by Calculated Risk on 4/25/2022 08:31:00 AM

Monday, April 25, 2022

Four High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Note: Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

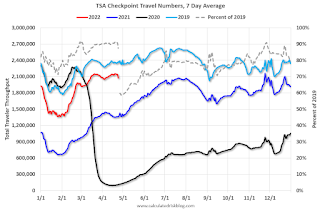

The TSA is providing daily travel numbers.

This data is as of April 24th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 12.6% from the same day in 2019 (87.4% of 2019). (Dashed line)

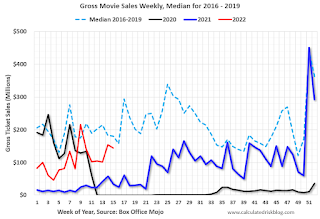

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $145 million last week, down about 20% from the median for the week.

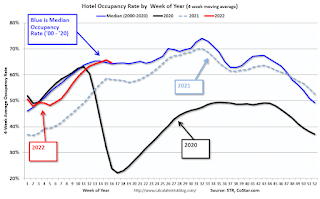

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

This data is through April 16th. The occupancy rate was down 5.6% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

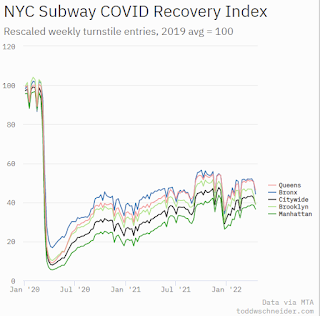

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, April 22nd.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Black Knight: "Mortgage Delinquencies Hit Record Low in March"

by Calculated Risk on 4/25/2022 08:05:00 AM

Note: At the beginning of the pandemic, the delinquency rate increased sharply. Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus. Foreclosures are starting to increase following the end of the moratorium, but are at very low levels (see: Delinquencies, Foreclosures and REO) for a discussion of rising foreclosures, and why this isn't a concern)

From Black Knight: Black Knight: Mortgage Delinquencies Hit Record Low in March, Driven by Both Seasonal and Broader Economic Improvements; Prepays Up Despite Rate Increases

• The national delinquency rate dropped by more than half a percentage point in March, falling to 2.84% and shattering the previous record low of 3.22% in January 2020According to Black Knight's First Look report, the percent of loans delinquent decreased 15.5% in March compared to February and decreased 43% year-over-year.

• While March typically sees the strongest mortgage performance of any month – with delinquencies falling more than 10% on average over the past 20 years – this year’s 15.5% reduction was exceptionally strong

• Robust employment, continued student loan deferrals, strong post-forbearance performance and millions of refinances into record-low interest rates have all helped put downward pressure on delinquency rates

• The strongest improvement was seen among borrowers who are a single payment past due, with 30-day delinquencies recording a 20% month-over-month decline

• Though serious delinquencies – those 90 or more days past due but not in foreclosure – fell 12% for the strongest single-month improvement in 20 years, they remain 70% above pre-pandemic levels

• Despite elevated serious delinquencies, foreclosure starts fell by 3% from the month prior and are holding well below pre-pandemic levels

• The number of active foreclosures edged slightly higher in March, marking the first year-over-year increase in almost 10 years, though inventories also remain well below pre-pandemic levels

• Prepayment activity bucked the recent trend of sharply rising interest rates driving falling prepay speeds, rising by 9% in March, likely driven at least in part by seasonal increases in home sales-related prepays

emphasis added

The percent of loans in the foreclosure process increased 3.7% in March and were up 3.9% over the last year. (First year-over-year increase in almost 10 years - but from very low levels)

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 2.84% in March, down from 3.36% in February.

The percent of loans in the foreclosure process increased in March to 0.32%, from 0.31% in February.

The number of delinquent properties, but not in foreclosure, is down 1,159,000 properties year-over-year, and the number of properties in the foreclosure process is up 7,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Mar 2022 | Feb 2022 | Mar 2021 | Mar 2020 | |

| Delinquent | 2.84% | 3.36% | 5.02% | 3.39% |

| In Foreclosure | 0.32% | 0.31% | 0.30% | 0.42% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,513,000 | 1,783,000 | 2,672,000 | 1,792,000 |

| Number of properties in foreclosure pre-sale inventory: | 169,000 | 162,000 | 162,000 | 220,000 |

| Total Properties | 1682,000 | 1,946,000 | 2,834,000 | 2,013,000 |

Sunday, April 24, 2022

Sunday Night Futures

by Calculated Risk on 4/24/2022 07:47:00 PM

Weekend:

• Schedule for Week of April 24, 2022

• U.S. Demographics: Largest 5-year cohorts, and Ten most Common Ages in 2021

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for March. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for April.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $100.58 per barrel and Brent at $105.03 per barrel. A year ago, WTI was at $62 and Brent was at $66 - so WTI oil prices are up 60% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.10 per gallon. A year ago prices were at $2.87 per gallon, so gasoline prices are up $1.23 per gallon year-over-year.

