by Calculated Risk on 4/10/2022 12:03:00 PM

Sunday, April 10, 2022

Second Home Markets and FHFA Changes as of April 1st

Today, in the Calculated Risk Real Estate Newsletter: Second Home Markets and FHFA Changes as of April 1st

A brief excerpt:

Earlier this year the FHFA announced “Targeted Increases to Enterprise Pricing Framework”. Effective April 1st (just over a week ago), these higher fees applied to certain high balance loans, and to second home loans (for Fannie and Freddie). Excerpt:There is more in the article. You can subscribe at https://calculatedrisk.substack.com/... In April, upfront fees for high balance loans will increase between 0.25 percent and 0.75 percent, tiered by loan-to-value ratio. Fannie Mae and Freddie Mac refer to these mortgages as high balance loans and super conforming loans, respectively. For second home loans, upfront fees will increase between 1.125 percent and 3.875 percent, tiered by loan-to-value ratio.South Lake Tahoe: Second Home Market

emphasis added

...

Click on graph for larger image.

With the pandemic, there was a surge in second home buying. One of the second home markets I’ve been tracking is South Lake Tahoe.The following graph is for single family homes in South Lake Tahoe since 2004 through March 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).Note: The median price is distorted by the mix, but this is the available data.

...

This will be interesting to watch over the next several months, but so far there isn't any evidence of a second home slowdown in these numbers.

Saturday, April 09, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 4/09/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• "Unpacking builders’ market sentiment with Rick Palacios"

• 1st Look at Local Housing Markets in March

• Rents Still Increasing Sharply Year-over-year

• Denver Real Estate: Active Inventory up Sharply in March

• Black Knight Mortgage Monitor for February; "Tightest affordability in 15 years"

This is usually published several times a week and provides more in-depth analysis of the housing market.

The blog will continue as always!

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of April 10, 2022

by Calculated Risk on 4/09/2022 08:11:00 AM

The key reports this week are March CPI and retail sales.

For manufacturing, the March Industrial Production report and the April NY Fed manufacturing survey will be released this week.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for March.

8:30 AM: The Consumer Price Index for March from the BLS. The consensus is for 1.2% increase in CPI (up 8.5% YoY) and a 0.5% increase in core CPI (up 6.6% YoY).

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Producer Price Index for March from the BLS. The consensus is for a 1.1% increase in PPI, and a 0.5% increase in core PPI.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a increase to 175 thousand from 166 thousand last week.

8:30 AM: Retail sales for March is scheduled to be released. The consensus is for a 0.6% increase in retail sales.

8:30 AM: Retail sales for March is scheduled to be released. The consensus is for a 0.6% increase in retail sales. This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 16.1% on a YoY basis in February.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for April).

8:30 AM: The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of 2.0, up from -11.8.

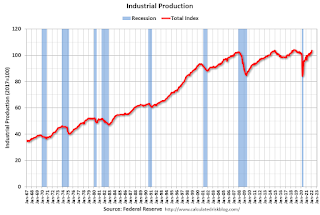

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 77.8%.

10:00 AM: State Employment and Unemployment (Monthly) for March 2022

Friday, April 08, 2022

COVID Update: Deaths Under 500 per day, Lowest since August 2021

by Calculated Risk on 4/08/2022 10:02:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.7% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 218.1 | --- | ≥2321 | |

| New Cases per Day3🚩 | 26,595 | 25,362 | ≤5,0002 | |

| Hospitalized3 | 10,164 | 11,990 | ≤3,0002 | |

| Deaths per Day3 | 496 | 637 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

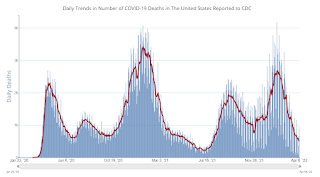

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths are the lowest since August 1st, 2021. The pandemic low (after initial surge) was just over 200 in July 2021.

Reis: Regional Mall Vacancy Rate Decreased in Q1

by Calculated Risk on 4/08/2022 03:08:00 PM

Reis reported that the vacancy rate for regional malls was 11.0% in Q1 2022, down from 11.2% in Q4 2021, and down from 11.4% in Q1 2021. The regional mall vacancy rate peaked at 11.5% in Q2 2021.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.3% in Q1, unchanged from 10.3% in Q4, and down from 10.6% in Q1 2021. For strip malls, the vacancy rate peaked during the pandemic at 10.6% in both Q1 and Q2 2021.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

In the last several years, even prior to the pandemic, the regional mall vacancy rates increased significantly from an already elevated level.

