by Calculated Risk on 3/03/2022 08:35:00 AM

Thursday, March 03, 2022

Weekly Initial Unemployment Claims Decrease to 215,000

The DOL reported:

In the week ending February 26, the advance figure for seasonally adjusted initial claims was 215,000, a decrease of 18,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 232,000 to 233,000. The 4-week moving average was 230,500, a decrease of 6,000 from the previous week's revised average. The previous week's average was revised up by 250 from 236,250 to 236,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 230,500.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.

Wednesday, March 02, 2022

Thursday: Fed Chair Powell Testimony, Unemployment Claims, ISM Services

by Calculated Risk on 3/02/2022 08:32:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 230 thousand from 232 thousand last week.

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

• Also at 10:00 AM, the ISM Services Index for February.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.0% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 215.8 | --- | ≥2321 | |

| New Cases per Day3 | 56,253 | 81,212 | ≤5,0002 | |

| Hospitalized3 | 40,190 | 56,955 | ≤3,0002 | |

| Deaths per Day3 | 1,674 | 1,687 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Fed's Beige Book: "Supply chain issues and low inventories continued to restrain growth"

by Calculated Risk on 3/02/2022 02:03:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of St. Louis based on information collected on or before February 18, 2022. "

Economic activity has expanded at a modest to moderate pace since mid-January. Many Districts reported that the surge in COVID-19 cases temporarily disrupted business activity as firms faced heighted absenteeism. Some Districts attributed a temporary weakening in demand in the hospitality sector to the rise in cases. Severe winter weather was also cited as disrupting activity. As a result, consumer spending was generally weaker than in the prior report. Reports on auto sales were mixed. Manufacturing activity continued to grow at a modest pace. All Districts noted that supply chain issues and low inventories continued to restrain growth, particularly in the construction sector. Reports from banking contacts indicated some weakening of financial conditions, although loan demand was generally unchanged. Demand for residential real estate was generally strong, although many Districts reported no change in home sales due to seasonal trends and low inventories. Agriculture reports were somewhat mixed, as some Districts experienced difficult growing conditions while others benefited from higher crop prices. Reports on the energy sector indicated modest growth. Among reporting Districts, the overall economic outlook over the next six months remained stable and generally optimistic, although reports highlighted an elevated degree of uncertainty.

...

Employment increased at a modest to moderate pace. Widespread strong demand for workers remained hampered by equally widespread reports of worker scarcity, though some Districts reported scattered signs of improving labor supply. Many firms had difficulty maintaining their staffing levels due to high turnover; this challenge was exacerbated by COVID-19 disruptions in January, though workers and firms recovered more quickly than during previous waves. Firms continued to increase compensation and introduce workplace flexibility to attract workers—especially in historically low-wage positions—with mixed success. Contacts reported they expect the tight labor market and consequent strong wage growth to continue, though a few Districts reported signs of wage growth moderating.

emphasis added

The War and Mortgage Rates

by Calculated Risk on 3/02/2022 12:57:00 PM

Today, in the Calculated Risk Real Estate Newsletter: The War and Mortgage Rates

A brief excerpt:

The invasion of Ukraine has clouded the economic outlook (of course, the economic outlook is inconsequential compared to the ongoing human suffering in Ukraine). Fed Chair Pro Tempore Powell said today:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/The near-term effects on the U.S. economy of the invasion of Ukraine, the ongoing war, the sanctions, and of events to come, remain highly uncertain.And in the Q&A, Powell said about the March FOMC meeting:"I am inclined to propose and support a 25 basis point rate hike"...Key points:

• The invasion is leading to significant uncertainty.

• Mortgage rates haven’t fallen as fast as Treasury yields.

• The Fed is still going to raise rates in March.

Fed Chair Powell: Raise Rates in March, Effects of Invasion "highly uncertain"

by Calculated Risk on 3/02/2022 08:43:00 AM

Watch Live here at 10 AM ET.

An excerpt from prepared testimony of Fed Chair Pro Tempore Powell: Semiannual Monetary Policy Report to the Congress

Our monetary policy has been adapting to the evolving economic environment, and it will continue to do so. We have phased out our net asset purchases. With inflation well above 2 percent and a strong labor market, we expect it will be appropriate to raise the target range for the federal funds rate at our meeting later this month.

The process of removing policy accommodation in current circumstances will involve both increases in the target range of the federal funds rate and reduction in the size of the Federal Reserve's balance sheet. As the FOMC noted in January, the federal funds rate is our primary means of adjusting the stance of monetary policy. Reducing our balance sheet will commence after the process of raising interest rates has begun, and will proceed in a predictable manner primarily through adjustments to reinvestments.

