by Calculated Risk on 3/09/2022 07:00:00 AM

Wednesday, March 09, 2022

MBA: Mortgage Applications Increase in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 8.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 4, 2022.

... The Refinance Index increased 9 percent from the previous week and was 50 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. The unadjusted Purchase Index increased 11 percent compared with the previous week and was 7 percent lower than the same week one year ago.

"Mortgage rates dropped for the first time in 12 weeks, as the war in Ukraine spurred an investor flight to quality, which pushed U.S. Treasury yields lower. A 6-basis-point decline in the 30-year fixed-rate mortgage led to a slight rebound in total refinance activity, with a larger gain in government refinances. Looking ahead, the potential for higher inflation amidst disruptions in oil and other commodity flows will likely lead to a period of volatility in rates as these effects work against each other,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase activity also increased, as prospective buyers acted on lower rates and the early start of the spring buying season. The average loan size remained close to record highs, with higher-balance loan applications continuing to dominate growth.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 4.09 percent from 4.15 percent, with points remaining unchanged at 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

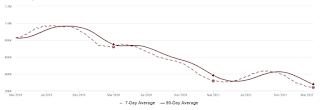

Click on graph for larger image.The first graph shows the refinance index since 1990.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 7% year-over-year unadjusted.

According to the MBA, purchase activity is down 7% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, March 08, 2022

Wednesday: Job Openings

by Calculated Risk on 3/08/2022 08:55:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for January from the BLS.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.1% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 216.3 | --- | ≥2321 | |

| New Cases per Day3 | 40,433 | 66,869 | ≤5,0002 | |

| Hospitalized3 | 29,633 | 42,589 | ≤3,0002 | |

| Deaths per Day3 | 1,208 | 1,887 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

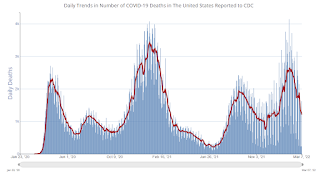

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Leading Index for Commercial Real Estate "Recovers in February"

by Calculated Risk on 3/08/2022 02:00:00 PM

From Dodge Data Analytics: Dodge Momentum Index Recovers in February

The Dodge Momentum Index increased 4% in February to 158.2 (2000=100), from the revised January reading of 151.9. The Momentum Index, issued by Dodge Construction Network, is a monthly measure of the initial report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. In February, institutional planning rose 9%, and commercial planning moved 1% higher.

The Dodge Momentum Index rebounded from three consecutive monthly declines that followed a 14-year high in October 2021. Much of February’s gain was due to a sizeable jump in the institutional component, as more education and healthcare projects entered planning. Commerical planning remained solid thanks to office and warehouse projects. When compared to February 2021, the overall Momentum Index was 11% higher in February 2022. The institutional component was up 37%, while the commercial component was down 1% on a year-over-year basis.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 158.2 in February, up from 151.9 in January.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggested a decline in Commercial Real Estate construction through most of 2021, but a solid pickup in 2022.

1st Look at Local Housing Markets in February

by Calculated Risk on 3/08/2022 10:27:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in February

A brief excerpt:

Here is a summary of active listings for these housing markets in February. Inventory was up 2.4% in February month-over-month (MoM) from January, and down 30.0% year-over-year (YoY).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

It appears inventory has bottomed seasonally in some areas. Last month, these markets were down 38.8% YoY, so the YoY decline in February is smaller than in January. This isn’t indicating a slowing market, but maybe a few baby steps towards a more balanced market in some areas.

Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle) and Santa Clara (San Jose)

Trade Deficit Increased to $89.7 Billion in January

by Calculated Risk on 3/08/2022 08:42:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $89.7 billion in January, up $7.7 billion from $82.0 billion in December, revised.

January exports were $224.4 billion, $3.9 billion less than December exports. January imports were $314.1 billion, $3.8 billion more than December imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports decreased and imports increased in January.

Exports are up 15% compared to January 2021; imports are up 21% year-over-year.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China increased to $36.4 billion in January, from $26.3 billion in January 2021.

Monday, March 07, 2022

Tuesday: Trade Deficit

by Calculated Risk on 3/07/2022 09:14:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Jump Back Up to Start The Week

Mortgage rates have experienced significant volatility so far in 2022. At first, this was almost exclusively a function of the Federal Reserve or, rather, the market's reaction to changes being discussed by the Fed. It was also almost exclusively biased toward higher rates.Tuesday:

Since late February, Ukraine is the key consideration for financial markets. At first, this pushed rates noticeably lower, but that trend has leveled off as of last week. Now we're seeing rates move broadly sideways in the bigger picture, with extreme volatility at times. [30 year fixed 4.09%]

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for February.

