by Calculated Risk on 2/18/2022 03:09:00 PM

Friday, February 18, 2022

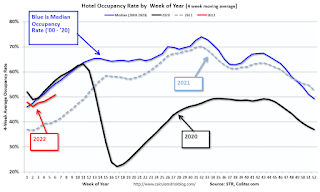

Hotels: Occupancy Rate Down 14% Compared to Same Week in 2019

U.S. weekly hotel performance advanced to its highest levels since December, according to STR‘s latest data through Feb. 12.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Feb. 6-12, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 54.6% (-14.0%)

• Average daily rate (ADR): $133.72 (+1.3%)

• Revenue per available room (RevPAR): $73.00 (-12.9%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

Q1 GDP Forecasts: Moving Up to Around 2%

by Calculated Risk on 2/18/2022 01:45:00 PM

Here are a few early forecasts for Q1 GDP.

From BofA:

In the second release of 4Q GDP, we expect a revision upwards to 7.5% qoq saar growth from 6.9%. We are now tracking 2.5% for 1Q (prev 2.0%), following the retail sales beat [February 17 estimate]From Goldman Sachs:

emphasis added

We left our Q1 GDP tracking estimate unchanged at +2.0% (qoq ar). [February 17 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2022 is 1.3 percent on February 17, down from 1.5 percent on February 16. After this morning’s housing starts report from the US Census Bureau, the nowcast of first-quarter real residential investment growth decreased from 4.7 percent to 0.3 percent. [February 17 estimate]

More Analysis on January Existing Home Sales

by Calculated Risk on 2/18/2022 11:31:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: Existing-Home Sales Increased to 6.50 million in January

Excerpt:

This graph shows existing home sales by month for 2021 and 2022.There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

Sales declined 2.3% year-over-year compared to January 2021. This was the sixth consecutive month with sales down year-over-year.

...

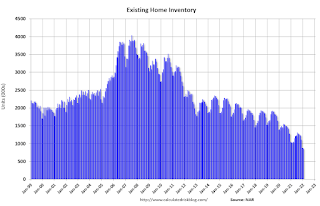

[and on inventory] According to the NAR, inventory decreased to 0.86 million in January from 0.88 million in December. Inventory is now at a record low.

NAR: Existing-Home Sales Increased to 6.50 million SAAR in January

by Calculated Risk on 2/18/2022 10:15:00 AM

From the NAR: Existing-Home Sales Surge 6.7% in January

Existing-home sales rose in January, making a notable move upward following a previous month where sales declined, according to the National Association of Realtors®. On a month-over-month basis, each of the four major U.S. regions experienced an increase in sales in January. However, year-over-year, activity was mixed as two regions reported sagging sales, another watched sales increase and a fourth region remained flat.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, climbed 6.7% from December to a seasonally adjusted annual rate of 6.50 million in January. Year-over-year, sales fell 2.3% (6.65 million in January 2021).

...

Total housing inventory at the end of January amounted to 860,000 units, down 2.3% from December and down 16.5% from one year ago (1.03 million). Unsold inventory sits at a 1.6-month supply at the current sales pace, down from 1.7 months in December and from 1.9 months in January 2021.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in January (6.50 million SAAR) were up 6.7% from last month and were 2.3% below the January 2021 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 0.86 million in January from 0.88 million in December.

According to the NAR, inventory decreased to 0.86 million in January from 0.88 million in December.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 16.5% year-over-year in January compared to January 2021.

Inventory was down 16.5% year-over-year in January compared to January 2021. Months of supply declined to 1.6 months in January from 1.7 months in December.

This was above the consensus forecast. I'll have more later.

LA Area Port Traffic: Record Inbound Traffic for January

by Calculated Risk on 2/18/2022 08:30:00 AM

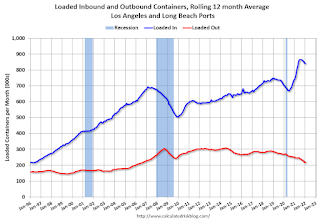

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Also, incoming port traffic is still backed up in the LA area.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic was up 0.1% in January compared to the rolling 12 months ending in December. Outbound traffic was down 0.5% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 2% YoY in January, and exports were down 5% YoY.

