by Calculated Risk on 3/29/2022 10:05:00 AM

Tuesday, March 29, 2022

BLS: Job Openings "little changed" at 11.3 million in February

From the BLS: Job Openings and Labor Turnover Summary

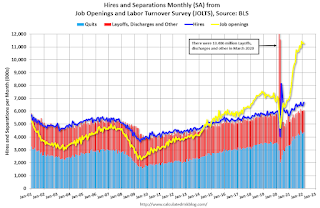

The number of job openings was little changed at 11.3 million on the last business day of February, the U.S. Bureau of Labor Statistics reported today. Hires edged up to 6.7 million while total separations were little changed at 6.1 million. Within separations, the quits rate was little changed at 2.9 percent and the layoffs and discharges rate was unchanged at 0.9 percent.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for February, the employment report this Friday will be for March.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spike in layoffs and discharges in March 2020 are labeled, but off the chart to better show the usual data.

Jobs openings decreased slightly in February to 11.266 million from 11.283 million in January.

The number of job openings (yellow) were up 43% year-over-year.

Quits were up 27% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

Case-Shiller: National House Price Index increased 19.2% year-over-year in January

by Calculated Risk on 3/29/2022 09:16:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for January ("January" is a 3-month average of November, December and January prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Reports 19.2% Annual Home Price Gain to Start 2022

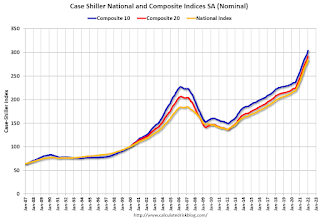

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 19.2% annual gain in January, up from 18.9% in the previous month. The 10-City Composite annual increase came in at 17.5%, up from 17.1% in the previous month. The 20-City Composite posted a 19.1% year-over-year gain, up from 18.6% in the previous month.

Phoenix, Tampa, and Miami reported the highest year-over-year gains among the 20 cities in January. Phoenix led the way with a 32.6% year-over-year price increase, followed by Tampa with a 30.8% increase and Miami with a 28.1% increase. Sixteen of the 20 cities reported higher price increases in the year ending January 2022 versus the year ending December 2021.

...

Before seasonal adjustment, the U.S. National Index posted an 1.1% month-over-month increase in January, while the 10-City and 20-City Composites both posted increases of 1.4%.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.6%, and the 10-City and 20-City Composites both posted increases of 1.8%.

In January, all 20 cities reported increases before and after seasonal adjustments.

“Home price changes in January 2022 continued the strength we had observed for much of the prior year,” says Craig J. Lazzara, Managing Director at S&P DJI. “The National Composite Index recorded a gain of 19.2% for the 12 months ended in January 2022; the 10- and 20-City Composites rose 17.5% and 19.1%, respectively. All three composites reflect a small acceleration of price growth for January 2022.

“Last fall we observed that home prices, although continuing to rise quite sharply, had begun to decelerate. Even that modest deceleration was on pause in January. The 19.2% year-over-year change for January was the fourth-largest reading in 35 years of history.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.4% in January (SA).

The Composite 20 index is up 1.4% (SA) in January.

The National index is 54% above the bubble peak (SA), and up 1.1% (SA) in January. The National index is up 108% from the post-bubble low set in February 2012 (SA).

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 17.5% year-over-year. The Composite 20 SA is up 19.1% year-over-year.

The National index SA is up 19.2% year-over-year.

Price increases were above expectations. I'll have more later.

Monday, March 28, 2022

Tuesday: Case-Shiller, Job Openings

by Calculated Risk on 3/28/2022 07:11:00 PM

From Matthew Graham at Mortgage News Daily: Uneventful Start This Week as Rates Flirt With 5%

Last week's big news was the rapid jump in rates. In fact, it was right in line with the worst week in decades in terms of the total increase in the average 30yr fixed rate. On that note, June 17-21, 2013 saw rates rise 0.52% compared to last week's 0.49%. Because rates are quoted in 0.125% increments, this would be a hit of 0.50% to prospective borrowers in either case. ... In more specific terms, the average lender is effectively unchanged when it comes to top tier 30yr fixed scenarios with quotes currently ranging from 4.875 to 5.125% in a majority of cases. [30 year fixed 4.95%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for January. The consensus is for a 18.3% year-over-year increase in the Comp 20 index.

