by Calculated Risk on 3/17/2022 10:03:00 AM

Thursday, March 17, 2022

February Housing Starts: Most Housing Units Under Construction Since 1973

Today, in the CalculatedRisk Real Estate Newsletter: February Housing Starts: Most Housing Units Under Construction Since 1973

Excerpt:

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

Red is single family units. Currently there are 799 thousand single family units under construction (SA). This is the highest level since December 2006.

For single family, many of these homes are already sold (Census counts sales when contract is signed). The reason there are so many homes is probably due to construction delays. Since many of these are already sold, it is unlikely this is “overbuilding”, or that this will impact prices (although the buyers will be moving out of their current home or apartment once these homes are completed).

Blue is for 2+ units. Currently there are 784 thousand multi-family units under construction. This is the highest level since June 1974! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Combined, there are 1.583 million units under construction. This is the most since August 1973.

Length of Time from Authorization to Start and from Start to Completion

Census released the annual data on the length of time from start to completion, and this showed construction delays in 2021.

In 2021, it took an average of 7.2 months from start to completion for single family homes, up from 6.8 months in 2020. For multi-family, it took 15.4 months for buildings with 2 or more units in 2021, the same as in 2020 (the long delays will likely show up in the 2022 data since it takes over a year to complete).

From Authorization to Start, it took 1.3 months in 2021 for single family homes, up from 1.0 months in 2020, and it took 2.1 months in 2021 for multi-family, up from 2.0 months.

Industrial Production Increased 0.5 Percent in February

by Calculated Risk on 3/17/2022 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

Total industrial production rose 0.5 percent in February to a level that is 103.6 percent of its 2017 average. Manufacturing output increased 1.2 percent after having been little changed in each of the previous two months. In February, the index for utilities declined 2.7 percent, and the output of mines edged up 0.l percent.

Total industrial production in February was 7.5 percent higher than its year-earlier level, but severe winter weather in February 2021 significantly suppressed industrial activity that month. A more useful comparison shows that the index has advanced a still-strong 4.2 percent since January 2021. Capacity utilization for the industrial sector increased 0.3 percentage point in February to 77.6 percent, a rate that is 1.9 percentage points below its long-run (1972–2021) average.

emphasis added

Click on graph for larger image.

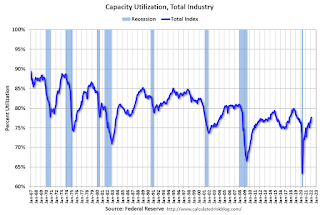

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 77.6% is 1.9% below the average from 1972 to 2020. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

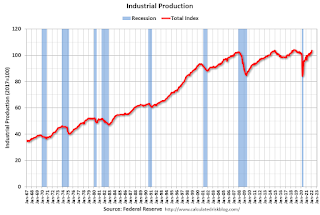

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in February to 103.6. This is above the February 2020 level.

The change in industrial production was at consensus expectations.

Housing Starts Increased to 1.769 million Annual Rate in February

by Calculated Risk on 3/17/2022 08:42:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in February were at a seasonally adjusted annual rate of 1,769,000. This is 6.8 percent above the revised January estimate of 1,657,000 and is 22.3 percent above the February 2021 rate of 1,447,000. Single‐family housing starts in February were at a rate of 1,215,000; this is 5.7 percent above the revised January figure of 1,150,000. The February rate for units in buildings with five units or more was 501,000.

Building Permits:

Privately‐owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,859,000. This is 1.9 percent below the revised January rate of 1,895,000, but is 7.7 percent above the February 2021 rate of 1,726,000. Single‐family authorizations in February were at a rate of 1,207,000; this is 0.5 percent below the revised January figure of 1,213,000. Authorizations of units in buildings with five units or more were at a rate of 597,000 in February.

emphasis added

Click on graph for larger image.

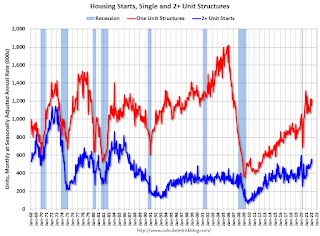

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) increased in February compared to January. Multi-family starts were up 46.5% year-over-year in February. Note: Last year, starts were impacted by the freeze in Texas.

Single-family starts (red) increased in February and were up 13.7% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery (but still not historically high).

Total housing starts in February were above expectations, and starts in December and January were revised up, combined.

I'll have more later …

Weekly Initial Unemployment Claims Decrease to 214,000

by Calculated Risk on 3/17/2022 08:33:00 AM

The DOL reported:

In the week ending March 12, the advance figure for seasonally adjusted initial claims was 214,000, a decrease of 15,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 227,000 to 229,000. The 4-week moving average was 223,000, a decrease of 8,750 from the previous week's revised average. The previous week's average was revised up by 500 from 231,250 to 231,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 223,000.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.

