by Calculated Risk on 3/20/2022 08:30:00 AM

Sunday, March 20, 2022

LA Area Port Traffic: Record February Inbound Traffic

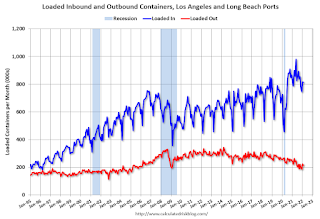

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic was up 0.3% in February compared to the rolling 12 months ending in January. Outbound traffic was down 0.3% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 4% YoY in February, and exports were down 3% YoY.

Saturday, March 19, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 3/19/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Decreased to 6.02 million SAAR in February

• February Housing Starts: Most Housing Units Under Construction Since 1973

• Housing, the Fed, Interest Rates and Inflation Housing is a key transmission mechanism for the FOMC

• 3rd Look at Local Housing Markets in February California Sales Down 8.2% YoY, Inventory up from January

• Housing Inventory May Have Bottomed Seasonally

This is usually published several times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of March 20, 2022

by Calculated Risk on 3/19/2022 08:11:00 AM

The key report this week is February New Home sales.

For manufacturing, the March Richmond and Kansas City manufacturing surveys will be released.

Also Fed Chair Powell speaks on the economic outlook, and Fed Governor Waller discusses the U.S. housing market.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

12:00 PM: Speech, Fed Chair Powell, Economic Outlook, At the National Association for Business Economics (NABE) Annual Economic Policy Conference, Washington, D.C

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:00 AM: Discussion, Fed Chair Powell, Panel on Emerging Challenges for Central Bank Governors in a Digital World, At the Bank for International Settlements (BIS) Innovation Summit 2022 (Virtual)

10:00 AM: New Home Sales for February from the Census Bureau.

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 815 thousand SAAR, up from 801 thousand in January.

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 215 thousand from 214 thousand last week.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.5% dncrease in durable goods orders.

9:10 AM: Discussion, Fed Governor Waller, U.S. Housing Market, At the Tel Aviv University and Rutgers University Webinar: Recent Fiscal and Monetary Policies and Implications for US and Israeli Real Estate Markets (Virtual)

11:00 AM: the Kansas City Fed manufacturing survey for March.

10:00 AM: Pending Home Sales Index for February. The consensus is for a 1.5% increase in the index.

10:00 AM: University of Michigan's Consumer sentiment index (Final for March). The consensus is for a reading of 59.7.

10:00 AM: State Employment and Unemployment (Monthly), February 2022

Friday, March 18, 2022

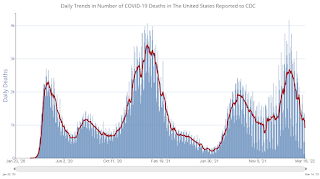

COVID Update: March 18, 2022; Deaths at 1,000 per Day, Lowest Since December 2021

by Calculated Risk on 3/18/2022 09:22:00 PM

Last June, new cases per day dropped to 8,000, hospitalizations fell to 12,000, and deaths were at 250 per day. We are still well above those levels.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.3% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 217.0 | --- | ≥2321 | |

| New Cases per Day3 | 29,312 | 34,471 | ≤5,0002 | |

| Hospitalized3 | 19,031 | 26,329 | ≤3,0002 | |

| Deaths per Day3 | 1,032 | 1,184 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Q1 GDP Forecasts: Around 1%

by Calculated Risk on 3/18/2022 02:05:00 PM

From BofA:

This week's data-retail sales, industrial production, and import & export prices- on balance lifted our 1Q GDP tracking estimate by 0.6ppt to 1.6% qoq saar. [March 18 estimate]From Goldman:

emphasis added

Following today’s data, we left our Q1 GDP tracking estimate unchanged at +0.5% (qoq ar). [March 18 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2022 is 1.3 percent on March 17, up from 1.2 percent on March 16. After this morning’s releases from the US Census Bureau and the Federal Reserve Board of Governors, the nowcast of first-quarter real gross private domestic investment growth increased from -4.9 percent to -4.2 percent. [March 17 estimate]

More Analysis on February Existing Home Sales

by Calculated Risk on 3/18/2022 11:06:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 6.02 million SAAR in February

Excerpt:

The Impact of the February 2021 Texas FreezeThere is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

When the local data was released, I highlighted the sharp increase in sales in Houston (up 25.6% year-over-year). From the Houston Association of REALTORS® (HAR): February Is a Strong Month for Houston Home SalesHome sales scored double-digit gains in February, but part of the strong showing was because the statistics compared to last February, when that deadly Texas freeze halted real estate activity for days, and in some cases, even longer. Undistorted by the weather factor were the continued squeeze on inventory, which returned to its all-time low, and pricing, which due to limited supply and ongoing consumer demand, soared to record highs.In February 2022, the only region that showed a year-over-year increase was the South (an increase from the weak sales in 2021 due to the freeze). The other regions were down an average of 6.7% year-over-year compared to the 2.4% reported by the NAR for the entire country.

emphasis added

...

