by Calculated Risk on 3/01/2022 10:19:00 AM

Tuesday, March 01, 2022

Construction Spending Increased 1.3% in January

From the Census Bureau reported that overall construction spending increased 1.3%:

Construction spending during January 2022 was estimated at a seasonally adjusted annual rate of $1,677.2 billion, 1.3 percent above the revised December estimate of $1,655.8 billion. The January figure is 8.2 percent above the January 2021 estimate of $1,549.8 billion.Private and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,326.5 billion, 1.5 percent above the revised December estimate of $1,307.1 billion ...

In January, the estimated seasonally adjusted annual rate of public construction spending was $350.7 billion, 0.6 percent above the revised December estimate of $348.7 billion.

Click on graph for larger image.

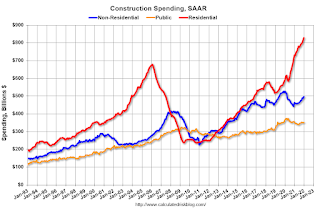

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 22% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential (blue) spending is 20% above the bubble era peak in January 2008 (nominal dollars).

Public construction spending is 8% above the peak in March 2009.

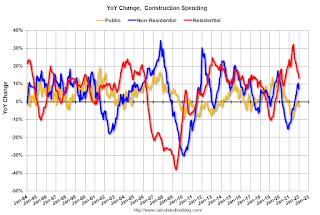

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 13.4%. Non-residential spending is up 7.3% year-over-year. Public spending is down 1.3% year-over-year.

ISM® Manufacturing index Increased to 58.6% in February

by Calculated Risk on 3/01/2022 10:05:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion. The PMI® was at 58.6% in February, up from 57.6% in January. The employment index was at 52.9%, down from 54.5% last month, and the new orders index was at 61.7%, up from 57.9%.

From ISM: Manufacturing PMI® at 58.6% February 2022 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in February, with the overall economy achieving a 21st consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing expanded at a slightly faster pace in February than in January.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The February Manufacturing PMI® registered 58.6 percent, an increase of 1 percentage point from the January reading of 57.6 percent. This figure indicates expansion in the overall economy for the 21st month in a row after a contraction in April and May 2020. The New Orders Index registered 61.7 percent, up 3.8 percentage points compared to the January reading of 57.9 percent. The Production Index registered 58.5 percent, an increase of 0.7 percentage point compared to the January reading of 57.8 percent. The Prices Index registered 75.6 percent, down 0.5 percentage point compared to the January figure of 76.1 percent. The Backlog of Orders Index registered 65 percent, 8.6 percentage points higher than the January reading of 56.4 percent. The Employment Index registered 52.9 percent, 1.6 percentage points lower than the January reading of 54.5 percent. The Supplier Deliveries Index registered 66.1 percent, an increase of 1.5 percentage points compared to the January figure of 64.6 percent. The Inventories Index registered 53.6 percent, 0.4 percentage point higher than the January reading of 53.2 percent. The New Export Orders Index registered 57.1 percent, up 3.4 percentage points compared to the January reading of 53.7 percent. The Imports Index registered 55.4 percent, a 0.3-percentage point increase from the January reading of 55.1 percent.”

emphasis added

CoreLogic: House Prices up 19.1% YoY in January; "Highest Level in at Least 45 Years"

by Calculated Risk on 3/01/2022 08:00:00 AM

Notes: This CoreLogic House Price Index report is for January. The recent Case-Shiller index release was for December. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: New Year, New Highs: CoreLogic Reports Home Price Appreciation Reaches 19.1% in January – Highest Level in at Least 45 Years

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for January 2022.

Consumers looking to purchase a home have remained optimistic moving into the new year, with more expecting to buy over the next six months as rapid home price appreciation is forecasted to slow. Despite market and economic challenges such as low inventory, continued buyer competition and declining affordability, potential buyers are ready to move while mortgage rates remain relatively low.

"In December and January, for-sale inventory continued to be the lowest we have seen in a generation,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Buyers have continued to bid prices up for the limited supply on the market. However, the rise in mortgage rates since January further eroded buyer affordability and is expected to slow price gains in coming months.”

...

Nationally, home prices increased 19.1% in January 2022, compared to January 2021. On a month-over-month basis, home prices increased by 1.4% compared to December 2021.

...

Home price gains are projected to slow to a 3.8% annual increase by January 2023.

emphasis added

Monday, February 28, 2022

Tuesday: ISM Mfg, Construction Spending, Vehicle Sales

by Calculated Risk on 2/28/2022 08:36:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Drop Noticeably as Global Drama Unfolds

To be sure, the average conventional 30yr fixed rate is still much higher than it was 3 weeks ago, but it's now lower than any day in between. Pricing is very stratified, depending on the lender, but the average lender is an entire eighth of a percent lower than Friday. That's a big move in general, but it's an exceptionally big move in the context of recent volatility.Tuesday:

emphasis added

• At 8:00 AM ET, Corelogic House Price index for January.

• At 10:00 AM, ISM Manufacturing Index for January. The consensus is for the ISM to be at 58.0, up from 57.6 in January.

• Also, at 10:00 AM, Construction Spending for December. The consensus is for a 0.2% decrease in construction spending.

• All day: Light vehicle sales for February. The consensus is for light vehicle sales to be 14.4 million SAAR in February, down from 15.0 million in January (Seasonally Adjusted Annual Rate).

