by Calculated Risk on 4/30/2022 02:11:00 PM

Saturday, April 30, 2022

Real Estate Newsletter Articles this Week

At the Calculated Risk Real Estate Newsletter this week:

• Realtor.com Reports Weekly Inventory down only 6% Year-over-year

• Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in February Worst "Affordability" since Housing Bubble

• March New Home Sales: Little Completed Inventory, High Number of Homes Under Construction

• Case-Shiller National Index up 19.8% Year-over-year in February; New Record Monthly Increase

• Housing and Demographics

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

The blog will continue as always!

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of May 1, 2022

by Calculated Risk on 4/30/2022 08:11:00 AM

The key report scheduled for this week is the April employment report.

Other key reports include April vehicle sales, and the March trade balance.

The FOMC meets this week, and the FOMC is expected to raise rates 50bp.

For manufacturing, the April ISM manufacturing index will be released.

10:00 AM ET: ISM Manufacturing Index for April. The consensus is for the ISM to be at 57.6, up from 57.1 in March.

10:00 AM: Construction Spending for March. The consensus is for a 0.7% increase in construction spending.

8:00 AM ET: Corelogic House Price index for March.

10:00 AM ET: Job Openings and Labor Turnover Survey for March from the BLS.

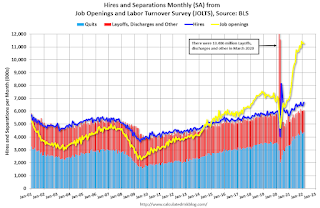

10:00 AM ET: Job Openings and Labor Turnover Survey for March from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased slightly in February to 11.266 million from 11.283 million in January. The number of job openings (yellow) were up 43% year-over-year.

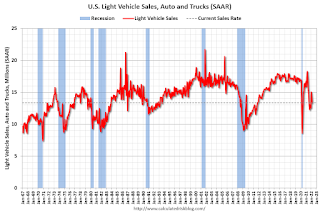

All day: Light vehicle sales for April. The expectation is for light vehicle sales to be 13.8 million SAAR in April, up from 13.36 million in March (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for April. The expectation is for light vehicle sales to be 13.8 million SAAR in April, up from 13.36 million in March (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for the previous month.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 395,000 payroll jobs added in April, down from 455,000 added in March.

8:30 AM: Trade Balance report for March from the Census Bureau.

8:30 AM: Trade Balance report for March from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $107.0 billion. The U.S. trade deficit was at $89.2 Billion in February.

10:00 AM: the ISM Services Index for April. The consensus is for a reading of 58.5, up from 58.3.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate by 50bp at this meeting and announce "commencement of balance sheet runoff".

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 180 thousand unchanged from 180 thousand last week.

8:30 AM: Employment Report for April. The consensus is for 400,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

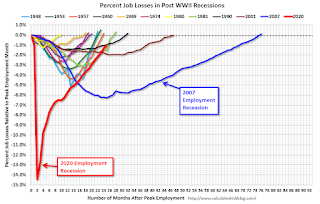

8:30 AM: Employment Report for April. The consensus is for 400,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.There were 431,000 jobs added in February, and the unemployment rate was at 3.6%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 25 months after the onset, has recovered quicker than the previous two recessions.

Friday, April 29, 2022

COVID Update: Hospitalizations and New Cases Increasing

by Calculated Risk on 4/29/2022 10:17:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.1% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 219.6 | --- | ≥2321 | |

| New Cases per Day3🚩 | 54,696 | 40,713 | ≤5,0002 | |

| Hospitalized3🚩 | 10,991 | 9,997 | ≤3,0002 | |

| Deaths per Day3 | 311 | 340 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

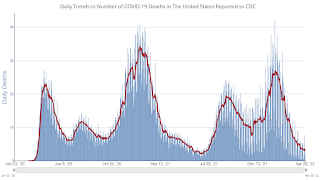

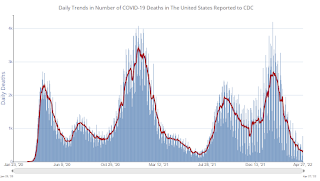

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in March

by Calculated Risk on 4/29/2022 04:09:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 1.01% in March from 1.11% in February. The serious delinquency rate is down from 2.58% in March 2021.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (1% of portfolio), 3.12% are seriously delinquent (down from 3.30% in February).

