by Calculated Risk on 4/16/2022 02:11:00 PM

Saturday, April 16, 2022

Real Estate Newsletter Articles this Week

At the Calculated Risk Real Estate Newsletter this week:

• Second Home Markets and FHFA Changes as of April 1st

• Apartment Vacancy Rate Declined in Q1 Effective Rents up 15.6% Year-over-year

• 2nd Look at Local Housing Markets in March

• How High will Mortgage Rates Rise?

• 3rd Look at Local Housing Markets in March

• Twin Cities: No Slowdown in Showings

This is usually published several times a week and provides more in-depth analysis of the housing market.

The blog will continue as always!

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of April 17, 2022

by Calculated Risk on 4/16/2022 08:11:00 AM

The key reports this week are March Housing Starts and Existing Home Sales.

10:00 AM: The April NAHB homebuilder survey. The consensus is for a reading of 77, down from 79. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM ET: Housing Starts for March.

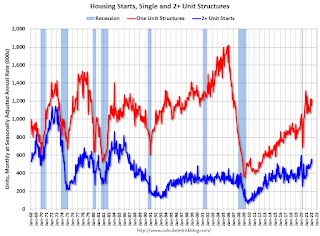

8:30 AM ET: Housing Starts for March. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.750 million SAAR, down from 1.769 million SAAR in February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

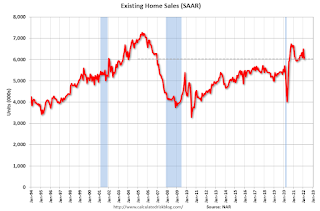

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.80 million SAAR, down from 6.02 million.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.80 million SAAR, down from 6.02 million.The graph shows existing home sales from 1994 through the report last month.

During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 185 thousand from 185 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for April. The consensus is for a reading of 20.0, down from 27.4.

1:00 PM: Discussion, Fed Chair Pro Tempore Jerome Powell, The Global Economy, At the International Monetary Fund Debate on the Global Economy

No major economic releases scheduled.

Friday, April 15, 2022

Twin Cities: No Slowdown in Showings

by Calculated Risk on 4/15/2022 07:43:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Twin Cities: No Slowdown in Showings

A brief excerpt:

The first graph shows the 7-day average showings for the Twin Cities area for 2019, 2020, 2021, and 2022.There is much more in the article. You can subscribe at Calculated Risk Real Estate Newsletter

There was a huge dip in showings in 2020 (black) at the start of the pandemic, and then showing were well above 2019 (blue) levels for the rest of the year. And showings in 2021 (gold) were very strong in the first half of the year, and then were closer to 2019 in the 2nd half.

Note that there were dips in showings during holidays (July 4th, Memorial Day, Thanksgiving and Christmas), and also dips related to protests and curfews related to the deaths of George Floyd and Daunte Wright.

So far, 2022 (red) has started off somewhat above 2019.

Hotels: Occupancy Rate Down 4.7% Compared to Same Week in 2019

by Calculated Risk on 4/15/2022 12:25:00 PM

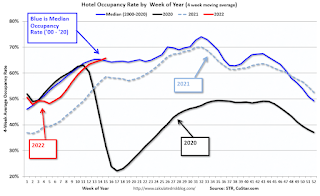

U.S. hotel performance increased from the previous week, according to STR‘s latest data through April 9.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

April 3-9, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 66.4% (-4.7%)

• Average daily rate (ADR): $150.45 (+10.6%)

• Revenue per available room (RevPAR): $99.93 (+5.4%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

Q1 GDP Forecasts: Around 1%

by Calculated Risk on 4/15/2022 10:42:00 AM

From Goldman:

Following [yesterday]’s upward revisions to retail sales, we boosted our Q1 GDP tracking estimate by 0.5pp to +1.5% (qoq ar). [April 14 estimate]And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2022 is 1.1 percent on April 14, unchanged from April 8 after rounding. After recent releases from the US Census Bureau, the US Bureau of Labor Statistics, and the US Department of the Treasury’s Bureau of the Fiscal Service, modest increases in the nowcasts of real personal consumption expenditures growth and real net exports were offset by declines in the nowcasts of real government spending growth and real residential investment growth. [April 14 estimate]

