by Calculated Risk on 4/15/2022 10:42:00 AM

Friday, April 15, 2022

Q1 GDP Forecasts: Around 1%

From Goldman:

Following [yesterday]’s upward revisions to retail sales, we boosted our Q1 GDP tracking estimate by 0.5pp to +1.5% (qoq ar). [April 14 estimate]And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2022 is 1.1 percent on April 14, unchanged from April 8 after rounding. After recent releases from the US Census Bureau, the US Bureau of Labor Statistics, and the US Department of the Treasury’s Bureau of the Fiscal Service, modest increases in the nowcasts of real personal consumption expenditures growth and real net exports were offset by declines in the nowcasts of real government spending growth and real residential investment growth. [April 14 estimate]

Industrial Production Increased 0.9 Percent in March

by Calculated Risk on 4/15/2022 09:21:00 AM

From the Fed: Industrial Production and Capacity Utilization

Total industrial production advanced 0.9 percent in March and rose at an annual rate of 8.1 percent for the first quarter. Manufacturing output gained 0.9 percent in March; the output of motor vehicles and parts jumped 7.8 percent, while factory output elsewhere moved up 0.4 percent. The index for utilities increased 0.4 percent, and the index for mining advanced 1.7 percent. At 104.6 percent of its 2017 average, total industrial production in March was 5.5 percent above its year-earlier level. Capacity utilization climbed to 78.3 percent, a rate that is 1.2 percentage points below its long-run (1972–2021) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.1% below the average from 1972 to 2020. This was above consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

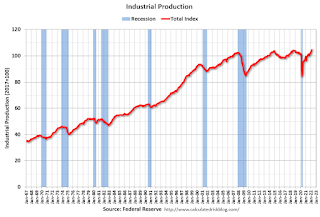

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in March to 104.6. This is above the February 2020 level.

The change in industrial production was above consensus expectations.

Thursday, April 14, 2022

Friday: NY Fed Mfg, Industrial Production

by Calculated Risk on 4/14/2022 09:12:00 PM

Friday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of 2.0, up from -11.8.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for March. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 77.8%.

• At 10:00 AM, State Employment and Unemployment (Monthly) for March 2022

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.9% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 218.7 | --- | ≥2321 | |

| New Cases per Day3🚩 | 31,391 | 26,357 | ≤5,0002 | |

| Hospitalized3 | 9,594 | 10,411 | ≤3,0002 | |

| Deaths per Day3 | 409 | 485 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

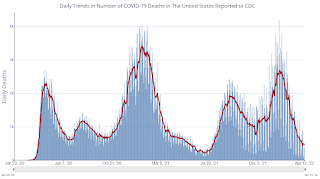

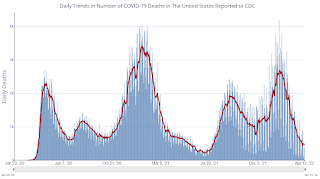

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

LA Area Port Traffic: Record March Inbound Traffic

by Calculated Risk on 4/14/2022 03:56:00 PM

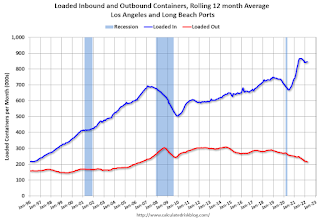

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic was up 0.2% in March compared to the rolling 12 months ending in February. Outbound traffic was down 1.4% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

3rd Look at Local Housing Markets in March

by Calculated Risk on 4/14/2022 02:21:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in March

A brief excerpt:

Adding Austin, Charlotte, Houston, Maryland, North Texas, Pennsylvania, South Carolina, and Washington, D.C.There is much more in the article. You can subscribe at Calculated Risk Real Estate Newsletter

...

The next milestone will be when inventory is up year-over-year (YoY). My current guess is inventory will be YoY near mid-year or in Q3.

...

Inventory was up 9.8% in March MoM from February, and down 15.8% YoY. Inventory in about 40% of these markets was already up YoY.

It appears inventory bottomed in February. Last month, these markets were down 25.2% YoY, so this is a significant change from February. This is the first step towards a more balanced market, but inventory levels are still very low.

Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle), North Texas (Dallas) and Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

3) Totals do not include Atlanta or Denver (included in state totals).

Retail Sales Increased 0.5% in March

by Calculated Risk on 4/14/2022 08:45:00 AM

On a monthly basis, retail sales were increased 0.5% from February to March (seasonally adjusted), and sales were up 6.9 percent from March 2021.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for March 2022, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $665.7 billion, an increase of 0.5 percent from the previous month, and 6.9 percent above March 2021. ... The January 2022 to February 2022 percent change was revised from up 0.3 percent to up 0.8 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.3% in March.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.4% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.4% on a YoY basis.Sales growth in March was slightly below expectations, however, sales in January and February were revised up, combined.

