by Calculated Risk on 3/31/2022 04:34:00 PM

Thursday, March 31, 2022

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in February

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 1.11% in February from 1.17% in January. The serious delinquency rate is down from 2.76% in February 2021.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (1% of portfolio), 3.30% are seriously delinquent (down from 3.39% in January).

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

The pandemic related increase in delinquencies was very different from the increase in delinquencies following the housing bubble. Lending standards had been fairly solid over the previous decade, and most of these homeowners had equity in their homes - and the vast majority of these homeowners have been able to restructure their loans once they were employed.

Freddie Mac reported earlier.

Hotels: Occupancy Rate Down 5.5% Compared to Same Week in 2019

by Calculated Risk on 3/31/2022 12:33:00 PM

With lower Spring Break travel volume, U.S. hotel performance dipped slightly from the previous week, according to STR‘s latest data through March 26.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

March 20-26, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 65.5% (-5.5%)

• Average daily rate (ADR): $149.38 (+13.5%)

• Revenue per available room (RevPAR): $97.92 (+7.3%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

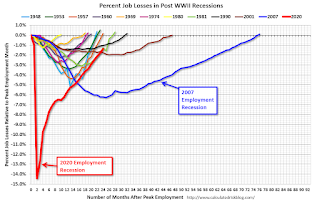

March Employment Preview

by Calculated Risk on 3/31/2022 12:11:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for March. The consensus is for 475,000 jobs added, and for the unemployment rate to decrease to 3.7%.

Click on graph for larger image.

Click on graph for larger image.• First, currently there are still about 2.1 million fewer jobs than in February 2020 (before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 24 months after the onset, is now significantly better than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a gain of 455,000 private sector jobs, slightly above the consensus estimates of 438,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests a solid March BLS report.

• ISM Surveys: The ISM surveys for March have not been released yet.

• Unemployment Claims: The weekly claims report showed a decrease in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 249,000 in February to 215,000 in March. This would usually suggest fewer layoffs in March than in February, although this might not be very useful right now. In general, weekly claims were below expectations in March.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the January report.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the January report.This data is only available back to 1994, so there is only data for three recessions. In February, the number of permanent job losers decreased to 1.583 million from 1.630 million in the previous month.

• Conclusion: There is optimism concerning the March employment report. Overall, the ADP report was solid, and unemployment claims decreased during the reference week. This suggests another solid employment report, probably at or above consensus expectations.

Personal Income increased 0.5% in February; Spending increased 0.2%

by Calculated Risk on 3/31/2022 08:44:00 AM

The BEA released the Personal Income and Outlays, February 2022:

Personal income increased $101.5 billion (0.5 percent) in February, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $76.1 billion (0.4 percent) and personal consumption expenditures (PCE) increased $34.9 billion (0.2 percent).The February PCE price index increased 6.4 percent year-over-year and the November PCE price index, excluding food and energy, increased 5.4 percent year-over-year.

Real DPI decreased 0.2 percent in February and Real PCE decreased 0.4 percent; goods decreased 2.1 percent and services increased 0.6 percent. The PCE price index increased 0.6 percent. Excluding food and energy, the PCE price index increased 0.4 percent

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through February 2022 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was at expectations, and the increase in PCE was below expectations.

Using the two-month method to estimate Q1 PCE growth, PCE was increasing at a 1.9% annual rate in Q1 2022. (Using the mid-month method, PCE was increasing at 1.3%).

Weekly Initial Unemployment Claims Increase to 202,000

by Calculated Risk on 3/31/2022 08:33:00 AM

The DOL reported:

In the week ending March 26, the advance figure for seasonally adjusted initial claims was 202,000, an increase of 14,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 187,000 to 188,000. The 4-week moving average was 208,500, a decrease of 3,500 from the previous week's revised average. The previous week's average was revised up by 250 from 211,750 to 212,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 208,500.

The previous week was revised up.

Weekly claims were slightly above the consensus forecast.

Wednesday, March 30, 2022

Thursday: Personal Income and Outlays, Unemployment Claims

by Calculated Risk on 3/30/2022 08:56:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for an increase to 195 thousand from 187 thousand last week.

• Also at 8:30 AM, Personal Income and Outlays for February. The consensus is for a 0.5% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.4%.

• At 9:45 AM, Chicago Purchasing Managers Index for March. The consensus is for a reading of 56.6, up from 56.3 in February.

