by Calculated Risk on 5/04/2022 10:07:00 AM

Wednesday, May 04, 2022

ISM® Services Index Decreased to 57.1% in April, Employment Contracted

(Posted with permission). The ISM® Services index was at 57.1%, down from 58.3% last month. The employment index decreased to 49.5%, from 54.0%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 57.1% April 2022 Services ISM® Report On Business®

Economic activity in the services sector grew in April for the 23rd month in a row — with the Services PMI® registering 57.1 percent — say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In April, the Services PMI® registered 57.1 percent, 1.2 percentage points lower than March’s reading of 58.3 percent. The Business Activity Index registered 59.1 percent, an increase of 3.6 percentage points compared to the reading of 55.5 percent in March, and the New Orders Index figure of 54.6 percent is 5.5 percentage points lower than the March reading of 60.1 percent.

...

Employment activity in the services sector contracted in April. ISM®’s Employment Index registered 49.5 percent, down 4.5 percentage points from the reading of 54 percent registered in March. Comments from respondents include: “Job openings exist, but finding talent to fill them remains a struggle across most industry sectors and job categories” and “Demand for employment remains hypercompetitive; there is just not enough qualified personnel available.”

emphasis added

Trade Deficit increased to $109.8 Billion in March

by Calculated Risk on 5/04/2022 08:40:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $109.8 billion in March, up $20.0 billion from $89.8 billion in February, revised.

March exports were $241.7 billion, $12.9 billion more than February exports. March imports were $351.5 billion, $32.9 billion more than February imports.

emphasis added

Click on graph for larger image.

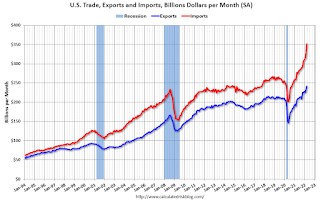

Click on graph for larger image.Both exports and imports increased in March.

Exports are up 18% year-over-year; imports are up 27% year-over-year.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

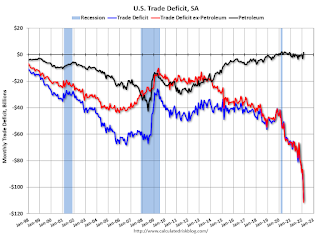

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China increased to $34.0 billion in March, from $27.7 billion a year ago.

ADP: Private Employment Increased 247,000 in April

by Calculated Risk on 5/04/2022 08:19:00 AM

Private sector employment increased by 247,000 jobs from March to April according to the April ADP® National Employment ReportTM. Broadly distributed to the public each month, free of charge, the ADP National Employment Report is produced by the ADP Research Institute® in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual data of those who are on a company’s payroll, measures the change in total nonfarm private employment each month on a seasonally-adjusted basisThis was below the consensus forecast of 395,000 for this report.

“In April, the labor market recovery showed signs of slowing as the economy approaches full employment,” said Nela Richardson, chief economist, ADP. “While hiring demand remains strong, labor supply shortages caused job gains to soften for both goods producers and services providers. As the labor market tightens, small companies, with fewer than 50 employees, struggle with competition for wages amid increased costs.”

emphasis added

The BLS report will be released Friday, and the consensus is for 400 thousand non-farm payroll jobs added in April. The ADP report has not been very useful in predicting the BLS report, but this suggests a weaker than expected BLS report.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 5/04/2022 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 29, 2022.

... The Refinance Index increased 0.2 percent from the previous week and was 71 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index increased 5 percent compared with the previous week and was 11 percent lower than the same week one year ago.

“Treasury yields eased slightly last week but remained close to 2018 highs, as financial markets await the news from the Federal Reserve on its latest plans for rate hikes and reducing its balance sheet holdings. The 30-year fixed rate was 5.36 percent, up over two percentage points from a year ago. The 127-basis point jump in rates over the past two months has triggered a 49 percent drop in refinance activity,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications increased for conventional, FHA, and VA loans and were up 4 percent overall. This is potentially a good sign for the spring home buying season, which has seen a slow start thus far. The purchase market remains challenged by low levels of housing inventory and rapid home-price gains, as well as the affordability hit from higher mortgage rates that are forcing prospective buyers to factor in higher monthly payments. The ARM share remained unchanged at around 9 percent, which is well below the 30 percent mark observed in the mid-2000s.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 5.36 percent from 5.37 percent, with points decreasing to 0.63 from 0.67 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

According to the MBA, purchase activity is down 11% year-over-year unadjusted.

According to the MBA, purchase activity is down 11% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, May 03, 2022

Wednesday: FOMC Statement, Trade Deficit, ADP Employment, ISM Services

by Calculated Risk on 5/03/2022 11:54:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 395,000 payroll jobs added in April, down from 455,000 added in March.

• At 8:30 AM, Trade Balance report for March from the Census Bureau. The consensus is the trade deficit to be $107.0 billion. The U.S. trade deficit was at $89.2 Billion in February.

• At 10:00 AM, the ISM Services Index for April. The consensus is for a reading of 58.5, up from 58.3.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate by 50bp at this meeting and announce "commencement of balance sheet runoff".

