by Calculated Risk on 4/01/2022 08:44:00 AM

Friday, April 01, 2022

March Employment Report: 431 thousand Jobs, 3.6% Unemployment Rate

From the BLS:

Total nonfarm payroll employment rose by 431,000 in March, and the unemployment rate declined to 3.6 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains continued in leisure and hospitality, professional and business services, retail trade, and manufacturing.

The change in total nonfarm payroll employment for January was revised up by 23,000, from +481,000 to +504,000, and the change for February was revised up by 72,000, from +678,000 to +750,000. With these revisions, employment in January and February combined is 95,000 higher than previously reported.

emphasis added

Click on graph for larger image.

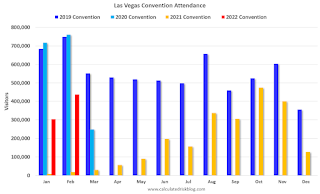

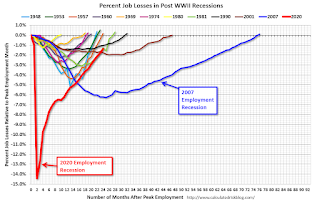

Click on graph for larger image.The first graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms.

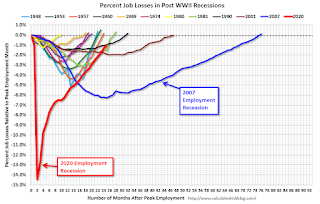

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In March, the year-over-year change was 6.5 million jobs. This was up significantly year-over-year.

Total payrolls increased by 431 thousand in March. Private payrolls increased by 426 thousand, and public payrolls increased 5 thousand.

Payrolls for January and February were revised up 95 thousand, combined.

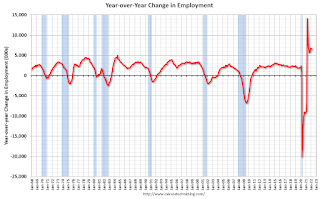

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 62.4% in March, from 62.3% in February. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 62.4% in March, from 62.3% in February. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 60.1% from 59.9% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

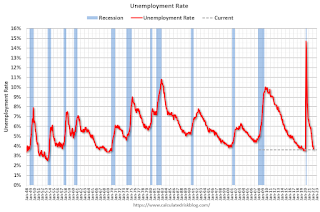

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in March to 3.6% from 3.8% in February.

This was slightly below consensus expectations; however, January and February payrolls were revised up by 95,000 combined.

Thursday, March 31, 2022

Friday: Employment Report, ISM Mfg, Construction Spending, Vehicle Sales

by Calculated Risk on 3/31/2022 09:07:00 PM

My March Employment Preview

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose by 575k in March (mom sa) ... we believe fierce competition for workers incentivized firms to pull forward recruiting activities earlier in the spring hiring season. We also note that short-term unemployment only partially reversed its Omicron spike with the February report, implying scope for additional rehiring in March. ... We estimate a one-tenth drop in the unemployment rate to 3.7%Friday:

emphasis added

• At 8:30 AM ET, Employment Report for March. The consensus is for 475,000 jobs added, and for the unemployment rate to decrease to 3.7%.

• At 10:00 AM, ISM Manufacturing Index for March. The consensus is for the ISM to be at 58.6, unchanged from 58.6 in February.

• At 10:00 AM, Construction Spending for February. The consensus is for a 0.9% increase in construction spending.

• All Day, Light vehicle sales for March. The consensus is for light vehicle sales to be 14.1 million SAAR in March, unchanged from 14.1 million in February (Seasonally Adjusted Annual Rate).

