by Calculated Risk on 4/20/2022 07:00:00 AM

Wednesday, April 20, 2022

MBA: Mortgage Applications Decrease in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 15, 2022.

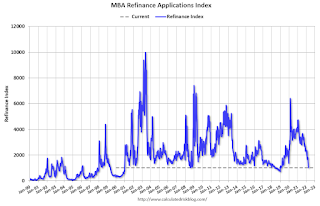

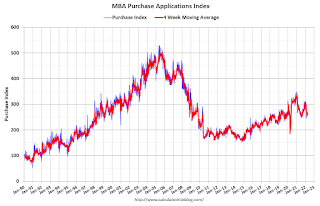

... The Refinance Index decreased 8 percent from the previous week and was 68 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 14 percent lower than the same week one year ago.

“Ongoing concerns about rapid inflation and tighter US monetary policy continued to push Treasury yields higher, driving mortgage rates to their highest level in over a decade. Rates increased across the board for all loan types, with the 30-year fixed rate hitting 5.2%, the highest level since 2010,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The 30-year rate has increased 70 basis points over the past month and is 2 full percentage points higher than a year ago. The recent surge in mortgage rates has shut most borrowers out of rate/term refinances, causing the refinance index to fall for the sixth consecutive week. In a housing market facing affordability challenges and low inventory, higher rates are causing a pullback or delay in home purchase demand as well. Home purchase activity has been volatile in recent weeks and has yet to see the typical pick up for this time of the year.”

Added Kan: “The ARM share of applications reached 8.5% last week, its highest level since 2019. As ARM loans typically have lower rates than fixed rate mortgages, and as this spread has widened, ARM loans have become more attractive to borrowers already facing home purchase loan amounts close to record highs.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 5.20 percent from 5.13 percent, with points increasing to 0.66 from 0.63 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

According to the MBA, purchase activity is down 14% year-over-year unadjusted.

According to the MBA, purchase activity is down 14% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, April 19, 2022

Wednesday: Existing Home Sales, Beige Book

by Calculated Risk on 4/19/2022 09:10:00 PM

From Matthew Graham at Mortgage News Daily: Highest Mortgage Rates Since 2009

Today's dubious distinction is that we'd have to go back to 2009 before seeing rates that were meaningfully higher. [30 year fixed 5.35%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.80 million SAAR, down from 6.02 million.

• During the day, The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.0% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 219.0 | --- | ≥2321 | |

| New Cases per Day3🚩 | 37,132 | 30,293 | ≤5,0002 | |

| Hospitalized3 | 9,560 | 9,883 | ≤3,0002 | |

| Deaths per Day3 | 389 | 489 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

Lawler: CoreLogic Home Purchases by Non-Investors and Investors

by Calculated Risk on 4/19/2022 03:14:00 PM

From housing economist Tom Lawler:

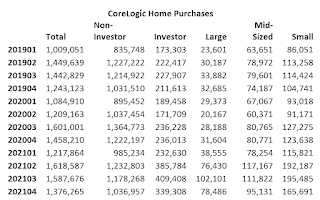

Below is a table showing CoreLogic’s data on home purchases (using its extensive property records database) for different “sized” investors – “small” (3-9 properties owned), “mid-sized” (10-99 properties owned), and “large” (100+ properties owned), as well as for non-investors by quarter. Recall the CoreLogic defines “investor” as follows:

“Using CoreLogic’s public records data, we define an investor as an entity (individual or corporate) who retained three or more properties simultaneously within the past 10 years.”

This definition, by the way, may exclude a fair number of very small investor purchases who own only one or two investor properties.

Note that in the second half of last year total home purchases were down just 3.1% from the second half of 2020, while non-investor purchases were down 14.4%.

March Existing Home Sales Forecast and 4th Look at Local Housing Markets

by Calculated Risk on 4/19/2022 12:23:00 PM

Today, in the Calculated Risk Real Estate Newsletter: March Existing Home Sales Forecast and 4th Look at Local Housing Markets

A brief excerpt:

Lawler forecast; Adding Boston, California, Memphis, Minneapolis, Phoenix, and Rhode IslandThere is much more in the article.

...

California Home Sales, Prices and Inventory in March

California doesn’t report monthly sales or inventory, but here is the press release from the California Association of Realtors® (C.A.R.): California home sales tick higher in March as statewide median price sets another all-time high, C.A.R. reportsActive listings in March climbed to the highest level in five months and posted the first year-over-year gain since June 2019. Newly added listings in March also increased for the first time in nine months, reaching the highest level since August 2021. The month-to-month increase of 37.7 percent in newly added listings was also the highest since May 2020....

Active Inventory in March

Here is a summary of active listings for these housing markets in March. Note: Inventory usually increases seasonally in March, so the month-over-month (MoM) increase is not surprising.

Inventory was up 9.5% in March MoM from February, and down 15.1% YoY. Inventory in about a third of these markets was already up YoY.

It appears inventory bottomed in February. Last month, these markets were down 23.7% YoY, so this is a significant change from February. This is the first step towards a more balanced market, but inventory levels are still very low.

Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle), North Texas (Dallas) and Santa Clara (San Jose), Jacksonville, Source: Northeast Florida Association of REALTORS®

3) Totals do not include Atlanta or Denver (included in state totals).

March Housing Starts: Most Housing Units Under Construction Since 1973

by Calculated Risk on 4/19/2022 09:06:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: March Housing Starts: Most Housing Units Under Construction Since 1973

Excerpt:

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

Red is single family units. Currently there are 811 thousand single family units under construction (SA). This is the highest level since November 2006.

