by Calculated Risk on 3/28/2022 09:40:00 AM

Monday, March 28, 2022

Housing Inventory Has Bottomed

Today, in the Calculated Risk Real Estate Newsletter: Housing Inventory Has Bottomed

A brief excerpt:

Altos Research reports inventory up 2.4% last week ...There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

As of March 25th, inventory was at 253 thousand (7-day average), compared to 248 thousand the prior week. Inventory was UP 2.4% from the previous week.

Last year inventory bottomed seasonally in April 2021 - very late in the year. This year, by this measure, inventory bottomed seasonally at the beginning of March.

Inventory is still very low. Compared to the same week in 2021, inventory is down 19.0%, and compared to the same week in 2020, and inventory is down 66.1% from 747 thousand.

One of the keys will be to watch the year-over-year change each week to see if the declines are decreasing. Here is a table of the year-over-year change by week since the beginning of the year.

Week Ending YoY Change 12/31/2021 -30.0% 1/7/2022 -26.0% 1/14/2022 -28.6% 1/21/2022 -27.1% 1/28/2022 -25.9% 2/4/2022 -27.9% 2/11/2022 -27.5% 2/18/2022 -25.8% 2/25/2022 -24.9% 3/4/2022 -24.2% 3/11/2022 -21.7% 3/18/2022 -21.7% 3/25/2022 -19.0%

Now we need to watch if the YoY change continues to decrease. Based on the current trend, it is possible inventory will be up YoY sometime in the second half of 2022.

Altos Research CEO Mike Simonsen discusses this data regularly on Youtube.

Six High Frequency Indicators for the Economy

by Calculated Risk on 3/28/2022 08:39:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of March 27th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 10.6% from the same day in 2019 (89.4% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through March 26, 2022.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Dining was mostly moving sideways but declined during the winter wave of COVID and is now increasing. The 7-day average for the US is down 4% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $102 million last week, down about 46% from the median for the week.

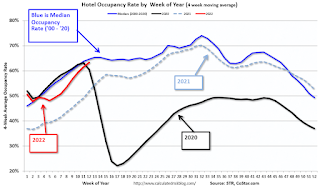

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

This data is through March 19th. The occupancy rate was down 3.7% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

This data is through March 26th

This data is through March 26th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 126% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, March 25th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, March 27, 2022

Sunday Night Futures

by Calculated Risk on 3/27/2022 09:15:00 PM

Weekend:

• Schedule for Week of March 27, 2022

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 15 and DOW futures are down 100 (fair value).

Oil prices were up over the last week with WTI futures at $109.92 per barrel and Brent at $116.63 per barrel. A year ago, WTI was at $61, and Brent was at $64 - so WTI oil prices are up 80% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.22 per gallon. A year ago prices were at $2.84 per gallon, so gasoline prices are up $1.38 per gallon year-over-year.

Census: Record 37.9% of adult population in the United States has a bachelor’s degree or higher

by Calculated Risk on 3/27/2022 12:23:00 PM

This was released last month by the Census Bureau: Census Bureau Releases New Educational Attainment Data

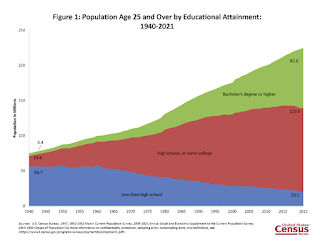

In 2021, the highest level of education of the population age 25 and older in the United States was distributed as follows:

• 8.9% had less than a high school diploma or equivalent.

• 27.9% had high school graduate as their highest level of school completed.

• 14.9% had completed some college but not a degree.

• 10.5% had an associate degree as their highest level of school completed.

• 23.5% had a bachelor’s degree as their highest degree.

• 14.4% had completed an advanced degree such as a master’s degree, professional degree or doctoral degree.

emphasis added

This graph shows the number of adults, 25 years and older, with less than high school education, high school or some college, and a bachelor's degree or higher since 1940.

This graph shows the number of adults, 25 years and older, with less than high school education, high school or some college, and a bachelor's degree or higher since 1940. In 1940, about 76% of the adult population (over 25) had less than a high school education. That has declined to less than 9% now.

In 1940, about 76% of the adult population (over 25) had less than a high school education. That has declined to less than 9% now.Saturday, March 26, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 3/26/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales and Cancellations

• February New Home Sales: Few Completed Inventory, High Number of Homes Under Construction

• Mortgage Rates Moving Closer to 5%

• Final Look at Local Housing Markets in February

This is usually published several times a week and provides more in-depth analysis of the housing market.

The blog will continue as always!

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of March 27, 2022

by Calculated Risk on 3/26/2022 08:11:00 AM

The key report scheduled for this week is the March employment report on Friday.

Other key reports include the 3rd estimate of Q4 GDP, February Personal Income & Outlays, January Case-Shiller house prices and March Auto Sales.

