by Calculated Risk on 2/16/2022 11:55:00 AM

Wednesday, February 16, 2022

Thoughts on Housing Supply and Demand With 30-year mortgage rates above 4%

Today, in the Calculated Risk Real Estate Newsletter: Thoughts on Housing Supply and Demand With 30-year mortgage rates above 4%

A brief excerpt:

So far, there has been no obvious impact on demand from 30-year mortgage rates above 4%.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

I’ve spoken to several mortgage brokers over the last few days, and they are reporting purchase demand remains strong. They did mention a decline in refinance activity due to higher rates, and several brokers mentioned appraisals are falling short - and buyers are having to fill the “appraisal gap”.

Other measures of demand - like the MBA purchase index - have weakened a little - but are still showing solid purchase demand

...

Meanwhile, homebuilders are struggling with both price increases and supply constraints. The most recent new home sales report showed that the Inventory of homes under construction highest since 2007 and the most recent housing starts report showed Most Housing Units Under Construction Since 1973

NAHB: Builder Confidence Decreased to 82 in February

by Calculated Risk on 2/16/2022 10:09:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 82, down from 83 in January. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Eases on Supply-Side Constraints

Despite strong buyer demand, builder sentiment continued to slip in February as the industry grapples with ongoing building material production bottlenecks that are raising construction costs and delaying projects.

Builder confidence in the market for newly built single-family homes moved one point lower to 82 in February, marking the second straight month that confidence levels have declined by a single point, according to the NAHB/Wells Fargo Housing Market Index (HMI) released today. Despite these monthly declines, the HMI has posted very solid readings at or above the 80-point mark for the past five months.

“Production disruptions are so severe that many builders are waiting months to receive cabinets, garage doors, countertops and appliances,” said NAHB Chairman Jerry Konter. “These delivery delays are raising construction costs and pricing prospective buyers out of the market. Policymakers must make it a priority to address supply chain issues that are harming housing affordability.”

“Residential construction costs are up 21% on a year over year basis, and these higher development costs have hit first-time buyers particularly hard,” said NAHB Chief Economist Robert Dietz. “Higher interest rates in 2022 will further reduce housing affordability even as demand remains solid due to a lack of resale inventory.”

...

The HMI index gauging current sales conditions increased one point to 90, the gauge measuring sales expectations in the next six months fell two points to 80, and the component charting traffic of prospective buyers posted a four-point decline to 65.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased three points to 76, the West rose one point to 89, the Midwest fell one point to 73 and the South edged one point lower to 86.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was at the consensus forecast, and a strong reading.

Industrial Production Increased 1.4 Percent in January

by Calculated Risk on 2/16/2022 09:21:00 AM

From the Fed: Industrial Production and Capacity Utilization

In January, total industrial production increased 1.4 percent. Manufacturing output and mining production rose 0.2 percent and 1.0 percent, respectively. The index for utilities jumped 9.9 percent; after being held down in December by unusually mild weather, the demand for heating surged in January with the arrival of significantly colder-than-normal temperatures. At 103.5 percent of its 2017 average, total industrial production in January was 4.1 percent higher than its year-earlier level and 2.1 percent above its pre-pandemic (February 2020) reading. Capacity utilization for the industrial sector increased 1.0 percentage point in January to 77.6 percent, a rate that is 1.9 percentage points below its long-run (1972–2021) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 77.6% is 1.9% below the average from 1972 to 2020. This was above consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

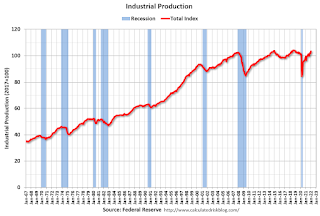

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in January to 103.5. This is above the February 2020 level.

The change in industrial production was above consensus expectations.

Retail Sales Increased 3.8% in January

by Calculated Risk on 2/16/2022 08:38:00 AM

On a monthly basis, retail sales were increased 3.8% from December to January (seasonally adjusted), and sales were up 13.0 percent from January 2021.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for January 2022, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $649.8 billion, an increase of 3.8 percent from the previous month, and 13.0 percent above January 2021.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 4.2% in January.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 2/16/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 11, 2022.

... The Refinance Index decreased 9 percent from the previous week and was 54 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index increased 5 percent compared with the previous week and was 7 percent lower than the same week one year ago.

“Mortgage rates increased across the board last week following the recent rise in Treasury yields, which have moved higher due to unrelenting inflationary pressures and increased market expectations of more aggressive policy moves by the Federal Reserve," said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting. "The 30-year fixed rate saw the largest single-week increase since March 2020 and was above the 4 percent mark for the first time since 2019. Consistent with this period of higher mortgage rates, refinance applications fell 9 percent last week and stood at around half of last year’s pace. The refinance share of applications was also at its lowest level since July 2019."