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

The pandemic related increase in delinquencies was very different from the increase in delinquencies following the housing bubble. Lending standards had been fairly solid over the previous decade, and most of these homeowners had equity in their homes - and the vast majority of these homeowners have been able to restructure their loans once they were employed.

Freddie Mac reported earlier.

Hotels: Occupancy Rate Down 4.2% Compared to Same Week in 2019

by Calculated Risk on 4/29/2022 02:32:00 PM

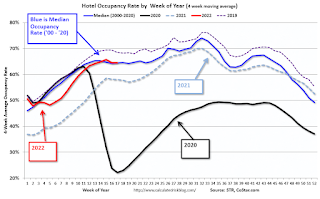

U.S. hotel performance increased from the previous week, according to STR‘s latest data through April 23.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

April 17-23, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 65.8% (-4.2%)

• Average daily rate (ADR): $148.35 (+15.4%)

• Revenue per available room (RevPAR): $97.66 (+10.5%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Realtor.com Reports Weekly Inventory down only 6% Year-over-year

by Calculated Risk on 4/29/2022 11:46:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Realtor.com Reports Weekly Inventory down only 6% Year-over-year

Excerpt:

Realtor.com has monthly and weekly data on the existing homes. Here is their most recent weekly report released yesterday: Weekly Housing Trends View — Data Week Ending April 23, 2022. They have data on list prices, new listing and more, but this focus is on inventory.• Active inventory is down just 6 percent from a year ago.

The number of homes for sale is past this year’s seasonal low, which was also a record low, which means the number of homes for sale is climbing week to week and month to month as it typically does in spring. While the market has not yet caught up to last year’s level, this week marked a big jump forward. The gap between this year’s homes for sale and last year’s is one-fifth the size that it was at the beginning of the year. The catch up is likely to continue, as we noted last week, as new listings grow and home sales slow, and we expect active inventory to surpass year ago levels in the next few months. This growth will mean more options for shoppers than they’ve had in a while, even though inventory continues to lag pre-pandemic normal.Here is a graph of the year-over-year change in inventory according to realtor.com. Note: I corrected a sign error in the data for Feb 26, 2022.

The previous week, inventory was down 12.6% YoY according to Realtor.com. That is close to the 11.2% that Altos reported. I expect Altos to report a single digit year-over-year decline in inventory on Monday.

Personal Income increased 0.5% in March; Spending increased 1.1%

by Calculated Risk on 4/29/2022 08:38:00 AM

The BEA released the Personal Income and Outlays report for March:

Personal income increased $107.2 billion (0.5 percent) in March, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $89.7 billion (0.5 percent) and personal consumption expenditures (PCE) increased $185.0 billion (1.1 percent).The March PCE price index increased 6.6 percent year-over-year and the PCE price index, excluding food and energy, increased 5.2 percent year-over-year.

Real DPI decreased 0.4 percent in March and Real PCE increased 0.2 percent; goods decreased 0.5 percent and services increased 0.6 percent. The PCE price index increased 0.9 percent. Excluding food and energy, the PCE price index increased 0.3 percent

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through March 2022 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was slightly above expectations, and the increase in PCE was above expectations.

Thursday, April 28, 2022

Friday: Personal Income and Outlays, Chicago PMI

by Calculated Risk on 4/28/2022 09:15:00 PM

Friday:

• At 8:30 AM ET: Personal Income and Outlays, March 2021. The consensus is for a 0.4% increase in personal income, and for a 0.6% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 6.4% YoY, and core PCE prices up 5.3% YoY.

