by Calculated Risk on 3/30/2022 11:04:00 AM

Wednesday, March 30, 2022

Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in January and a look at "Affordability"

Today, in the Calculated Risk Real Estate Newsletter: Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in January

Excerpt:

I’ve put together my own affordability index - since 1976 - that is similar to the FirstAm approach (more of a house price index adjusted by mortgage rates and the median household income).

I used median income from the Census Bureau (estimated 2021), assumed a 15% down payment, and used a 2% estimate for property taxes, insurance and maintenance. This is probably low for high property tax states like New Jersey and Texas, and too high for lower property tax states. If we were including condos, we’d also include HOA fees too (this is excluded).

For house prices, I used the Case-Shiller National Index, Seasonally Adjusted (SA). Also, for the down payment - there wasn’t a significant difference between 15% and 20%. For mortgage rates, I used the Freddie Mac PMMS (30-year fixed rates).

So here is what the index looks like (lower is more affordable like the FirstAm index):

Note that by this index, during the early ‘80s, homes were very unaffordable due to the very high mortgage rates. During the housing bubble, houses were also less affordable using 30-year mortgage rates, however, during the bubble, there were many “affordability products” that allowed borrowers to be qualified at the teaser rate (usually around 1%) that made houses seem more affordable.

In general, this would suggest houses are the least affordable since the housing bubble. This says nothing about if “now is a good time to buy” (see the bottom of my post Housing: A Look at "Affordability" Indexes).

Also, in January, the average 30-year mortgage rates were around 3.45%, and currently mortgage rates are close to 4.9% - so we already know the “Affordability Price Index” will increase sharply over the next couple of months (meaning houses are even less affordable).

Q4 GDP Growth Revised down to 6.9% Annual Rate

by Calculated Risk on 3/30/2022 08:36:00 AM

From the BEA: Gross Domestic Product (Third Estimate), Corporate Profits, and GDP by Industry, Fourth Quarter and Year 2021

Real gross domestic product (GDP) increased at an annual rate of 6.9 percent in the fourth quarter of 2021, according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 2.3 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised down from 3.1% to 2.5%. Residential investment was revised up from 1.0% to 2.2%.

The "third" estimate of GDP released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 7.0 percent. The downward revision primarily reflected downward revisions to personal consumption expenditures (PCE) and exports that were partly offset by an upward revision to private inventory investment.

emphasis added

ADP: Private Employment Increased 455,000 in March

by Calculated Risk on 3/30/2022 08:22:00 AM

Private sector employment increased by 455,000 jobs from February to March according to the March ADP® National Employment ReportTM. Broadly distributed to the public each month, free of charge, the ADP National Employment Report is produced by the ADP Research Institute® in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual data of those who are on a company’s payroll, measures the change in total nonfarm private employment each month on a seasonally-adjusted basisThis was slightly above the consensus forecast of 438,000 for this report.

“Job growth was broad-based across sectors in March, contributing to the nearly 1.5 million jobs added for the first quarter in 2022,” said Nela Richardson, chief economist, ADP. “Businesses are hiring, specifically among the service providers which had the most ground to make up due to early pandemic losses. However, a tight labor supply remains an obstacle for continued growth in consumer-facing industries

emphasis added

The BLS report will be released Friday, and the consensus is for 475 thousand non-farm payroll jobs added in March. The ADP report has not been very useful in predicting the BLS report, but this suggests a solid March BLS report.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 3/30/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 6.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 25, 2022.

... The Refinance Index decreased 15 percent from the previous week and was 60 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 10 percent lower than the same week one year ago.

