by Calculated Risk on 4/18/2022 11:06:00 AM

Monday, April 18, 2022

Goldman Sachs "Will Higher Rates Put Out the Housing Fire?"

Today, in the Calculated Risk Real Estate Newsletter: Goldman Sachs "Will Higher Rates Put Out the Housing Fire?"

A brief excerpt:

Goldman Sachs economist Ronnie Walker put out a research note this morning titled: “Will Higher Rates Put Out the Housing Fire?"There is much more in the article. You can subscribe at Calculated Risk Real Estate Newsletter

Walker discusses the recent sharp increase in mortgage rates and writes:“Standard economic models suggest that an increase of that magnitude should weigh substantially on housing, the most interest rate-sensitive segment of the economy and the textbook channel of monetary policy transmission.”Last month, in Housing, the Fed, Interest Rates and Inflation, I noted that housing is a key transmission mechanism for Fed policy. However, Walker argues that“the extreme supply-demand imbalance in today’s housing market will likely dampen the hit to activity from higher rates”.This is critical, and if correct, may suggest the Fed will have to hike rates more than expected.

Along these lines, over the weekend, Nick Timiraos at the WSJ tweeted:High levels of all-cash sales and investor purchases may make housing markets more resilient to a big run-up in mortgage rates that is depriving shocked buyers of purchasing powerAnd I responded:The new conundrum: The Fed’s primary channel of policy transmission is housing. The more resilient housing is to rates, the more the Fed will have to hike to cool embedded inflation.Interesting times!

NAHB: Builder Confidence Decreased to 77 in April, "Housing Market at Inflection Point"

by Calculated Risk on 4/18/2022 10:06:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 77, down from 79 in March. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Housing Market at Inflection Point as Builder Confidence Continues to Fall

Rapidly rising interest rates combined with ongoing home price increases and higher construction costs continue to take a toll on builder confidence and housing affordability.

Builder confidence in the market for newly built single-family homes moved two points lower to 77 in April, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This is the fourth straight month that builder sentiment has declined.

“Despite low existing inventory, builders report sales traffic and current sales conditions have declined to their lowest points since last summer as a sharp jump in mortgage rates and persistent supply chain disruptions continue to unsettle the housing market,” said NAHB Chairman Jerry Konter, a builder and developer from Savannah, Ga. “Policymakers must take proactive steps to fix supply chain issues that will reduce the cost of development, stem the rise in home prices and allow builders to increase production.”

“The housing market faces an inflection point as an unexpectedly quick rise in interest rates, rising home prices and escalating material costs have significantly decreased housing affordability conditions, particularly in the crucial entry-level market,” said NAHB Chief Economist Robert Dietz.

...

The HMI index gauging current sales conditions fell two points to 85 and the component charting traffic of prospective buyers posted a six-point decline to 60. The gauge measuring sales expectations in the next six months increased three points to 73 following a 10-point drop in March.

Looking at the three-month moving averages for regional HMI scores, the Northeast posted a one-point gain to 72 while the Midwest dropped three points to 69, the South fell two points to 82 and the West edged one-point lower to 89.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was at the consensus forecast, and still a solid reading.

Four High Frequency Indicators for the Economy

by Calculated Risk on 4/18/2022 09:17:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Note: Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

The TSA is providing daily travel numbers.

This data is as of April 16th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA since 2019 (Blue).

The red line is the percent of 2019 for the seven-day average.

The 7-day average is down 9.5% from the same day in 2019 (90.5% of 2019). (Red line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $154 million last week, down about 15% from the median for the week.

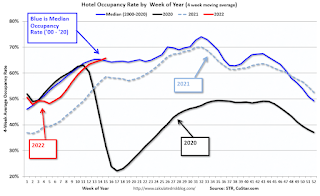

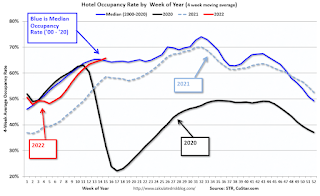

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

This data is through April 9th. The occupancy rate was down 4.7% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

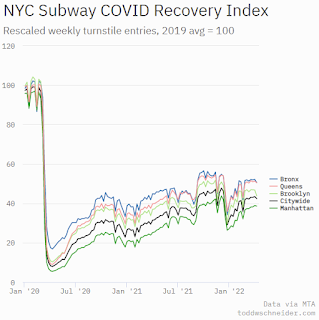

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, April 15th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Housing Inventory April 18th Update: Inventory up 3.7% Week-over-week; Up 12.3% from Seasonal Bottom

by Calculated Risk on 4/18/2022 08:33:00 AM

Tracking existing home inventory is very important in 2022.

Inventory usually declines in the winter, and then increases in the spring. Inventory bottomed seasonally at the beginning of March 2022 and is now up 12.3% since then.

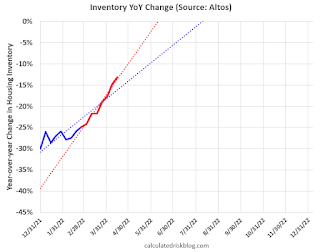

This inventory graph is courtesy of Altos Research.

Last year inventory bottomed seasonally in April 2021 - very late in the year. This year, by this measure, inventory bottomed seasonally at the beginning of March.

Inventory is still very low. Compared to the same week in 2021, inventory is down 13.1% from 312 thousand, and compared to the same week in 2020, and inventory is down 63.9% from 749 thousand.

