by Calculated Risk on 5/10/2022 09:00:00 PM

Tuesday, May 10, 2022

Wednesday: CPI

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for April from the BLS. The consensus is for 0.2% increase in CPI (up 8.1% YoY), and a 0.4% increase in core CPI (up 6.1% YoY).

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.3% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 220.2 | --- | ≥2321 | |

| New Cases per Day3🚩 | 74,712 | 60,554 | ≤5,0002 | |

| Hospitalized3🚩 | 13,538 | 12,047 | ≤3,0002 | |

| Deaths per Day3 | 323 | 331 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

Mortgage Originations by Credit Score and Age

by Calculated Risk on 5/10/2022 12:01:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Mortgage Originations by Credit Score and Age

A brief excerpt:

The NY Fed released the Q1 Quarterly Report on Household Debt and Credit this morning. Here are a couple of charts from the report.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

The first graph shows mortgage originations by credit score (this includes both purchase and refinance). Look at the difference in credit scores in the recent period compared to the during the bubble years (2003 through 2006). Recently there have been almost no originations for borrowers with credit scores below 620, and few below 660. A significant majority of recent originations have been to borrowers with credit score above 760.

Solid underwriting is a key reason I’ve argued Don't Compare the Current Housing Boom to the Bubble and Bust, Look instead at the 1978 to 1982 period for lessons.

From the NY Fed:

Mortgage originations, measured as appearances of new mortgages on consumer credit reports and which include refinances, were at $859 billion in 2022Q1. This represented a decrease from the high volumes seen during 2021, but still was $197 billion higher than the volume seen in 2020Q1, just before the pandemic hit.

The median credit score of newly originated mortgages declined again, to 776, down from a series high in 2021Q1 of 788. Yet, credit scores on newly originated mortgages remain very high and reflect continuing high lending standards.

NY Fed Q1 Report: Total Household Debt Increases to $15.8 trillion

by Calculated Risk on 5/10/2022 11:10:00 AM

From the NY Fed: Total Household Debt Increases in Q1 2022, Driven by Mortgage and Auto Balances

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The Report shows a solid increase in total household debt in the first quarter of 2022, increasing by $266 billion (1.7%) to $15.84 trillion. Balances now stand $1.7 trillion higher than at the end of 2019, before the COVID-19 pandemic. The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel.

Mortgage balances rose by $250 billion in the first quarter of 2022 and stood at $11.18 trillion at the end of March. In line with seasonal trends typically seen at the start of the year, credit card balances declined by $15 billion. Credit card balances are still $71 billion higher than Q1 2021 and represent a substantial year-over-year increase. Auto loan balances increased by $11 billion in the first quarter, while student loan balances increased by $14 billion and now stand at $1.59 trillion. In total, non-housing balances grew by $17 billion.

Mortgage and auto loan originations both declined in the first quarter, after historically high volumes in 2021. Mortgage originations were at $859 billion, representing a decline from the high volumes seen during 2021, yet still $197 billion higher than in Q1 2020, right before the pandemic hit the United States. The volume of newly originated auto loans was $177 billion during the first quarter, primarily reflecting an increase in auto prices. Aggregate limits on credit card accounts increased by $64 billion and now stand at $4.12 trillion–$224 billion above the pre-pandemic level.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are three graphs from the report:

The first graph shows aggregate consumer debt increased in Q1. Household debt previously peaked in 2008 and bottomed in Q3 2013. Unlike following the great recession, there wasn't a huge decline in debt during the pandemic.

From the NY Fed:

Aggregate household debt balances increased by $266 billion in the first quarter of 2022, a 1.7% rise from 2021Q4. Balances now stand at $15.84 trillion, $1.7 trillion higher than at the end of 2019, just before the Covid pandemic.

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate was unchanged in Q1. From the NY Fed:

Aggregate delinquency rates were unchanged in the first quarter of 2022 and remain very low, after declining sharply through the beginning of the pandemic. Delinquency rates have been low in part due to forbearances (provided by both the CARES Act and voluntarily offered by lenders), which protect borrowers’ credit records from the reporting of skipped or deferred payments. Although these forbearances have ended for most types of debts, the pause on student loan payments remains in place. As of late March, 2.7% of outstanding debt was in some stage of delinquency, a 2.0 percentage point decrease from the fourth quarter of 2019, just before the COVID-19 pandemic hit the United States.There is much more in the report.

Second Home Market: South Lake Tahoe in April

by Calculated Risk on 5/10/2022 08:11:00 AM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes like the recent FHFA Targeted Increases to Enterprise Pricing Framework, rising mortgage rates or the easing of the pandemic.

This graph is for South Lake Tahoe since 2004 through April 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, but up from the record low set in February 2022, and up slightly year-over-year. Prices are up 12.7% YoY (but the YoY change has been trending down).

Monday, May 09, 2022

Tuesday: Q1 Quarterly Report on Household Debt and Credit

by Calculated Risk on 5/09/2022 09:10:00 PM

From Matthew Graham at Mortgage News Daily: Rates Start High, But Improved Significantly By The Afternoon

2022 has been the year of volatility for mortgage rates with most of the swings resulting in successive runs to long-term highs. Every now and then, however, rates have a good day. Today was one of those days. [30 year fixed 5.52%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for April.

