by Calculated Risk on 5/02/2022 08:46:00 PM

Monday, May 02, 2022

Tuesday: Job Openings, Corelogic House Prices, Vehicle Sales

From Matthew Graham at Mortgage News Daily: 30yr Fixed Mortgage Rates Now Over 5.5%

The hits keep coming for mortgage rates in 2022. Not since the early 80s have rates risen as quickly as they have in the past 2 months (or the past 4 months for that matter). Less than 6 months ago, some lenders were still quoting top tier conforming 30yr fixed rates just under 3%. As recently as early March, those same rates were still in the high 3's at times. Now today, the average lender is easily over 5.5%. [30 year fixed 5.55%]Tuesday:

emphasis added

• At 8:00 AM ET, Corelogic House Price index for March.

• At 10:00 AM, Job Openings and Labor Turnover Survey for March from the BLS.

• All day, Light vehicle sales for April. The expectation is for light vehicle sales to be 13.8 million SAAR in April, up from 13.36 million in March (Seasonally Adjusted Annual Rate).

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.2% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 219.7 | --- | ≥2321 | |

| New Cases per Day3🚩 | 57,020 | 45,428 | ≤5,0002 | |

| Hospitalized3🚩 | 10,591 | 10,366 | ≤3,0002 | |

| Deaths per Day3 | 307 | 346 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

Update: Framing Lumber Prices: Down from Recent Peak, but increasing Recently

by Calculated Risk on 5/02/2022 04:08:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through May 2nd.

Click on graph for larger image.

Click on graph for larger image.A combination of strong demand and various supply constraints have kept lumber prices high and volatile.

Black Knight Mortgage Monitor: Record Low Delinquencies, "Home Affordability Nears All-Time Low"

by Calculated Risk on 5/02/2022 11:37:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor for March: "Home Affordability Nears All-Time Low"

A brief excerpt:

Note: Black Knights data on affordability goes back to 1996. This doesn’t include housing in the 1980 period when 30-year mortgage rates peaked at over 18%.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

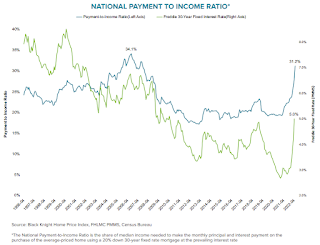

And on the payment to income ratio:

• The least affordable American housing has ever been was back in July 2006, when it took 34.1% of median income to make the monthly P&I payment on the average-priced home bought with 20% downAs Black Knight has noted, there were “affordability products” with low teaser rates available during the housing bubble. Excluding the bubble years, this is the worst affordability since at least the early ‘90s, maybe '80s.

• As of April 21, that payment-to-income ratio has now climbed all the way to 32.5%, within just 1.6 points of the prior record

• A rise of just 50 more basis points (BPS) in rates or a 5% rise in home prices, would push affordability to its worst level on record, and they are already up 200 BPS and 5.9% respectively since the start of 2022

• 37 markets – representing nearly a third of the country – are now the least affordable they’ve ever been

Construction Spending Increased 0.1% in March

by Calculated Risk on 5/02/2022 10:20:00 AM

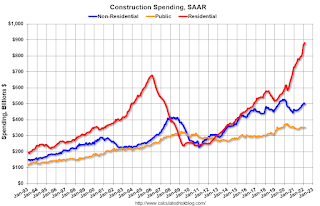

From the Census Bureau reported that overall construction spending increased 1.3%:

Construction spending during March 2022 was estimated at a seasonally adjusted annual rate of $1,730.5 billion, 0.1 percent above the revised February estimate of $1,728.6 billion. The March figure is 11.7 percent above the March 2021 estimate of $1,548.6 billion.Private spending increased and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,379.7 billion, 0.2 percent above the revised February estimate of $1,376.9 billion. ...

In March, the estimated seasonally adjusted annual rate of public construction spending was $350.8 billion, 0.2 percent below the revised February estimate of $351.7 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 30% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential (blue) spending is 20% above the bubble era peak in January 2008 (nominal dollars).

Public construction spending is 8% above the peak in March 2009.

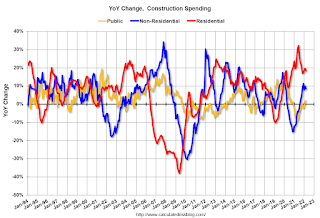

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 18.4%. Non-residential spending is up 8.5% year-over-year. Public spending is up 1.7% year-over-year.

ISM® Manufacturing index Decreased to 55.4% in April

by Calculated Risk on 5/02/2022 10:05:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion. The PMI® was at 55.4% in April, down from 57.1% in March. The employment index was at 50.9%, down from 56.3% last month, and the new orders index was at 53.5%, down from 53.8%.

