by Calculated Risk on 2/18/2022 10:15:00 AM

Friday, February 18, 2022

NAR: Existing-Home Sales Increased to 6.50 million SAAR in January

From the NAR: Existing-Home Sales Surge 6.7% in January

Existing-home sales rose in January, making a notable move upward following a previous month where sales declined, according to the National Association of Realtors®. On a month-over-month basis, each of the four major U.S. regions experienced an increase in sales in January. However, year-over-year, activity was mixed as two regions reported sagging sales, another watched sales increase and a fourth region remained flat.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, climbed 6.7% from December to a seasonally adjusted annual rate of 6.50 million in January. Year-over-year, sales fell 2.3% (6.65 million in January 2021).

...

Total housing inventory at the end of January amounted to 860,000 units, down 2.3% from December and down 16.5% from one year ago (1.03 million). Unsold inventory sits at a 1.6-month supply at the current sales pace, down from 1.7 months in December and from 1.9 months in January 2021.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in January (6.50 million SAAR) were up 6.7% from last month and were 2.3% below the January 2021 sales rate.

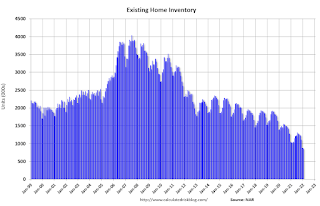

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 0.86 million in January from 0.88 million in December.

According to the NAR, inventory decreased to 0.86 million in January from 0.88 million in December.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 16.5% year-over-year in January compared to January 2021.

Inventory was down 16.5% year-over-year in January compared to January 2021. Months of supply declined to 1.6 months in January from 1.7 months in December.

This was above the consensus forecast. I'll have more later.

LA Area Port Traffic: Record Inbound Traffic for January

by Calculated Risk on 2/18/2022 08:30:00 AM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Also, incoming port traffic is still backed up in the LA area.

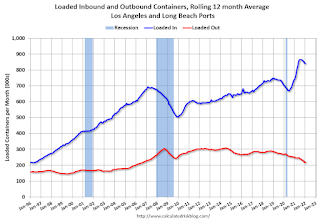

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic was up 0.1% in January compared to the rolling 12 months ending in December. Outbound traffic was down 0.5% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 2% YoY in January, and exports were down 5% YoY.

Thursday, February 17, 2022

Friday: Existing Home Sales

by Calculated Risk on 2/17/2022 08:49:00 PM

Friday:

• At 10:00 AM ET, Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 6.12 million SAAR, down from 6.18 million.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 64.6% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 214.5 | --- | ≥2321 | |

| New Cases per Day3 | 121,664 | 213,625 | ≤5,0002 | |

| Hospitalized3 | 80,185 | 107,772 | ≤3,0002 | |

| Deaths per Day3 | 2,020 | 2,363 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

January Forecast and 4th Look at Local Housing Markets

by Calculated Risk on 2/17/2022 04:20:00 PM

Today, in the CalculatedRisk Real Estate Newsletter: January Forecast and 4th Look at Local Housing Markets

Excerpt:

From housing economist Tom Lawler:There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 6.36 million in January, up 4.3% from December’s preliminary pace but down 4.5% from last January’s seasonally adjusted pace.CR Note: The National Association of Realtors (NAR) is scheduled to release January existing home sales tomorrow, Friday, February 18, 2022, at 10:00 AM ET. The consensus is for 6.12 million SAAR. Take the over.

Local realtor reports, as well as reports from national inventory trackers, suggest that the YOY % decline in the inventory of existing homes for sale last month was a bit larger than that in December.

Finally, local realtor/MLS reports suggest the median existing single-family home sales price last month was up by about 14.5% from last January.

(Note: The January NAR report will incorporate updated seasonal adjustment factors.)

January Housing Starts: Most Housing Units Under Construction Since 1973

by Calculated Risk on 2/17/2022 01:02:00 PM

Today, in the CalculatedRisk Real Estate Newsletter: January Housing Starts: Most Housing Units Under Construction Since 1973

Excerpt:

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

Red is single family units. Currently there are 785 thousand single family units under construction (SA). This is the highest level since December 2006.

For single family, many of these homes are already sold (Census counts sales when contract is signed). The reason there are so many homes is probably due to construction delays. Since many of these are already sold, it is unlikely this is “overbuilding”, or that this will impact prices (although the buyers will be moving out of their current home or apartment once these homes are completed).

Blue is for 2+ units. Currently there are 758 thousand multi-family units under construction. This is the highest level since July 1974! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Census will release data in March (part of February survey) on the length of time from start to completion, and that will probably show long delays in 2021. In 2020, it took an average of 6.8 months from start to completion for single family homes, and 15.4 months for buildings with 2 or more units.

Combined, there are 1.543 million units under construction. This is the most since September 1973.

Weekly Initial Unemployment Claims Increase to 248,000

by Calculated Risk on 2/17/2022 10:30:00 AM

The DOL reported:

In the week ending February 12, the advance figure for seasonally adjusted initial claims was 248,000, an increase of 23,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 223,000 to 225,000. The 4-week moving average was 243,250, a decrease of 10,500 from the previous week's revised average. The previous week's average was revised up by 500 from 253,250 to 253,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 243,250.

The previous week was revised up.

Weekly claims were higher than the consensus forecast.