• Also at 9:00 AM, FHFA House Price Index for January 2021. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for February from the BLS.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.5% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 217.4 | --- | ≥2321 | |

| New Cases per Day3🚩 | 27,775 | 27,104 | ≤5,0002 | |

| Hospitalized3 | 12,487 | 17,168 | ≤3,0002 | |

| Deaths per Day3 | 690 | 927 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Housing Inventory Has Bottomed

by Calculated Risk on 3/28/2022 09:40:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Housing Inventory Has Bottomed

A brief excerpt:

Altos Research reports inventory up 2.4% last week ...There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

As of March 25th, inventory was at 253 thousand (7-day average), compared to 248 thousand the prior week. Inventory was UP 2.4% from the previous week.

Last year inventory bottomed seasonally in April 2021 - very late in the year. This year, by this measure, inventory bottomed seasonally at the beginning of March.

Inventory is still very low. Compared to the same week in 2021, inventory is down 19.0%, and compared to the same week in 2020, and inventory is down 66.1% from 747 thousand.

One of the keys will be to watch the year-over-year change each week to see if the declines are decreasing. Here is a table of the year-over-year change by week since the beginning of the year.

Week Ending YoY Change 12/31/2021 -30.0% 1/7/2022 -26.0% 1/14/2022 -28.6% 1/21/2022 -27.1% 1/28/2022 -25.9% 2/4/2022 -27.9% 2/11/2022 -27.5% 2/18/2022 -25.8% 2/25/2022 -24.9% 3/4/2022 -24.2% 3/11/2022 -21.7% 3/18/2022 -21.7% 3/25/2022 -19.0%

Now we need to watch if the YoY change continues to decrease. Based on the current trend, it is possible inventory will be up YoY sometime in the second half of 2022.

Altos Research CEO Mike Simonsen discusses this data regularly on Youtube.

Six High Frequency Indicators for the Economy

by Calculated Risk on 3/28/2022 08:39:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of March 27th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 10.6% from the same day in 2019 (89.4% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through March 26, 2022.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Dining was mostly moving sideways but declined during the winter wave of COVID and is now increasing. The 7-day average for the US is down 4% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $102 million last week, down about 46% from the median for the week.

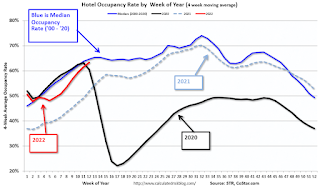

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

This data is through March 19th. The occupancy rate was down 3.7% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

This data is through March 26th

This data is through March 26th The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 126% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, March 25th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, March 27, 2022

Sunday Night Futures

by Calculated Risk on 3/27/2022 09:15:00 PM

Weekend:

• Schedule for Week of March 27, 2022

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 15 and DOW futures are down 100 (fair value).

Oil prices were up over the last week with WTI futures at $109.92 per barrel and Brent at $116.63 per barrel. A year ago, WTI was at $61, and Brent was at $64 - so WTI oil prices are up 80% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.22 per gallon. A year ago prices were at $2.84 per gallon, so gasoline prices are up $1.38 per gallon year-over-year.

Census: Record 37.9% of adult population in the United States has a bachelor’s degree or higher

by Calculated Risk on 3/27/2022 12:23:00 PM

This was released last month by the Census Bureau: Census Bureau Releases New Educational Attainment Data

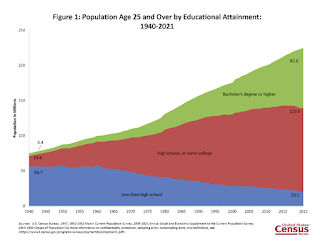

In 2021, the highest level of education of the population age 25 and older in the United States was distributed as follows:

• 8.9% had less than a high school diploma or equivalent.