One of the keys will be to watch the year-over-year change each week to see if the declines are decreasing. Here is a table of the year-over-year change by week since the beginning of the year.

| Week Ending | YoY Change |

|---|---|

| 12/31/2021 | -30.0% |

| 1/7/2022 | -26.0% |

| 1/14/2022 | -28.6% |

| 1/21/2022 | -27.1% |

| 1/28/2022 | -25.9% |

| 2/4/2022 | -27.9% |

| 2/11/2022 | -27.5% |

| 2/18/2022 | -25.8% |

| 2/25/2022 | -24.9% |

| 3/4/2022 | -24.2% |

| 3/11/2022 | -21.7% |

| 3/18/2022 | -21.7% |

| 3/25/2022 | -19.0% |

| 4/1/2022 | -17.6% |

| 4/8/2022 | -14.8% |

| 4/15/2022 | -13.1% |

Sunday, April 17, 2022

Monday: Homebuilder Suvery

by Calculated Risk on 4/17/2022 07:06:00 PM

Weekend:

• Schedule for Week of April 17, 2022

Monday:

• At 10:00 AM ET, The April NAHB homebuilder survey. The consensus is for a reading of 77, down from 79. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 15 and DOW futures are down 80 (fair value).

Oil prices were up over the last week with WTI futures at $106.95 per barrel and Brent at $111.70 per barrel. A year ago, WTI was at $63 and Brent was at $66 - so WTI oil prices are up 70% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.06 per gallon. A year ago prices were at $2.85 per gallon, so gasoline prices are up $1.21 per gallon year-over-year.

BLS: 12 States Set New Record Series Low Unemployment rates in March

by Calculated Risk on 4/17/2022 01:08:00 PM

On Friday, from the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in March in 37 states and stable in 13 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. All 50 states and the District had jobless rate decreases from a year earlier.

...

Nebraska and Utah had the lowest jobless rates in March, 2.0 percent each. The next lowest rates were in Indiana, 2.2 percent, and Montana, 2.3 percent. The rates in these four states set new series lows, as did the rates in the following eight states (all state series begin in 1976): Alaska (5.0 percent), Arizona (3.3 percent), Georgia (3.1 percent), Idaho (2.7 percent), Mississippi (4.2 percent), Tennessee (3.2 percent), West Virginia (3.7 percent), and Wisconsin (2.8 percent). The District of Columbia had the highest unemployment rate, 6.0 percent, followed by New Mexico, 5.3 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006.

Saturday, April 16, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 4/16/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Second Home Markets and FHFA Changes as of April 1st

• Apartment Vacancy Rate Declined in Q1 Effective Rents up 15.6% Year-over-year

• 2nd Look at Local Housing Markets in March

• How High will Mortgage Rates Rise?

• 3rd Look at Local Housing Markets in March

• Twin Cities: No Slowdown in Showings

This is usually published several times a week and provides more in-depth analysis of the housing market.

The blog will continue as always!

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of April 17, 2022

by Calculated Risk on 4/16/2022 08:11:00 AM

The key reports this week are March Housing Starts and Existing Home Sales.

10:00 AM: The April NAHB homebuilder survey. The consensus is for a reading of 77, down from 79. Any number above 50 indicates that more builders view sales conditions as good than poor.

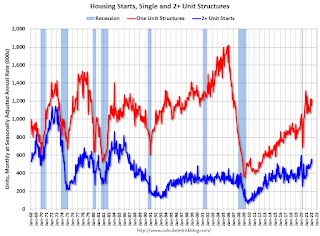

8:30 AM ET: Housing Starts for March.

8:30 AM ET: Housing Starts for March. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.750 million SAAR, down from 1.769 million SAAR in February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

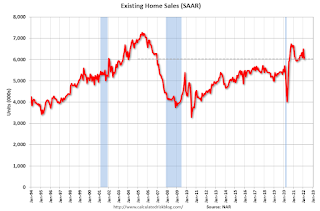

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.80 million SAAR, down from 6.02 million.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.80 million SAAR, down from 6.02 million.The graph shows existing home sales from 1994 through the report last month.

During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 185 thousand from 185 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for April. The consensus is for a reading of 20.0, down from 27.4.

1:00 PM: Discussion, Fed Chair Pro Tempore Jerome Powell, The Global Economy, At the International Monetary Fund Debate on the Global Economy

No major economic releases scheduled.

Friday, April 15, 2022

Twin Cities: No Slowdown in Showings

by Calculated Risk on 4/15/2022 07:43:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Twin Cities: No Slowdown in Showings

A brief excerpt:

The first graph shows the 7-day average showings for the Twin Cities area for 2019, 2020, 2021, and 2022.There is much more in the article. You can subscribe at Calculated Risk Real Estate Newsletter

There was a huge dip in showings in 2020 (black) at the start of the pandemic, and then showing were well above 2019 (blue) levels for the rest of the year. And showings in 2021 (gold) were very strong in the first half of the year, and then were closer to 2019 in the 2nd half.

Note that there were dips in showings during holidays (July 4th, Memorial Day, Thanksgiving and Christmas), and also dips related to protests and curfews related to the deaths of George Floyd and Daunte Wright.

So far, 2022 (red) has started off somewhat above 2019.

Hotels: Occupancy Rate Down 4.7% Compared to Same Week in 2019

by Calculated Risk on 4/15/2022 12:25:00 PM

U.S. hotel performance increased from the previous week, according to STR‘s latest data through April 9.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

April 3-9, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 66.4% (-4.7%)

• Average daily rate (ADR): $150.45 (+10.6%)

• Revenue per available room (RevPAR): $99.93 (+5.4%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.