Housing Starts Decreased to 1.638 million Annual Rate in January

by Calculated Risk on 2/17/2022 08:37:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in January were at a seasonally adjusted annual rate of 1,638,000. This is 4.1 percent below the revised December estimate of 1,708,000, but is 0.8 percent above the January 2021 rate of 1,625,000. Single‐family housing starts in January were at a rate of 1,116,000; this is 5.6 percent below the revised December figure of 1,182,000. The January rate for units in buildings with five units or more was 510,000.

Building Permits:

Privately‐owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 1,899,000. This is 0.7 percent above the revised December rate of 1,885,000 and is 0.8 percent above the January 2021 rate of 1,883,000. Single‐family authorizations in January were at a rate of 1,205,000; this is 6.8 percent above the revised December figure of 1,128,000. Authorizations of units in buildings with five units or more were at a rate of 629,000 in January.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) decreased in January compared to December. Multi-family starts were up 8.3% year-over-year in January.

Single-family starts (red) decreased in January and were down 2.4% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery (but still not historically high).

Total housing starts in January were below expectations, however, starts in November and December were revised up, combined.

I'll have more later …

Wednesday, February 16, 2022

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 2/16/2022 08:39:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for a decrease to 222 thousand from 223 thousand last week.

• Also, at 8:30 AM, Housing Starts for January. The consensus is for 1.700 million SAAR, down from 1.702 million SAAR.

• Also, at 8:30 AM, the Philly Fed manufacturing survey for February. The consensus is for a reading of 20.0, down from 23.2.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 64.5% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 214.2 | --- | ≥2321 | |

| New Cases per Day3 | 134,468 | 229,428 | ≤5,0002 | |

| Hospitalized3 | 80,185 | 107,772 | ≤3,0002 | |

| Deaths per Day3 | 2,100 | 2,331 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Fannie and Freddie: REO inventory declined in Q4 year-over-year; Expected to increase in 2022

by Calculated Risk on 2/16/2022 04:59:00 PM

Fannie and Freddie earlier reported results for Q4 2021. Here is some information on single-family Real Estate Owned (REOs).

"In response to the pandemic and with instruction from FHFA, we prohibited our servicers from completing foreclosures on our single-family loans through July 31, 2021, except in the case of vacant or abandoned properties. In addition, as described in “Single-Family Acquisition and Servicing Policies and Underwriting and Servicing Standards—COVID-19 Servicing Policies,” our servicers were required to comply with a CFPB rule that prohibited certain new single-family foreclosures on mortgage loans secured by the borrower’s principal residence until after December 31, 2021. As a result, foreclosure volumes were lower through 2021 and 2020 compared with pre-pandemic levels. We expect foreclosure volumes to gradually increase in 2022." emphasis added

For Freddie, this is down 98% from the 74,897 peak number of REOs in Q3 2010.

Fannie Mae reported the number of REO declined to 7,166 at the end of Q4 2021 compared to 7,973 at the end of Q4 2020.

For Fannie, this is down 96% from the 166,787 peak number of REOs in Q3 2010.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q4 2021, and combined inventory is down 10% year-over-year.

This is well below a normal level of REOs for Fannie and Freddie, and REO levels will increase in 2022.

FOMC Minutes: "Faster" is the Word

by Calculated Risk on 2/16/2022 02:13:00 PM

From the Fed: Minutes of the Federal Open Market Committee, January 25-26, 2022. Excerpt on inflation:

In light of elevated inflation pressures and the strong labor market, participants continued to judge that the Committee's net asset purchases should be concluded soon. Most participants preferred to continue to reduce the Committee's net asset purchases according to the schedule announced in December, bringing them to an end in early March. A couple of participants stated that they favored ending the Committee's net asset purchases sooner to send an even stronger signal that the Committee was committed to bringing down inflation.

Participants discussed the implications of the economic outlook for the likely timing and pace for removing policy accommodation. Compared with conditions in 2015 when the Committee last began a process of removing monetary policy accommodation, participants viewed that there was a much stronger outlook for growth in economic activity, substantially higher inflation, and a notably tighter labor market. Consequently, most participants suggested that a faster pace of increases in the target range for the federal funds rate than in the post-2015 period would likely be warranted, should the economy evolve generally in line with the Committee's expectation. Even so, participants emphasized that the appropriate path of policy would depend on economic and financial developments and their implications for the outlook and the risks around the outlook, and they will be updating their assessments of the appropriate setting for the policy stance at each meeting. Participants noted that the removal of policy accommodation in current circumstances depended on the timing and pace of both increases in the target range of the federal funds rate and the reduction in the size of the Federal Reserve's balance sheet. In this context, a number of participants commented that conditions would likely warrant beginning to reduce the size of the balance sheet sometime later this year.

In their discussion of the outlook for monetary policy, many participants noted the influence on financial conditions of the Committee's recent communications and viewed these communications as helpful in shifting private-sector expectations regarding the policy outlook into better alignment with the Committee's assessment of appropriate policy. Participants continued to stress that maintaining flexibility to implement appropriate policy adjustments on the basis of risk-management considerations should be a guiding principle in conducting policy in the current highly uncertain environment. Most participants noted that, if inflation does not move down as they expect, it would be appropriate for the Committee to remove policy accommodation at a faster pace than they currently anticipate. Some participants commented on the risk that financial conditions might tighten unduly in response to a rapid removal of policy accommodation. A few participants remarked that this risk could be mitigated through clear and effective communication of the Committee's assessments of the economic outlook, the risks around the outlook, and the appropriate path for monetary policy.

emphasis added