by Calculated Risk on 4/08/2022 08:11:00 AM

Friday, April 08, 2022

AAR: March Rail Carloads Up Year-over-year, Intermodal Down

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

March 2022 was another mixed month for U.S. rail volumes. Total carloads were up 1.2% over March 2021. That’s their 12th gain in the past 13 months, but also their smallest percentage gain during that period. Total carloads averaged 233,909 per week, the second most in the past nine months. Intermodal originations, by contrast, were down 6.4% in March 2022 from March 2021. Intermodal has been down on a year-over-year basis for seven of the past eight months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2020, 2021 and 2022:

n March 2022, total originated U.S. rail carloads were up 1.2% (13,456 carloads) over March 2021. That’s the 12th gain for total carloads in the past 13 months, but it’s also the smallest percentage increase for the 12 months with gains. Total carloads averaged 233,909 per week in March 2022, the second most in the past nine months (October 2021 was higher).

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):For intermodal, originations in March 2022 totaled 1.34 million containers and trailers, down 6.4% (92,170 units) from March 2021. For the first three months of 2022, volume was 3.37 million units, down 6.9% (249,672) from last year. The first three months of 2021 were by far the highest-volume first three months of a year in history for intermodal. The comparable figure for this year is the fourth highest in history (behind 2021, 2018, and 2019).

Thursday, April 07, 2022

1st Look at Local Housing Markets in March: A Sea Change in Active Inventory

by Calculated Risk on 4/07/2022 02:20:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in March

A brief excerpt:

Here is a summary of active listings for these housing markets in March. Note: Inventory usually increases seasonally in March, so the month-over-month (MoM) increase is not surprising.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Inventory was up 31.5% in March MoM from February, and down 1.0% year-over-year (YoY). The YoY decline in inventory in these markets was due entirely to San Diego (a very tight market). The other markets were up YoY.

This is early, and just a few markets, but it appears inventory has bottomed. Last month, these markets were down 26.1% YoY, so this is a significant change from February. This is the first step towards a more balanced market, but inventory levels are still very low.

Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle)

Hotels: Occupancy Rate Down 6.4% Compared to Same Week in 2019

by Calculated Risk on 4/07/2022 01:01:00 PM

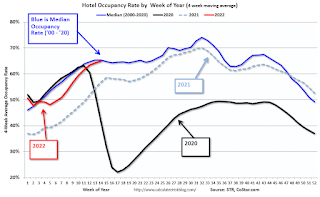

Reflecting continued seasonal slowing in spring break travel, U.S. hotel performance fell slightly from the previous week, according to STR‘s latest data through April 2.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

March 27 through April 2, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 64.1% (-6.4%)

• Average daily rate (ADR): $145.74 (+11.7%)

• Revenue per available room (RevPAR): $93.48 (+4.5%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

Used Vehicle Wholesale Prices Decline Seasonally Adjusted in March

by Calculated Risk on 4/07/2022 09:14:00 AM

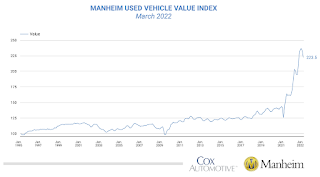

From Manheim Consulting today: Wholesale Used-Vehicle Prices Decline in March from Seasonal Adjustment

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) declined 3.3% in March from February. The Manheim Used Vehicle Value Index declined to 223.5, which was up 24.8% from a year ago. The non-adjusted price change in March was an increase of 0.6% compared to February, leaving the unadjusted average price up 23.2% year over year.

Manheim Market Report (MMR) values saw weekly price increases that accelerated in each full week of March after the first week saw the smallest decline of the year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Weekly Initial Unemployment Claims Decrease to 166,000

by Calculated Risk on 4/07/2022 08:38:00 AM

The DOL reported:

In the week ending April 2, the advance figure for seasonally adjusted initial claims was 166,000, a decrease of 5,000 from the previous week's revised level. The previous week's level was revised down by 31,000 from 202,000 to 171,000. The 4-week moving average was 170,000, a decrease of 8,000 from the previous week's revised average. The previous week's average was revised down by 30,500 from 208,500 to 178,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 170,000.

The previous week was revised down (there was a significant change to seasonal adjustment factors).

Weekly claims were well below the consensus forecast.

Wednesday, April 06, 2022

Thursday: Unemployment Claims

by Calculated Risk on 4/06/2022 09:08:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 200 thousand from 202 thousand last week.

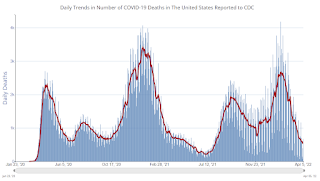

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.6% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 218.0 | --- | ≥2321 | |

| New Cases per Day3🚩 | 26,845 | 24,809 | ≤5,0002 | |

| Hospitalized3 | 10,505 | 12,729 | ≤3,0002 | |

| Deaths per Day3 | 533 | 642 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths are the lowest since early August 2021.