• At 8:30 AM, Trade Balance report for January from the Census Bureau. The consensus is the trade deficit to be $87.1 billion. The U.S. trade deficit was at $80.7 Billion in December.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.1% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 216.2 | --- | ≥2321 | |

| New Cases per Day3 | 42,204 | 62,266 | ≤5,0002 | |

| Hospitalized3 | 29,837 | 44,714 | ≤3,0002 | |

| Deaths per Day3 | 1,259 | 1,723 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Homebuilder Comments in February: “Demand is still high"

by Calculated Risk on 3/07/2022 05:28:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Homebuilder Comments in February: “Demand is still high"

A brief excerpt:

Some homebuilder comments courtesy of Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting (a must follow for housing on twitter!):There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Here is Rick’s summary of builder comments for various markets (emphasis added in bold):

Homebuilder survey results are in for February. Top themes: 1) Record high new home price increases at +20% YOY nationally. 2) Record low builder finished inventory. 3) Demand still off the charts & quality of home buyer prospect lists still solid. Market commentary to follow ...

#Charlotte builder: “We’ve stopped selling homes in the majority of our communities due to supply chain & labor delays. We release homes for sale once they get to drywall stage. This will throw off our community counts & sales numbers."

#Boston builder: “We continue to limit lot releases, even sold our models. Our agents are not holding open houses nor advertising. Lots are reserved within days of release.”

#Nashville builder: “Market is still extremely strong even with rates moving up. Still a large shortage of homes on the market.”

#Dallas builder: “We’re limiting sales to spec inventory in order to limit inflation risk.”

#Austin builder: “Traditional detached sales (entry level and move-up) continued to be very strong in February."

Black Knight Mortgage Monitor for January: "$275 billion in equity withdrawn" in 2021

by Calculated Risk on 3/07/2022 12:45:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor for January: "$275 billion in equity withdrawn" in 2021

A brief excerpt:

And on the payment to income ratio (this is high):There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

• Rising home prices and interest rates continue to put significant pressure on home buyers

• The principal and interest payment required to buy the average-priced home is up $186 (14%) over the first two months of the year and $417 (37%) year-over-year

• It now requires 27.5% of the median household income to purchase the average home – well above the long-term affordability benchmark of 25%, though still below the high of 34% during the pre-Great Recession bubble

• From 2013 through 2019, a payment-to-income ratio of 21.5% universally corresponded with home price deceleration – a trend that's been shattered in the post-pandemic world

Housing Inventory March 7th Update: Inventory Down 1.4% Week-over-week; New Record Low; Possible Bottom

by Calculated Risk on 3/07/2022 09:42:00 AM

Tracking existing home inventory is very important in 2022.

Inventory usually declines in the winter, and this is a new record low for this series.

This inventory graph is courtesy of Altos Research.

| Week Ending | YoY Change |

|---|---|

| 12/31/2021 | -30.0% |

| 1/7/2022 | -26.0% |

| 1/14/2022 | -28.6% |

| 1/21/2022 | -27.1% |

| 1/28/2022 | -25.9% |

| 2/4/2022 | -27.9% |

| 2/11/2022 | -27.5% |

| 2/18/2022 | -25.8% |

| 2/25/2022 | -24.9% |

| 3/4/2022 | -24.2% |

Based on the trend, it appears possible inventory bottomed seasonally last week, and will be up week-over-week in the next report.

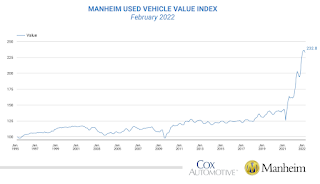

Used Vehicle Wholesale Prices Decline in February

by Calculated Risk on 3/07/2022 09:18:00 AM

From Manheim Consulting today: Wholesale Used-Vehicle Prices Decline in February

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) declined 2.1% in February from January. The Manheim Used Vehicle Value Index declined to 231.3, which was a 36.7% increase from a year ago. The non-adjusted price change in February was a decline of 2.2% compared to January, leaving the unadjusted average price up 32.4% year over year.

Manheim Market Report (MMR) values saw weekly price decreases in February that decelerated each week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.