by Calculated Risk on 2/11/2022 10:03:00 PM

Friday, February 11, 2022

COVID Update: February 11, 2022: Falling Cases, Deaths and Hospitalizations

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 64.3% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 213.6 | --- | ≥2321 | |

| New Cases per Day3 | 190,401 | 344,320 | ≤5,0002 | |

| Hospitalized3 | 95,642 | 121,845 | ≤3,0002 | |

| Deaths per Day3 | 2,305 | 2,419 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

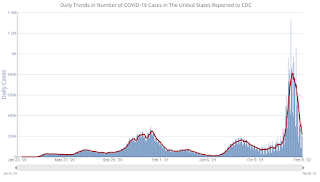

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Lawler: Deaths by Age

by Calculated Risk on 2/11/2022 05:01:00 PM

From housing economist Tom Lawler: (CR Note: This is valuable demographic data)

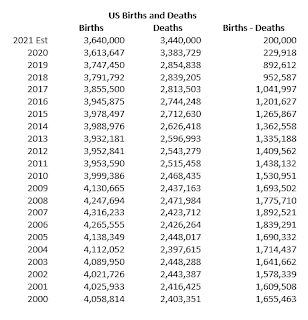

Provisional data from the CDC indicate that there have been 3,427,882 US deaths reported for 2021 as of 2/9/2022, up from 3,383,729 deaths in 2020. Because of reporting delays in some parts of the country the 2021 final death numbers will be a little bit higher that the numbers in the 2/9 report.

CDC also reports provisional death counts by age groups, and below is a table showing 2021 deaths reported so far by age compared to final death counts by age for 2020 and 2019.

Missing Workers by Age Group

by Calculated Risk on 2/11/2022 02:09:00 PM

Note: This is an update to an earlier post.

Back in November, Goldman Sachs economists put out a research note on the labor force participation rate: Why Isn’t Labor Force Participation Recovering?

While the unemployment rate continues to fall quickly, labor force participation has made no progress since August 2020. ... Most of the 5.0mn persons who have exited the labor force since the start of the pandemic are over age 55 (3.4mn), largely reflecting early (1.5mn) and natural (1mn) retirements that likely won’t reverse. The outlook for prime-age persons who have exited the labor force (1.7mn) is more positive, since very few are discouraged and most still view their exits as temporary.

The jobs number comes from Current Employment Statistics (CES: payroll survey), a sample of approximately 634,000 business establishments nationwide.

These are very different surveys: the CPS gives the total number of employed (and unemployed including the alternative measures), and the CES gives the total number of positions (excluding some categories like the self-employed, and a person working two jobs counts as two positions).

Click on graph for larger image.

Click on graph for larger image.This data is comparing January 2022 to January 2020, using Not Seasonally Adjusted (NSA) data (I compared to January 2020 to minimize the seasonal impact when using NSA data).

Almost all of the missing employed workers - by this method - are in the 25 to 29 and 45 to 49 age groups, and most are women.

Note: this is over a 2-year period, and there have been some demographic shifts between cohorts.

This data would suggest most of the missing workers are prime age (or some took early retirement).

Q1 GDP Forecasts: Slightly Positive

by Calculated Risk on 2/11/2022 11:28:00 AM

Here are a few early forecasts for Q1 GDP.

From BofA:

1Q GDP tracking estimate to 2.0% qoq saar [February 4 estimate]From Goldman Sachs:

emphasis added

We left our Q1 GDP tracking estimate unchanged at +0.5% (qoq ar). We also left our past-quarter GDP tracking estimate for Q4 unchanged at +7.1% (qoq ar). [February 9 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2022 is 0.7 percent on February 9, unchanged from February 8 after rounding. After this morning’s wholesale trade release from the US Census Bureau, the nowcast of the contribution of inventory investment to first-quarter real GDP growth decreased from -2.40 percentage points to -2.41 percentage points. [February 9 estimate]

Lawler: Update on US Demographic Drivers in 2021

by Calculated Risk on 2/11/2022 09:02:00 AM

From housing economist Tom Lawler: Update on US Demographic Drivers in 2021

Births: Provisional data from the CDC show that US births totaled 978,000 in the third quarter of 2021, up 2.8% from the comparable quarter of 2020. While births in the first nine months of 2021 were down 0.18% from the comparable period of 2020, the trend in births began increasing in the second half of last year. Assuming this trend continued through last quarter – and adjusting for the normal seasonal pattern of births – a “best guess” for total US births in 2021 would be about 3.64 million. That level would be about 0.7% above 2020’s historically low level, though it would still be the second lowest annual number of births since 1981.

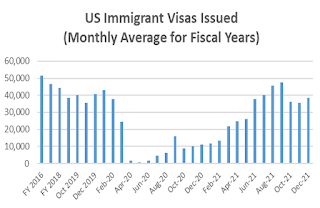

Net International Migration: While there are no timely data on net international migration, there are some indicators that suggest that US immigration increased significantly in the second half of last year from the incredibly low levels of the previous 18 months.

The U.S Department of State’s data on monthly immigrant visa issuance show that such issuance, which was incredibly low in the last nine months of 2020 and the first few months of 2021, increased significantly beginning in the Spring of last year.

If that were the case, and if the birth and death numbers I showed in the above were correct, then the US resident population last year would have increased by 650,000, or 0.2%. While such growth is historically extremely low, it is actually somewhat higher than the Census estimate for growth from 7/1/2020 to 7/1/2021 (392,665, or 0.1%).