Thursday, February 17, 2022

Friday: Existing Home Sales

by Calculated Risk on 2/17/2022 08:49:00 PM

Friday:

• At 10:00 AM ET, Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 6.12 million SAAR, down from 6.18 million.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 64.6% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 214.5 | --- | ≥2321 | |

| New Cases per Day3 | 121,664 | 213,625 | ≤5,0002 | |

| Hospitalized3 | 80,185 | 107,772 | ≤3,0002 | |

| Deaths per Day3 | 2,020 | 2,363 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

January Forecast and 4th Look at Local Housing Markets

by Calculated Risk on 2/17/2022 04:20:00 PM

Today, in the CalculatedRisk Real Estate Newsletter: January Forecast and 4th Look at Local Housing Markets

Excerpt:

From housing economist Tom Lawler:There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 6.36 million in January, up 4.3% from December’s preliminary pace but down 4.5% from last January’s seasonally adjusted pace.CR Note: The National Association of Realtors (NAR) is scheduled to release January existing home sales tomorrow, Friday, February 18, 2022, at 10:00 AM ET. The consensus is for 6.12 million SAAR. Take the over.

Local realtor reports, as well as reports from national inventory trackers, suggest that the YOY % decline in the inventory of existing homes for sale last month was a bit larger than that in December.

Finally, local realtor/MLS reports suggest the median existing single-family home sales price last month was up by about 14.5% from last January.

(Note: The January NAR report will incorporate updated seasonal adjustment factors.)

January Housing Starts: Most Housing Units Under Construction Since 1973

by Calculated Risk on 2/17/2022 01:02:00 PM

Today, in the CalculatedRisk Real Estate Newsletter: January Housing Starts: Most Housing Units Under Construction Since 1973

Excerpt:

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

Red is single family units. Currently there are 785 thousand single family units under construction (SA). This is the highest level since December 2006.

For single family, many of these homes are already sold (Census counts sales when contract is signed). The reason there are so many homes is probably due to construction delays. Since many of these are already sold, it is unlikely this is “overbuilding”, or that this will impact prices (although the buyers will be moving out of their current home or apartment once these homes are completed).

Blue is for 2+ units. Currently there are 758 thousand multi-family units under construction. This is the highest level since July 1974! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Census will release data in March (part of February survey) on the length of time from start to completion, and that will probably show long delays in 2021. In 2020, it took an average of 6.8 months from start to completion for single family homes, and 15.4 months for buildings with 2 or more units.

Combined, there are 1.543 million units under construction. This is the most since September 1973.

Weekly Initial Unemployment Claims Increase to 248,000

by Calculated Risk on 2/17/2022 10:30:00 AM

The DOL reported:

In the week ending February 12, the advance figure for seasonally adjusted initial claims was 248,000, an increase of 23,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 223,000 to 225,000. The 4-week moving average was 243,250, a decrease of 10,500 from the previous week's revised average. The previous week's average was revised up by 500 from 253,250 to 253,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 243,250.

The previous week was revised up.

Weekly claims were higher than the consensus forecast.

Housing Starts Decreased to 1.638 million Annual Rate in January

by Calculated Risk on 2/17/2022 08:37:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in January were at a seasonally adjusted annual rate of 1,638,000. This is 4.1 percent below the revised December estimate of 1,708,000, but is 0.8 percent above the January 2021 rate of 1,625,000. Single‐family housing starts in January were at a rate of 1,116,000; this is 5.6 percent below the revised December figure of 1,182,000. The January rate for units in buildings with five units or more was 510,000.

Building Permits:

Privately‐owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 1,899,000. This is 0.7 percent above the revised December rate of 1,885,000 and is 0.8 percent above the January 2021 rate of 1,883,000. Single‐family authorizations in January were at a rate of 1,205,000; this is 6.8 percent above the revised December figure of 1,128,000. Authorizations of units in buildings with five units or more were at a rate of 629,000 in January.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) decreased in January compared to December. Multi-family starts were up 8.3% year-over-year in January.

Single-family starts (red) decreased in January and were down 2.4% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery (but still not historically high).

Total housing starts in January were below expectations, however, starts in November and December were revised up, combined.

I'll have more later …