The near-term effects on the U.S. economy of the invasion of Ukraine, the ongoing war, the sanctions, and of events to come, remain highly uncertain. Making appropriate monetary policy in this environment requires a recognition that the economy evolves in unexpected ways. We will need to be nimble in responding to incoming data and the evolving outlook.

emphasis added

ADP: Private Employment Increased 475,000 in February

by Calculated Risk on 3/02/2022 08:19:00 AM

Private sector employment increased by 475,000 jobs from January to February according to the February ADP® National Employment ReportTM. Broadly distributed to the public each month, free of charge, the ADP National Employment Report is produced by the ADP Research Institute® in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual data of those who are on a company’s payroll, measures the change in total nonfarm private employment each month on a seasonally-adjusted basisThis was above the consensus forecast of 320,000 for this report.

“Hiring remains robust but capped by reduced labor supply post-pandemic. Last month large companies showed they are well-poised to compete with higher wages and benefit offerings, and posted the strongest reading since the early days of the pandemic recovery,” said Nela Richardson, chief economist, ADP. “Small companies lost ground as they continue to stuggle to keep pace with the wages and benefits needed to attract a limited pool of qualified workers.”

emphasis added

The BLS report will be released Friday, and the consensus is for 400 thousand non-farm payroll jobs added in February. The ADP report has not been very useful in predicting the BLS report, but this suggests a solid February BLS report.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 3/02/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 25, 2022.

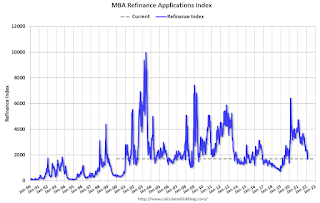

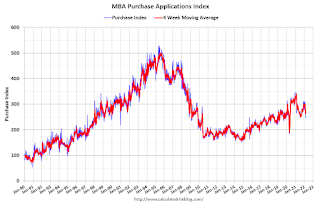

... The Refinance Index increased 1 percent from the previous week and was 56 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 9 percent lower than the same week one year ago.

“Mortgage rates last week reached multi-year highs, putting a damper on applications activity. The 30- year fixed rate reached its highest level since 2019 at 4.15 percent, and the refinance share of applications dipped below 50 percent. Although there was an increase in government refinance applications, higher rates continue to push potential refinance borrowers out of the market,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase activity remained weak, but the average loan size increased again, which indicates that home-price growth remains strong, and a greater share of the activity is occurring at the higher end of the market.”

Added Kan, “We will continue to assess the potential impact on mortgage demand from the sharp drop in interest rates this week due to the invasion of Ukraine.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 4.15 percent from 4.06 percent, with points decreasing to 0.44 from 0.48 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 9% year-over-year unadjusted.

According to the MBA, purchase activity is down 9% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, March 01, 2022

Wednesday: Fed Chair Powell Testimony, ADP Employment, Beige Book

by Calculated Risk on 3/01/2022 09:37:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 320,000 payroll jobs added in February, up from 301,000 lost in January.

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.0% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 215.7 | --- | ≥2321 | |

| New Cases per Day3 | 68,480 | 80,815 | ≤5,0002 | |

| Hospitalized3 | 41,898 | 59,829 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,832 | 1,686 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

February Vehicles Sales decreased to 14.07 million SAAR

by Calculated Risk on 3/01/2022 07:24:00 PM

Wards Auto released their estimate of light vehicle sales for February. Wards Auto estimates sales of 14.07 million SAAR in February 2022 (Seasonally Adjusted Annual Rate), down 6.3% from the January sales rate, and down 11.7% from February 2021.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for February (red).

The impact of COVID-19 was significant, and April 2020 was the worst month. After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic).

Rents Still Increasing Sharply Year-over-year

by Calculated Risk on 3/01/2022 12:44:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Rents Still Increasing Sharply Year-over-year

A brief excerpt:

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. All of these measures are through January 2022 (Apartment List through February 2022).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Note that new lease measures (Zillow, Apartment List) dipped early in the pandemic, whereas the BLS measures were steady. Then new leases took off, and the BLS measures are just starting to pick up.

...

The Zillow measure is up 15.9% YoY in January, down slightly from 16.0% YoY in December. And the ApartmentList measure is up 17.6% as of February, down slightly from 17.9% in January. Both the Zillow measure (a repeat rent index), and ApartmentList are showing a sharp increase in rents.

Clearly rents are still increasing, and we should expect this to continue to spill over into measures of inflation in 2022. The Owners’ Equivalent Rent (OER) was up 4.1% YoY in January, from 3.8% YoY in December - and will likely increase further in the coming months.