Thursday, February 10, 2022

"Mortgage Rates Hit 4.0% For First Time Since May 2019"

by Calculated Risk on 2/10/2022 09:17:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Hit 4.0% For First Time Since May 2019

In case it wasn't already clear based on the headline, the average is currently up to 4.02%. Keep in mind that is an average among top tier scenarios. It means that some lenders are quoting 3.625% and others are up to 4.375%. Adding any complexity to the scenario would mean a different rate. Also keep in mind that lenders are MUCH more widely stratified than normal, which is often the case when we've seen as much volatility as we have so far in 2022. [30 year fixed 4.02%]On COVID (focus on hospitalizations and deaths):

emphasis added

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 64.3% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 213.4 | --- | ≥2321 | |

| New Cases per Day3 | 215,418 | 376,855 | ≤5,0002 | |

| Hospitalized3 | 99,535 | 125,219 | ≤3,0002 | |

| Deaths per Day3 | 2,313 | 2,458 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Hotels: Occupancy Rate Down 16% Compared to Same Week in 2019

by Calculated Risk on 2/10/2022 04:27:00 PM

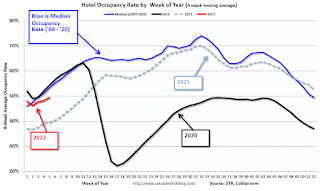

U.S. weekly hotel occupancy eclipsed 50% for the first time in more than a month, but the index to 2019 dipped from the week prior, according to STR‘s latest data through 5 February.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Jan. 30 through Feb. 5, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 50.4% (-15.8%)

• Average daily rate (ADR): $125.06 (-1.2%)

• evenue per available room (RevPAR): $63.05 (-16.8%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

The Impact on Housing of Higher Mortgage Rates

by Calculated Risk on 2/10/2022 12:05:00 PM

Today, in the Calculated Risk Real Estate Newsletter: The Impact on Housing of Higher Mortgage Rates

A brief excerpt:

Looking back at previous periods with similar increases in mortgage rates - like in 2013 when mortgage rates increased from 3.4% to 4.5% from May to July - new home sales fell from about 440 thousand per month to about 390 thousand per month. This was a decline of about 10%.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

There was a similar decline in 1994 when rates increased from 7.2% to 8.4%, and new home sales fell from around 730 thousand to 650 thousand. And in 2018, rates increased from around 4.0% to 4.9%, and new home sales declined from around 650 thousand to 590 thousand.

There are other periods when rates increased - like in 1999 - and new home sales only declined slightly. Here is a graph of 30-year mortage rates. The arrows point to the three periods mentioned above.

...

With 4% 30-year mortgage rates, we will likely see a slowdown in both new and existing home sales (based on previous periods of rising rates). It also seems likely house price growth will slow. However, the impact on inventory is unclear.

An interesting question: Will higher mortgage rates slow investor buying? Higher rates will make buy-to-rent less attractive. Investor buying - and build-to-rent - will be areas to watch.

There is further downside risk if mortgage rates continue to increase, or if we see a significant increase in inventory (something we didn’t see in previous periods of rising mortgage rates).

Cleveland Fed: Median CPI increased 0.6% and Trimmed-mean CPI increased 0.6% in January

by Calculated Risk on 2/10/2022 11:21:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.6% in January. The 16% trimmed-mean Consumer Price Index also increased 0.6% in January. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details here: "Used Cars" were only up 19% annualized, and this will likely show declines in coming months.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

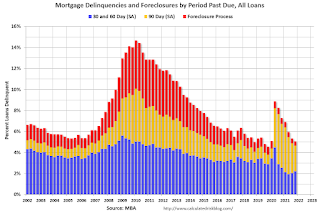

MBA: "Mortgage Delinquencies Decrease in the Fourth Quarter of 2021"

by Calculated Risk on 2/10/2022 10:44:00 AM

From the MBA: Mortgage Delinquencies Decrease in the Fourth Quarter of 2021

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 4.65 percent of all loans outstanding at the end of the fourth quarter of 2021, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage. The delinquency rate was down 23 basis points from the third quarter of 2021 and down 208 basis points from one year ago.

“Mortgage delinquencies descended in the final three months of 2021, reaching levels at or below MBA’s survey averages dating back to 1979,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “The fourth-quarter delinquency rate of 4.65 percent was 67 basis points lower than MBA’s survey average of 5.32 percent. Furthermore, the seriously delinquent rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 2.83 percent in the fourth quarter, close to the long-term average of 2.80 percent.”

Added Walsh, “The quarters right before the COVID-19 pandemic represented some of the lowest delinquencies ever recorded. Delinquencies are now approaching levels not seen since the first quarter of 2020, which is a testament to the strength of the U.S. labor market.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Overall delinquencies decreased in Q4.

From the MBA:

Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate increased 14 basis points to 1.65 percent, the 60-day delinquency rate increased 4 basis points to 0.56 percent, and the 90-day delinquency bucket decreased 41 basis points to 2.44 percent.This sharp increase in 2020 in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 0.42 percent, down 4 basis points from the third quarter of 2021 and 14 basis points lower than one year ago. This is the lowest foreclosure inventory rate since the third quarter of 1981. The percentage of loans on which foreclosure actions were started in the fourth quarter rose by 1 basis point to 0.04 percent, up from the survey low seen in third-quarter 2021 at 0.03 percent.

The percent of loans in the foreclosure process declined further and was at the lowest level since 1981.