by Calculated Risk on 3/14/2022 09:19:00 AM

Monday, March 14, 2022

Housing Inventory May Have Bottomed Seasonally

Today, in the Calculated Risk Real Estate Newsletter: Housing Inventory May Have Bottomed Seasonally

A brief excerpt:

Last year inventory bottomed seasonally in April 2021 - very late in the year. This year, by this measure, it appears inventory bottomed seasonally at the beginning of March (we need a few more weeks of increasing inventory to confirm this).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Inventory is still very low. Compared to the same week in 2021, inventory is down 21.7%, and compared to the same week in 2020, and inventory is down 65.9% from 730 thousand.

One of the keys will be to watch the year-over-year change each week to see if the declines are decreasing. Here is a table of the year-over-year change by week since the beginning of the year.

Week Ending YoY Change 12/31/2021 -30.0% 1/7/2022 -26.0% 1/14/2022 -28.6% 1/21/2022 -27.1% 1/28/2022 -25.9% 2/4/2022 -27.9% 2/11/2022 -27.5% 2/18/2022 -25.8% 2/25/2022 -24.9% 3/4/2022 -24.2% 3/11/2022 -21.7%

Last week I wrote: "Based on the trend, it appears possible inventory bottomed seasonally last week, and will be up week-over-week in the next report." That happened.

Now we need to watch if the YoY change continues to decrease. Based on the current trend, it is possible inventory will be up YoY later this year.

Six High Frequency Indicators for the Economy

by Calculated Risk on 3/14/2022 08:38:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of March 14th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 14.3% from the same day in 2019 (85.7% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through March 9, 2022.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Dining was mostly moving sideways but declined during the winter wave of COVID and is now increasing. The 7-day average for the US is down 7% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $216 million last week, up about 23% from the median for the week. Almost all of the ticket sales were for The Batman.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

This data is through March 5th. The occupancy rate was down 8.2% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

This data is through March 11th

This data is through March 11th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 118% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, March 11th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, March 13, 2022

Sunday Night Futures

by Calculated Risk on 3/13/2022 06:52:00 PM

Weekend:

• Schedule for Week of March 13, 2022

Monday:

• At 10:00 AM, State Employment and Unemployment (Monthly), January 2022

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 20, and and DOW futures are up 147 fair value).

Oil prices were down over the last week with WTI futures at $106.98 per barrel and Brent at $110.71 per barrel. A year ago, WTI was at $65, and Brent was at $69 - so WTI oil prices are up 65% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.30 per gallon. A year ago prices were at $2.85 per gallon, so gasoline prices are up $1.45 per gallon year-over-year.

FOMC Preview: Liftoff

by Calculated Risk on 3/13/2022 10:11:00 AM

Expectations are the FOMC will announce a 25bps rate hike at the meeting this week. In addition, the FOMC will hint at balance sheet reduction (runoff of assets / not reinvesting) and indicate further rate hikes at upcoming meetings.

"We expect the Fed to kick off the rate hiking cycle at the March FOMC meeting with a 25bp increase in the fed funds target range to 0.25-0.50%. In addition, the Fed is likely to release an addendum to their “Principles for Reducing the Size of the Federal Reserve's Balance Sheet”, with specifics on caps for the unwinding of their holdings of Treasuries and agency securities. This will provide a strong signal that the Fed is ready to commence Quantitative Tightening (QT) as early as the following meeting in May ...These actions would be in line with Chair Powell’s messaging at the semi-annual monetary policy testimony in early March, in which he explicitly stated that he would propose and support a 25bp hike and that he expects the Committee to set the pace of balance sheet runoff at the next meeting."

emphasis added

"We are raising our Fed forecast to include seven consecutive 25bp rate hikes at each of the remaining FOMC meetings in 2022 (vs. five hikes in 2022 previously).”And from Merrill:

"Inflation is here and it continues to make its presence known everywhere. We remain comfortable with our hawkish call for the Fed to hike seven times this year."Wall Street forecasts are for GDP to barely increase in Q1 2022, and to be in the 2% to 3% range for 2022. This is a sharp reduction in Wall Street growth forecasts, and the FOMC will probably lower their 2022 forecast down to 3% or so.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Dec 2021 | 3.6 to 4.5 | 2.0 to 2.5 | 1.8 to 2.0 | |

The unemployment rate was at 3.8% in February. There will likely be a slight reduction in the unemployment rate forecast for Q4 2022.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Dec 2021 | 3.4 to 3.7 | 3.2 to 3.6 | 3.2 to 3.7 | |

As of January 2022, PCE inflation was up 6.1% from January 2021. It seems like the FOMC will revise up their inflation projections for 2022.

"From the Russian Revolution to Vietnam, war has been a reliable precursor to inflation. History may be about to repeat as Russia’s invasion of Ukraine tilts the balance of global political and economic forces toward higher inflation."