Weekly Initial Unemployment Claims Increase to 185,000

by Calculated Risk on 4/14/2022 08:34:00 AM

The DOL reported:

In the week ending April 9, the advance figure for seasonally adjusted initial claims was 185,000, an increase of 18,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 166,000 to 167,000. The 4-week moving average was 172,250, an increase of 2,000 from the previous week's revised average. The previous week's average was revised up by 250 from 170,000 to 170,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 170,000.

The previous week was revised up.

Weekly claims were well above the consensus forecast.

Wednesday, April 13, 2022

Thursday: Retail Sales, Unemployment Claims

by Calculated Risk on 4/13/2022 09:46:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a increase to 175 thousand from 166 thousand last week.

• At 8:30 AM, Retail sales for March is scheduled to be released. The consensus is for a 0.6% increase in retail sales.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for April).

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.8% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 218.5 | --- | ≥2321 | |

| New Cases per Day3🚩 | 29,401 | 26,563 | ≤5,0002 | |

| Hospitalized3 | 9,674 | 10,590 | ≤3,0002 | |

| Deaths per Day3 | 452 | 517 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Office Vacancy Rates for Two SoCal Counties

by Calculated Risk on 4/13/2022 02:05:00 PM

Voit released their Q1 CRE reports today. These reports are for several cities in the west (these are for several categories of CRE - offices, retail, industrial). There is plenty of detail for those interested in Commercial Real Estate.

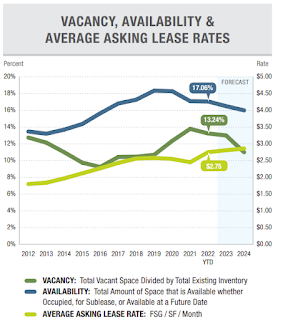

The following graphs show vacancy rate and lease rates for offices in Orange County and San Diego.

Click on graph for larger image.

Click on graph for larger image.The first graph is from Voit for Orange County (not labeled). From Voit:

The office market really suffered during the worst of the pandemic, as the initial lockdown essentially shut it down in Q2 of 2020 and the majority of office workers scrambled to adapt to technologies that allowed them to work from home. Ongoing safety protocols made it is especially difficult for building owners and office-centric business owners to get people back in the office. Even today, with the worst of the health crisis behind us, less than half of office workers are back at their desks on a regular basis. High-rise and mid-rise buildings are facing the biggest challenge because of employee density and dependence on elevators for access to individual spaces. Add the fact that many businesses are considering long-term adoption of a work-from-home or hybrid model for their workforces, and it is easy to see that the office market still has some major challenges to overcome.

...

After two years of consistent upward pressure on vacancy, the overall rate in Q1 actually declined by a substantial margin, shedding 55 basis points to end the period at 13.24%. That’s just 9 basis points higher than it was in Q1 of 2021, further evidence that the market is stabilizing.

The 2nd graph is for San Diego.

The 2nd graph is for San Diego.From Voit:

The office market started 2022 on a bright note with leasing in line with historical norms for the first time since the onset of COVID. Fundamental metrics point towards a healthy office market in 1Q with positive net absorption, rising rental rates, and a decrease in the availability rate. The current health of the office market is being buoyed by the rapid expansion of San Diego’s biotech industry.

How High will Mortgage Rates Rise?

by Calculated Risk on 4/13/2022 11:05:00 AM

Today, in the Calculated Risk Real Estate Newsletter: How High will Mortgage Rates Rise?

A brief excerpt:

Currently most forecasts are for the Fed Funds rate to rise to around 3.25%. Goldman Sach’s chief economist Jan Hatzius recently said he thinks the Fed may have to raise rates above 4%, although their baseline forecast is just about 3%.There is much more in the article. You can subscribe at Calculated Risk Real Estate Newsletter

When the Fed Funds rate peaks in this cycle, the yield curve will likely be fairly flat - meaning the 10-year treasury yield will be at about the same level as the Fed Funds rate. Based on the current estimate for the peak Fed Funds rate (3.25% to 4.0%), the 30-year fixed mortgage will likely peak at between 5.0% and 5.7%. There is some variability in the relationship, so we might see rates as high as the low 6% range. (This all depends on inflation and the Fed Funds rate - but I don’t expect rates to move much higher than the current rate - although 6% is possible).