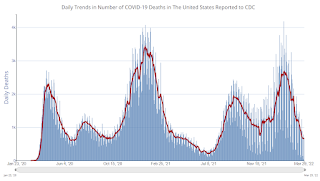

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.6% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 217.6 | --- | ≥2321 | |

| New Cases per Day3 | 25,732 | 26,518 | ≤5,0002 | |

| Hospitalized3 | 12,243 | 15,482 | ≤3,0002 | |

| Deaths per Day3 | 626 | 732 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Housing: Don't Compare the Current Housing Boom to the Bubble and Bust

by Calculated Risk on 3/31/2022 04:39:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Housing: Don't Compare the Current Housing Boom to the Bubble and Bust

Excerpt:

It is natural to compare the current housing boom to the mid-00s housing bubble. The bubble and subsequent bust are part of our collective memories. And graphs of nominal house prices and price-to-rent ratios look eerily similar to the housing bubble.

However, there are significant differences. First, lending has been reasonably solid during the current boom, whereas in the mid-00s, underwriting standards were almost non-existent (“fog a mirror, get a loan”). And demographics are much more favorable today than in the mid-00s.

...

A much more similar period to today is the late ‘70s and early ‘80s. House prices were increasing sharply. Demographics were very favorable for homebuying as the baby boomers moved into the first-time homebuying age group (similar to the millennials now). And inflation picked up from an already elevated level due to the second oil embargo in 1979, followed by the Iran-Iraq war in 1980, driving up costs.

In 1979, the Volcker Fed responded by raising rates, and combined with inflation, this pushed up mortgage rates sharply. Now the Powell Fed is embarking on a tightening cycle and mortgage rates have already increased significantly.

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in February

by Calculated Risk on 3/31/2022 04:34:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 1.11% in February from 1.17% in January. The serious delinquency rate is down from 2.76% in February 2021.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (1% of portfolio), 3.30% are seriously delinquent (down from 3.39% in January).

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

The pandemic related increase in delinquencies was very different from the increase in delinquencies following the housing bubble. Lending standards had been fairly solid over the previous decade, and most of these homeowners had equity in their homes - and the vast majority of these homeowners have been able to restructure their loans once they were employed.

Freddie Mac reported earlier.

Hotels: Occupancy Rate Down 5.5% Compared to Same Week in 2019

by Calculated Risk on 3/31/2022 12:33:00 PM

With lower Spring Break travel volume, U.S. hotel performance dipped slightly from the previous week, according to STR‘s latest data through March 26.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

March 20-26, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 65.5% (-5.5%)

• Average daily rate (ADR): $149.38 (+13.5%)

• Revenue per available room (RevPAR): $97.92 (+7.3%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

March Employment Preview

by Calculated Risk on 3/31/2022 12:11:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for March. The consensus is for 475,000 jobs added, and for the unemployment rate to decrease to 3.7%.

Click on graph for larger image.

Click on graph for larger image.• First, currently there are still about 2.1 million fewer jobs than in February 2020 (before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 24 months after the onset, is now significantly better than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a gain of 455,000 private sector jobs, slightly above the consensus estimates of 438,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests a solid March BLS report.

• ISM Surveys: The ISM surveys for March have not been released yet.

• Unemployment Claims: The weekly claims report showed a decrease in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 249,000 in February to 215,000 in March. This would usually suggest fewer layoffs in March than in February, although this might not be very useful right now. In general, weekly claims were below expectations in March.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the January report.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the January report.This data is only available back to 1994, so there is only data for three recessions. In February, the number of permanent job losers decreased to 1.583 million from 1.630 million in the previous month.

• Conclusion: There is optimism concerning the March employment report. Overall, the ADP report was solid, and unemployment claims decreased during the reference week. This suggests another solid employment report, probably at or above consensus expectations.

Personal Income increased 0.5% in February; Spending increased 0.2%

by Calculated Risk on 3/31/2022 08:44:00 AM

The BEA released the Personal Income and Outlays, February 2022:

Personal income increased $101.5 billion (0.5 percent) in February, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $76.1 billion (0.4 percent) and personal consumption expenditures (PCE) increased $34.9 billion (0.2 percent).The February PCE price index increased 6.4 percent year-over-year and the November PCE price index, excluding food and energy, increased 5.4 percent year-over-year.