U.S. Demographics: Largest 5-year cohorts, and Ten most Common Ages in 2021

by Calculated Risk on 4/24/2022 08:11:00 AM

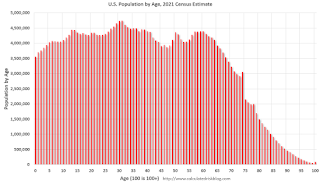

Eight years ago, I wrote: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group.

This month the Census Bureau released the population estimates for July 2021 by age, and I've updated the table from the previous post.

The table below shows the top 10 cohorts by size for 2010, 2021 (released this month), and the most recent Census Bureau projections for 2030.

In 2021, 6 of the top 7 cohorts were under 40 (the Boomers are fading away), and by 2030 the top 10 cohorts will be the youngest 10 cohorts.

There will be plenty of "gray hairs" walking around in 2030, but the key for the economy is the population in the prime working age group is now increasing.

As I noted in 2014, this was positive for apartments, and more recently positive for housing.

| Population: Largest 5-Year Cohorts by Year | ||||

|---|---|---|---|---|

| Largest Cohorts | 2010 | 2021 | 2030 | |

| 1 | 45 to 49 years | 30 to 34 years | 35 to 39 years | |

| 2 | 50 to 54 years | 25 to 29 years | 40 to 44 years | |

| 3 | 15 to 19 years | 35 to 39 years | 30 to 34 years | |

| 4 | 20 to 24 years | 55 to 59 years | 25 to 29 years | |

| 5 | 25 to 29 years | 15 to 19 years | 20 to 24 years | |

| 6 | 40 to 44 years | 20 to 24 years | 45 to 49 years | |

| 7 | 10 to 14 years | 10 to 14 years | 5 to 9 years | |

| 8 | 5 to 9 years | 60 to 64 years | 10 to 14 years | |

| 9 | Under 5 years | 40 to 44 years | Under 5 years | |

| 10 | 35 to 39 years | 50 to 54 years | 15 to 19 years | |

Click on graph for larger image.

This graph, based on the 2021 population estimate, shows the U.S. population by age in July 2021 according to the Census Bureau.

Note that the largest age groups are all in their late-20s or 30s. There is also a large cohort in their mid-teens.

And below is a table showing the ten most common ages in 2010, 2021, and 2030 (projections are from the Census Bureau, 2017).

Note the younger baby boom generation dominated in 2010. In 2021 the millennials have taken over and the boomers are off the list.

This is why - a number of years ago - I was so positive on housing. And this is still positive for the economy.

| Population: Most Common Ages by Year | ||||

|---|---|---|---|---|

| 2010 | 2021 | 2030 | ||

| 1 | 50 | 31 | 39 | |

| 2 | 49 | 30 | 40 | |

| 3 | 19 | 29 | 38 | |

| 4 | 48 | 32 | 37 | |

| 5 | 47 | 28 | 36 | |

| 6 | 46 | 33 | 41 | |

| 7 | 20 | 35 | 35 | |

| 8 | 45 | 36 | 30 | |

| 9 | 18 | 34 | 34 | |

| 10 | 52 | 27 | 33 | |

Saturday, April 23, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 4/23/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Goldman Sachs "Will Higher Rates Put Out the Housing Fire?"

• March Housing Starts: Most Housing Units Under Construction Since 1973

• NAR: Existing-Home Sales Decreased to 5.77 million SAAR in February

• Final Look at Local Housing Markets in March and Housing Inventory Milestones to Watch

• March Existing Home Sales Forecast and 4th Look at Local Housing Markets

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

The blog will continue as always!

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of April 24, 2022

by Calculated Risk on 4/23/2022 08:11:00 AM

The key reports scheduled for this week are the advance estimate of Q1 GDP and March New Home sales.

Other key reports include February Case-Shiller house prices and Personal Income and Outlays for March.

For manufacturing, the April Dallas, Richmond and Kansas City manufacturing surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for March. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for April.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 1.0% increase in durable goods orders.

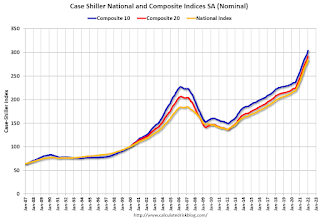

9:00 AM: S&P/Case-Shiller House Price Index for February.

9:00 AM: S&P/Case-Shiller House Price Index for February.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 18.4% year-over-year increase in the Comp 20 index for February.

9:00 AM: FHFA House Price Index for February. This was originally a GSE only repeat sales, however there is also an expanded index.

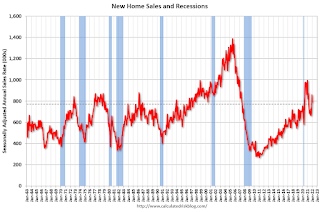

10:00 AM: New Home Sales for March from the Census Bureau.