Added Kan, “Purchase applications saw a modest decline over the week, with government purchase applications accounting for most of the decrease. Prospective buyers still face elevated sales prices in addition to higher mortgage rates. The heavier mix of conventional applications again contributed to another record average loan size at $453,000.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 4.05 percent from 3.83 percent, with points increasing to 0.45 from 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 7% year-over-year unadjusted.

According to the MBA, purchase activity is down 7% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, February 15, 2022

Wednesday: Retail Sales, Industrial Production, Homebuilder Survey, FOMC Minutes

by Calculated Risk on 2/15/2022 07:19:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for January is scheduled to be released. The consensus is for a 1.8% increase in retail sales. Retail sales ex-gasoline were down 2.0% in December.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for January. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 76.7%.

• At 10:00 AM, The February NAHB homebuilder survey. The consensus is for a reading of 82, down from 83. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 2:00 PM, FOMC Minutes, Meeting of Jan. 25-26

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 64.5% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 214.1 | --- | ≥2321 | |

| New Cases per Day3 | 146,921 | 244,558 | ≤5,0002 | |

| Hospitalized3 | 80.185 | 107,772 | ≤3,0002 | |

| Deaths per Day3 | 2,208 | 2,422 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Boston: "Soft" Housing Sales in January due to Lack of Inventory

by Calculated Risk on 2/15/2022 11:10:00 AM

From the Greater Boston Association of REALTORS® (GBAR): Greater Boston Housing Market Feels Effects of Low Inventory, Sales Soften and Price Appreciation Slows in January

Sales of single-family homes and condominiums declined from year ago levels for a second consecutive month in January as inventory levels waned and mortgage rates rose, which compounded seasonal softening in buyer activity. ...This is a common complaint amoung agents. Inventory levels are near record lows almost everywhere.

“We’ve got very little to sell. In some communities, you can count on one or two hands the number of properties available for sale over the past month,” stated GBAR President Melvin A. Vieira, Jr., an agent at RE/MAX Destiny in Cambridge. “The appetite to buy is still quite strong, but the reality is it can be a lengthy process when there is little to choose from. The lack of listings remains the biggest drag on sales right now, but there is increasing anxiety over the rise in mortgage rates, and that’s going to affect buying power and possibly the size of the buyer pool going forward,” he noted.

The Housing Bubble and Mortgage Debt as a Percent of GDP

by Calculated Risk on 2/15/2022 09:11:00 AM

Today, in the Calculated Risk Real Estate Newsletter: The Housing Bubble and Mortgage Debt as a Percent of GDP

A brief excerpt:

In a 2005 post, I included a graph of household mortgage debt as a percent of GDP. Several readers asked if I could update the graph.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

The second graph shows household mortgage debt as a percent of GDP through Q3 2021 (based on the Fed’s Flow of Funds report).

The "bubble" is pretty obvious on this graph, and the sharp increase in mortgage debt was one of the warning signs.

The blip up in Q2 2020 was related to the collapse in GDP rather than an increase in mortgage debt. With the recent house price increases, some people are worried about a new housing bubble - but mortgage debt isn't a concern and lending standards are much better now than during the bubble.

Monday, February 14, 2022

Tuesday: PPI, NY Fed Mfg

by Calculated Risk on 2/14/2022 08:12:00 PM

From Matthew Graham at Mortgage News Daily: Rates Jump Back Up to The Highs

Russia/Ukraine headlines continued throughout the day. Although this did cause some volatility at times, markets progressively tuned out. Moreover, geopolitical risk is not destined to be the key market moving consideration unless things get appreciably worse. Even then, the primary narrative remains focused on inflation and the Fed's evolving policy response. [30 year fixed 4.10%]Tuesday:

emphasis added

• At 8:30 AM ET, The Producer Price Index for December from the BLS. The consensus is for a 0.5% increase in PPI, and a 0.5% increase in core PPI.

• Also, at 8:30 AM: The New York Fed Empire State manufacturing survey for February. The consensus is for a reading of 12.0, up from -0.7.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 64.4% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 214.0 | --- | ≥2321 | |

| New Cases per Day3 | 161,197 | 287,209 | ≤5,0002 | |

| Hospitalized3 | 81,007 | 111,402 | ≤3,0002 | |

| Deaths per Day3 | 2,196 | 2,339 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

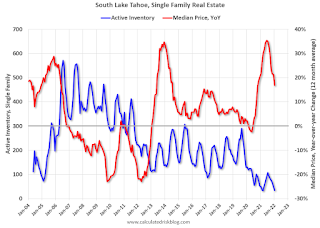

Second Home Market: South Lake Tahoe in January

by Calculated Risk on 2/14/2022 04:15:00 PM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from the lending changes.

This graph is for South Lake Tahoe since 2004 through January 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low - just above the record low set in March 2021, and down YoY - and prices are up sharply YoY (but the YoY change has been trending down).