• At 9:45 AM, Chicago Purchasing Managers Index for April. The consensus is for a reading of 62.0, down from 62.9 in March.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 65.7.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.1% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 219.6 | --- | ≥2321 | |

| New Cases per Day3🚩 | 53,133 | 42,426 | ≤5,0002 | |

| Hospitalized3🚩 | 10,803 | 9,909 | ≤3,0002 | |

| Deaths per Day3 | 334 | 352 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

NMHC: April Apartment Market Survey shows Tighter Conditions

by Calculated Risk on 4/28/2022 03:05:00 PM

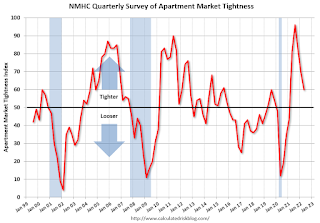

From the National Multifamily Housing Council (NMHC): Apartment Demand Continues to Grow, but Investors Face Tougher Financing Conditions

Apartment markets tightened further according to the National Multifamily Housing Council’s Quarterly Survey of Apartment Market Conditions for April 2022, while financing became more costly. The Market Tightness (60) index was the only index to come in above the breakeven level (50) this quarter; the Sales Volume (50) index came in at exactly 50, with much disagreement among respondents; while both the Equity Financing (35) and Debt Financing (9) indexes indicated weaker conditions compared to three months prior.

“Demand for apartments continues to exceed supply, resulting in the fifth straight quarter of tightening markets,” noted NMHC’s Chief Economist, Mark Obrinsky. “Yet, even as rent growth and occupancy remain elevated, developers are struggling to build more housing due to the increasing cost of materials, a lack of available labor, continued obstructionism from NIMBYs, and, because of rising interest rates, an increasing cost of capital.”

...

The Market Tightness Index came in at 60 this quarter – above the breakeven level of 50 – indicating that market conditions have become tighter. While less than one-third (30 percent) of respondents reported markets to be tighter than three months ago, an even smaller share (10 percent) thought that markets have become looser. A majority of respondents (59 percent), meanwhile, thought that apartment market conditions were unchanged from last quarter.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter.

Las Vegas March 2022: Visitor Traffic Down 10% Compared to 2019

by Calculated Risk on 4/28/2022 02:38:00 PM

From the Las Vegas Visitor Authority: March 2022 Las Vegas Visitor Statistics

The positive visitation trajectory continued in March as Las Vegas hosted more than 3.3M visitors, nearly 50% ahead of last March and roughly 10% shy of March 2019.

With meetings returning across the destination along with tradeshows such as ASD Las Vegas, Nat'l Automobile Dealers Assn, Bar & Restaurant Expo, and Int'l Pizza Expo, the convention segment saw continued improvement, reaching an est. 495k attendees for the month, roughly 90% of pre‐COVID levels of Mar 2019. Overall hotel occupancy reached 80.6%, up approx. 25 pts YoY and down only 10.9 pts vs. March 2019. Weekend occupancy exceeded 92% (up 14.4 pts YoY and down 5.0 pts vs. March 2019) and Midweek occupancy reached 76.6% (up 28.8 pts YoY and down 12.3 pts vs. March 2019).

ADR exceeded $163, well ahead of last March (+63.0%) and March 2019 (+21.8%) while RevPAR reached $131.49 for the month, dramatically ahead of March 2021 (+136.7%) and 7.3% over March 2019 levels

Click on graph for larger image.

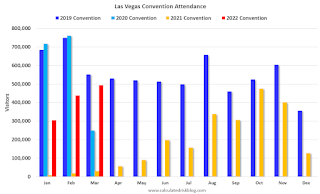

Click on graph for larger image. The first graph shows visitor traffic for 2019 (dark blue), 2020 (light blue), 2021 (yellow) and 2022 (red)

Visitor traffic was down 9.8% compared to the same month in 2019.

Note: There was almost no convention traffic from April 2020 through May 2021.