“Mortgage rates jumped to their highest level in more than three years last week, as investors continue to price in the impact of a more restrictive monetary policy from the Federal Reserve. Not surprisingly, refinance application volume declined further, as fewer borrowers have an incentive to apply at rates that are significantly higher than a year ago. Refinance application volume is now 60 percent below last year’s levels, in line with MBA’s forecast for 2022,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “Even with the ongoing climb in rates, purchase application volumes were little changed last week. This is particularly auspicious, as we are now in the beginning of the spring homebuying season, and those shopping for homes are struggling with not only higher and more volatile mortgage rates, but also an ongoing shortage of homes on the market. Given these hurdles, it appears to be promising news that purchase application volume has not declined, as many potential buyers are likely feeling the squeeze in their purchasing power from the jump in rates.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 4.80 percent from 4.50 percent, with points decreasing to 0.56 from 0.59 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

According to the MBA, purchase activity is down 10% year-over-year unadjusted.

According to the MBA, purchase activity is down 10% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, March 29, 2022

Wednesday: GDP, ADP Employment

by Calculated Risk on 3/29/2022 09:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 438,000 payroll jobs added in March, down from 475,000 added in February.

• At 8:30 AM, Gross Domestic Product, 4th quarter 2021 (Third estimate). The consensus is that real GDP increased 7.1% annualized in Q4.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.5% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 217.5 | --- | ≥2321 | |

| New Cases per Day3 | 26,190 | 27,282 | ≤5,0002 | |

| Hospitalized3 | 12,934 | 16,599 | ≤3,0002 | |

| Deaths per Day3 | 700 | 862 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Mortgage Rates Ease Slightly

by Calculated Risk on 3/29/2022 05:21:00 PM

From Matthew Graham at MortgageNewsDaily: Here We Go Again: Mortgage Rates Making Another Recovery Attempt

Now today, we have another improvement in the bond market that looks quite similar to the one seen last week. This one arose due to hopes for some sort of de-escalation in Ukraine. The thought process is that de-escalation helps oil prices drop, thus easing upward pressure on inflation and allowing the Fed to be slightly less aggressive in making policy changes that are unfriendly to rates.

If recent instances of hope and the subsequent crushing of those hopes are any guide, this could certainly be another head fake. There's no way to tell how likely that is. What we can say is that it would take several more days with bigger improvements to alter the broader rising rate trend.

The average lender was closest to 5.0% on Friday and Monday for top tier conventional 30yr fixed scenarios. Today's number is closer to 4.875% for the same scenarios.

Click on graph for larger image.

Click on graph for larger image.This is a graph from Mortgage News Daily (MND) showing 30-year fixed rates from three sources (MND, MBA, Freddie Mac) since 2010.

Comments on January Case-Shiller and FHFA House Price Increases

by Calculated Risk on 3/29/2022 10:45:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller National Index up 19.2% Year-over-year in January

Excerpt:

This graph below shows existing home months-of-supply (inverted, from the NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999 through January 2022).

Note that the months-of-supply is not seasonally adjusted.

There is a clear relationship, and this is no surprise (but interesting to graph). If months-of-supply is high, prices decline. If months-of-supply is very low (like now), prices rise quickly.

In January, the months-of-supply was at 1.6 months, and the Case-Shiller National Index (SA) increased 1.56% month-over-month. The black arrow points to the January 2022 dot. In the February existing home sales report, the NAR reported months-of-supply increased to 1.7 months.

My sense is the Case-Shiller National annual growth rate of 19.98% in August was probably the peak YoY growth rate, however, since the normal level of inventory is probably in the 4 to 6 months range - we’d have to see a significant increase in inventory to sharply slow price increases, and that is why I’m focused on inventory!

Note: I’ll have more on real prices, price-to-rent and affordability tomorrow.emphasis added

BLS: Job Openings "little changed" at 11.3 million in February

by Calculated Risk on 3/29/2022 10:05:00 AM

From the BLS: Job Openings and Labor Turnover Summary

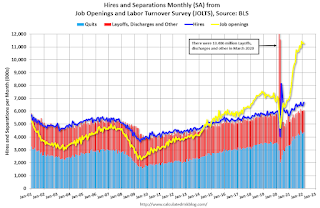

The number of job openings was little changed at 11.3 million on the last business day of February, the U.S. Bureau of Labor Statistics reported today. Hires edged up to 6.7 million while total separations were little changed at 6.1 million. Within separations, the quits rate was little changed at 2.9 percent and the layoffs and discharges rate was unchanged at 0.9 percent.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for February, the employment report this Friday will be for March.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spike in layoffs and discharges in March 2020 are labeled, but off the chart to better show the usual data.