Mall vacancy data courtesy of Reis

Reis: Office Vacancy Rates Unchanged in Q1

by Calculated Risk on 4/08/2022 01:40:00 PM

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis also reported that office effective rents were essentially unchanged in Q1; rents are about at the same rate as early 2019.

Q1 GDP Forecasts: Around 1%

by Calculated Risk on 4/08/2022 12:39:00 PM

From BofA:

Our 1Q GDP tracking estimate remains unchanged at 0.4% qoq SAAR. [April 8 estimate]From Goldman:

emphasis added

[W]e left our Q1 GDP tracking estimate unchanged at +1.0% (qoq ar). [April 6 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2022 is 1.1 percent on April 8, up from 0.9 percent on April 5. After this morning's wholesale trade release from the US Census Bureau, the nowcast of first-quarter real gross private domestic investment growth increased from -1.0 percent to -0.1 percent. [April 8 estimate]

"Unpacking builders’ market sentiment with Rick Palacios"

by Calculated Risk on 4/08/2022 10:46:00 AM

This is a very informative podcast on the impact of higher mortgage rates on new home builders: Unpacking builders’ market sentiment with Rick Palacios. In the podcast, Housing Wire CEO Clayton Collins interviews Rick Palacios Jr., the director of research, at John Burns Real Estate Consulting about the findings in their March new home builder survey. Here is a tweet from Rick about the survey results:

"Pretty clear shift in builder tone this month across our survey"Here are a couple of quotes from Rick in the podcast:

"On the entry level side, that is the part of the market that always feels it first when rates start to climb, and we definitely saw that [in the March survey]”And on an early indicator:

emphasis added

"There are always early indicators of price declines on the new home side, and one of the earliest indicators is lot premiums going way. ... When the market starts to pull back, those lot premiums start to shrink pretty quickly. And those are some of the comments we've been picking up [in the March survey]. Which again, big picture, now versus a year ago, that is a total shift."Note: This is also in the Real Estate Newsletter; You can subscribe at https://calculatedrisk.substack.com/

AAR: March Rail Carloads Up Year-over-year, Intermodal Down

by Calculated Risk on 4/08/2022 08:11:00 AM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

March 2022 was another mixed month for U.S. rail volumes. Total carloads were up 1.2% over March 2021. That’s their 12th gain in the past 13 months, but also their smallest percentage gain during that period. Total carloads averaged 233,909 per week, the second most in the past nine months. Intermodal originations, by contrast, were down 6.4% in March 2022 from March 2021. Intermodal has been down on a year-over-year basis for seven of the past eight months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2020, 2021 and 2022:

n March 2022, total originated U.S. rail carloads were up 1.2% (13,456 carloads) over March 2021. That’s the 12th gain for total carloads in the past 13 months, but it’s also the smallest percentage increase for the 12 months with gains. Total carloads averaged 233,909 per week in March 2022, the second most in the past nine months (October 2021 was higher).

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):For intermodal, originations in March 2022 totaled 1.34 million containers and trailers, down 6.4% (92,170 units) from March 2021. For the first three months of 2022, volume was 3.37 million units, down 6.9% (249,672) from last year. The first three months of 2021 were by far the highest-volume first three months of a year in history for intermodal. The comparable figure for this year is the fourth highest in history (behind 2021, 2018, and 2019).

Thursday, April 07, 2022

1st Look at Local Housing Markets in March: A Sea Change in Active Inventory

by Calculated Risk on 4/07/2022 02:20:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in March

A brief excerpt:

Here is a summary of active listings for these housing markets in March. Note: Inventory usually increases seasonally in March, so the month-over-month (MoM) increase is not surprising.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Inventory was up 31.5% in March MoM from February, and down 1.0% year-over-year (YoY). The YoY decline in inventory in these markets was due entirely to San Diego (a very tight market). The other markets were up YoY.

This is early, and just a few markets, but it appears inventory has bottomed. Last month, these markets were down 26.1% YoY, so this is a significant change from February. This is the first step towards a more balanced market, but inventory levels are still very low.

Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle)