by Calculated Risk on 4/05/2022 03:39:00 PM

Tuesday, April 05, 2022

Q1 2022 Update: Unofficial Problem Bank list Decreased to 54 Institutions

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources only, and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here are the quarterly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List through March 31, 2022. Since the last update at the end of December 2021, the list decreased by three to 54 institutions after two additions and five removals. Assets increased by $4.3 billion to $60.9 billion, with the change primarily resulting from a $4.1 billion increase from updated asset figures through December 31, 2021. A year ago, the list held 65 institutions with assets of $48.6 billion. Additions during the fourth quarter Nano Banc, Irvine, CA ($1.2 billion) and Citizens State Bank, Ganado, TX ($64.5 million). Removals during the quarter because of action termination included Florida Capital Bank, National Association, Jacksonville, FL ($442 million); Southwest Capital Bank, Albuquerque, NM ($413 million); Commonwealth National Bank, Mobile, AL ($57 million); Ford County State Bank, Spearville, KS ($53 million); and State Bank, Green River, WY ($42 million).

With the conclusion of the fourth quarter, we bring an updated transition matrix to detail how banks are transitioning off the Unofficial Problem Bank List. Since we first published the Unofficial Problem Bank List on August 7, 2009 with 389 institutions, 1,783 institutions have appeared on a weekly or monthly list since then. Only 3.0 percent of the banks that have appeared on a list remain today as 1,729 institutions have transitioned through the list. Departure methods include 1,022 action terminations, 411 failures, 278 mergers, and 19 voluntary liquidations. Of the 389 institutions on the first published list, only 3 or less than 1.0 percent, still have a troubled designation more than ten years later. The 411 failures represent 23.1 percent of the 1,783 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

On March 1, 2021, the FDIC released fourth quarter results and provided an update on the Official Problem Bank List. While FDIC did not make a comment within its press release on the Official Problem Bank List, they provided details in an attachment that listed 44 institutions with assets of $170 billion, which was a material increase in assets from the $51 billion of assets listed in the preceding disclosure. The last time the Official Problem Bank List had assets this high was $174 billion as of September 30, 2013. Given the decline in the number of institutions from last quarter, there is speculation as to what institution with assets of about $125 billion was added to the list during the quarter. At year-end 2021, there are six insured institutions with assets ranging from $115 billion to $130 billion. While one these could have caused the large asset jump, there could have been a large removal to mask the identity of the addition. There are stories, perhaps urban myths, of the list being manipulated during the early 1990s to obfuscate the addition of a money center bank to the list. On March 10, 2022, the American Banker published an article on the mystery of the large jump in assets.

Denver Real Estate: Active Inventory up Sharply in March

by Calculated Risk on 4/05/2022 12:46:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Denver Real Estate: Active Inventory up Sharply in March

A brief excerpt:

Today, the Denver Metro Association of Realtors® (DMAR) has released their data for March, and it appears to show a sea change in active inventory.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

From the DMAR: DMAR Real Estate Market Trends Report... Month-end active inventory went up 81.16 percent from February to March.DMAR reports total residential active inventory (detached and attached) was 2,221 at the end of March, up 81.2% from 1,226 at the end of February, and up 9.7% year-over-year from 1,921 in March 2021.

...

“Earlier in the year, buyers offered six figures above the asking price while competing with dozens of offers,” commented Andrew Abrams, Chair of the DMAR Market Trends Committee and Metro Denver Realtor®. “With the recently increased inventory, it is more common to compete with just a few offers."

...

I’ll have data on many more markets soon.

ISM® Services Index Increased to 58.3% in March

by Calculated Risk on 4/05/2022 10:03:00 AM

(Posted with permission). The ISM® Services index was at 58.3%, up from 56.5% last month. The employment index increased to 54.0%, from 48.5%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 56.5% February 2022 Services ISM® Report On Business®

Economic activity in the services sector grew in March for the 22nd month in a row — with the Services PMI® registering 58.3 percent — say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®.The employment index increased to 54.0%, from 48.5% the previous month.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In March, the Services PMI® registered 58.3 percent, 1.8 percentage points higher than February’s reading of 56.5 percent. The Business Activity Index registered 55.5 percent, an increase of 0.4 percentage point compared to the reading of 55.1 percent in February, and the New Orders Index figure of 60.1 percent is 4 percentage points higher than the February reading of 56.1 percent.

emphasis added

Trade Deficit Mostly Unchanged at $89.2 Billion in February

by Calculated Risk on 4/05/2022 08:40:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $89.2 billion in February, down less than $0.1 billion from $89.2 billion in January, revised.

February exports were $228.6 billion, $4.1 billion more than January exports. February imports were $317.8 billion, $4.1 billion more than January imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports decreased and imports increased in January.

Exports are up 20% compared to January 2021; imports are up 23% year-over-year.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

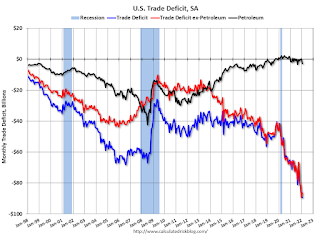

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China increased to $30.7 billion in February, from $24.6 billion in February 2021.