Jobs openings decreased slightly in February to 11.266 million from 11.283 million in January.

The number of job openings (yellow) were up 43% year-over-year.

Quits were up 27% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

Case-Shiller: National House Price Index increased 19.2% year-over-year in January

by Calculated Risk on 3/29/2022 09:16:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for January ("January" is a 3-month average of November, December and January prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

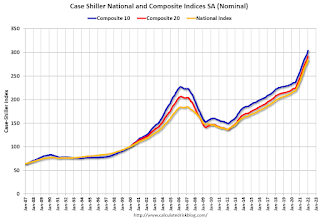

From S&P: S&P Corelogic Case-Shiller Index Reports 19.2% Annual Home Price Gain to Start 2022

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 19.2% annual gain in January, up from 18.9% in the previous month. The 10-City Composite annual increase came in at 17.5%, up from 17.1% in the previous month. The 20-City Composite posted a 19.1% year-over-year gain, up from 18.6% in the previous month.

Phoenix, Tampa, and Miami reported the highest year-over-year gains among the 20 cities in January. Phoenix led the way with a 32.6% year-over-year price increase, followed by Tampa with a 30.8% increase and Miami with a 28.1% increase. Sixteen of the 20 cities reported higher price increases in the year ending January 2022 versus the year ending December 2021.

...

Before seasonal adjustment, the U.S. National Index posted an 1.1% month-over-month increase in January, while the 10-City and 20-City Composites both posted increases of 1.4%.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.6%, and the 10-City and 20-City Composites both posted increases of 1.8%.

In January, all 20 cities reported increases before and after seasonal adjustments.

“Home price changes in January 2022 continued the strength we had observed for much of the prior year,” says Craig J. Lazzara, Managing Director at S&P DJI. “The National Composite Index recorded a gain of 19.2% for the 12 months ended in January 2022; the 10- and 20-City Composites rose 17.5% and 19.1%, respectively. All three composites reflect a small acceleration of price growth for January 2022.

“Last fall we observed that home prices, although continuing to rise quite sharply, had begun to decelerate. Even that modest deceleration was on pause in January. The 19.2% year-over-year change for January was the fourth-largest reading in 35 years of history.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.4% in January (SA).

The Composite 20 index is up 1.4% (SA) in January.

The National index is 54% above the bubble peak (SA), and up 1.1% (SA) in January. The National index is up 108% from the post-bubble low set in February 2012 (SA).

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 17.5% year-over-year. The Composite 20 SA is up 19.1% year-over-year.

The National index SA is up 19.2% year-over-year.

Price increases were above expectations. I'll have more later.

Monday, March 28, 2022

Tuesday: Case-Shiller, Job Openings

by Calculated Risk on 3/28/2022 07:11:00 PM

From Matthew Graham at Mortgage News Daily: Uneventful Start This Week as Rates Flirt With 5%

Last week's big news was the rapid jump in rates. In fact, it was right in line with the worst week in decades in terms of the total increase in the average 30yr fixed rate. On that note, June 17-21, 2013 saw rates rise 0.52% compared to last week's 0.49%. Because rates are quoted in 0.125% increments, this would be a hit of 0.50% to prospective borrowers in either case. ... In more specific terms, the average lender is effectively unchanged when it comes to top tier 30yr fixed scenarios with quotes currently ranging from 4.875 to 5.125% in a majority of cases. [30 year fixed 4.95%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for January. The consensus is for a 18.3% year-over-year increase in the Comp 20 index.

• Also at 9:00 AM, FHFA House Price Index for January 2021. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for February from the BLS.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.5% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 217.4 | --- | ≥2321 | |

| New Cases per Day3🚩 | 27,775 | 27,104 | ≤5,0002 | |

| Hospitalized3 | 12,487 | 17,168 | ≤3,0002 | |

| Deaths per Day3 | 690 | 927 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.