by Calculated Risk on 5/05/2022 09:35:00 AM

Thursday, May 05, 2022

April Employment Preview

On Friday at 8:30 AM ET, the BLS will release the employment report for April. The consensus is for 400,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

Click on graph for larger image.

Click on graph for larger image.• First, currently there are still about 1.6 million fewer jobs than in February 2020 (the month before the pandemic).

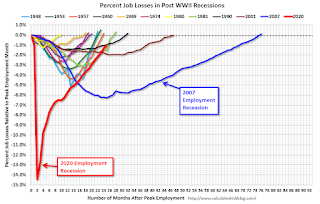

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 25 months after the onset, has recovered quicker than the previous two recessions.

• ADP Report: The ADP employment report showed a gain of 247,000 private sector jobs, well below the consensus estimates of 395,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests a weaker than expected BLS report.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in April to 50.9%, down from 56.3% last month. This would suggest 15,000 jobs lost in manufacturing employment in April. ADP showed 25,000 manufacturing jobs added.

The ISM® Services employment index decreased in April to 49.5%, down from 54.0% last month. This would suggest a 60 thousand increase in service employment in April. Combined, the ISM indexes suggest employment well below the consensus estimate.

• Unemployment Claims: The weekly claims report showed an increase in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 177,000 in March to 185,000 in April. This would usually suggest a few mort layoffs in April than in March, although this might not be very useful right now. In general, weekly claims were at expectations in April.

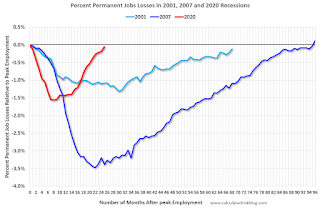

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the January report.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the January report.This data is only available back to 1994, so there is only data for three recessions. In March, the number of permanent job losers decreased to 1.392 million from 1.583 million in the previous month.

• Conclusion: The consensus is for job growth to slow to 400,000 jobs added in April. Overall, the ADP report was below expectations, the ISM employment surveys were weak, and unemployment claims was mostly neutral during the reference week. This suggests a weaker than expected employment report for April.

Weekly Initial Unemployment Claims Increase to 200,000

by Calculated Risk on 5/05/2022 08:33:00 AM

The DOL reported:

In the week ending April 30, the advance figure for seasonally adjusted initial claims was 200,000, an increase of 19,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 180,000 to 181,000. The 4-week moving average was 188,000, an increase of 8,000 from the previous week's revised average. The previous week's average was revised up by 250 from 179,750 to 180,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 188,000.

The previous week was revised up.

Weekly claims were higher than the consensus forecast.

Wednesday, May 04, 2022

Thursday: Unemployment Claims

by Calculated Risk on 5/04/2022 10:49:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 180 thousand unchanged from 180 thousand last week.

FOMC Statement: Raise Rates 50bp; Runoff Starts June 1st

by Calculated Risk on 5/04/2022 02:04:00 PM

Fed Chair Powell press conference video here starting at 2:30 PM ET.

FOMC Statement:

Although overall economic activity edged down in the first quarter, household spending and business fixed investment remained strong. Job gains have been robust in recent months, and the unemployment rate has declined substantially. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.

The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The implications for the U.S. economy are highly uncertain. The invasion and related events are creating additional upward pressure on inflation and are likely to weigh on economic activity. In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions. The Committee is highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2 percent objective and the labor market to remain strong. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 3/4 to 1 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee decided to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities on June 1, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that were issued in conjunction with this statement.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; James Bullard; Esther L. George; Patrick Harker; Loretta J. Mester; and Christopher J. Waller. Patrick Harker voted as an alternate member at this meeting.

emphasis added

Denver Real Estate in April: Active Inventory up Sharply

by Calculated Risk on 5/04/2022 12:04:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Denver Real Estate in April: Active Inventory up Sharply

A brief excerpt:

Every month I track about 35 local housing markets in the US, and I usually post several markets at a time. But this is worth noting.There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

The Denver market is still hot, with historically low inventory, prices increasing, and homes selling above list price, but we are seeing a sharp increase in active inventory. We are still a long way from the “only looky-loos and crickets” phase of the housing cycle, but there is a clear sea change in active inventory.

The Denver Metro Association of Realtors® (DMAR) has released their data for April this morning. From the DMAR: DMAR Real Estate Market Trends ReportThe increased interest rates are already impacting the amount of inventory sitting on the market. While Denver Metro is still relatively low in inventory, the word “historic” is no longer applicable as there were 610 fewer properties on the market last year compared to today. The market usually sees an 8.59 percent increase in month-over-month inventory. This month, it saw an outstanding 44.26 percent increase.DMAR reports total residential active inventory (detached and attached) was 3,204 at the end of April, up 44.3% from 2,221 at the end of March, and up 23.5% year-over-year from 2,594 in March 2021. Inventory is up 171% from the all-time low set in January of this year.