• 27.9% had high school graduate as their highest level of school completed.

• 14.9% had completed some college but not a degree.

• 10.5% had an associate degree as their highest level of school completed.

• 23.5% had a bachelor’s degree as their highest degree.

• 14.4% had completed an advanced degree such as a master’s degree, professional degree or doctoral degree.

emphasis added

This graph shows the number of adults, 25 years and older, with less than high school education, high school or some college, and a bachelor's degree or higher since 1940.

This graph shows the number of adults, 25 years and older, with less than high school education, high school or some college, and a bachelor's degree or higher since 1940. In 1940, about 76% of the adult population (over 25) had less than a high school education. That has declined to less than 9% now.

In 1940, about 76% of the adult population (over 25) had less than a high school education. That has declined to less than 9% now.Saturday, March 26, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 3/26/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales and Cancellations

• February New Home Sales: Few Completed Inventory, High Number of Homes Under Construction

• Mortgage Rates Moving Closer to 5%

• Final Look at Local Housing Markets in February

This is usually published several times a week and provides more in-depth analysis of the housing market.

The blog will continue as always!

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of March 27, 2022

by Calculated Risk on 3/26/2022 08:11:00 AM

The key report scheduled for this week is the March employment report on Friday.

Other key reports include the 3rd estimate of Q4 GDP, February Personal Income & Outlays, January Case-Shiller house prices and March Auto Sales.

For manufacturing, the March Dallas Fed survey and the ISM Manufacturing survey will be released.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

9:00 AM: S&P/Case-Shiller House Price Index for January.

9:00 AM: S&P/Case-Shiller House Price Index for January.This graph shows the year-over-year change for the Case-Shiller National, Composite 10 and Composite 20 indexes, through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 18.3% year-over-year increase in the Comp 20 index.

9:00 AM: FHFA House Price Index for January 2021. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in January to 11.3 million from 11.4 million in December.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 438,000 payroll jobs added in March, down from 475,000 added in February.

8:30 AM, Gross Domestic Product, 4th quarter 2021 (Third estimate). The consensus is that real GDP increased 7.1% annualized in Q4.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 195 thousand from 187 thousand last week.

8:30 AM: Personal Income and Outlays for February. The consensus is for a 0.5% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.4%.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 56.6, up from 56.3 in February.

8:30 AM: Employment Report for March. The consensus is for 475,000 jobs added, and for the unemployment rate to decrease to 3.7%.

8:30 AM: Employment Report for March. The consensus is for 475,000 jobs added, and for the unemployment rate to decrease to 3.7%.There were 678,000 jobs added in February, and the unemployment rate was at 3.8%.

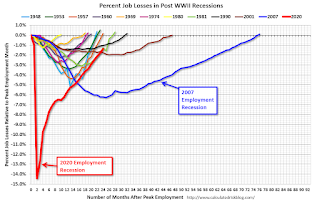

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 24 months after the onset, is now significantly better than the worst of the "Great Recession".

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 58.6, unchanged from 58.6 in February.

10:00 AM: Construction Spending for February. The consensus is for a 0.9% increase in construction spending.

All Day: Light vehicle sales for March. The consensus is for light vehicle sales to be 14.1 million SAAR in March, unchanged from 14.1 million in February (Seasonally Adjusted Annual Rate).

All Day: Light vehicle sales for March. The consensus is for light vehicle sales to be 14.1 million SAAR in March, unchanged from 14.1 million in February (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

Friday, March 25, 2022

COVID Update: March 25, 2022; Deaths at 732 per Day, Lowest Since August 2021

by Calculated Risk on 3/25/2022 09:29:00 PM

Last June, new cases per day dropped to 8,000, hospitalizations fell to 12,000, and deaths were at 250 per day. Hospitalizations are approaching the June levels.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.5% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 217.3 | --- | ≥2321 | |

| New Cases per Day3 | 27,784 | 28,007 | ≤5,0002 | |

| Hospitalized3 | 14,768 | 19,249 | ≤3,0002 | |

| Deaths per Day3 | 732 | 1,042 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.