CoreLogic: House Prices up 20% YoY in February

by Calculated Risk on 4/05/2022 08:00:00 AM

Notes: This CoreLogic House Price Index report is for February. The recent Case-Shiller index release was for January. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: Annual Home Price Growth Again Hits New High in February, CoreLogic Reports

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for February 2022.

U.S. home price growth registered a year-over-year increase of 20% in February, another series high and marking 12 months of consecutive double-digit gains. Annual price growth has been recorded every month for the past decade. While prospective buyers outnumber sellers, a record-low number of homes for sale remains the primary culprit for the rapid price gains. The CoreLogic HPI Forecast shows national year-over-year appreciation slowing to 5% by February 2023, as rising interest rates are expected to sideline even more buyers.

"New listings have not kept up with the large number of families looking to buy, leading to homes selling quickly and often above list price,” said Dr. Frank Nothaft, chief economist at CoreLogic. “This imbalance between an insufficient number of owners looking to sell relative to buyers searching for a home has led to the record appreciation of the past 12 months. Higher prices and mortgage rates erode buyer affordability and should dampen demand in coming months, leading to the moderation in price growth in our forecast.”

...

Nationally, home prices increased 20% in February 2022, compared to February 2021. On a month-over-month basis, home prices increased by 2.2% compared to January 2022.

...

Home price gains are projected to slow to 5% by February 2023.

At the state level, warmer regions of the U.S. continued to show the largest increases, with Florida showing the country’s strongest price growth at 29.1%. Arizona ranked a close second with 28.6% growth, while Nevada was third, at 25.8% annual appreciation.

emphasis added

Monday, April 04, 2022

Tuesday: Trade Deficit, CoreLogic House Prices, ISM Services

by Calculated Risk on 4/04/2022 09:11:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Lower to Begin New Week

Mortgage rates are fresh off their best week since early March in terms of outright improvement. The catch is that they were at the highest levels since late 2018 immediately before that. ... As for today, we can enjoy a very modest improvement in rates and continue to wait for bigger news to cast a bigger vote on whether the next move is higher or lower. [30 year fixed 4.84%]Tuesday:

emphasis added

• At 8:00 AM ET, Corelogic House Price index for February.

• At 8:30 AM, Trade Balance report for February from the Census Bureau. The consensus is the trade deficit to be $88.7 billion. The U.S. trade deficit was at $89.7 billion in January.

• At 10:00 AM, the ISM Services Index for March.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.6% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 217.9 | --- | ≥2321 | |

| New Cases per Day3 | 25,074 | 26,185 | ≤5,0002 | |

| Hospitalized3 | 10,348 | 13,574 | ≤3,0002 | |

| Deaths per Day3 | 572 | 680 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths are the lowest since early August 2021.

Lawler: What is the Yield Curve Signaling?

by Calculated Risk on 4/04/2022 06:04:00 PM

From housing economist Tom Lawler: What is the Yield Curve Signaling?

Before addressing the above question, here is a little quiz:

The current Treasury yield is by historical standards:

(a) Unusually steep

(b) A bit flatter than normal

(c) Very unusually inverted

(d) All of the above

The current answer is, of course, (d), as the current Treasury yield curve is historically very steep from 3-months to 2-years, a bit flatter than normal from 2- to 3-years, and inverted from 3- to 10-years. (And spreads between the 3-year Treasury and the Fed funds rate is at its widest level since 1994).

Below is a chart comparing average yields curves during the previous three decades compared to today’s (mid-afternoon) yield curve.

Such “humped” yield curves as the current curve are unusual, and the degree of “humpiest” in the current curve is virtually unprecedented.

Such “humped” yield curves as the current curve are unusual, and the degree of “humpiest” in the current curve is virtually unprecedented.Many analysts, economists, and financial news reporters have expressed significant “angst” recently because the spread between the 10-year Treasury yield and the 2-year Treasury yields has turned slightly negative, and such “inversions” have been leading indicators of recessions (though lag times vary considerably.)

However, there is nothing “magical” about the “10/2” spread: other yield curve measures have been comparable or some have argued even better indicators of recessions/growth slowdowns. For example, in a March “reprise” of their 2018 paper, Fed economists Engstrom and Sharpe (https://www.federalreserve.gov/econres/notes/feds-notes/dont-fear-the-yield-curve-reprise-20220325.htm) argue that a much shorter term yield curve measure (the implied forward 3-month Treasury rate 6 months out compared to the current 3-month Treasury rate) is a better forward indicator than the 10/2 spread.

While I’m not a fan of their particular “curve” indicator because (1) it requires quotes on 21 month and 18 month Treasuries, which are not readily available on screens or historically, and (2) the short part of the Treasury curve has at times been much steeper than private money market yield curves for reasons other than “expectations” (see Rowe, Lawler, and Cook https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.1009.2682&rep=rep1&type=pdf , 1986), there are other yield curve measures that have had the same or better “indicator” value as the 10/2 spread but which today are sending much different signals than the 10/2 spread.

