by Calculated Risk on 4/28/2022 09:15:00 PM

Thursday, April 28, 2022

Friday: Personal Income and Outlays, Chicago PMI

Friday:

• At 8:30 AM ET: Personal Income and Outlays, March 2021. The consensus is for a 0.4% increase in personal income, and for a 0.6% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 6.4% YoY, and core PCE prices up 5.3% YoY.

• At 9:45 AM, Chicago Purchasing Managers Index for April. The consensus is for a reading of 62.0, down from 62.9 in March.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 65.7.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.1% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 219.6 | --- | ≥2321 | |

| New Cases per Day3🚩 | 53,133 | 42,426 | ≤5,0002 | |

| Hospitalized3🚩 | 10,803 | 9,909 | ≤3,0002 | |

| Deaths per Day3 | 334 | 352 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

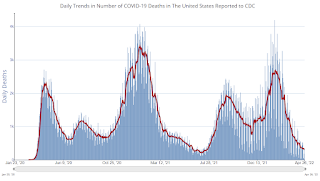

Click on graph for larger image.

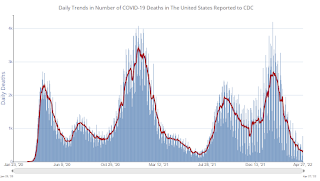

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

NMHC: April Apartment Market Survey shows Tighter Conditions

by Calculated Risk on 4/28/2022 03:05:00 PM

From the National Multifamily Housing Council (NMHC): Apartment Demand Continues to Grow, but Investors Face Tougher Financing Conditions

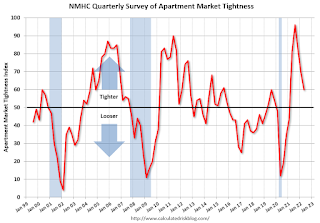

Apartment markets tightened further according to the National Multifamily Housing Council’s Quarterly Survey of Apartment Market Conditions for April 2022, while financing became more costly. The Market Tightness (60) index was the only index to come in above the breakeven level (50) this quarter; the Sales Volume (50) index came in at exactly 50, with much disagreement among respondents; while both the Equity Financing (35) and Debt Financing (9) indexes indicated weaker conditions compared to three months prior.

“Demand for apartments continues to exceed supply, resulting in the fifth straight quarter of tightening markets,” noted NMHC’s Chief Economist, Mark Obrinsky. “Yet, even as rent growth and occupancy remain elevated, developers are struggling to build more housing due to the increasing cost of materials, a lack of available labor, continued obstructionism from NIMBYs, and, because of rising interest rates, an increasing cost of capital.”

...

The Market Tightness Index came in at 60 this quarter – above the breakeven level of 50 – indicating that market conditions have become tighter. While less than one-third (30 percent) of respondents reported markets to be tighter than three months ago, an even smaller share (10 percent) thought that markets have become looser. A majority of respondents (59 percent), meanwhile, thought that apartment market conditions were unchanged from last quarter.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter.

Las Vegas March 2022: Visitor Traffic Down 10% Compared to 2019

by Calculated Risk on 4/28/2022 02:38:00 PM

From the Las Vegas Visitor Authority: March 2022 Las Vegas Visitor Statistics

The positive visitation trajectory continued in March as Las Vegas hosted more than 3.3M visitors, nearly 50% ahead of last March and roughly 10% shy of March 2019.

With meetings returning across the destination along with tradeshows such as ASD Las Vegas, Nat'l Automobile Dealers Assn, Bar & Restaurant Expo, and Int'l Pizza Expo, the convention segment saw continued improvement, reaching an est. 495k attendees for the month, roughly 90% of pre‐COVID levels of Mar 2019. Overall hotel occupancy reached 80.6%, up approx. 25 pts YoY and down only 10.9 pts vs. March 2019. Weekend occupancy exceeded 92% (up 14.4 pts YoY and down 5.0 pts vs. March 2019) and Midweek occupancy reached 76.6% (up 28.8 pts YoY and down 12.3 pts vs. March 2019).

ADR exceeded $163, well ahead of last March (+63.0%) and March 2019 (+21.8%) while RevPAR reached $131.49 for the month, dramatically ahead of March 2021 (+136.7%) and 7.3% over March 2019 levels

Click on graph for larger image.