From ISM: Manufacturing PMI® at 55.4% April 2022 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in April, with the overall economy achieving a 23rd consecutive month of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing expanded at a slower pace in April than in March. This was below the consensus forecast, and the employment index was weak in April.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The April Manufacturing PMI® registered 55.4 percent, a decrease of 1.7 percentage points from the March reading of 57.1 percent. This figure indicates expansion in the overall economy for the 23rd month in a row after a contraction in April and May 2020. This is the lowest reading since July 2020 (53.9 percent). The New Orders Index registered 53.5 percent, down 0.3 percentage point compared to the March reading of 53.8 percent. The Production Index reading of 53.6 percent is a 0.9-percentage point decrease compared to March’s figure of 54.5 percent. The Prices Index registered 84.6 percent, down 2.5 percentage points compared to the March figure of 87.1 percent. The Backlog of Orders Index registered 56 percent, 4 percentage points lower than the March reading of 60 percent. The Employment Index figure of 50.9 percent is 5.4 percentage points lower than the 56.3 percent recorded in March. The Supplier Deliveries Index registered 67.2 percent, an increase of 1.8 percentage points compared to the March figure of 65.4 percent. The Inventories Index registered 51.6 percent, 3.9 percentage points lower than the March reading of 55.5 percent. The New Export Orders Index reading of 52.7 percent is down 0.5 percentage point compared to March’s figure of 53.2 percent. The Imports Index registered 51.4 percent, a 0.4-percentage point decrease from the March reading of 51.8 percent.”

emphasis added

Housing Inventory May 2nd Update: Inventory Down 4.9% Year-over-Year

by Calculated Risk on 5/02/2022 08:41:00 AM

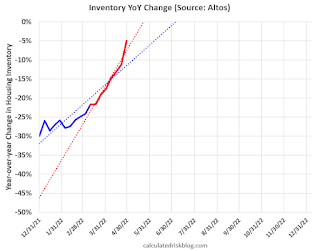

Tracking existing home inventory is very important in 2022.

Inventory usually declines in the winter, and then increases in the spring. Inventory bottomed seasonally at the beginning of March 2022 and is now up 21.2% since then.

This inventory graph is courtesy of Altos Research.

Last year inventory bottomed seasonally in April 2021 - very late in the year. This year, by this measure, inventory bottomed seasonally at the beginning of March.

Inventory is still very low. Compared to the same week in 2021, inventory is down 4.9% from 307 thousand, but compared to the same week in 2020, and inventory is down 60.4% from 738 thousand.

1. The seasonal bottom (already happened on March 4th for Altos)✅

2. Inventory up year-over-year (likely very soon)

3. Inventory up compared to two years ago (currently down 60% according to Altos)

4. Inventory back to 1999 levels (currently down 67%).

For the second milestone, here is a table of the year-over-year change by week since the beginning of the year.

| Week Ending | YoY Change |

|---|---|

| 12/31/2021 | -30.0% |

| 1/7/2022 | -26.0% |

| 1/14/2022 | -28.6% |

| 1/21/2022 | -27.1% |

| 1/28/2022 | -25.9% |

| 2/4/2022 | -27.9% |

| 2/11/2022 | -27.5% |

| 2/18/2022 | -25.8% |

| 2/25/2022 | -24.9% |

| 3/4/2022 | -24.2% |

| 3/11/2022 | -21.7% |

| 3/18/2022 | -21.7% |

| 3/25/2022 | -19.0% |

| 4/1/2022 | -17.6% |

| 4/8/2022 | -14.8% |

| 4/15/2022 | -13.1% |

| 4/22/2022 | -11.2% |

| 4/29/2022 | -4.9% |

Four High Frequency Indicators for the Economy

by Calculated Risk on 5/02/2022 08:07:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Note: Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

The TSA is providing daily travel numbers.

This data is as of May 1st.

Click on graph for larger image.

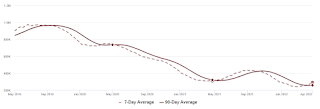

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 9.7% from the same day in 2019 90.3% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $121 million last week, down about 23% from the median for the week.

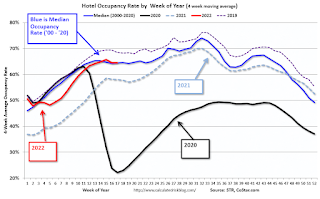

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

This data is through April 23rd. The occupancy rate was down 4.2% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

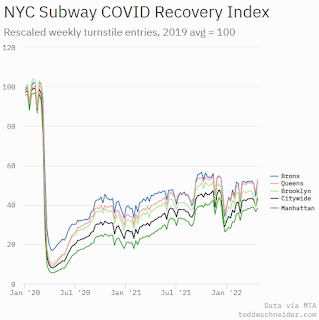

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, April 29th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, May 01, 2022

Monday: ISM Mfg, Construction Spending

by Calculated Risk on 5/01/2022 06:40:00 PM

Weekend:

• Schedule for Week of May 1, 2022

• FOMC Preview: 50bp Rate Hike, Announce "commencement of balance sheet runoff"

• Housing: "What Killed the Home ATM in 2006?"