Industrial Production Increased 0.9 Percent in March

by Calculated Risk on 4/15/2022 09:21:00 AM

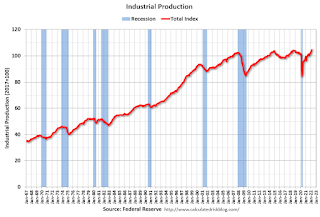

From the Fed: Industrial Production and Capacity Utilization

Total industrial production advanced 0.9 percent in March and rose at an annual rate of 8.1 percent for the first quarter. Manufacturing output gained 0.9 percent in March; the output of motor vehicles and parts jumped 7.8 percent, while factory output elsewhere moved up 0.4 percent. The index for utilities increased 0.4 percent, and the index for mining advanced 1.7 percent. At 104.6 percent of its 2017 average, total industrial production in March was 5.5 percent above its year-earlier level. Capacity utilization climbed to 78.3 percent, a rate that is 1.2 percentage points below its long-run (1972–2021) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.1% below the average from 1972 to 2020. This was above consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in March to 104.6. This is above the February 2020 level.

The change in industrial production was above consensus expectations.

Thursday, April 14, 2022

Friday: NY Fed Mfg, Industrial Production

by Calculated Risk on 4/14/2022 09:12:00 PM

Friday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of 2.0, up from -11.8.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for March. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 77.8%.

• At 10:00 AM, State Employment and Unemployment (Monthly) for March 2022

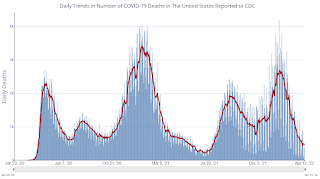

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.9% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 218.7 | --- | ≥2321 | |

| New Cases per Day3🚩 | 31,391 | 26,357 | ≤5,0002 | |

| Hospitalized3 | 9,594 | 10,411 | ≤3,0002 | |

| Deaths per Day3 | 409 | 485 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

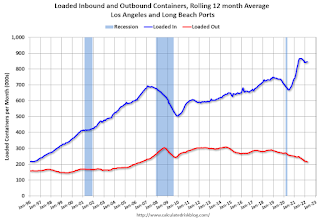

LA Area Port Traffic: Record March Inbound Traffic

by Calculated Risk on 4/14/2022 03:56:00 PM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic was up 0.2% in March compared to the rolling 12 months ending in February. Outbound traffic was down 1.4% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

3rd Look at Local Housing Markets in March

by Calculated Risk on 4/14/2022 02:21:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in March

A brief excerpt:

Adding Austin, Charlotte, Houston, Maryland, North Texas, Pennsylvania, South Carolina, and Washington, D.C.There is much more in the article. You can subscribe at Calculated Risk Real Estate Newsletter

...

The next milestone will be when inventory is up year-over-year (YoY). My current guess is inventory will be YoY near mid-year or in Q3.

...

Inventory was up 9.8% in March MoM from February, and down 15.8% YoY. Inventory in about 40% of these markets was already up YoY.

It appears inventory bottomed in February. Last month, these markets were down 25.2% YoY, so this is a significant change from February. This is the first step towards a more balanced market, but inventory levels are still very low.

Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle), North Texas (Dallas) and Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

3) Totals do not include Atlanta or Denver (included in state totals).

Retail Sales Increased 0.5% in March

by Calculated Risk on 4/14/2022 08:45:00 AM

On a monthly basis, retail sales were increased 0.5% from February to March (seasonally adjusted), and sales were up 6.9 percent from March 2021.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for March 2022, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $665.7 billion, an increase of 0.5 percent from the previous month, and 6.9 percent above March 2021. ... The January 2022 to February 2022 percent change was revised from up 0.3 percent to up 0.8 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.3% in March.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.4% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.4% on a YoY basis.Sales growth in March was slightly below expectations, however, sales in January and February were revised up, combined.