ISM® Services Index Decreased to 57.1% in April, Employment Contracted

by Calculated Risk on 5/04/2022 10:07:00 AM

(Posted with permission). The ISM® Services index was at 57.1%, down from 58.3% last month. The employment index decreased to 49.5%, from 54.0%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 57.1% April 2022 Services ISM® Report On Business®

Economic activity in the services sector grew in April for the 23rd month in a row — with the Services PMI® registering 57.1 percent — say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In April, the Services PMI® registered 57.1 percent, 1.2 percentage points lower than March’s reading of 58.3 percent. The Business Activity Index registered 59.1 percent, an increase of 3.6 percentage points compared to the reading of 55.5 percent in March, and the New Orders Index figure of 54.6 percent is 5.5 percentage points lower than the March reading of 60.1 percent.

...

Employment activity in the services sector contracted in April. ISM®’s Employment Index registered 49.5 percent, down 4.5 percentage points from the reading of 54 percent registered in March. Comments from respondents include: “Job openings exist, but finding talent to fill them remains a struggle across most industry sectors and job categories” and “Demand for employment remains hypercompetitive; there is just not enough qualified personnel available.”

emphasis added

Trade Deficit increased to $109.8 Billion in March

by Calculated Risk on 5/04/2022 08:40:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $109.8 billion in March, up $20.0 billion from $89.8 billion in February, revised.

March exports were $241.7 billion, $12.9 billion more than February exports. March imports were $351.5 billion, $32.9 billion more than February imports.

emphasis added

Click on graph for larger image.

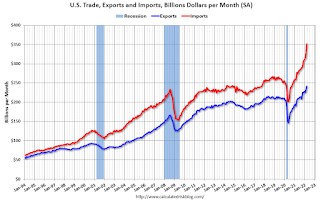

Click on graph for larger image.Both exports and imports increased in March.

Exports are up 18% year-over-year; imports are up 27% year-over-year.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

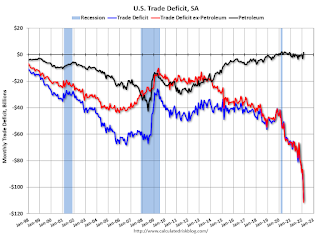

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China increased to $34.0 billion in March, from $27.7 billion a year ago.

ADP: Private Employment Increased 247,000 in April

by Calculated Risk on 5/04/2022 08:19:00 AM

Private sector employment increased by 247,000 jobs from March to April according to the April ADP® National Employment ReportTM. Broadly distributed to the public each month, free of charge, the ADP National Employment Report is produced by the ADP Research Institute® in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual data of those who are on a company’s payroll, measures the change in total nonfarm private employment each month on a seasonally-adjusted basisThis was below the consensus forecast of 395,000 for this report.

“In April, the labor market recovery showed signs of slowing as the economy approaches full employment,” said Nela Richardson, chief economist, ADP. “While hiring demand remains strong, labor supply shortages caused job gains to soften for both goods producers and services providers. As the labor market tightens, small companies, with fewer than 50 employees, struggle with competition for wages amid increased costs.”

emphasis added

The BLS report will be released Friday, and the consensus is for 400 thousand non-farm payroll jobs added in April. The ADP report has not been very useful in predicting the BLS report, but this suggests a weaker than expected BLS report.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 5/04/2022 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 29, 2022.

... The Refinance Index increased 0.2 percent from the previous week and was 71 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index increased 5 percent compared with the previous week and was 11 percent lower than the same week one year ago.

“Treasury yields eased slightly last week but remained close to 2018 highs, as financial markets await the news from the Federal Reserve on its latest plans for rate hikes and reducing its balance sheet holdings. The 30-year fixed rate was 5.36 percent, up over two percentage points from a year ago. The 127-basis point jump in rates over the past two months has triggered a 49 percent drop in refinance activity,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications increased for conventional, FHA, and VA loans and were up 4 percent overall. This is potentially a good sign for the spring home buying season, which has seen a slow start thus far. The purchase market remains challenged by low levels of housing inventory and rapid home-price gains, as well as the affordability hit from higher mortgage rates that are forcing prospective buyers to factor in higher monthly payments. The ARM share remained unchanged at around 9 percent, which is well below the 30 percent mark observed in the mid-2000s.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 5.36 percent from 5.37 percent, with points decreasing to 0.63 from 0.67 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

According to the MBA, purchase activity is down 11% year-over-year unadjusted.

According to the MBA, purchase activity is down 11% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, May 03, 2022

Wednesday: FOMC Statement, Trade Deficit, ADP Employment, ISM Services

by Calculated Risk on 5/03/2022 11:54:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 395,000 payroll jobs added in April, down from 455,000 added in March.

• At 8:30 AM, Trade Balance report for March from the Census Bureau. The consensus is the trade deficit to be $107.0 billion. The U.S. trade deficit was at $89.2 Billion in February.

• At 10:00 AM, the ISM Services Index for April. The consensus is for a reading of 58.5, up from 58.3.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate by 50bp at this meeting and announce "commencement of balance sheet runoff".

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.2% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 219.8 | --- | ≥2321 | |

| New Cases per Day3🚩 | 60,410 | 47,510 | ≤5,0002 | |

| Hospitalized3🚩 | 11,584 | 10,531 | ≤3,0002 | |

| Deaths per Day3 | 318 | 320 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

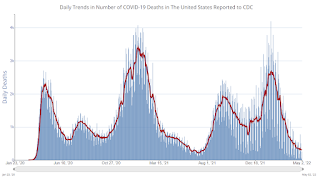

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.