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for April. The consensus is for the ISM to be at 57.6, up from 57.1 in March.

• Also at 10:00 AM, Construction Spending for March. The consensus is for a 0.7% increase in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $104.58 per barrel and Brent at $106.73 per barrel. A year ago, WTI was at $64 and Brent was at $68 - so WTI oil prices are up over 60% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.17 per gallon. A year ago prices were at $2.89 per gallon, so gasoline prices are up $1.28 per gallon year-over-year.

Housing: "What Killed the Home ATM in 2006?"

by Calculated Risk on 5/01/2022 02:21:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Housing: "What Killed the Home ATM in 2006?"

Excerpt:

A reader (ht SV) asked an interesting question: What killed the Home ATM in 2006?

First, the “Home ATM” is a joking reference to mortgage equity withdrawal (MEW), where homeowners extract equity from their homes - like a cash-out refinance or with a Home Equity Line of Credit (HELOC).

In this post, I’ll compare MEW for the current period to both the housing bubble and the 1978 to 1982 period. In Housing: Don't Compare the Current Housing Boom to the Bubble and Bust, I pointed out that demographics, lending standards, and the Fed fighting inflation are similar to the 1978 to 1982 period, and dissimilar to the housing bubble - and I suggested that we look to the 1980 for parallels to the current boom and coming housing slowdown (not the bubble).

...

The following graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note that MEW (as a percent of DPI) was at about the same level in 1980 as today and is well below the peak bubble years.

...

So, this is another reason - along with similar demographics, lending standards, and concerns about inflation - to compare the current housing market to the 1978 to 1982 period, and not to the housing bubble. (Of course, there are differences too).

FOMC Preview: 50bp Rate Hike, Announce "commencement of balance sheet runoff"

by Calculated Risk on 5/01/2022 08:11:00 AM

Expectations are the FOMC will announce a 50bp rate increase in the federal funds rate at the meeting this week and probably also announce the "commencement of balance sheet runoff".

"The Fed has signaled a major hawkish shift at this meeting, and we expect them to deliver, with a 50bp rate increase and the announcement of Quantitative Tightening (QT) starting in June.From Goldman Sachs:

...

On QT, the minutes of the March FOMC meeting detailed the plans for reducing the size of the balance sheet, indicating general agreement behind monthly caps of $60bn for Treasuries and $35bn for agency MBS phased in over three months or more. These finalized details clear the way for QT to be announced at this meeting, with starting monthly caps of $20bn for Treasuries and $10bn for agency MBS. Importantly, our US rates strategy team believes QT implementation will actually begin with a lag in June."

"Policy actions at the May FOMC meeting seem set after Chair Powell and other FOMC members strongly suggested that they intend to raise the policy rate by 50bp and announce the start of balance sheet reduction.

The key question is therefore what comes next. We forecast another 50bp hike in June followed by a deceleration to a 25bp/meeting pace of tightening for the rest of 2022, but see reasonably high chances that the FOMC will continue to hike in 50bp increments until reaching their median neutral rate estimate of 2.25-2.5%. We will therefore be paying close attention to any comments from Chair Powell at the press conference that suggest the FOMC intends to hike in 50bp increments beyond June."

Wall Street forecasts are being revised down for 2022 due to the ongoing negative supply chain impacts from the pandemic (see China), and the war in Ukraine. For example, Goldman Sachs is now forecasting a 1.6% increase in real GDP, Q4-over-Q4 for 2022, well below the FOMC projections in March.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Mar 2022 | 2.5 to 3.0 | 2.1 to 2.5 | 1.8 to 2.0 | |

| Dec 2021 | 3.6 to 4.5 | 2.0 to 2.5 | 1.8 to 2.0 | |

The unemployment rate was at 3.6% in March. The question is: Will the slowdown in economic growth push up the unemployment rate? Or will the rate continue to decline?

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Mar 2022 | 3.4 to 3.6 | 3.3 to 3.6 | 3.2 to 3.7 | |

| Dec 2021 | 3.4 to 3.7 | 3.2 to 3.6 | 3.2 to 3.7 | |

As of March 2022, PCE inflation was up 6.6% from March 2021. This was a new cycle high. With the ongoing negative impacts on the supply chain, and on energy and food costs from the war, inflation might stay elevated longer than expected.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Mar 2022 | 4.1 to 4.7 | 2.3 to 3.0 | 2.1 to 2.4 | |

| Dec 2021 | 2.2 to 3.0 | 2.1 to 2.5 | 2.0 to 2.2 | |

PCE core inflation was up 5.2% in March year-over-year. This was slightly below the February YoY increase, but it is too early to say the core inflation has peaked.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Mar 2022 | 3.9 to 4.4 | 2.4 to 3.0 | 2.1 to 2.4 | |

| Dec 2021 | 2.5 to 3.0 | 2.1 to 2.4 | 2.0 to 2.2 | |