FOMC Minutes: Plans for Reducing the Size of the Balance Sheet

by Calculated Risk on 4/06/2022 02:05:00 PM

From the Fed: Minutes of the Federal Open Market Committee, March 15-16, 2022, 2022. Excerpt on the "Plans for Reducing the Size of the Balance Shee"t:

Participants continued their discussion of topics related to plans for reducing the size of the Federal Reserve's balance sheet in a manner consistent with the approach described in the Principles for Reducing the Size of the Federal Reserve's Balance Sheet that the Committee released following its January meeting.

The participants' discussion was preceded by a staff presentation that reviewed the Committee's 2017–19 experience with balance sheet reduction and presented a range of possible options for reducing the Federal Reserve's securities holdings over time in a predictable manner. All of the options featured a more rapid pace of balance sheet runoff than in the 2017–19 episode. The options differed primarily with respect to the size of the monthly caps for securities redemptions in the SOMA portfolio. The presentation addressed the potential implications of each option for the path of the balance sheet during and after runoff. The staff presentation also featured alternative approaches the Committee could consider with respect to SOMA holdings of Treasury bills as well as alternative ways the Committee could eventually slow and then stop balance sheet runoff as the size of the SOMA portfolio approached levels consistent with the Committee's ample-reserves framework for policy implementation.

In their discussion, all participants agreed that elevated inflation and tight labor market conditions warranted commencement of balance sheet runoff at a coming meeting, with a faster pace of decline in securities holdings than over the 2017–19 period. Participants reaffirmed that the Federal Reserve's securities holdings should be reduced over time in a predictable manner primarily by adjusting the amounts reinvested of principal payments received from securities held in the SOMA. Principal payments received from securities held in the SOMA would be reinvested to the extent they exceeded monthly caps. Several participants remarked that they would be comfortable with relatively high monthly caps or no caps. Some other participants noted that monthly caps for Treasury securities should take into consideration potential risks to market functioning. Participants generally agreed that monthly caps of about $60 billion for Treasury securities and about $35 billion for agency MBS would likely be appropriate. Participants also generally agreed that the caps could be phased in over a period of three months or modestly longer if market conditions warrant.

Participants discussed the approach toward implementing caps for Treasury securities and the role that the Federal Reserve's holdings of Treasury bills might play in the Committee's plan to reduce the size of the balance sheet. Most participants judged that it would be appropriate to redeem coupon securities up to the cap amount each month and to redeem Treasury bills in months when Treasury coupon principal payments were below the cap. Under this approach, redemption of Treasury bills would typically bring the total amount of Treasury redemptions up to the monthly cap. Several participants remarked that reducing the Federal Reserve's Treasury bill holdings over time would be appropriate because Treasury bills are highly valued as safe and liquid assets by the private sector, and the Treasury could increase bill issuance to the public as SOMA bill holdings decline. In addition, participants generally noted that maintaining large holdings of Treasury bills is not necessary under the Federal Reserve's ample-reserves operating framework; in the previous scarce-reserves regime, Treasury bill holdings were useful as a tool that could be used to drain reserves from the banking system when necessary to control short-term interest rates. A couple of participants commented that holding some Treasury bills could be appropriate if the Federal Reserve wished to keep its Treasury portfolio neutral with respect to the universe of outstanding Treasury securities.

With respect to the Federal Reserve's agency MBS redemptions, participants generally noted that MBS principal prepayments would likely run under the proposed monthly cap in a range of plausible interest rate scenarios but that the cap could guard against outsized reductions in the Federal Reserve's agency MBS holdings in scenarios with especially high prepayments. Some participants noted that under the proposed approach to running off Treasury and agency securities primarily through adjustments to reinvestments, agency MBS holdings would still make up a sizable share of the Federal Reserve's asset holdings for many years. Participants generally agreed that after balance sheet runoff was well under way, it will be appropriate to consider sales of agency MBS to enable suitable progress toward a longer-run SOMA portfolio composed primarily of Treasury securities. A Committee decision to implement a program of agency MBS sales would be announced well in advance.

Several participants noted the significant uncertainty around the future level of reserves that would be consistent with the Committee's ample-reserves operating framework. Against this backdrop, participants generally agreed that it would be appropriate to first slow and then stop the decline in the size of the balance sheet when reserve balances were above the level the Committee judged to be consistent with ample reserves, thereby allowing reserves to decline more gradually as nonreserve liabilities increased over time. Participants agreed that lessons learned from the previous balance sheet reduction episode should inform the Committee's current approach to reaching ample reserve levels and that close monitoring of money market conditions and indicators of near-ample reserves should help inform adjustments to the pace of runoff. A couple of participants noted that the establishment of the SRF, which did not exist in the previous runoff episode, could address unexpected money market pressures that might emerge if the Committee adopted an approach to balance sheet reduction in which reserves declined relatively rapidly, but several others noted that the facility was not intended as a substitute for ample reserves. Participants generally agreed that it was important for the Committee to be prepared to adjust any of the details of its approach to reducing the size of the balance sheet in light of economic and financial developments.