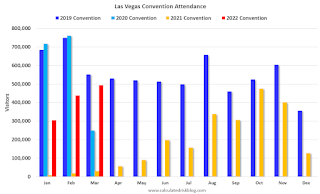

Click on graph for larger image. The first graph shows visitor traffic for 2019 (dark blue), 2020 (light blue), 2021 (yellow) and 2022 (red)

Visitor traffic was down 9.8% compared to the same month in 2019.

Note: There was almost no convention traffic from April 2020 through May 2021.

A Few Comments on Q1 GDP and Investment

by Calculated Risk on 4/28/2022 12:22:00 PM

Earlier from the BEA: Gross Domestic Product, Fourth Quarter and Year 2021 (Advance Estimate)

Real gross domestic product (GDP) decreased at an annual rate of 1.4 percent in the first quarter of 2022, according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 6.9 percent....The advance Q1 GDP report, at -1.4% annualized, was below expectations, primarily due to a negative impact from trade and a decrease in inventories.

The decrease in real GDP reflected decreases in private inventory investment, exports, federal government spending, and state and local government spending, while imports, which are a subtraction in the calculation of GDP, increased. Personal consumption expenditures (PCE), nonresidential fixed investment, and residential fixed investment increased.

emphasis added

Personal consumption expenditures (PCE) increased at a 2.7% annualized rate in Q1.

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So, the usual pattern - both into and out of recessions is - red, green, blue.

Of course - with the sudden economic stop due to COVID-19 - the usual pattern didn't apply.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.Residential investment (RI) increased at a 2.1% annual rate in Q1. Equipment investment increased at a 15.3% annual rate, and investment in non-residential structures increased at a 9.2% annual rate.

On a 3-quarter trailing average basis, RI (red) is unchanged, equipment (green) is up, and nonresidential structures (blue) is still down.

The second graph shows residential investment as a percent of GDP.

The second graph shows residential investment as a percent of GDP.Residential Investment as a percent of GDP increased in Q1.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single-family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

Weekly Initial Unemployment Claims Decrease to 180,000

by Calculated Risk on 4/28/2022 08:41:00 AM

The DOL reported:

In the week ending April 23, the advance figure for seasonally adjusted initial claims was 180,000, a decrease of 5,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 184,000 to 185,000. The 4-week moving average was 179,750, an increase of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 177,250 to 177,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 179,750.

The previous week was revised up.

Weekly claims were close to the consensus forecast.

BEA: Real GDP decreased at 1.4% Annualized Rate in Q1

by Calculated Risk on 4/28/2022 08:35:00 AM

From the BEA: Gross Domestic Product, First Quarter 2022 (Advance Estimate)

Real gross domestic product (GDP) decreased at an annual rate of 1.4 percent in the first quarter of 2022, according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 6.9 percent....PCE increased at a 2.7% rate, and residential investment increased at a 2.1% rate. Change in private inventories and trade were a huge drag in Q1. The advance Q1 GDP report, with 1.4% annualized decline, was below expectations.

The decrease in real GDP reflected decreases in private inventory investment, exports, federal government spending, and state and local government spending, while imports, which are a subtraction in the calculation of GDP, increased. Personal consumption expenditures (PCE), nonresidential fixed investment, and residential fixed investment increased.

emphasis added

I'll have more later ...

MBA: Median Mortgage Application Payment Up 5.0% in March compared to February

by Calculated Risk on 4/28/2022 07:00:00 AM

This is a new monthly affordability index from the Mortgage Bankers Association (MBA).

From the MBA: Mortgage Application Payments Jumped 5 Percent to $1,736 in March

Homebuyer affordability declined in March, with the national median payment applied for by applicants rising 5.0 percent to $1,736 from $1,653 in February. This is according to the Mortgage Bankers Association's (MBA) new Purchase Applications Payment Index (PAPI), which measures how new monthly mortgage payments vary across time – relative to income – using data from MBA’s Weekly Applications Survey (WAS).This will increase further in April with the further increase in mortgage rates.

“The start of the spring homebuying season is off to a mixed start. The healthy labor market and robust wage gains fueled demand throughout the country in March, but rapid home-price growth and the 42- basis-point surge in mortgage rates last month slowed purchase application activity. A typical borrower’s principal and interest payment was $387 more than in March 2021,” said Edward Seiler, MBA's Associate Vice President, Housing Economics, and Executive Director, Research Institute for Housing America. “Swift price-appreciation, sky-high inflation, low inventory, and mortgage rates now two percentage points higher than last year are all headwinds for the housing market in the coming months – especially for first-time buyers.”

...