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 64.9% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 215.6 | --- | ≥2321 | |

| New Cases per Day3 | 62,556 | 99,986 | ≤5,0002 | |

| Hospitalized3 | 41,242 | 62,792 | ≤3,0002 | |

| Deaths per Day3 | 1,686 | 1,940 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

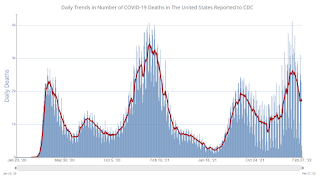

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in January

by Calculated Risk on 2/28/2022 04:18:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 1.17% in January, from 1.25% in December. The serious delinquency rate is down from 2.80% in January 2021.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (1% of portfolio), 3.39% are seriously delinquent (down from 3.48% in December).

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

The pandemic related increase in delinquencies was very different from the increase in delinquencies following the housing bubble. Lending standards had been fairly solid over the previous decade, and most of these homeowners had equity in their homes - and the vast majority of these homeowners have been able to restructure their loans once they were employed.

Freddie Mac reported earlier.

Median vs Repeat Sales Index House Prices

by Calculated Risk on 2/28/2022 12:37:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Median vs Repeat Sales Index House Prices

Excerpt:

Back in October, I wrote The Coming Deceleration in House Price Growth. In that post, I noted that the median prices (as reported by the National Association of Realtors® (NAR) was showing a slowdown in year-over-year (YoY) house price growth.

In October ... the YoY growth in median prices started falling - and I expected Case-Shiller to follow.

Here is the same graph through the most recent reports.

Sure enough, the YoY growth in the Case-Shiller started to decelerate.

However, median prices have picked up over the last three months - so there isn’t evidence of a sharp decline in the YOY growth.

If there is a slowdown in house price growth, we should expect to see it in median prices first.

Housing Inventory February 28th Update: Inventory Down 1.3% Week-over-week; New Record Low

by Calculated Risk on 2/28/2022 10:12:00 AM

Tracking existing home inventory is very important in 2022.

Inventory usually declines in the winter, and this is a new record low for this series.

This inventory graph is courtesy of Altos Research.

| Week Ending | YoY Change |

|---|---|

| 12/31/2021 | -30.0% |

| 1/7/2022 | -26.0% |

| 1/14/2022 | -28.6% |

| 1/21/2022 | -27.1% |

| 1/28/2022 | -25.9% |

| 2/4/2022 | -27.9% |

| 2/11/2022 | -27.5% |

| 2/18/2022 | -25.8% |

| 2/25/2022 | -24.9% |

Mike Simonsen discusses this data regularly on Youtube.

Six High Frequency Indicators for the Economy

by Calculated Risk on 2/28/2022 08:53:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of February 27th.

Click on graph for larger image.

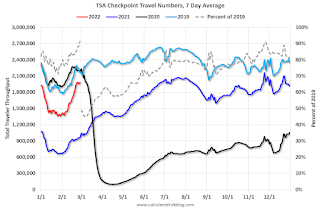

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 8.8% from the same day in 2019 (91.2% of 2019). (Dashed line) This is the smallest decline since the start of the pandemic.

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through February 26, 2022.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Dining was mostly moving sideways but declined during the winter wave of COVID and is now increasing. The 7-day average for the US is down 3% compared to 2019.

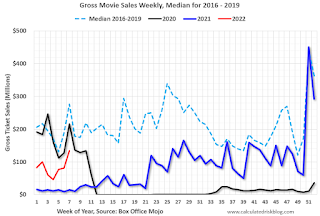

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $134 million last week, down about 52% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

This data is through February 19th. The occupancy rate was down 8.4% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

This data is through February 24th

This data is through February 24th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 112% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, February 25th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, February 27, 2022

Sunday Night Futures

by Calculated Risk on 2/27/2022 06:30:00 PM

Weekend:

• Schedule for Week of February 27, 2022

Monday:

• At 9:45 AM, Chicago Purchasing Managers Index for February. The consensus is for a reading of 63.9, down from 65.2 in January.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for February. This is the last of regional manufacturing surveys for February.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are down 102, and and DOW futures are down 442 fair value).

Oil prices were up over the last week with WTI futures at $98.09 per barrel and Brent at $104.54 per barrel. A year ago, WTI was at $62, and Brent was at $66 - so WTI oil prices are up about 60% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.59 per gallon. A year ago prices were at $2.72 per gallon, so gasoline prices are up $0.87 per gallon year-over-year.

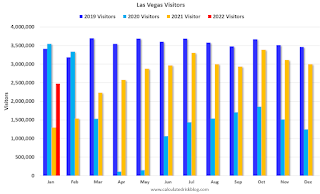

Las Vegas Visitor Authority for January 2022: Visitor Traffic Down 27.5% Compared to 2019

by Calculated Risk on 2/27/2022 01:24:00 PM

From the Las Vegas Visitor Authority: January 2022 Las Vegas Visitor Statistics

With the Omicron variant and continued impacts on the convention group segment, Las Vegas visitation reached 2.47M, roughly three‐quarters of pre‐COVID levels of January 2019 but dramatically higher (+91.2%) than January 2021.

Overall hotel occupancy reached 59.3%, +27.7 pts ahead of January 2021 but ‐24.7 pts below January 2019. Reflecting the challenged convention group segment, Midweek saw occupancy reach 52.0%, +29.5 pts vs. January 2021 but ‐30.1 pts vs. January 2019. As in the past several months, weekends fared better than midweek as Weekend occupancy reached 74.6%, +26.3 pts ahead of January 2021 and ‐14.2 pts vs. January 2019.

Reaching $145, January 2022 ADR exceeded January 2021 by +60.1% while lagging January 2019 by ‐7.2%. RevPAR reached $86.12 for the month, approx. triple January 2021's depressed levels but down ‐34.5% from January 2019.

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (dark blue), 2020 (light blue), 2021 (yellow) and 2022 (red)

Visitor traffic was down 27.5% compared to the same month in 2019.

Note: There was almost no convention traffic from April 2020 through May 2021.