by Calculated Risk on 3/24/2022 08:41:00 PM

Thursday, March 24, 2022

Friday: Pending Home Sales

Friday:

• At 10:00 AM ET, Pending Home Sales Index for February. The consensus is for a 1.5% increase in the index.

• Also, at 10:00 AM, University of Michigan's Consumer sentiment index (Final for March). The consensus is for a reading of 59.7.

• Also, at 10:00 AM, State Employment and Unemployment (Monthly), February 2022

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.4% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 217.3 | --- | ≥2321 | |

| New Cases per Day3 | 27,134 | 28,695 | ≤5,0002 | |

| Hospitalized3 | 15,227 | 20,978 | ≤3,0002 | |

| Deaths per Day3 | 749 | 1,063 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Hotels: Occupancy Rate Down 4% Compared to Same Week in 2019

by Calculated Risk on 3/24/2022 04:42:00 PM

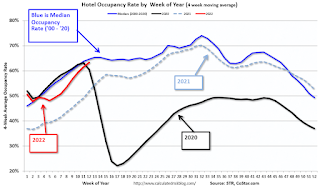

Lifted by spring break travel, U.S. hotel performance rose from the previous week and showed improved comparisons against 2019, according to STR‘s latest data through March 19.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

March 13-19, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 66.9% (-3.7%)

• Average daily rate (ADR): $151.63 (+13.6%)

• Revenue per available room (RevPAR): $101.44 (+9.5%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

New Home Sales and Cancellations

by Calculated Risk on 3/24/2022 02:23:00 PM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales and Cancellations

Brief excerpt:

At first glance, we might think that new home sales, as reported by the Census Bureau, would be impacted by rising mortgage rates sooner than existing home sales. This is because new home sales are reported when the contract is signed, but existing home sales are reported when the transaction closes.There is much more in the newsletter.

However, with the sharp increase in mortgage rates, we might see more cancellations for the homebuilders, and cancellations confuse the timing issue.When looking at new home sales, we are interested in net sales, but the Census Bureau reports gross new sales. A simple equation would be:

Sales (net) = Sales (gross) – Cancellations + Sales of earlier cancellations.

In the long run, the cancellation terms balance out, and the Census Bureau numbers are what we want. In other words, Sales(net) = sales(gross). But in the short run, when cancellations increase, the Census Bureau overestimates sales; and when cancellations decrease, the Census Bureau underestimates sales.

...

Currently cancellation rates are below normal for the home builders. Here is a table of selected public builders and the currently reported cancellation rate (I’m still gathering data).

As an example, Toll Brothers just announced a cancellation rate of 4.3%, up from 3.3%, but well below their historical rate of 7%. During the housing bust, Toll Brothers cancellation rates peaked close to 40%.

You can subscribe at https://calculatedrisk.substack.com/.

Black Knight: National Mortgage Delinquency Rate Increased in February

by Calculated Risk on 3/24/2022 11:19:00 AM

Note: At the beginning of the pandemic, the delinquency rate increased sharply. Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus. Foreclosures are starting to increase following the end of the moratorium, but are at very low levels (see: Delinquencies, Foreclosures and REO) for a discussion of rising foreclosures, and why this isn't a concern)

From Black Knight: February Uptick in Early-Stage Delinquencies Drives First Increase in Past- Due Mortgages in Nine Months; Foreclosure Starts Fall 24% Following January Spike

• Though past-due loans edged higher (+1.8%) in February, the national delinquency rate remains near pre-pandemic levels heading into March, a month known for strong seasonal performance improvementsAccording to Black Knight's First Look report, the percent of loans delinquent increased 1.8% in February compared to January and decreased 44% year-over-year.

• February’s increase was driven by a rise of 97,000 in early-stage delinquencies – which nevertheless remain well below pre-pandemic levels

• At the same time, the number of seriously delinquent mortgages (those 90 or more days past due) fell by 72,000 as borrowers leaving forbearance plans continue to return to making payments

• After seeing a sizable spike in January, foreclosure starts pulled back by 24%, with the month’s 25,000 starts 25% below February 2020 levels, prior to the onset of pandemic-related economic stress

• Likewise, despite a 39,000 increase in the number of loans in active foreclosure, the population remains 32% below February 2020 levels

• Prepayment activity – as reflected in single-month mortality – dropped another 11% in February, hitting a nearly three-year low as rising rates continue to impact refinance volumes

emphasis added

The percent of loans in the foreclosure process increased 9% in February and were down 3% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.36% in February, down from 3.30% in January.

