by Calculated Risk on 4/13/2022 02:05:00 PM

Wednesday, April 13, 2022

Office Vacancy Rates for Two SoCal Counties

Voit released their Q1 CRE reports today. These reports are for several cities in the west (these are for several categories of CRE - offices, retail, industrial). There is plenty of detail for those interested in Commercial Real Estate.

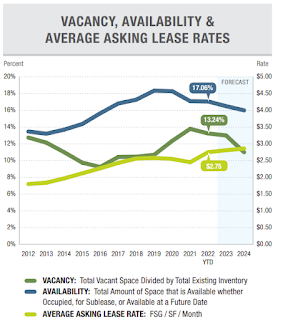

The following graphs show vacancy rate and lease rates for offices in Orange County and San Diego.

Click on graph for larger image.

Click on graph for larger image.The first graph is from Voit for Orange County (not labeled). From Voit:

The office market really suffered during the worst of the pandemic, as the initial lockdown essentially shut it down in Q2 of 2020 and the majority of office workers scrambled to adapt to technologies that allowed them to work from home. Ongoing safety protocols made it is especially difficult for building owners and office-centric business owners to get people back in the office. Even today, with the worst of the health crisis behind us, less than half of office workers are back at their desks on a regular basis. High-rise and mid-rise buildings are facing the biggest challenge because of employee density and dependence on elevators for access to individual spaces. Add the fact that many businesses are considering long-term adoption of a work-from-home or hybrid model for their workforces, and it is easy to see that the office market still has some major challenges to overcome.

...

After two years of consistent upward pressure on vacancy, the overall rate in Q1 actually declined by a substantial margin, shedding 55 basis points to end the period at 13.24%. That’s just 9 basis points higher than it was in Q1 of 2021, further evidence that the market is stabilizing.

The 2nd graph is for San Diego.

The 2nd graph is for San Diego.From Voit:

The office market started 2022 on a bright note with leasing in line with historical norms for the first time since the onset of COVID. Fundamental metrics point towards a healthy office market in 1Q with positive net absorption, rising rental rates, and a decrease in the availability rate. The current health of the office market is being buoyed by the rapid expansion of San Diego’s biotech industry.

How High will Mortgage Rates Rise?

by Calculated Risk on 4/13/2022 11:05:00 AM

Today, in the Calculated Risk Real Estate Newsletter: How High will Mortgage Rates Rise?

A brief excerpt:

Currently most forecasts are for the Fed Funds rate to rise to around 3.25%. Goldman Sach’s chief economist Jan Hatzius recently said he thinks the Fed may have to raise rates above 4%, although their baseline forecast is just about 3%.There is much more in the article. You can subscribe at Calculated Risk Real Estate Newsletter

When the Fed Funds rate peaks in this cycle, the yield curve will likely be fairly flat - meaning the 10-year treasury yield will be at about the same level as the Fed Funds rate. Based on the current estimate for the peak Fed Funds rate (3.25% to 4.0%), the 30-year fixed mortgage will likely peak at between 5.0% and 5.7%. There is some variability in the relationship, so we might see rates as high as the low 6% range. (This all depends on inflation and the Fed Funds rate - but I don’t expect rates to move much higher than the current rate - although 6% is possible).

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 4/13/2022 07:00:00 AM

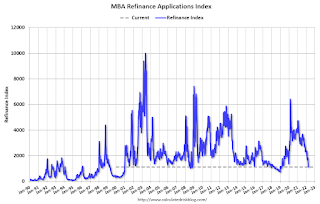

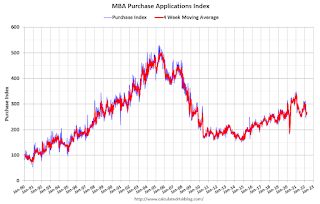

Mortgage applications decreased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 8, 2022.

... The Refinance Index decreased 5 percent from the previous week and was 62 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 6 percent lower than the same week one year ago.

