by Calculated Risk on 3/05/2022 02:11:00 PM

Saturday, March 05, 2022

Real Estate Newsletter Articles this Week

At the Calculated Risk Real Estate Newsletter this week:

• Delinquencies, Foreclosures and REO

• The War and Mortgage Rates

• Rents Still Increasing Sharply Year-over-year Higher Rents will impact measures of inflation in 2022

• Median vs Repeat Sales Index House Prices

This is usually published several times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of March 6, 2022

by Calculated Risk on 3/05/2022 08:11:00 AM

The key report scheduled for this week is February CPI.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for February.

8:30 AM: Trade Balance report for January from the Census Bureau.

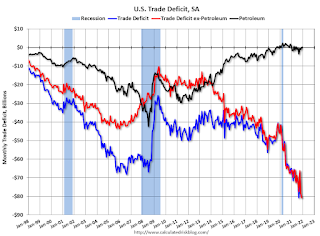

8:30 AM: Trade Balance report for January from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $87.1 billion. The U.S. trade deficit was at $80.7 Billion in December.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM ET: Job Openings and Labor Turnover Survey for January from the BLS.

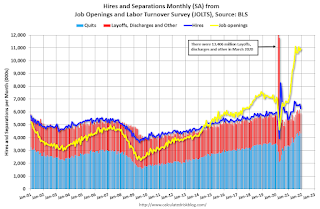

10:00 AM ET: Job Openings and Labor Turnover Survey for January from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in December to 10.9 million from 10.8 million in November.

8:30 AM: The Consumer Price Index for February from the BLS. The consensus is for a 0.8% increase in CPI, and a 0.5% increase in core CPI. The consensus is for CPI to be up 7.9% Year-over-year (YoY), and core CPI to be up 6.4% YoY.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 210 thousand from 215 thousand last week.

12:00 PM: Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for March).

Friday, March 04, 2022

COVID Update: March 4, 2022; Under 50,000 New Cases First Time Since July 2021

by Calculated Risk on 3/04/2022 09:15:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.1% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 216.0 | --- | ≥2321 | |

| New Cases per Day3 | 49,888 | 70,968 | ≤5,0002 | |

| Hospitalized3 | 36,278 | 51,764 | ≤3,0002 | |

| Deaths per Day3 | 1,413 | 1,739 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

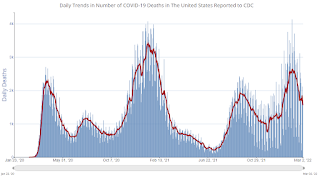

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

AAR: February Rail Carloads and Intermodal Up Year-over-year; Still Soft

by Calculated Risk on 3/04/2022 03:59:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

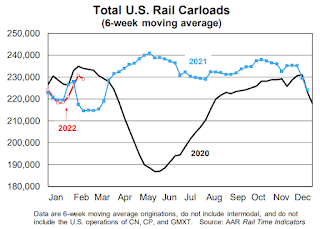

U.S. rail carloads were up 11.0% in February 2022 over February 2021, but that’s misleading — the big percentage gain is mainly a function of weak carloads in February 2021 caused by severe winter storms back then in Texas and elsewhere. (The third week of February 2021 had the fewest rail carloads of any week in our records going back to 1988.) For the first two months of 2022, carloads were up 3.6% ...

U.S. intermodal volume in February 2022 was up 1.4% over last year

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2019, 2020 and 2021:

Total carloads were 915,329 in February 2022, an average of 228,832 per week. Other than February 2020, that’s the lowest weekly average for a February since sometime before 1988, when our U.S. rail traffic data begin.

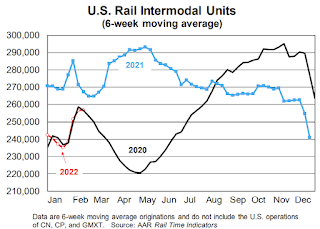

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2019, 2020 and 2021: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2019, 2020 and 2021: (using intermodal or shipping containers):Volume in February 2022 was 1.03 million, up 1.4% (14,294 containers and trailers) over February 2021. The weekly average in February 2022 was 238,220, well below the first half 2021 weekly average of 282,004 and the second half 2021 average of 261,938. The two-month total in 2022 was 2.03 million. Since 2016, only 2020 had a lower January-February total.

Delinquencies, Foreclosures and REO

by Calculated Risk on 3/04/2022 01:53:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Delinquencies, Foreclosures and REO

A brief excerpt:

Last year, I pointed out that the foreclosure moratorium, combined with the expiration of a large number of forbearance plans, would NOT lead to a surge in foreclosures and impact house prices (as happened following the housing bubble).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is some data on REOs through Q4 2021 …

...

We will probably see an increase in REOs in 2022.

This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosed houses) declined from $1.11 billion in Q4 2020 to $0.78 billion in Q4 2021. This is the lowest level of REOs in many years. (Probably declined sharply due to foreclosure moratoriums, forbearance programs and house price increases).

...

The bottom line is there will be an increase in foreclosures in 2022 (from record low levels), but it will not be a huge wave of foreclosures.

Q1 GDP Forecasts: Moving Down

by Calculated Risk on 3/04/2022 12:35:00 PM

From BofA:

This week’s data pushed up 4Q GDP tracking to 7.4% qoq saar from 7.0%, but lowered 1Q GDP tracking to 1.6% from 2.5%. [March 4 estimate]And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2022 is 0.0 percent on March 1, down from 0.6 percent on February 25. [March 1 estimate]

Comments on February Employment Report

by Calculated Risk on 3/04/2022 09:31:00 AM

This was a strong report with upward revisions to prior months.

The headline jobs number in the February employment report was above expectations, and employment for the previous two months was revised up by 92,000. The participation rate and the employment-population ratio both increased, and the unemployment rate decreased to 3.8%.

In February, the year-over-year employment change was 6.67 million jobs.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today.

In February, the number of permanent job losers decreased to 1.583 million from 1.630 million in the previous month.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The prime working age will be key as the economy recovers.

The 25 to 54 participation rate increased in February to 82.2% from 82.0% in January, and the 25 to 54 employment population ratio increased to 79.5% from 79.1% the previous month.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons increased by 418,000 to 4.1 million in February but remains below its February 2020 level of 4.4 million. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons increased in February to 4.135 million from 3.717 million in January. This is lower than pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.2% from 7.1% in the previous month. This is down from the record high in April 22.9% for this measure since 1994. This measure was at 7.0% in February 2020 (pre-pandemic).

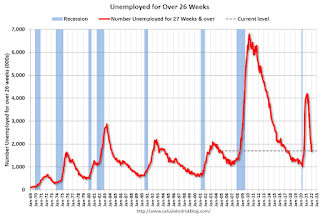

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.702 million workers who have been unemployed for more than 26 weeks and still want a job, up from 1.691 million the previous month.

This does not include all the people that left the labor force.

Summary:

The headline monthly jobs number was above expectations; and the previous two months were revised up by 92,000 combined.

February Employment Report: 678 thousand Jobs, 3.8% Unemployment Rate

by Calculated Risk on 3/04/2022 08:44:00 AM

From the BLS:

Total nonfarm payroll employment rose by 678,000 in February, and the unemployment rate edged down to 3.8 percent, the U.S. Bureau of Labor Statistics reported today. Job growth was widespread, led by gains in leisure and hospitality, professional and business services, health care, and construction.

The change in total nonfarm payroll employment for December was revised up by 78,000, from +510,000 to +588,000, and the change for January was revised up by 14,000, from +467,000 to +481,000. With these revisions, employment in December and January combined is 92,000 higher than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In February, the year-over-year change was 6.67 million jobs. This was up significantly year-over-year.

Total payrolls increased by 678 thousand in February. Private payrolls increased by 654 thousand, and public payrolls increased 24 thousand.

Payrolls for December and January were revised up 92 thousand, combined.

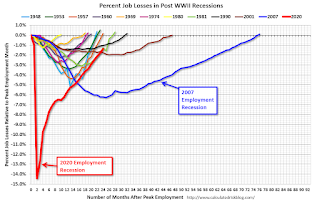

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 24 months after the onset, is now significantly better than the worst of the "Great Recession".

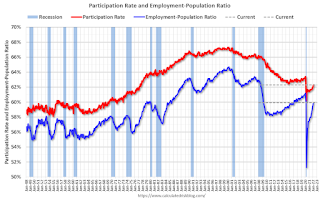

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 62.3% in February, from 62.2% in January. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 62.3% in February, from 62.2% in January. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 59.9% from 59.7% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

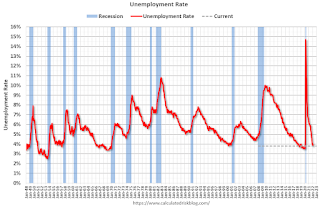

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in February to 3.8% from 4.0% in January.

This was above consensus expectations; and November and December payrolls were revised up by 92,000 combined.

Thursday, March 03, 2022

Friday: February Employment Report

by Calculated Risk on 3/03/2022 09:08:00 PM

My February Employment Preview

Goldman February Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for February. The consensus is for 400,000 jobs added, and for the unemployment rate to decrease to 3.9%.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.0% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 215.9 | --- | ≥2321 | |

| New Cases per Day3 | 53,016 | 74,143 | ≤5,0002 | |

| Hospitalized3 | 38,175 | 54,307 | ≤3,0002 | |

| Deaths per Day3 | 1,558 | 1,711 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Goldman February Payrolls Preview

by Calculated Risk on 3/03/2022 04:28:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose by 500k in February (mom sa), above consensus of +400k. Our forecast assumes the return of roughly 200k payroll workers who missed work in January due to Omicron. ... We estimate a two-tenths drop in the unemployment rate to 3.8%—compared to consensus of 3.9%.CR Note: The consensus is for 400 thousand jobs added, and for the unemployment rate to decline to 3.9%.

emphasis added