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

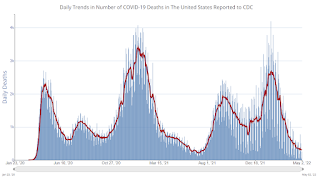

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.2% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 219.8 | --- | ≥2321 | |

| New Cases per Day3🚩 | 60,410 | 47,510 | ≤5,0002 | |

| Hospitalized3🚩 | 11,584 | 10,531 | ≤3,0002 | |

| Deaths per Day3 | 318 | 320 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

April Vehicles Sales increased to 14.29 million SAAR

by Calculated Risk on 5/03/2022 09:33:00 PM

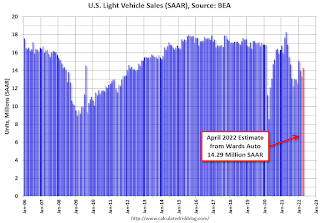

Wards Auto released their estimate of light vehicle sales for April. Wards Auto estimates sales of 14.29 million SAAR in April 2022 (Seasonally Adjusted Annual Rate), up 6.9% from the March sales rate, and down 21.9% from April 2021.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for April (red).

The impact of COVID-19 was significant, and April 2020 was the worst month. After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic).

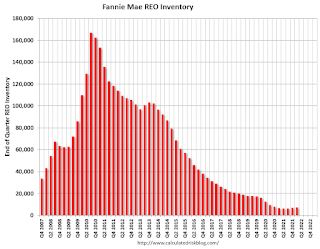

Fannie REO inventory increased in Q1 year-over-year; Expected to increase further in 2022

by Calculated Risk on 5/03/2022 03:23:00 PM

Fannie reported results for Q1 2022. Here is some information on single-family Real Estate Owned (REOs).

"In response to the pandemic and with instruction from FHFA, we prohibited our servicers from completing foreclosures on our single-family loans through July 31, 2021, except in the case of vacant or abandoned properties. In addition, our servicers were required to comply with a Consumer Financial Protection Bureau (the “CFPB”) rule that prohibited certain new single-family foreclosures on mortgage loans secured by the borrower’s principal residence until after December 31, 2021. As a result, our foreclosure volumes were slightly higher in the first quarter of 2022 compared with the first quarter of 2021. We expect foreclosure volumes to gradually increase throughout 2022.

In April 2022, FHFA announced a suspension of foreclosure activities for up to 60 days for borrowers who apply for assistance under Treasury’s Homeowner Assistance Fund." emphasis added

For Fannie, this is down 96% from the 166,787 peak number of REOs in Q3 2010.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie Real Estate Owned (REO).

REO inventory increased in Q1 2022, and inventory is up 7% year-over-year.

This is well below a normal level of REOs for Fannie, and REO levels will increase in 2022 now that the moratorium is over, but there will not be a huge wave of foreclosures.

Rent Increases Up Sharply Year-over-year, Pace may be slowing

by Calculated Risk on 5/03/2022 12:45:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Rent Increases Up Sharply Year-over-year, Pace may be slowing

A brief excerpt:

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. All of these measures are through March 2022 (Apartment List through April 2022).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Note that new lease measures (Zillow, Apartment List) dipped early in the pandemic, whereas the BLS measures were steady. Then new leases took off, and the BLS measures are picking up.

...

The Zillow measure is up 16.8% YoY in February, down from 17.2% YoY in February. And the ApartmentList measure is up 16.4% as of April, down from 17.2% in March. Both the Zillow measure (a repeat rent index), and ApartmentList are showing a sharp increase in rents.

Clearly rents are still increasing, and we should expect this to continue to spill over into measures of inflation in 2022. The Owners’ Equivalent Rent (OER) was up 4.5% YoY in March, from 4.3% YoY in February - and will likely increase further in the coming months.

My suspicion - based on all of the above data - is rent increases will slow over the coming months.

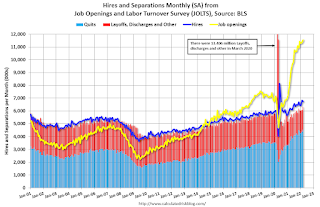

BLS: Job Openings at Series High 11.5 million in March

by Calculated Risk on 5/03/2022 10:05:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was at a series high of 11.5 million on the last business day of March, although little changed over the month, the U.S. Bureau of Labor Statistics reported today. Hires, at 6.7 million, were also little changed while total separations edged up to 6.3 million. Within separations, quits edged up to a series high of 4.5 million, while layoffs and discharges were little changed at 1.4 million.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for March, the employment report this Friday will be for April.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 are labeled, but off the chart to better show the usual data.

Jobs openings increased slightly in March to 11.549 million from 11.344 million in February.

The number of job openings (yellow) were up 36% year-over-year.

Quits were up 23% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

CoreLogic: House Prices up Record 20.9% YoY in March

by Calculated Risk on 5/03/2022 08:00:00 AM

Notes: This CoreLogic House Price Index report is for March. The recent Case-Shiller index release was for February. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: U.S. Annual Home Price Growth Exceeds 20% in March, CoreLogic Reports

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for March 2022.

U.S. home prices continued to post significant year-over-year gains in March, up by 20.9%, another record high. Even with the past year’s streak of double-digit price increases, annual gains are projected to slow to around 6% by next March, due in part to rising mortgage rates and higher home prices hampering affordability for some home shoppers. Buyers who closed on a property in March had a good chance of locking in mortgage rates around 4% or slightly lower. By late April, rates had moved up to more than 5%, a jump of about 30% from the same time last year and a trend that might derail more prospective buyers.

“The annual growth in the U.S. index was the largest we have measured in the 45-year history of the CoreLogic Home Price Index,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Couple that price increase with the rapid rise in mortgage rates and buyer affordability has fallen sharply. In April, 30-year fixed mortgage rates averaged nearly 2 percentage points higher than one year earlier. With the growth in home prices, that means the monthly principal and interest payment to buy the median-priced home was up about 50% in April compared with last April.”

...

Nationally, home prices increased 20.9% in March 2022, compared to March 2021. On a month-over-month basis, home prices increased by 3.3% compared to February 2022.

...

Annual home price gains are forecast to slow to 5.9% by March 2023.

emphasis added