by Calculated Risk on 2/23/2022 07:00:00 AM

Wednesday, February 23, 2022

MBA: Mortgage Applications Decrease in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 13.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 18, 2022.

... The Refinance Index decreased 16 percent from the previous week and was 56 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 10 percent from one week earlier. The unadjusted Purchase Index decreased 6 percent compared with the previous week and was 6 percent lower than the same week one year ago.

Mortgage applications dropped to their lowest level since December 2019 last week, as mortgage rates continued to inch higher. The 30-year fixed rate was 4.06 percent, almost a full percentage point higher than a year ago. Higher mortgage rates have quickly shut off refinances, with activity down in six of the first seven weeks of 2022. Conventional refinances in particular saw a 17 percent decrease last week,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications, already constrained by elevated sales prices and tight inventory, have also been impacted by these higher rates and declined for the third straight week. While the average loan size did not increase this week, it remained close to the survey’s record high.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 4.06 percent from 4.05 percent, with points increasing to 0.48 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 6% year-over-year unadjusted.

According to the MBA, purchase activity is down 6% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, February 22, 2022

"Mortgage Rates Edging Back Up Toward Long-Term Highs"

by Calculated Risk on 2/22/2022 09:01:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Edging Back Up Toward Long-Term Highs

The average lender is now roughly 0.04 higher than they were on Friday afternoon, but not yet back to the recent multi-year highs seen at the beginning of last week. That said, they're close enough to those highs that the average borrower won't be able to see a difference in this afternoon's loan quote. [30 year fixed 4.12%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day: The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 64.8% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 215.0 | --- | ≥2321 | |

| New Cases per Day3 | 78,306 | 145,931 | ≤5,0002 | |

| Hospitalized3 | 80,185 | 107,772 | ≤3,0002 | |

| Deaths per Day3 | 1,597 | 2,228 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

February Vehicle Sales Forecast: Decrease to 14.2 million SAAR

by Calculated Risk on 2/22/2022 06:33:00 PM

From WardsAuto: Volume Up But February’s U.S. Light-Vehicle SAAR Set to Decline from January (pay content)

Supply issues continue to impact vehicle sales, but it appears the supply chain disruption bottom is in.

This graph shows actual sales from the BEA (Blue), and Wards forecast for January (Red).

The Wards forecast of 14.2 million SAAR, would be down about 6% from last month, and down 11% from a year ago (sales were solid in February 2021, as sales recovered from the depths of the pandemic, and weren't yet impacted by supply chain issues).

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 1.30% in January"

by Calculated Risk on 2/22/2022 04:00:00 PM

Note: This is as of January 31st.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 1.30% in January

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 11 basis points from 1.41% of servicers’ portfolio volume in the prior month to 1.30% as of January 31, 2022. According to MBA’s estimate, 650,000 homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 4 basis points to 0.68%. Ginnie Mae loans in forbearance decreased 3 basis points to 1.60%, and the forbearance share for portfolio loans and private-label securities (PLS) declined 41 basis points to 3.02%.

“For the second straight month, the pace of forbearance exits reached another low since MBA began tracking exits in June 2020,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “There was also a pick-up in new forbearance requests and re-entries for all loans, and particularly for Ginnie Mae loans. Even though the forbearance rate continued its downward trajectory, it was the smallest monthly decline since January 2021.”

Added Walsh, “The positive news is that the percentage of borrowers who were current on their mortgage payments increased from December 2021. However, there was some deterioration in the performance of borrowers with existing loan workouts. Borrowers in loan workouts may have experienced new life events unrelated to the pandemic, or alternatively, the omicron variant may have triggered or re-triggered employment, health, or other stresses.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. The number of forbearance plans is decreasing.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 2/22/2022 01:09:00 PM

A few key points:

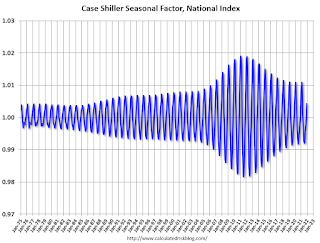

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now closer to normal (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Jed Kolko's article from 2014 "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through December 2021). The seasonal pattern was smaller back in the '90s and early '00s and increased once the bubble burst.

The seasonal swings declined following the bubble, however the recent price surge changed the month-over-month pattern.

The swings in the seasonal factors have decreased, and the seasonal factors has been moving back towards more normal levels.

Comments on Case-Shiller and FHFA House Price Increases

by Calculated Risk on 2/22/2022 10:37:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller National Index up 18.8% Year-over-year in December

Excerpt:

This graph below shows existing home months-of-supply (inverted, from the NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999 through December 2021).

Note that the months-of-supply is not seasonally adjusted.

There is a clear relationship, and this is no surprise (but interesting to graph). If months-of-supply is high, prices decline. If months-of-supply is very low (like now), prices rise quickly.