“Mortgage rates across all loan types continued to move higher, with the 30-year fixed rate exceeding the 5-percent mark to 5.13 percent – the highest since November 2018. Refinance activity as a result declined to the slowest weekly pace since 2019,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Higher rates are increasing borrower interest in ARMs. Their share of applications last week was at 7.4 percent, which was the highest share since June 2019. In a promising sign of strong purchase demand amidst affordability challenges, both conventional and government purchase applications increased.”

Given the faster than expected increase in mortgage rates, and the likelihood of more aggressive actions from the Federal Reserve to curb inflation, MBA’s April 2022 forecast now calls for mortgage originations to total $2.58 trillion in 2022 – a 35.5 percent decline from 2021. Purchase originations are still forecasted to reach a record $1.72 trillion this year – a 4 percent increase from 2021. Refinance originations are now expected to fall 64 percent to $841 billion.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 5.13 percent from 4.90 percent, with points increasing to 0.63 from 0.53 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

According to the MBA, purchase activity is down 6% year-over-year unadjusted.

According to the MBA, purchase activity is down 6% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, April 12, 2022

Wednesday: PPI

by Calculated Risk on 4/12/2022 09:41:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for March from the BLS. The consensus is for a 1.1% increase in PPI, and a 0.5% increase in core PPI.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.8% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 218.5 | --- | ≥2321 | |

| New Cases per Day3🚩 | 30,496 | 25,208 | ≤5,0002 | |

| Hospitalized3 | 9,704 | 10,807 | ≤3,0002 | |

| Deaths per Day3 | 507 | 540 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

2nd Look at Local Housing Markets in March

by Calculated Risk on 4/12/2022 03:02:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in March

A brief excerpt:

Here is a summary of active listings for these housing markets in March. Note: Inventory usually increases seasonally in March, so the month-over-month (MoM) increase is not surprising.There is much more in the article. You can subscribe at Calculated Risk Real Estate Newsletter

Inventory was up 9.3% in March MoM from February, and down 13.4% year-over-year (YoY). Inventory in about half of these markets was up YoY.

It appears inventory bottomed in February. Last month, these markets were down 23.3% YoY, so this is a significant change from February. This is the first step towards a more balanced market, but inventory levels are still very low.

Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle) and Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

3) Totals do not include Atlanta or Denver (included in state totals).

Cleveland Fed: Median CPI increased 0.5% and Trimmed-mean CPI increased 0.5% in March

by Calculated Risk on 4/12/2022 11:09:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.5% in March. The 16% trimmed-mean Consumer Price Index also increased 0.5% in March. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details here: "Used Cars" were down 37% annualized in March, and this will likely show further declines in coming months. Motor fuel was up 648% annualized in March!

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

BLS: CPI increased 1.2% in March; Core CPI increased 0.3%

by Calculated Risk on 4/12/2022 08:33:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 1.2 percent in March on a seasonally adjusted basis after rising 0.8 percent in February, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 8.5 percent before seasonal adjustment.CPI was at expectations and core CPI was lower than expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

Increases in the indexes for gasoline, shelter, and food were the largest contributors to the seasonally adjusted all items increase. The gasoline index rose 18.3 percent in March and accounted for over half of the all items monthly increase; other energy component indexes also increased. The food index rose 1.0 percent and the food at home index rose 1.5 percent.

The index for all items less food and energy rose 0.3 percent in March following a 0.5-percent increase the prior month. The shelter index was by far the biggest factor in the increase, with a broad set of other indexes also contributing, including those for airline fares, household furnishings and operations, medical care, and motor vehicle insurance. In contrast, the index for used cars and trucks fell 3.8 percent over the month.

