined further and was at the lowest level since 1981.

Weekly Initial Unemployment Claims Decrease to 223,000

by Calculated Risk on 2/10/2022 08:40:00 AM

The DOL reported:

In the week ending February 5, the advance figure for seasonally adjusted initial claims was 223,000, a decrease of 16,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 238,000 to 239,000. The 4-week moving average was 253,250, a decrease of 2,000 from the previous week's revised average. The previous week's average was revised up by 250 from 255,000 to 255,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 253,250.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.

BLS: CPI increased 0.6% in January; Core CPI increased 0.6%

by Calculated Risk on 2/10/2022 08:31:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.6 percent in January on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 7.5 percent before seasonal adjustment.Both CPI and core CPI were above expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

Increases in the indexes for food, electricity, and shelter were the largest contributors to the seasonally adjusted all items increase. The food index rose 0.9 percent in January following a 0.5-percent increase in December. The energy index also increased 0.9 percent over the month, with an increase in the electricity index being partially offset by declines in the gasoline index and the natural gas index.

The index for all items less food and energy rose 0.6 percent in January, the same increase as in December. This was the seventh time in the last 10 months it has increased at least 0.5 percent. Along with the index for shelter, the indexes for household furnishings and operations, used cars and trucks, medical care, and apparel were among many indexes that increased over the month.

The all items index rose 7.5 percent for the 12 months ending January, the largest 12-month increase since the period ending February 1982. The all items less food and energy index rose 6.0 percent, the largest 12-month change since the period ending August 1982. The energy index rose 27.0 percent over the last year, and the food index increased 7.0 percent.

emphasis added

Wednesday, February 09, 2022

Thursday: CPI, Initial Unemployment Claims

by Calculated Risk on 2/09/2022 08:14:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for a decrease to 235 thousand from 238 thousand last week.

• Also, at 8:30 AM, The Consumer Price Index for January from the BLS. The consensus is for 0.5% increase in CPI, and a 0.5% increase in core CPI.

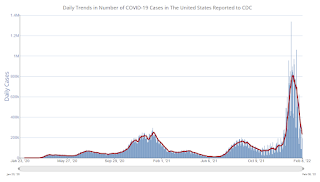

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 64.2% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 213.2 | --- | ≥2321 | |

| New Cases per Day3 | 230,602 | 413,730 | ≤5,0002 | |

| Hospitalized3 | 102,695 | 128,366 | ≤3,0002 | |

| Deaths per Day3 | 2,303 | 2,402 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

2nd Look at Local Housing Markets in January

by Calculated Risk on 2/09/2022 03:09:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in January

A brief excerpt:

Adding Houston, Memphis, Nashville, New Hampshire, North Texas and PortlandThere is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This is the second look at local markets in January. I’m tracking about 30 local housing markets in the US. Some of the 30 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

My view is that if the housing market starts slowing, it will show up in inventory first (not yet!).

The following data is important, especially active inventory. One of the key factors for house prices is supply and tracking local inventory reports will help us understand what is happening with supply.

On a national basis, we are seeing record low inventory over the Winter. I’ll be watching to see if inventory follows the normal seasonal pattern and bottoms in February. Last year, inventory didn’t bottom until April.

...

Here is a summary of active listings for these housing markets in January. Inventory was down 9.5% in January month-over-month (MoM) from December, and down 25.7% year-over-year (YoY).

Inventory almost always declines seasonally during the Winter, so the MoM decline is not a surprise. Last month, these markets were down 24.8% YoY, so the YoY decline in January is slightly larger than in December. This isn’t indicating a slowing market.

Notes for all tables:

New additions to table in BOLD.

Northwest (Seattle), North Texas (Dallas)

Energy expenditures as a percentage of PCE

by Calculated Risk on 2/09/2022 09:25:00 AM

During the early stages of the pandemic, energy expenditures as a percentage of PCE hit an all-time low of 3.3% of PCE. Since then, energy expenditures have increased. Here is an update through the December PCE report.

Below is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through December 2021.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

In general, energy expenditures as a percent of PCE have been trending down for years.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 2/09/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

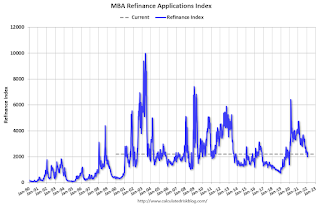

Mortgage applications decreased 8.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 4, 2022.

... The Refinance Index decreased 7 percent from the previous week and was 52 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 10 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 12 percent lower than the same week one year ago.

“Mortgage rates continued to edge higher last week, with the 30-year fixed rate climbing to 3.83 percent. Mortgage rates followed the U.S. 10-year yield and other sovereign bonds as the Federal Reserve and other key global central banks responded to growing inflationary pressures and signaled that they will start to remove accommodative policies. With rates 87 basis points higher than the same week a year ago, refinance applications continued to decrease,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase activity slowed after the previous week's gain. Both conventional and FHA purchase applications saw proportional declines, resulting in purchase activity overall dropping 10 percent. The average loan size again hit another record high at $446,000. Activity continues to be dominated by larger loan balances, as inventory remains tight for entry-level buyers.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 3.83 percent from 3.78 percent, with points decreasing to 0.40 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 12% year-over-year unadjusted.

According to the MBA, purchase activity is down 12% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, February 08, 2022

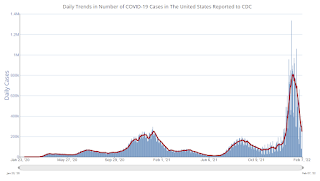

COVID February 8, 2022: New Cases and Hospitalizations Declining

by Calculated Risk on 2/08/2022 09:08:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 64.2% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 213.1 | --- | ≥2321 | |

| New Cases per Day3 | 247,319 | 444,473 | ≤5,0002 | |

| Hospitalized3 | 105,449 | 131,099 | ≤3,0002 | |

| Deaths per Day3🚩 | 2,404 | 2,334 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.