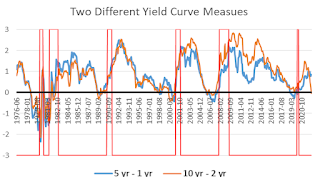

E.g., [here] is a chart comparing the historical behavior of the spread between the 10-year and the 2-year Treasury with the spread between the 5-year and the 1-year Treasury. (Recessions are shown poorly in the chart.)

E.g., [here] is a chart comparing the historical behavior of the spread between the 10-year and the 2-year Treasury with the spread between the 5-year and the 1-year Treasury. (Recessions are shown poorly in the chart.) As the chart shows, both of these yield curves meaasures have normally moved together, and both have typically inverted at about the same time – until recently. While the 10/2 spread went from an average of 79 bp in December of last year to negative 4 bp today, the 5/1 spread today is about 85 bp, down only slightly from the 93 bp average last December. And the spread between the 5-year Treasury and the Fed funds rate (not show here) has WIDENED to about 223 bp today from an 87 bp average last December.

[Here] is another yield curve chart comparing spreads between 3-year Treasuries and Fed Funds as well as 3-year Treasuries and 6-month Treasuries from 1990 through today. This chart highlights have these yield curve measures have widened substantially this year. (The chart only goes back to 1990).

[Here] is another yield curve chart comparing spreads between 3-year Treasuries and Fed Funds as well as 3-year Treasuries and 6-month Treasuries from 1990 through today. This chart highlights have these yield curve measures have widened substantially this year. (The chart only goes back to 1990).While the current “inversion” of the Treasury yield curve from 3-year to 10 years may reflect “the market’s” view that there may be a slowdown in the economy 3+year out in part because of substanial increases in the Fed’s target Fed funds rate over the next several years (though so far the Fed has only increased the funds rate by 25 bp current steepness of the the curve from the very short end to 3 years suggest that the yield curve is not giving any signals of a slowdown in economic growth over the next several years.

Update: Framing Lumber Prices: Down from Recent Peak, Up Triple from 2 Years Ago

by Calculated Risk on 4/04/2022 02:12:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through April 4th.

Click on graph for larger image.

Click on graph for larger image.A combination of strong demand and various supply constraints have kept lumber prices high and volatile.

Black Knight Mortgage Monitor for February: "Tightest affordability in 15 years"

by Calculated Risk on 4/04/2022 11:22:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor for February: "Tightest affordability in 15 years"

A brief excerpt:

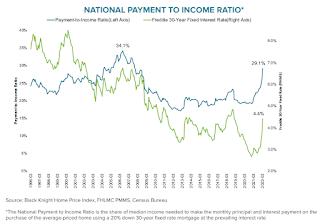

And on the payment to income ratio (this is high):There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

• It now takes 29.1% of the median household income to make that P&I payment, up from 19.3% just 15 months agoAs Black Knight noted, there were “affordability products” with low teaser rates available during the housing bubble. Excluding the bubble years, this is the worst affordability since the early ‘90s.

• That is a full 4 percentage points more than the 1995-2003 long-term average, though still below the 2006 high of 34%

• In recent years, a payment-to-income ratio above 21% has worked to cool the housing market, but record-low inventory continues to fuel growth even in the face of the tightest affordability in 15 years

• At current home prices and interest rates, it would take a 16% rise in incomes to bring the P&I ratio back down to benchmark affordability levels

Housing Inventory April 4th Update: Inventory up 0.7% Week-over-week; Up 5.9% from Seasonal Bottom

by Calculated Risk on 4/04/2022 09:13:00 AM

Tracking existing home inventory is very important in 2022.

Inventory usually declines in the winter, and then increases in the spring. Inventory bottomed seasonally at the beginning of March 2022 and is now up 5.9% since then.

This inventory graph is courtesy of Altos Research.

Last year inventory bottomed seasonally in April 2021 - very late in the year. This year, by this measure, inventory bottomed seasonally at the beginning of March.

Inventory is still very low. Compared to the same week in 2021, inventory is down 17.6% from 310 thousand, and compared to the same week in 2020, and inventory is down 66.0% from 751 thousand.

One of the keys will be to watch the year-over-year change each week to see if the declines are decreasing. Here is a table of the year-over-year change by week since the beginning of the year.

| Week Ending | YoY Change |

|---|---|

| 12/31/2021 | -30.0% |

| 1/7/2022 | -26.0% |

| 1/14/2022 | -28.6% |

| 1/21/2022 | -27.1% |

| 1/28/2022 | -25.9% |

| 2/4/2022 | -27.9% |

| 2/11/2022 | -27.5% |

| 2/18/2022 | -25.8% |

| 2/25/2022 | -24.9% |

| 3/4/2022 | -24.2% |

| 3/11/2022 | -21.7% |

| 3/18/2022 | -21.7% |

| 3/25/2022 | -19.0% |

| 4/4/2022 | -17.6% |