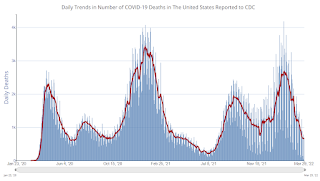

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.5% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 217.6 | --- | ≥2321 | |

| New Cases per Day3 | 25,218 | 26,682 | ≤5,0002 | |

| Hospitalized3 | 12,625 | 16,043 | ≤3,0002 | |

| Deaths per Day3 | 644 | 755 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

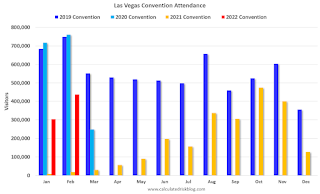

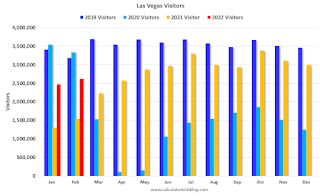

Las Vegas February 2022: Visitor Traffic Down 18% Compared to 2019

by Calculated Risk on 3/30/2022 02:21:00 PM

From the Las Vegas Visitor Authority: February 2022 Las Vegas Visitor Statistics

Despite continued waning effects of the Omicron variant during the month, Las Vegas visitation exceeded 2.6M in February, 70% ahead of a year ago but down ‐18% vs. February 2019.

Overall hotel occupancy reached 69.3%, roughly 10 pts ahead of January, up 27.3 pts YoY and down 17.7 pts vs. February 2019. Weekend occupancy came in relatively strong at 87.5%, 24.7 pts ahead of the weekend levels of last February and only 4.4 pts below February 2019. Midweek occupancy still reflected a convention segment in recovery but reached 60.7%, well over the 32.1% level of last February (+28.6 pts) but down 23.9 pts vs. February 2019.

February 2022 ADR approached $150, surpassing both February 2021 (+52.5%) and February 2019 (+15.0%) while RevPAR reached $103.62 for the month, dramatically ahead of February 2021 (+151.7%) and down only 8.4% vs. February 2019.

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (dark blue), 2020 (light blue), 2021 (yellow) and 2022 (red)

Visitor traffic was down 18.0% compared to the same month in 2019.

Note: There was almost no convention traffic from April 2020 through May 2021.

Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in January and a look at "Affordability"

by Calculated Risk on 3/30/2022 11:04:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in January

Excerpt:

I’ve put together my own affordability index - since 1976 - that is similar to the FirstAm approach (more of a house price index adjusted by mortgage rates and the median household income).

I used median income from the Census Bureau (estimated 2021), assumed a 15% down payment, and used a 2% estimate for property taxes, insurance and maintenance. This is probably low for high property tax states like New Jersey and Texas, and too high for lower property tax states. If we were including condos, we’d also include HOA fees too (this is excluded).

For house prices, I used the Case-Shiller National Index, Seasonally Adjusted (SA). Also, for the down payment - there wasn’t a significant difference between 15% and 20%. For mortgage rates, I used the Freddie Mac PMMS (30-year fixed rates).

So here is what the index looks like (lower is more affordable like the FirstAm index):

Note that by this index, during the early ‘80s, homes were very unaffordable due to the very high mortgage rates. During the housing bubble, houses were also less affordable using 30-year mortgage rates, however, during the bubble, there were many “affordability products” that allowed borrowers to be qualified at the teaser rate (usually around 1%) that made houses seem more affordable.

In general, this would suggest houses are the least affordable since the housing bubble. This says nothing about if “now is a good time to buy” (see the bottom of my post Housing: A Look at "Affordability" Indexes).

Also, in January, the average 30-year mortgage rates were around 3.45%, and currently mortgage rates are close to 4.9% - so we already know the “Affordability Price Index” will increase sharply over the next couple of months (meaning houses are even less affordable).

Q4 GDP Growth Revised down to 6.9% Annual Rate

by Calculated Risk on 3/30/2022 08:36:00 AM

From the BEA: Gross Domestic Product (Third Estimate), Corporate Profits, and GDP by Industry, Fourth Quarter and Year 2021

Real gross domestic product (GDP) increased at an annual rate of 6.9 percent in the fourth quarter of 2021, according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 2.3 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised down from 3.1% to 2.5%. Residential investment was revised up from 1.0% to 2.2%.

The "third" estimate of GDP released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 7.0 percent. The downward revision primarily reflected downward revisions to personal consumption expenditures (PCE) and exports that were partly offset by an upward revision to private inventory investment.

emphasis added

ADP: Private Employment Increased 455,000 in March

by Calculated Risk on 3/30/2022 08:22:00 AM

Private sector employment increased by 455,000 jobs from February to March according to the March ADP® National Employment ReportTM. Broadly distributed to the public each month, free of charge, the ADP National Employment Report is produced by the ADP Research Institute® in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual data of those who are on a company’s payroll, measures the change in total nonfarm private employment each month on a seasonally-adjusted basisThis was slightly above the consensus forecast of 438,000 for this report.

“Job growth was broad-based across sectors in March, contributing to the nearly 1.5 million jobs added for the first quarter in 2022,” said Nela Richardson, chief economist, ADP. “Businesses are hiring, specifically among the service providers which had the most ground to make up due to early pandemic losses. However, a tight labor supply remains an obstacle for continued growth in consumer-facing industries

emphasis added

The BLS report will be released Friday, and the consensus is for 475 thousand non-farm payroll jobs added in March. The ADP report has not been very useful in predicting the BLS report, but this suggests a solid March BLS report.