For manufacturing, the March Dallas Fed survey and the ISM Manufacturing survey will be released.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

9:00 AM: S&P/Case-Shiller House Price Index for January.

9:00 AM: S&P/Case-Shiller House Price Index for January.This graph shows the year-over-year change for the Case-Shiller National, Composite 10 and Composite 20 indexes, through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 18.3% year-over-year increase in the Comp 20 index.

9:00 AM: FHFA House Price Index for January 2021. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in January to 11.3 million from 11.4 million in December.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 438,000 payroll jobs added in March, down from 475,000 added in February.

8:30 AM, Gross Domestic Product, 4th quarter 2021 (Third estimate). The consensus is that real GDP increased 7.1% annualized in Q4.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 195 thousand from 187 thousand last week.

8:30 AM: Personal Income and Outlays for February. The consensus is for a 0.5% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.4%.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 56.6, up from 56.3 in February.

8:30 AM: Employment Report for March. The consensus is for 475,000 jobs added, and for the unemployment rate to decrease to 3.7%.

8:30 AM: Employment Report for March. The consensus is for 475,000 jobs added, and for the unemployment rate to decrease to 3.7%.There were 678,000 jobs added in February, and the unemployment rate was at 3.8%.

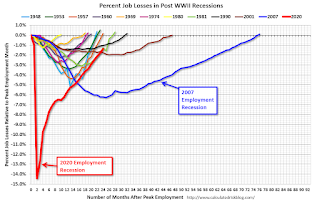

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 24 months after the onset, is now significantly better than the worst of the "Great Recession".

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 58.6, unchanged from 58.6 in February.

10:00 AM: Construction Spending for February. The consensus is for a 0.9% increase in construction spending.

All Day: Light vehicle sales for March. The consensus is for light vehicle sales to be 14.1 million SAAR in March, unchanged from 14.1 million in February (Seasonally Adjusted Annual Rate).

All Day: Light vehicle sales for March. The consensus is for light vehicle sales to be 14.1 million SAAR in March, unchanged from 14.1 million in February (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

Friday, March 25, 2022

COVID Update: March 25, 2022; Deaths at 732 per Day, Lowest Since August 2021

by Calculated Risk on 3/25/2022 09:29:00 PM

Last June, new cases per day dropped to 8,000, hospitalizations fell to 12,000, and deaths were at 250 per day. Hospitalizations are approaching the June levels.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.5% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 217.3 | --- | ≥2321 | |

| New Cases per Day3 | 27,784 | 28,007 | ≤5,0002 | |

| Hospitalized3 | 14,768 | 19,249 | ≤3,0002 | |

| Deaths per Day3 | 732 | 1,042 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Freddie Mac: Mortgage Serious Delinquency Rate decreased in February

by Calculated Risk on 3/25/2022 12:33:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in February was 0.99%, down from 1.06% in January. Freddie's rate is down year-over-year from 2.52% in January 2021.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report but are not reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once (if) they are employed.

Also - for multifamily - delinquencies were at 0.08%, down from the peak of 0.20% in April 2021.

Q1 GDP Forecasts: Under 1%

by Calculated Risk on 3/25/2022 12:00:00 PM

From BofA:

Our 1Q GDP tracking estimate moved down to 1.0% qoq saar from 1.6% previously, reflecting recent weaker-than-expected housing and inventory data. 4Q 2021 GDP is likely to get revised up modestly to 7.2% qoq saar from 7.0% qoq saar in the third and final release next week. [March 25 estimate]From Goldman:

emphasis added

Following today’s data,we left our Q1 GDP tracking estimate unchanged on a rounded basis at +0.5% (qoq ar). [March 24 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2022 is 0.9 percent on March 24, down from 1.3 percent on March 17. After recent releases from the US Census Bureau and the National Association of Realtors, the nowcast of first-quarter real gross private domestic investment growth decreased from -4.2 percent to -5.8 percent. [March 24 estimate]

NAR: Pending Home Sales Decreased 4.1% in February

by Calculated Risk on 3/25/2022 10:09:00 AM

From CNBC: Pending home sales sink in February, setting a grim tone as housing market enters key spring season

In a grim sign for the housing market’s busiest season, pending home sales, which measure signed contracts on existing homes, fell 4.1% in February compared with January, according to the National Association of Realtors.This was well below expectations of a 1.5% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in March and April.

Sales were down 5.4% compared with February 2021. Analysts were expecting a slight gain. This is the fourth straight month of declines in pending sales, which are an indicator of future closings, one to two months out.

...

Regionally, pending sales rose 1.9% month-to-month in the Northeast but were down 9.2% from a year ago. In the Midwest, sales decreased 6.0% for the month and were down 5.2% from February 2021. In the South, sales fell 4.4% monthly and 4.3% annually, and in the West they were down 5.4% for the month and 5.3% from a year ago.

emphasis added