For single family, many of these homes are already sold (Census counts sales when contract is signed). The reason there are so many homes is probably due to construction delays. Since many of these are already sold, it is unlikely this is “overbuilding”, or that this will impact prices (although the buyers will be moving out of their current home or apartment once these homes are completed).

Blue is for 2+ units. Currently there are 811 thousand multi-family units under construction. This is the highest level since May 1974! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Combined, there are 1.622 million units under construction. This is the most since February 1973, when a record 1.628 million units were under construction (mostly apartments in 1973 for the baby boom generation).

Housing Starts Increased to 1.793 million Annual Rate in March

by Calculated Risk on 4/19/2022 08:36:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in March were at a seasonally adjusted annual rate of 1,793,000. This is 0.3 percent above the revised February estimate of 1,788,000 and is 3.9 percent above the March 2021 rate of 1,725,000. Single‐family housing starts in March were at a rate of 1,200,000; this is 1.7 percent below the revised February figure of 1,221,000. The March rate for units in buildings with five units or more was 574,000.

Building Permits:

Privately‐owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 1,873,000. This is 0.4 percent above the revised February rate of 1,865,000 and is 6.7 percent above the March 2021 rate of 1,755,000. Single‐family authorizations in March were at a rate of 1,147,000; this is 4.8 percent below the revised February figure of 1,205,000. Authorizations of units in buildings with five units or more were at a rate of 672,000 in March.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) increased in March compared to February. Multi-family starts were up 26.2% year-over-year in March.

Single-family starts (red) decreased in March and were down 4.4% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery (but still not historically high).

Total housing starts in March were above expectations, and starts in January and February were revised up, combined.

I'll have more later …

Monday, April 18, 2022

Tuesday: Housing Starts

by Calculated Risk on 4/18/2022 09:02:00 PM

From Matthew Graham at Mortgage News Daily: Rates Jump Back Up to Match Multi-Year Highs

The average mortgage lender was quoting conventional 30yr fixed rates of 5.25% last Monday for top tier scenarios--the highest since late 2018. [30 year fixed 5.25%]Tuesday:

emphasis added

• 8:30 AM ET, Housing Starts for March. The consensus is for 1.750 million SAAR, down from 1.769 million SAAR in February.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.9% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 218.9 | --- | ≥2321 | |

| New Cases per Day3🚩 | 35,212 | 29,246 | ≤5,0002 | |

| Hospitalized3 | 8,885 | 9,947 | ≤3,0002 | |

| Deaths per Day3 | 373 | 494 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths are the lowest since early July 2021. Average daily deaths bottomed in July 2021 at 214 per day.

Lawler: Early Read on Existing Home Sales in March

by Calculated Risk on 4/18/2022 05:06:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.74 million in March, down 4.7% from February’s preliminary pace and down 5.0% from last March’s seasonally adjusted pace.

Local realtor reports, as well as reports from national inventory trackers, suggest that the YOY % decline in the inventory of existing homes for sale last month was significantly lower than that in February.

Finally, local realtor/MLS reports suggest the median existing single-family home sales price last month was up by about 16.3% from last March.

CR Note: The National Association of Realtors (NAR) is scheduled to release March existing home sales on Wednesday, April 20, 2022, at 10:00 AM ET. The consensus is for 5.80 million SAAR.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 1.05% in March"

by Calculated Risk on 4/18/2022 04:00:00 PM

Note: This is as of March 31st.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 1.05% in March

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 13 basis points from 1.18% of servicers’ portfolio volume in the prior month to 1.05% as of March 31, 2022. According to MBA’s estimate, 525,000 homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 7 basis points to 0.49%. Ginnie Mae loans in forbearance decreased 12 basis points to 1.38%, and the forbearance share for portfolio loans and private-label securities (PLS) declined 28 basis points to 2.44%.

“March was another month of lower forbearance rates, and a higher share of overall loans and forbearance-related workout loans that are current,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “The share of loans in forbearance continues to dwindle and is just 5 basis points shy of hitting 1 percent - or 500,000 homeowners - after peaking at 4.3 million borrowers in June 2020. It has been a remarkable recovery for many homeowners in less than two years.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time.

The share of forbearance plans is decreasing, and, at the end of March, there were about 525,000 homeowners in forbearance plans.

Goldman Sachs "Will Higher Rates Put Out the Housing Fire?"

by Calculated Risk on 4/18/2022 11:06:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Goldman Sachs "Will Higher Rates Put Out the Housing Fire?"

A brief excerpt:

Goldman Sachs economist Ronnie Walker put out a research note this morning titled: “Will Higher Rates Put Out the Housing Fire?"There is much more in the article. You can subscribe at Calculated Risk Real Estate Newsletter

Walker discusses the recent sharp increase in mortgage rates and writes:“Standard economic models suggest that an increase of that magnitude should weigh substantially on housing, the most interest rate-sensitive segment of the economy and the textbook channel of monetary policy transmission.”Last month, in Housing, the Fed, Interest Rates and Inflation, I noted that housing is a key transmission mechanism for Fed policy. However, Walker argues that“the extreme supply-demand imbalance in today’s housing market will likely dampen the hit to activity from higher rates”.This is critical, and if correct, may suggest the Fed will have to hike rates more than expected.

Along these lines, over the weekend, Nick Timiraos at the WSJ tweeted:High levels of all-cash sales and investor purchases may make housing markets more resilient to a big run-up in mortgage rates that is depriving shocked buyers of purchasing powerAnd I responded:The new conundrum: The Fed’s primary channel of policy transmission is housing. The more resilient housing is to rates, the more the Fed will have to hike to cool embedded inflation.Interesting times!