10:00 AM: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 762 thousand SAAR, down from 772 thousand in February.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for March. The consensus is for a 1.8% decrease in the index.

10:00 AM: the Q1 2022 Housing Vacancies and Homeownership from the Census Bureau.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 180 thousand down from 184 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2021 (Advance estimate). The consensus is that real GDP increased 1.0% annualized in Q1, down from 6.9% in Q4.

11:00 AM: the Kansas City Fed manufacturing survey for April. This is the last of regional manufacturing surveys for April.

8:30 AM ET: Personal Income and Outlays, March 2021. The consensus is for a 0.4% increase in personal income, and for a 0.6% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 6.4% YoY, and core PCE prices up 5.3% YoY.

9:45 AM: Chicago Purchasing Managers Index for April. The consensus is for a reading of 62.0, down from 62.9 in March.

10:00 AM: University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 65.7.

Friday, April 22, 2022

COVID Update: Hospitalizations Starting to Increase

by Calculated Risk on 4/22/2022 09:21:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.0% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 219.2 | --- | ≥2321 | |

| New Cases per Day3🚩 | 42,604 | 31,495 | ≤5,0002 | |

| Hospitalized3🚩 | 9,794 | 9,760 | ≤3,0002 | |

| Deaths per Day3 | 375 | 414 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

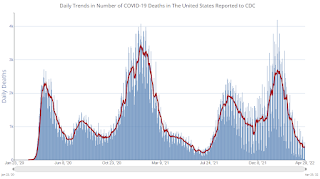

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

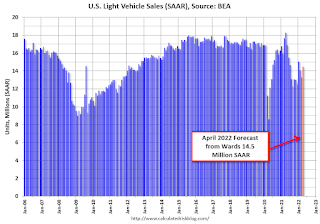

April Vehicle Sales Forecast: Increase to 14.5 million SAAR

by Calculated Risk on 4/22/2022 07:46:00 PM

From WardsAuto: April, Second-Quarter U.S. Light-Vehicle Sales to Continue Sequential Growth (pay content). Brief excerpt:

"Bottom line is U.S. sales remain weak, and below potential, but are trending up from the depths they fell to in the second half of last year due to a dearth in supply. Although geopolitics, economic headwinds and ongoing supply-chain issues undeniably are creating huge risks to the outlook, sales still are expected to gradually rise through the end of the year."

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for April (Red).

The Wards forecast of 14.5 million SAAR, would be up about 9% from last month, and down 21% from a year ago (sales were solid in April 2021, as sales recovered from the depths of the pandemic, and weren't yet impacted by supply chain issues).

Yellen: Inflation May have Peaked

by Calculated Risk on 4/22/2022 01:54:00 PM

According to Reuters, quoting Treasury Secretary Janet Yellen:

She said inflation may have peaked in the United States, but cautioned that prices may remain elevated "for a while longer."There are many drivers of inflation right now - supply chain issues, high energy and food prices, housing (Owners' Equivalent Rent will keep inflation high for some time) - to name a few. But it is possible, due to base effects, that inflation "may have peaked".

Click on graph for larger image.

Click on graph for larger image.This graph shows the month-to-month increase in PCE and core PCE prices since January 2020.

"Examining Resolution of Mortgage Forbearances and Delinquencies"

by Calculated Risk on 4/22/2022 10:45:00 AM

Here is a new report from the Philly Fed: Examining Resolution of Mortgage Forbearances and Delinquencies – April 2022

By our projections, 2.15 million mortgages are either in forbearance or past due; around 630,000 of those were still in forbearance as of April 7.And an excerpt from the report:

Forbearances and seriously delinquent loans continue to decline to prepandemic levels, attributable to the strong housing market and loss mitigation activities implemented by policymakers, investors, and mortgage servicers. Nonetheless, there are still pockets of borrowers who remain at high risk of losing their homes and require special attention. This report documents how these loss mitigation programs have performed to date and the remaining pockets of risk.

As shown in Table 1, as of April 7, we estimate that 629,714 mortgage loans remain in forbearance.In general, borrowers exiting forbearance have performed very well. The report shows that of 8.65 million forbearances, only 8% remain in active forbearance, and only 3% are delinquent, in-loss mitigation and not paying. Since the foreclosure moratoriums have ended, we've seen a pickup in foreclosures, but there will not be a huge wave of foreclosures.

These include mortgages from the Federal Housing Administration (FHA), Veterans Affairs (VA), and the two government-sponsored enterprises (GSEs) — Fannie Mae and Freddie Mac — comprising almost all of the federally insured mortgages, along with the major private-sector mortgages from private-label mortgage-backed securities (PLMBS) and portfolio loans.

Click on graph for larger image.

Figure 1 presents the projected forbearance expirations, assuming borrowers take the maximum forbearance allowed by various programs. Note that 39 percent of forbearances are FHA/VA mortgages. Unless mortgage servicers can successfully execute home-retention options in the coming months, many borrowers face the prospect of selling their homes or losing them to foreclosure.