No decision regarding the Committee's plan to reduce the Federal Reserve's balance sheet was made at this meeting, but participants agreed they had made substantial progress on the plan and that the Committee was well placed to begin the process of reducing the size of the balance sheet as early as after the conclusion of its upcoming meeting in May.

emphasis added

Rents Still Increasing Sharply Year-over-year

by Calculated Risk on 4/06/2022 10:39:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Rents Still Increasing Sharply Year-over-year

A brief excerpt:

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. All of these measures are through February 2022 (Apartment List through March 2022).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Note that new lease measures (Zillow, Apartment List) dipped early in the pandemic, whereas the BLS measures were steady. Then new leases took off, and the BLS measures are picking up.

...

The Zillow measure is up 17.0% YoY in February, up from 16.2% YoY in January. And the ApartmentList measure is up 17.1% as of March, down from 17.7% in February. Both the Zillow measure (a repeat rent index), and ApartmentList are showing a sharp increase in rents.

Clearly rents are still increasing, and we should expect this to continue to spill over into measures of inflation in 2022. The Owners’ Equivalent Rent (OER) was up 4.3% YoY in February, from 4.1% YoY in January - and will likely increase further in the coming months.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 4/06/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

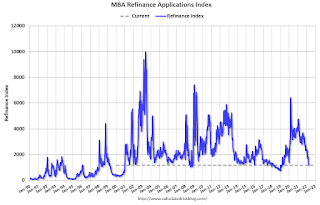

Mortgage applications decreased 6.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 1, 2022.

... The Refinance Index decreased 10 percent from the previous week and was 62 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 9 percent lower than the same week one year ago.

“Mortgage application volume continues to decline due to rapidly rising mortgage rates, as financial markets expect significantly tighter monetary policy in the coming months. The 30-year fixed mortgage rate increased for the fourth consecutive week to 4.90 percent and is now more than 1.5 percentage points higher than a year ago. As higher rates reduce the incentive to refinance, application volume dropped to its lowest level since the spring of 2019. The refinance share of all applications dipped to 38.8 percent, down from 51 percent a year ago,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The hot job market and rapid wage growth continue to support housing demand, despite the surge in rates and swift home-price appreciation. However, insufficient for-sale inventory is restraining purchase activity. Additionally, the elevated average purchase loan size, and steeper 8 percent drop in FHA purchase applications, are both indicative of first-time buyers being disproportionately impacted by supply and affordability challenges.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 4.90 percent from 4.80 percent, with points decreasing to 0.53 from 0.56 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

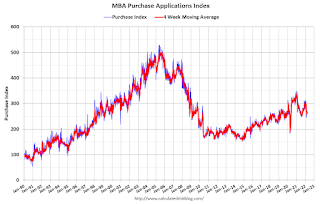

Click on graph for larger image.The first graph shows the refinance index since 1990.

According to the MBA, purchase activity is down 9% year-over-year unadjusted.

According to the MBA, purchase activity is down 9% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, April 05, 2022

Wednesday: Mortgage Applications, FOMC Minutes

by Calculated Risk on 4/05/2022 09:15:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Jump Over 5%

The most recent bump was from Fed Chair Powell two weeks ago. It resulted in rates spiking to nearly 5%. Last week offered a bit of a lull and markets hoped that rates might finally be leveling off.Wednesday:

Now today, we have another bump from Fed Vice Chair Brainard. She's typically more rate-friendly than other Fed members, but today she offered a blunt reminder that Fed bond buying would be winding down significantly more and significantly faster than last time.

With tomorrow bringing the release of the Minutes from the most recent Fed meeting (a more detailed account of all of the voices within the Fed as opposed to the carefully worded policy statement), markets are on edge about just how troublesome that conversation may have been for the rate outlook. Is the Fed planning more "bumps" and simply pacing themselves? That's the concern pushed mortgage rates up and over 5.0% today. [30 year fixed 5.02%]

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, FOMC Minutes, Minutes Meeting of March 15-16, 2022

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.6% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 217.9 | --- | ≥2321 | |

| New Cases per Day3 | 25,537 | 25,664 | ≤5,0002 | |

| Hospitalized3 | 10,645 | 13,134 | ≤3,0002 | |

| Deaths per Day3 | 537 | 681 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths are the lowest since early August 2021.