In December, the months-of-supply was at 1.7 months, and the Case-Shiller National Index (SA) increased 1.31% month-over-month. The black arrow points to the December 2021 dot. In the January existing home sales report, the NAR reported months-of-supply decreased to a record low 1.6 months in January.

My sense is the Case-Shiller National annual growth rate of 19.98% in August was probably the peak YoY growth rate, however, since the normal level of inventory is probably in the 4 to 6 months range - we’d have to see a significant increase in inventory to sharply slow price increases, and that is why I’m focused on inventory!

Note: I’ll have more on real prices, price-to-rent and affordability tomorrow.emphasis added

Case-Shiller: National House Price Index increased 18.8% year-over-year in December

by Calculated Risk on 2/22/2022 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for December ("December" is a 3-month average of October, November and December prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Reports 18.8% Annual Home Price Gain for Calendar 2021

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported an 18.8% annual gain in December, remaining the same from the previous month. The 10-City Composite annual increase came in at 17.0%, up from 16.9% in the previous month. The 20-City Composite posted an 18.6% year-over-year gain, up from 18.3% in the previous month.

Phoenix, Tampa, and Miami reported the highest year-over-year gains among the 20 cities in December. Phoenix led the way with a 32.5% year-over-year price increase, followed by Tampa with a 29.4% increase and Miami with a 27.3% increase. Fifteen of the 20 cities reported higher price increases in the year ending December 2021 versus the year ending November 2021.

...

Before seasonal adjustment, the U.S. National Index posted a 0.9% month-over-month increase in December, while the 10-City and 20-City Composites posted increases of 1.0% and 1.1%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.3%, and the 10-City and 20-City Composites posted increases of 1.4% and 1.5%, respectively.

In December, all 20 cities reported increases before and after seasonal adjustments.

“We have noted that for the past several months, home prices have been rising at a very high, but decelerating rate. The deceleration paused in December, as year-over-year changes in all three composite indices were slightly ahead of their November levels. December’s 18.8% gain for the National Composite is the fifth-highest reading in history. [says Craig J. Lazzara, Managing Director at S&P DJI]. ...

“We have previously suggested that the strength in the U.S. housing market is being driven in part by a change in locational preferences as households react to the COVID pandemic. More data will be required to understand whether this demand surge simply represents an acceleration of purchases that would have occurred over the next several years rather than a more permanent secular change. In the short term, meanwhile, we should soon begin to see the impact of increasing mortgage rates on home prices.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.4% in December (SA).

The Composite 20 index is up 1.5% (SA) in December.

The National index is 50% above the bubble peak (SA), and up 1.3% (SA) in December. The National index is up 105% from the post-bubble low set in February 2012 (SA).

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 17.0% year-over-year. The Composite 20 SA is up 18.6% year-over-year.

The National index SA is up 18.8% year-over-year.

Price increases were above expectations. I'll have more later.

Monday, February 21, 2022

Tuesday: Case-Shiller House Prices, Richmond Fed Mfg

by Calculated Risk on 2/21/2022 08:55:00 PM

Tuesday:

• At 9:00 AM ET, FHFA House Price Index for December 2021. This was originally a GSE only repeat sales, however there is also an expanded index.

• Also at 9:00 AM, S&P/Case-Shiller House Price Index for December. The consensus is for a 18.2% year-over-year increase in the Comp 20 index for December.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for February.

Final Look at Local Housing Markets in January

by Calculated Risk on 2/21/2022 12:53:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in January

A brief excerpt:

This update adds Columbus, Illinois, Indiana, Miami, New York and Phoenix.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is a summary of active listings for these housing markets in January. Inventory was down 10.2% in January month-over-month (MoM) from December, and down 31.8% year-over-year (YoY).

Inventory almost always declines seasonally in January, so the MoM decline is not a surprise. Last month, these markets were down 29.4% YoY, so the YoY decline in January was larger than in December. This isn’t indicating a slowing market.

Notes for all tables:

1. New additions to table in BOLD.

2. Northwest (Seattle), North Texas (Dallas), and Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

3. Totals do not include Atlanta, Denver, Minneapolis (included in state totals).

Housing Inventory February 21st Update: Inventory Down Slightly Week-over-week; New Record Low

by Calculated Risk on 2/21/2022 10:07:00 AM

Tracking existing home inventory is very important in 2022.

Inventory usually declines in the winter, and this is a new record low for this series.

This inventory graph is courtesy of Altos Research.

| Week Ending | YoY Change |

|---|---|

| 12/31/2021 | -30.0% |

| 1/7/2022 | -26.0% |

| 1/14/2022 | -28.6% |

| 1/21/2022 | -27.1% |

| 1/28/2022 | -25.9% |

| 2/4/2022 | -27.9% |

| 2/11/2022 | -27.5% |

| 2/18/2022 | -25.8% |

Mike Simonsen discusses this data regularly on Youtube.