The all items index continued to accelerate, rising 8.5 percent for the 12 months ending March, the largest 12-month increase since the period ending December 1981. The all items less food and energy index rose 6.5 percent, the largest 12-month change since the period ending August 1982. The energy index rose 32.0 percent over the last year, and the food index increased 8.8 percent, the largest 12-month increase since the period ending May 1981.

emphasis added

Monday, April 11, 2022

Tuesday: CPI

by Calculated Risk on 4/11/2022 08:16:00 PM

From Matthew Graham at Mortgage News Daily: MBS Live Recap: Running Out of Ways to Say "Higher Rates"

Market watchers are at risk of major desensitization when it comes to "rates continuing higher." For essentially all of 2022 apart from the onset of the Ukraine war, rates have moved one direction. Not only that, but the pace has been relatively unprecedented unless we compare it to some of the most horrific historical precedents. It seems that every time the market gives us a shred of hope that the outlook is moderating, the hope is quickly shredded and we're back to wondering how high rates will go before we see legitimate relief. Today ended up being just another day in that saga. [30 year fixed 5.25%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for March.

• At 8:30 AM, The Consumer Price Index for March from the BLS. The consensus is for 1.2% increase in CPI (up 8.5% YoY) and a 0.5% increase in core CPI (up 6.6% YoY).

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.8% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 218.4 | --- | ≥2321 | |

| New Cases per Day3🚩 | 28,927 | 25,877 | ≤5,0002 | |

| Hospitalized3 | 9,240 | 11,064 | ≤3,0002 | |

| Deaths per Day3 | 500 | 582 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths are the lowest since early August 2021.

Apartment Vacancy Rate Declined in Q1

by Calculated Risk on 4/11/2022 01:23:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Apartment Vacancy Rate Declined in Q1

A brief excerpt:

Reis reported that the apartment vacancy rate was at 4.7% in Q1 2022, down from 4.8% in Q4, and down from a pandemic peak of 5.4% in both Q1 and Q2 2021.There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.Reis also reported the effective rents were up 2.5% in Q1 compared to Q4, and up 15.6% year-over-year. ...

Click on graph for larger image.

Effective rents declined significantly in the early stages of the pandemic, and even with the recent surge in rents, rents are only up 5.9% annualized over the last 2 years. So, a large portion of the rent increase over the last year was just making up for the previous declines.

For some cities, effective rents were up significantly more, especially in some cities like Albuquerque, Jacksonville and Phoenix. Other sunbelt areas like Las Vegas, Florida, and Southern California also saw huge rent increases.

Housing Inventory April 11th Update: Inventory up 2.3% Week-over-week; Up 8.3% from Seasonal Bottom

by Calculated Risk on 4/11/2022 09:32:00 AM

Tracking existing home inventory is very important in 2022.

Inventory usually declines in the winter, and then increases in the spring. Inventory bottomed seasonally at the beginning of March 2022 and is now up 8.3% since then.

This inventory graph is courtesy of Altos Research.

Last year inventory bottomed seasonally in April 2021 - very late in the year. This year, by this measure, inventory bottomed seasonally at the beginning of March.

Inventory is still very low. Compared to the same week in 2021, inventory is down 14.8% from 307 thousand, and compared to the same week in 2020, and inventory is down 65.1% from 749 thousand.

One of the keys will be to watch the year-over-year change each week to see if the declines are decreasing. Here is a table of the year-over-year change by week since the beginning of the year.

| Week Ending | YoY Change |

|---|---|

| 12/31/2021 | -30.0% |

| 1/7/2022 | -26.0% |

| 1/14/2022 | -28.6% |

| 1/21/2022 | -27.1% |

| 1/28/2022 | -25.9% |

| 2/4/2022 | -27.9% |

| 2/11/2022 | -27.5% |

| 2/18/2022 | -25.8% |

| 2/25/2022 | -24.9% |

| 3/4/2022 | -24.2% |

| 3/11/2022 | -21.7% |

| 3/18/2022 | -21.7% |

| 3/25/2022 | -19.0% |

| 4/1/2022 | -17.6% |

| 4/8/2022 | -14.8% |