The percent of loans in the foreclosure process increased in February to 0.31%, from 0.28% in January.

The number of delinquent properties, but not in foreclosure, is down 1,403,000 properties year-over-year, and the number of properties in the foreclosure process is down 6,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Feb 2022 | Jan 2022 | Feb 2021 | Feb 2020 | |

| Delinquent | 3.36% | 3.30% | 6.00% | 3.28% |

| In Foreclosure | 0.31% | 0.28% | 0.32% | 0.45% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,783,000 | 1,758,000 | 3,186,000 | 1,737,000 |

| Number of properties in foreclosure pre-sale inventory: | 162,000 | 149,000 | 168,000 | 239,000 |

| Total Properties | 1,946,000 | 1,907,000 | 3,354,000 | 1,976,000 |

Weekly Initial Unemployment Claims Decrease to 187,000; Lowest Since 1969

by Calculated Risk on 3/24/2022 08:34:00 AM

The DOL reported:

In the week ending March 19, the advance figure for seasonally adjusted initial claims was 187,000, a decrease of 28,000 from the previous week's revised level. This is the lowest level for initial claims since September 6, 1969 when it was 182,000. The previous week's level was revised up by 1,000 from 214,000 to 215,000. The 4-week moving average was 211,750, a decrease of 11,500 from the previous week's revised average. The previous week's average was revised up by 250 from 223,000 to 223,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 211,750.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.

MBA: Median Mortgage Application Payment Up 8.3% from January

by Calculated Risk on 3/24/2022 07:00:00 AM

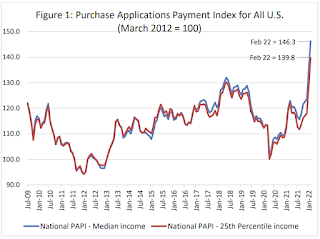

This is a new monthly affordability index from the Mortgage Bankers Association (MBA).

From the MBA: Median Mortgage Application Payment Jumped 8.3 Percent in February to $1,653

Homebuyer affordability decreased in February, with the national median payment applied for by applicants jumping 8.3 percent to $1,653 from $1,526 in January. This is according to the Mortgage Bankers Association's (MBA) new Purchase Applications Payment Index (PAPI), which measures how new monthly mortgage payments vary across time – relative to income – using data from MBA’s Weekly Applications Survey (WAS).

“Low unemployment has spurred strong income growth in early 2022, but homebuyer affordability has decreased due to the quick rise in mortgage rates amidst steep home-price growth,” said Edward Seiler, MBA's Associate Vice President, Housing Economics, and Executive Director, Research Institute for Housing America. “The 30-year fixed-rate mortgage spiked 73 basis points from December 2021 through February 2022. Together with increased loan application amounts, a mortgage applicant’s median principal and interest payment in February jumped $127 from January and $337 from one year ago.”

An increase in MBA’s PAPI – indicative of declining borrower affordability conditions – means that the mortgage payment to income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings. A decrease in the PAPI – indicative of improving borrower affordability conditions – occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA's PAPI since 2009.

The national PAPI (Figure 1) increased 8.3 percent to 146.3 in February 2022 from 135.1 in January 2022, meaning payments on new mortgages take up a larger share of a typical person’s income. Compared to February 2021 (120.0), the index jumped 21.9 percent. For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment increased 9.8 percent to $1,094 from $996 in January 2022.This will increase further in March with the recent sharp increase in mortgage rates.

Wednesday, March 23, 2022

Thursday: Unemployment Claims, Durable Goods

by Calculated Risk on 3/23/2022 09:06:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for an increase to 215 thousand from 214 thousand last week.

• At 8:30 AM, Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.5% decrease in durable goods orders.