Wednesday, March 16, 2022

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg, Industrial Production

by Calculated Risk on 3/16/2022 08:55:00 PM

Thursday:

• At 8:30 AM ET, Housing Starts for February. The consensus is for 1.695 million SAAR, up from 1.638 million SAAR.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 225 thousand from 227 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for March. The consensus is for a reading of 15.0, down from 16.0.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for February. The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 77.9%.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.3% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 216.8 | --- | ≥2321 | |

| New Cases per Day3 | 30,934 | 36,852 | ≤5,0002 | |

| Hospitalized3 | 20,780 | 29,017 | ≤3,0002 | |

| Deaths per Day3 | 1,107 | 1,153 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Housing, the Fed, Interest Rates and Inflation

by Calculated Risk on 3/16/2022 04:43:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Housing, the Fed, Interest Rates and Inflation

A brief excerpt:

It is important to understand that housing is a key transmission mechanism for Federal Open Market Committee (FOMC) policy. There are several channels according to economist Frederick Mishkin: Housing and the Monetary Transmission MechanismThere is much more in the article.By raising or lowering short-term interest rates, monetary policy affects the housing market, and in turn the overall economy, directly or indirectly through at least six channels: through the direct effects of interest rates on (1) the user cost of capital, (2) expectations of future house-price movements, and (3) housing supply; and indirectly through (4) standard wealth effects from house prices, (5) balance sheet, credit-channel effects on consumer spending, and (6) balance sheet, credit-channel effects on housing demand.So, when the FOMC raises rates, housing is a key target. For example, higher rates change the trade-off between buying and renting, and also changes the calculation for investors. Higher rates have already slowed down the “home ATM” (Mortgage Equity Withdrawal) and will likely impact demand (not yet!).

FOMC Projections and Press Conference

by Calculated Risk on 3/16/2022 02:11:00 PM

Statement here.

Fed Chair Powell press conference video here starting at 2:30 PM ET.

Here are the projections. In December, most participants expected three rate hikes in 2022. Now, participants expect 7 rate hikes in 2022.

Wall Street forecasts are for GDP to barely increase in Q1 2022, and to be in the 2% to 3% range for 2022. This was a sharp reduction in Wall Street growth forecasts, and the FOMC lowered their 2022 forecast down significantly to similar growth rates.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Mar 2022 | 2.5 to 3.0 | 2.1 to 2.5 | 1.8 to 2.0 | |

| Dec 2021 | 3.6 to 4.5 | 2.0 to 2.5 | 1.8 to 2.0 | |

The unemployment rate was at 3.8% in February. So, there was a slight reduction in the unemployment rate forecast for Q4 2022.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Mar 2022 | 3.4 to 3.6 | 3.3 to 3.6 | 3.2 to 3.7 | |

| Dec 2021 | 3.4 to 3.7 | 3.2 to 3.6 | 3.2 to 3.7 | |

As of January 2022, PCE inflation was up 6.1% from January 2021. The FOMC revised up sharply their inflation projections for 2022.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Mar 2022 | 4.1 to 4.7 | 2.3 to 3.0 | 2.1 to 2.4 | |

| Dec 2021 | 2.2 to 3.0 | 2.1 to 2.5 | 2.0 to 2.2 | |

PCE core inflation was up 5.2% in January year-over-year and the FOMC revised up their projections.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Mar 2022 | 3.9 to 4.4 | 2.4 to 3.0 | 2.1 to 2.4 | |

| Dec 2021 | 2.5 to 3.0 | 2.1 to 2.4 | 2.0 to 2.2 | |

FOMC Statement: Raise Rates 25bps

by Calculated Risk on 3/16/2022 02:03:00 PM

Fed Chair Powell press conference video here starting at 2:30 PM ET.

FOMC Statement:

Indicators of economic activity and employment have continued to strengthen. Job gains have been strong in recent months, and the unemployment rate has declined substantially. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.

The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The implications for the U.S. economy are highly uncertain, but in the near term the invasion and related events are likely to create additional upward pressure on inflation and weigh on economic activity.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2 percent objective and the labor market to remain strong. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 1/4 to 1/2 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Esther L. George; Patrick Harker; Loretta J. Mester; and Christopher J. Waller. Voting against this action was James Bullard, who preferred at this meeting to raise the target range for the federal funds rate by 0.5 percentage point to 1/2 to 3/4 percent. Patrick Harker voted as an alternate member at this meeting.

emphasis added

NAHB: Builder Confidence Decreased to 79 in March

by Calculated Risk on 3/16/2022 10:08:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 79, down from 81 in February. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Diminished Future Sales Expectations, Rising Costs Lower Builder Confidence

Ongoing lumber and building material supply-side constraints and rising construction costs and expectations of higher interest rates continue to negatively affect builder sentiment even as buyer demand remains relatively solid.

Builder confidence in the market for newly built single-family homes moved two points lower to 79 in March from a downwardly revised reading in February, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This is the fourth straight month that builder sentiment has declined and the first time that the HMI has dipped below the 80-point mark since last September.

While builders continue to report solid buyer traffic numbers, helped by historically low existing home inventory and a persistent housing deficit, increasing development and construction costs have taken a toll on builder confidence.

The March HMI recorded the lowest future sales expectations in the survey since June 2020. Builders are reporting growing concerns that increasing construction costs (up 20% over the last 12 months) and expected higher interest rates connected to tightening monetary policy will price prospective home buyers out of the market. While low existing inventory and favorable demographics are supporting demand, the impact of elevated inflation and expected higher interest rates suggests caution for the second half of 2022.

...

The HMI index gauging current sales conditions fell three points to 86 and the gauge measuring sales expectations in the next six months dropped a whopping 10 points to 70. The component charting traffic of prospective buyers posted a two-point gain to 67.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell seven points to 69, the Midwest dropped one point to 72 and the South fell three points to 83. The West moved up one point to 90.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was below the consensus forecast, and still a strong reading.

Retail Sales Increased 0.3% in February

by Calculated Risk on 3/16/2022 08:42:00 AM

On a monthly basis, retail sales were increased 0.3% from January to February (seasonally adjusted), and sales were up 17.6 percent from February 2021.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for February 2022, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $658.1 billion, an increase of 0.3 percent from the previous month, and 17.6 percent above February 2021. ... The December 2021 to January 2022 percent change was revised from up 3.8 percent to up 4.9 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.2% in February.