This graph shows existing home sales by month for 2021 and 2022.

Sales declined 2.3% year-over-year compared to January 2021. This was the seventh consecutive month with sales down year-over-year.

...

[and on inventory] According to the NAR, inventory increased to 0.87 million in February from 0.85 million in January. Inventory is now just above the record low.

NAR: Existing-Home Sales Decreased to 6.02 million SAAR in February

by Calculated Risk on 3/18/2022 10:12:00 AM

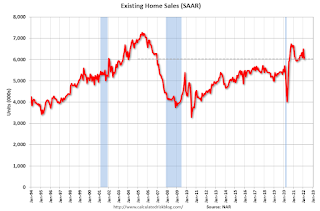

From the NAR: Existing-Home Sales Fade 7.2% in February

Existing-home sales dipped in February, continuing a seesawing pattern of gains and declines over the last few months, according to the National Association of Realtors®. Each of the four major U.S. regions saw sales fall on a month-over-month basis in February. Sales activity year-over-year was also down overall, though the South experienced an increase while the remaining three regions reported drops in transactions.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, sank 7.2% from January to a seasonally adjusted annual rate of 6.02 million in February. Year-over-year, sales decreased 2.4% (6.17 million in February 2021).

...

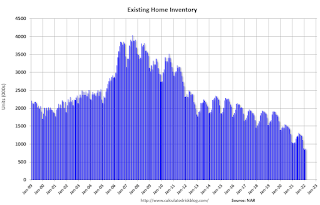

Total housing inventory at the end of February totaled 870,000 units, up 2.4% from January and down 15.5% from one year ago (1.03 million). Unsold inventory sits at a 1.7-month supply at the current sales pace, up from the record-low supply in January of 1.6 months and down from 2.0 months in February 2021.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February (6.02 million SAAR) were down 7.2% from the previous month and were 2.4% below the February 2021 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 0.87 million in February from 0.85 million in January.

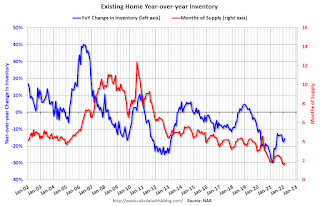

According to the NAR, inventory increased to 0.87 million in February from 0.85 million in January.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 15.5% year-over-year (blue) in February compared to February 2021.

Inventory was down 15.5% year-over-year (blue) in February compared to February 2021. Months of supply (red) increased to 1.7 months in February from 1.6 months in January.

This was below the consensus forecast. I'll have more later.

Hotels: Occupancy Rate Down 10% Compared to Same Week in 2019

by Calculated Risk on 3/18/2022 08:30:00 AM

Overall U.S. hotel performance increased from the previous week, according to STR‘s latest data through March 12.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

March 6-12, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 63.2% (-9.8%)

• Average daily rate (ADR): $144.68 (+7.7%)

• Revenue per available room (RevPAR): $91.45 (-2.8%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

Thursday, March 17, 2022

Friday: Existing Home Sales

by Calculated Risk on 3/17/2022 08:54:00 PM

Thursday:

• At 10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 6.16 million SAAR, down from 6.50 million. Housing economist Tom Lawler expects the NAR to report 5.97 million SAAR.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.3% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 216.9 | --- | ≥2321 | |

| New Cases per Day3 | 30,040 | 36,009 | ≤5,0002 | |

| Hospitalized3 | 20,780 | 29,017 | ≤3,0002 | |

| Deaths per Day3 | 909 | 1,187 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Lawler: Early Read on Existing Home Sales in February

by Calculated Risk on 3/17/2022 02:02:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.97 million in February, down 8.2% from January’s preliminary pace and down 3.2% from last February’s seasonally adjusted pace.

Local realtor reports, as well as reports from national inventory trackers, suggest that the YOY % decline in the inventory of existing homes for sale last month was lower than that in January.

Finally, local realtor/MLS reports suggest the median existing single-family home sales price last month was up by about 16.5% from last February.

CR Note: The National Association of Realtors (NAR) is scheduled to release February existing home sales tomorrow, Friday, March 18, 2022, at 10:00 AM ET. The consensus is for 6.16 million SAAR.