Real DPI decreased 0.2 percent in February and Real PCE decreased 0.4 percent; goods decreased 2.1 percent and services increased 0.6 percent. The PCE price index increased 0.6 percent. Excluding food and energy, the PCE price index increased 0.4 percent

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through February 2022 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was at expectations, and the increase in PCE was below expectations.

Using the two-month method to estimate Q1 PCE growth, PCE was increasing at a 1.9% annual rate in Q1 2022. (Using the mid-month method, PCE was increasing at 1.3%).

Weekly Initial Unemployment Claims Increase to 202,000

by Calculated Risk on 3/31/2022 08:33:00 AM

The DOL reported:

In the week ending March 26, the advance figure for seasonally adjusted initial claims was 202,000, an increase of 14,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 187,000 to 188,000. The 4-week moving average was 208,500, a decrease of 3,500 from the previous week's revised average. The previous week's average was revised up by 250 from 211,750 to 212,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 208,500.

The previous week was revised up.

Weekly claims were slightly above the consensus forecast.

Wednesday, March 30, 2022

Thursday: Personal Income and Outlays, Unemployment Claims

by Calculated Risk on 3/30/2022 08:56:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for an increase to 195 thousand from 187 thousand last week.

• Also at 8:30 AM, Personal Income and Outlays for February. The consensus is for a 0.5% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.4%.

• At 9:45 AM, Chicago Purchasing Managers Index for March. The consensus is for a reading of 56.6, up from 56.3 in February.

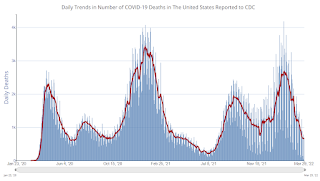

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.5% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 217.6 | --- | ≥2321 | |

| New Cases per Day3 | 25,218 | 26,682 | ≤5,0002 | |

| Hospitalized3 | 12,625 | 16,043 | ≤3,0002 | |

| Deaths per Day3 | 644 | 755 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Las Vegas February 2022: Visitor Traffic Down 18% Compared to 2019

by Calculated Risk on 3/30/2022 02:21:00 PM

From the Las Vegas Visitor Authority: February 2022 Las Vegas Visitor Statistics

Despite continued waning effects of the Omicron variant during the month, Las Vegas visitation exceeded 2.6M in February, 70% ahead of a year ago but down ‐18% vs. February 2019.

Overall hotel occupancy reached 69.3%, roughly 10 pts ahead of January, up 27.3 pts YoY and down 17.7 pts vs. February 2019. Weekend occupancy came in relatively strong at 87.5%, 24.7 pts ahead of the weekend levels of last February and only 4.4 pts below February 2019. Midweek occupancy still reflected a convention segment in recovery but reached 60.7%, well over the 32.1% level of last February (+28.6 pts) but down 23.9 pts vs. February 2019.

February 2022 ADR approached $150, surpassing both February 2021 (+52.5%) and February 2019 (+15.0%) while RevPAR reached $103.62 for the month, dramatically ahead of February 2021 (+151.7%) and down only 8.4% vs. February 2019.

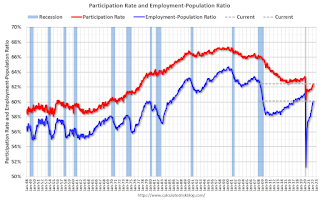

Click on graph for larger image.

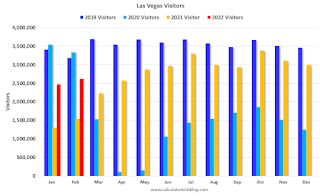

Click on graph for larger image. The first graph shows visitor traffic for 2019 (dark blue), 2020 (light blue), 2021 (yellow) and 2022 (red)

Visitor traffic was down 18.0% compared to the same month in 2019.

Note: There was almost no convention traffic from April 2020 through May 2021.