An increase in MBA’s PAPI – indicative of declining borrower affordability conditions – means that the mortgage payment to income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings. A decrease in the PAPI – indicative of improving borrower affordability conditions – occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

Click on graph for larger image.

The national PAPI (Figure 1) increased 5.0 percent to 150.9 in March from 143.7 in February, meaning payments on new mortgages take up a larger share of a typical person’s income. Compared to March 2021 (122.9), the index jumped 22.8 percent. For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment increased 3.2 percent to $1,129 from $1,094 in February

emphasis added

Wednesday, April 27, 2022

Thursday: GDP, Unemployment Claims

by Calculated Risk on 4/27/2022 09:23:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 180 thousand down from 184 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 1st quarter 2021 (Advance estimate). The consensus is that real GDP increased 1.0% annualized in Q1, down from 6.9% in Q4.

• At 11:00 AM, the Kansas City Fed manufacturing survey for April. This is the last of regional manufacturing surveys for April.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.1% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 219.4 | --- | ≥2321 | |

| New Cases per Day3🚩 | 48,692 | 40,812 | ≤5,0002 | |

| Hospitalized3🚩 | 10,606 | 9,833 | ≤3,0002 | |

| Deaths per Day3 | 299 | 360 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

Zillow Case-Shiller House Price Forecast: 20% YoY in March

by Calculated Risk on 4/27/2022 04:12:00 PM

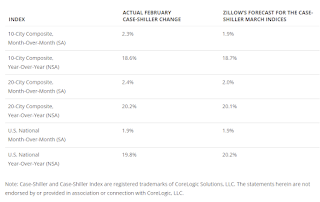

The Case-Shiller house price indexes for February were released this week. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow Research: February 2022 Case-Shiller Results & Forecast: Prices Accelerate Again

While these challenging conditions might be expected to drain the pool of buyers, and may still do so eventually, there are signs the market remains very competitive. Listings are going pending after about a week on the market and a large share of homes are continuing to sell above their asking price. Existing home sales have trended below 2021 levels, but that appears to be more a function of low inventory than a lack of demand. There are fewer than half the number of homes on the market than at this time in 2019 – the last comparable period prior to the pandemic – yet sales continue to trend above pre-pandemic levels. Changes in inventory and affordability will remain key to the housing decisions of prospective buyers in the months ahead.

Annual home price growth as reported by Case-Shiller are expected to accelerate in the national and 10-city indices and slow slightly in the 20-city index. Monthly appreciation in March is expected to decelerate from February in both city indices, and hold in the national index. S&P Dow Jones Indices is expected to release data for the March S&P CoreLogic Case-Shiller Indices on Tuesday, May 31.

emphasis added

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be a record 20.2% in March.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be a record 20.2% in March.

Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in February; Worst "Affordability" since Housing Bubble

by Calculated Risk on 4/27/2022 11:48:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in February

Excerpt:

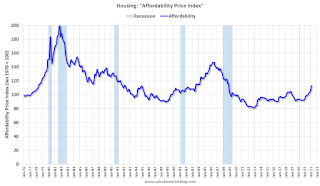

I’ve put together my own affordability index - since 1976 - that is similar to the FirstAm approach (more of a house price index adjusted by mortgage rates and the median household income).

I used median income from the Census Bureau (estimated 2021 and 2022), assumed a 15% down payment, and used a 2% estimate for property taxes, insurance and maintenance. This is probably low for high property tax states like New Jersey and Texas, and too high for lower property tax states. If we were including condos, we’d also include HOA fees too (this is excluded).

For house prices, I used the Case-Shiller National Index, Seasonally Adjusted (SA). Also, for the down payment - there wasn’t a significant difference between 15% and 20%. For mortgage rates, I used the Freddie Mac PMMS (30-year fixed rates).

So here is what the index looks like (lower is more affordable like the FirstAm index):

Note that by this index, during the early ‘80s, homes were very unaffordable due to the very high mortgage rates. During the housing bubble, houses were also less affordable using 30-year mortgage rates, however, during the bubble, there were many “affordability products” that allowed borrowers to be qualified at the teaser rate (usually around 1%) that made houses seem more affordable.

In general, this would suggest houses are the least affordable since the housing bubble. And excluding the bubble - with all the “affordability products” - this is the worst affordability since 1995.

Also, in February, the average 30-year mortgage rates were around 3.8%, and currently mortgage rates are close to 5.3% - so we already know the “Affordability Price Index” will increase sharply over the next couple of months (meaning houses are even less affordable).