by Calculated Risk on 3/10/2022 08:39:00 AM

Thursday, March 10, 2022

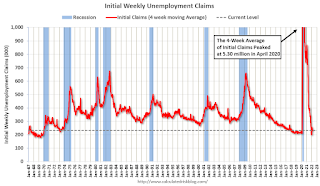

Weekly Initial Unemployment Claims Increase to 227,000

The DOL reported:

In the week ending March 5, the advance figure for seasonally adjusted initial claims was 227,000, an increase of 11,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 215,000 to 216,000. The 4-week moving average was 231,250, an increase of 500 from the previous week's revised average. The previous week's average was revised up by 250 from 230,500 to 230,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 231,250.

The previous week was revised up.

Weekly claims were higher than the consensus forecast.

BLS: CPI increased 0.8% in February; Core CPI increased 0.5%

by Calculated Risk on 3/10/2022 08:31:00 AM

Note: This is pre-invasion, and there will be sharp increases in energy prices for March.

From the BLS:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.8 percent in February on a seasonally adjusted basis after rising 0.6 percent in January, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 7.9 percent before seasonal adjustment.Both CPI and core CPI were at expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

Increases in the indexes for gasoline, shelter, and food were the largest contributors to the seasonally adjusted all items increase. The gasoline index rose 6.6 percent in February and accounted for almost a third of the all items monthly increase; other energy component indexes were mixed. The food index rose 1.0 percent as the food at home index rose 1.4 percent; both were the largest monthly increases since April 2020.

The index for all items less food and energy rose 0.5 percent in February following a 0.6-percent increase the prior month. The shelter index was by far the biggest factor in the increase, with a broad set of indexes also contributing, including those for recreation, household furnishings and operations, motor vehicle insurance, personal care, and airline fares.

The all items index rose 7.9 percent for the 12 months ending February. The 12-month increase has been steadily rising and is now the largest since the period ending January 1982. The all items less food and energy index rose 6.4 percent, the largest 12-month change since the period ending August 1982. The energy index rose 25.6 percent over the last year, and the food index increased 7.9 percent, the largest 12-month increase since the period ending July 1981.

emphasis added

Wednesday, March 09, 2022

Thursday: CPI, Unemployment Claims, Q4 Flow of Funds

by Calculated Risk on 3/09/2022 08:59:00 PM

Thursday:

• At 8:30 AM ET, The Consumer Price Index for February from the BLS. The consensus is for a 0.8% increase in CPI, and a 0.5% increase in core CPI. The consensus is for CPI to be up 7.9% Year-over-year (YoY), and core CPI to be up 6.4% YoY.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 210 thousand from 215 thousand last week.

• At 12:00 PM, Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

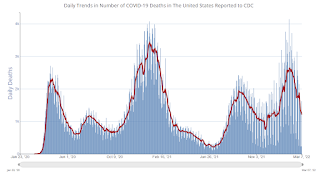

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.2% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 216.4 | --- | ≥2321 | |

| New Cases per Day3 | 37,879 | 55,018 | ≤5,0002 | |

| Hospitalized3 | 28,090 | 40,581 | ≤3,0002 | |

| Deaths per Day3 | 1,161 | 1,683 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

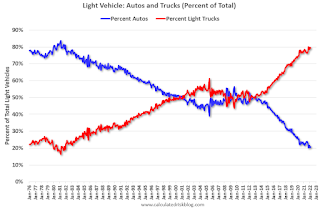

Vehicle Sales Mix and Heavy Trucks

by Calculated Risk on 3/09/2022 02:22:00 PM

This graph shows the percent of light vehicle sales between passenger cars and trucks / SUVs through February 2022.

Over time the mix has changed more and more towards light trucks and SUVs.

Over time the mix has changed more and more towards light trucks and SUVs.Only when oil prices are high, does the trend slow or reverse.

The percent of light trucks and SUVs was at 79.2% in February 2022 - just below the record high percentage of 80.0% last October.

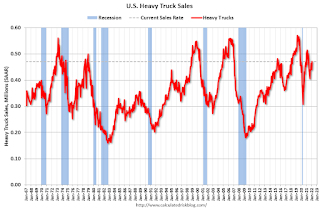

The second graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the February 2022 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all time high of 563 thousand SAAR in September 2019.

Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales really declined at the beginning of the pandemic, falling to a low of 299 thousand SAAR in May 2020.