• At 9:10 AM, Discussion, Fed Governor Waller, U.S. Housing Market, At the Tel Aviv University and Rutgers University Webinar: Recent Fiscal and Monetary Policies and Implications for US and Israeli Real Estate Markets (Virtual)

• At 11:00 AM, the Kansas City Fed manufacturing survey for March.

On COVID data tracker is down today.

AIA: "Demand for design service continues to grow" in February

by Calculated Risk on 3/23/2022 02:24:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Demand for design service continues to grow

Demand for design services in February grew slightly since January, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for February was 51.3, up from a score of 51.0 in January. Any score above 50 indicates an increase in billings. Firms reported both project inquiries and design contracts remaining positive in February, but while project inquiries increased to 62.5 from 61.9 in January, design contracts decreased to 55.2 from 56.1.

“Despite the continued healthy demand for design services, activity is plateauing as firms face a myriad of external challenges, from staffing to supply chain disruptions to high inflation and rising interest rates,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “While the rebound from the pandemic has positively impacted firms in most regions, the prolonged lack of demand for design services in the Northeast is of growing concern.”

...

• Regional averages: South (58.6); Midwest (53.2); West (47.9); Northeast (44.3)

• Sector index breakdown: commercial/industrial (55.4); mixed practice (53.8); multi-family residential (52.6); institutional (47.2)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.3 in February, up from 51.0 in January. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index has been positive for thirteen consecutive months.

February New Home Sales: Few Completed Inventory, High Number of Homes Under Construction

by Calculated Risk on 3/23/2022 11:36:00 AM

Today, in the Calculated Risk Real Estate Newsletter: February New Home Sales: Few Completed Inventory, High Number of Homes Under Construction

Brief excerpt:

The next graph shows new home sales for 2021 and 2022 by month (Seasonally Adjusted Annual Rate). Sales in February 2022 were down 6.2% from February 2021.You can subscribe at https://calculatedrisk.substack.com/.

The year-over-year comparisons will be easier going forward.

...

The next graph shows the months of supply by stage of construction. “Months of supply” is inventory at each stage, divided by the sales rate.

The inventory of completed homes for sale was at 35 thousand in February, up from the record low of 33 thousand in several months in 2021. That is about 0.5 months of completed supply (red line). This is about half the normal level.

The inventory of new homes under construction is at 4.1 months (blue line) - well above the normal level. This elevated level of homes under construction is due to supply chain constraints.

And 106 thousand homes have not been started - about 1.7 months of supply (grey line) - almost double the normal level. Homebuilders are probably waiting to start some homes until they have a firmer grasp on prices.

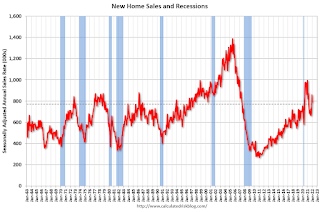

New Home Sales decrease to 772,000 Annual Rate in February

by Calculated Risk on 3/23/2022 10:08:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 772 thousand.

The previous three months were revised up slightly, combined.

Sales of new single‐family houses in February 2022 were at a seasonally adjusted annual rate of 772,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.0 percent below the revised January rate of 788,000 and is 6.2 percent below the February 2021 estimate of 823,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales are now declining year-over-year since sales soared following the first few months of the pandemic.

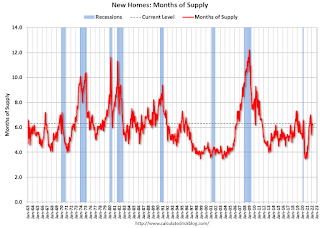

The second graph shows New Home Months of Supply.

The months of supply increased in February to 6.3 months from 6.1 months in January.

The months of supply increased in February to 6.3 months from 6.1 months in January. The all-time record high was 12.1 months of supply in January 2009. The all-time record low was 3.5 months, most recently in October 2020.

This is above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of February was 407,000. This represents a supply of 6.3 months at the current sales rate."

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In February 2022 (red column), 65 thousand new homes were sold (NSA). Last year, 70 thousand homes were sold in February

The all-time high for February was 109 thousand in 2005, and the all-time low for February was 22 thousand in 2011.

This was below expectations, however sales in the three previous months were revised up slightly, combined. I'll have more later today.