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Dec 2021 | 2.2 to 3.0 | 2.1 to 2.5 | 2.0 to 2.2 | |

PCE core inflation was up 5.2% in January year-over-year.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Dec 2021 | 2.5 to 3.0 | 2.1 to 2.4 | 2.0 to 2.2 | |

Saturday, March 12, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 3/12/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• 2nd Look at Local Housing Markets in February

• The Home ATM Open in Q4 2021; Closing in 2022

• 1st Look at Local Housing Markets in February

• Homebuilder Comments in February: “Demand is still high"

• Black Knight Mortgage Monitor for January; "$275 billion in equity withdrawn" in 2021

This is usually published several times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of March 13, 2022

by Calculated Risk on 3/12/2022 08:11:00 AM

The key reports this week are February Retail Sales, Housing Starts and Existing Home Sales.

For manufacturing, the February Industrial Production report and the March NY and Philly Fed manufacturing surveys will be released.

The FOMC meets this week, and the FOMC is expected to raise rates.

10:00 AM: State Employment and Unemployment (Monthly), January 2022

8:30 AM: The New York Fed Empire State manufacturing survey for March. The consensus is for a reading of 7.2, up from 3.1.

8:30 AM ET: The Producer Price Index for February from the BLS. The consensus is for a 0.9% increase in PPI, and a 0.6% increase in core PPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Retail sales for February is scheduled to be released. The consensus is for a 0.4% increase in retail sales.

8:30 AM: Retail sales for February is scheduled to be released. The consensus is for a 0.4% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales ex-gasoline were up 4.2% in January.

10:00 AM: The March NAHB homebuilder survey. The consensus is for a reading of 81, down from 82. Any number above 50 indicates that more builders view sales conditions as good than poor.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate by 25bps at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: Housing Starts for February.

8:30 AM: Housing Starts for February. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.695 million SAAR, up from 1.638 million SAAR.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 225 thousand from 227 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for March. The consensus is for a reading of 15.0, down from 16.0.

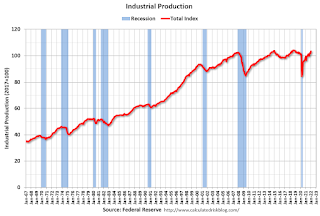

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.This graph shows industrial production since 1967.

The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 77.9%.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 6.16 million SAAR, down from 6.50 million.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 6.16 million SAAR, down from 6.50 million.The graph shows existing home sales from 1994 through the report last month.

Friday, March 11, 2022

COVID Update: March 11, 2022; New Cases at 35,000, Lowest Since July 2021

by Calculated Risk on 3/11/2022 09:19:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.2% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 216.4 | --- | ≥2321 | |

| New Cases per Day3 | 35,652 | 49,000 | ≤5,0002 | |

| Hospitalized3 | 25,878 | 36,756 | ≤3,0002 | |

| Deaths per Day3 | 1,197 | 1,434 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Q1 GDP Forecasts: Close to Zero

by Calculated Risk on 3/11/2022 12:53:00 PM

From BofA:

This week’s trade and inventory data along with some adjustments to assumptions left our 1Q GDP tracking estimate unchanged at 1.0% qoq saar. [March 11 estimate]From Goldman:

emphasis added

We are downgrading our US GDP forecast to reflect higher oil prices and other drags on growth related to the war in Ukraine. ... As a result, we now forecast GDP growth of +0.5%/+1.5%/+2.5%/+2.5% in 2022Q1-Q4 (vs. 1.0%/2.5%/2.5%/2.0% previously), lowering our 2022 real GDP growth forecast to +1.75% on a Q4/Q4 basis (vs. +2.0% previous; 2.7% consensus). [0.5% Q1 March 10 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2022 is 0.5 percent on March 8, up from 0.0 percent on March 1. [March 8 estimate]

2nd Look at Local Housing Markets in February

by Calculated Risk on 3/11/2022 10:02:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in February

A brief excerpt:

Important on Houston MarketThere is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

From the Houston Association of REALTORS® (HAR): February Is a Strong Month for Houston Home Sales (Sales up sharply due partially to the freeze in February 2021)Home sales scored double-digit gains in February, but part of the strong showing was because the statistics compared to last February, when that deadly Texas freeze halted real estate activity for days, and in some cases, even longer. Undistorted by the weather factor were the continued squeeze on inventory, which returned to its all-time low, and pricing, which due to limited supply and ongoing consumer demand, soared to record highs.

emphasis addedAnd a table of February sales. Sales in these areas were down 2.0% YoY, Not Seasonally Adjusted (NSA). Note: The Houston market was up 25.6% year-over-year due to the freeze in February 2021.

Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle), North Texas (Dallas), and Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

3) Totals do not include Atlanta, and Denver (included in state totals).

Hotels: Occupancy Rate Down 8% Compared to Same Week in 2019

by Calculated Risk on 3/11/2022 08:30:00 AM

U.S. hotel performance decreased from the previous week, according to STR‘s latest data through March 5.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Feb. 27 through March 5, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 61.2% (-8.2%)

• Average daily rate (ADR): $137.96 (+4.7%)

• Revenue per available room (RevPAR): $84.39 (-3.8%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.