Heavy truck sales really declined at the beginning of the pandemic, falling to a low of 299 thousand SAAR in May 2020. BLS: Job Openings "little changed" at 11.3 million in January

by Calculated Risk on 3/09/2022 10:09:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 11.3 million on the last business day of January, the U.S. Bureau of Labor Statistics reported today. Hires and total separations were little changed at 6.5 million and 6.1 million, respectively. Within separations, the quits rate decreased to 2.8 percent. The layoffs and discharges rate was little changed at 0.9 percent.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January, the employment report last Friday was for February.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spike in layoffs and discharges in March 2020 are labeled, but off the chart to better show the usual data.

Jobs openings decreased in January to 11.3 million from 11.4 million in December.

The number of job openings (yellow) were up 56% year-over-year.

Quits were up 28% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 3/09/2022 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 8.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 4, 2022.

... The Refinance Index increased 9 percent from the previous week and was 50 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. The unadjusted Purchase Index increased 11 percent compared with the previous week and was 7 percent lower than the same week one year ago.

"Mortgage rates dropped for the first time in 12 weeks, as the war in Ukraine spurred an investor flight to quality, which pushed U.S. Treasury yields lower. A 6-basis-point decline in the 30-year fixed-rate mortgage led to a slight rebound in total refinance activity, with a larger gain in government refinances. Looking ahead, the potential for higher inflation amidst disruptions in oil and other commodity flows will likely lead to a period of volatility in rates as these effects work against each other,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase activity also increased, as prospective buyers acted on lower rates and the early start of the spring buying season. The average loan size remained close to record highs, with higher-balance loan applications continuing to dominate growth.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 4.09 percent from 4.15 percent, with points remaining unchanged at 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 7% year-over-year unadjusted.

According to the MBA, purchase activity is down 7% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, March 08, 2022

Wednesday: Job Openings

by Calculated Risk on 3/08/2022 08:55:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for January from the BLS.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.1% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 216.3 | --- | ≥2321 | |

| New Cases per Day3 | 40,433 | 66,869 | ≤5,0002 | |

| Hospitalized3 | 29,633 | 42,589 | ≤3,0002 | |

| Deaths per Day3 | 1,208 | 1,887 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Leading Index for Commercial Real Estate "Recovers in February"

by Calculated Risk on 3/08/2022 02:00:00 PM

From Dodge Data Analytics: Dodge Momentum Index Recovers in February

The Dodge Momentum Index increased 4% in February to 158.2 (2000=100), from the revised January reading of 151.9. The Momentum Index, issued by Dodge Construction Network, is a monthly measure of the initial report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. In February, institutional planning rose 9%, and commercial planning moved 1% higher.

The Dodge Momentum Index rebounded from three consecutive monthly declines that followed a 14-year high in October 2021. Much of February’s gain was due to a sizeable jump in the institutional component, as more education and healthcare projects entered planning. Commerical planning remained solid thanks to office and warehouse projects. When compared to February 2021, the overall Momentum Index was 11% higher in February 2022. The institutional component was up 37%, while the commercial component was down 1% on a year-over-year basis.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 158.2 in February, up from 151.9 in January.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggested a decline in Commercial Real Estate construction through most of 2021, but a solid pickup in 2022.

1st Look at Local Housing Markets in February

by Calculated Risk on 3/08/2022 10:27:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in February

A brief excerpt:

Here is a summary of active listings for these housing markets in February. Inventory was up 2.4% in February month-over-month (MoM) from January, and down 30.0% year-over-year (YoY).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

It appears inventory has bottomed seasonally in some areas. Last month, these markets were down 38.8% YoY, so the YoY decline in February is smaller than in January. This isn’t indicating a slowing market, but maybe a few baby steps towards a more balanced market in some areas.

Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle) and Santa Clara (San Jose)

Trade Deficit Increased to $89.7 Billion in January

by Calculated Risk on 3/08/2022 08:42:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $89.7 billion in January, up $7.7 billion from $82.0 billion in December, revised.

January exports were $224.4 billion, $3.9 billion less than December exports. January imports were $314.1 billion, $3.8 billion more than December imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports decreased and imports increased in January.

Exports are up 15% compared to January 2021; imports are up 21% year-over-year.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China increased to $36.4 billion in January, from $26.3 billion in January 2021.