• At 11:00 AM, NY Fed: Q1 Quarterly Report on Household Debt and Credit

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.3% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 220.2 | --- | ≥2321 | |

| New Cases per Day3🚩 | 66,564 | 58,569 | ≤5,0002 | |

| Hospitalized3🚩 | 12,466 | 11,823 | ≤3,0002 | |

| Deaths per Day3 | 323 | 324 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

Homebuilder Comments in April: “Demand is slowing", "Investors pulling back"

by Calculated Risk on 5/09/2022 03:09:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Homebuilder Comments in April: “Demand is slowing", "Investors pulling back"

A brief excerpt:

Read these comments. These are clear signs of a slowdown.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Some homebuilder comments courtesy of Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting (a must follow for housing on twitter!):

...

#Dallas builder: “Interest lists are shrinking or buyers are truly pausing.”

...

#SanAntonio builder: “Traffic has been cut in half since the hike in rates.”

#Raleigh builder: “Investor activity has slowed dramatically.”

...

Allentown builder: “Double hit of higher home prices and higher mortgage interest rates clearly has reduced the number of qualified buyers. Our waiting list is almost zero as of April 30th.”

#Philadelphia builder: “Between higher interest rates and higher sales prices, along with high gas prices and a volatile stock market, we’re seeing a pullback in our sales.”

#Tampa builder: “We’ve seen a significant shift in buyer behavior in the last 30 days. Florida was on fire and pricing has really come to a high point, and people are not willing to pay the prices anymore.”

#Indianapolis builder: “Traffic has significantly declined and people have paused on moving forward with purchases.”

Fed Survey: Banks reported Eased Standards, Weaker Demand for Residential Real Estate Loans

by Calculated Risk on 5/09/2022 02:06:00 PM

From the Federal Reserve: The April 2022 Senior Loan Officer Opinion Survey on Bank Lending Practices

The April 2022 Senior Loan Officer Opinion Survey on Bank Lending Practices addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the first quarter of 2022.

Regarding loans to businesses, respondents to the survey reported, on balance, unchanged standards for commercial and industrial (C&I) loans to firms of all sizes, after having eased them over the previous four quarters, while demand strengthened over the first quarter. Meanwhile, banks reported unchanged standards and demand for most commercial real estate (CRE) loan categories except for those secured by multifamily residential properties, for which they eased standards and demand strengthened on net.

Banks also responded to a set of special questions about changes in lending policies and demand for CRE loans over the past year. Banks reportedly eased some lending terms across all CRE loan categories, including the maximum loan size and maturity, the spread of loan rates over their cost of funds, the length of interest-only periods, and the market areas served.

For loans to households, banks eased standards across most categories of residential real estate (RRE) loans and home equity lines of credit (HELOCs) over the first quarter, while also reporting weaker demand for all types of RRE loans but stronger demand for HELOCs on net. In addition, banks eased standards for card loans and auto loans, while demand reportedly strengthened for all consumer loan types over the first quarter

emphasis added

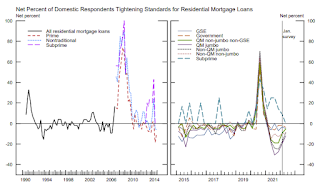

Click on graph for larger image.

Click on graph for larger image.This graph on Residential Real Estate lending is from the Senior Loan Officer Survey Charts.

This shows that banks have eased standards for residential real estate.

The second graph shows demand for residential real estate.

This was was Q1. Demand is probably dropping sharply in Q2.

This was was Q1. Demand is probably dropping sharply in Q2.

Housing Market: Where it's at. Where it's going. May 2022 Update

by Calculated Risk on 5/09/2022 11:08:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Housing Market: Where it's at. Where it's going.

A brief excerpt:

House prices are up 20% year-over-year. Inventory is near record lows. And real estate agents are still selling homes well above list price. And on credit, lending standards have been reasonably solid, and mortgage delinquencies are very low.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

However, mortgage rates are up sharply (from 3% six months ago to 5.64% today), and we are starting to see an increase in inventory levels. House prices are too high based on fundamentals like price-to-income and price-to-rent. And some investors appear to be pulling back due to higher cap rates, and some builders are reporting buyers actually want to negotiate on price!

...

On mortgage rates, it is the change in monthly payments that impacts housing. Monthly payments include principal, interest, taxes, insurance (PITI), and sometimes HOA fees (Homeowners Association). We could also include maintenance, utilities and other costs. The following graph shows the year-over-year change in principal & interest (P&I) assuming a fixed loan amount since 1977. Currently P&I is up about 35% year-over-year for a fixed amount (this doesn’t take into account the change in house prices).

The last time we saw an increase like this in monthly payments was in the ‘78 to’82 period. This is one reason I’ve been suggesting Housing: Don't Compare the Current Housing Boom to the Bubble and Bust, Look instead at the 1978 to 1982 period for lessons.

Housing Inventory May 9th Update: Inventory Down 1.6% Year-over-Year

by Calculated Risk on 5/09/2022 09:00:00 AM

Tracking existing home inventory is very important in 2022.

Inventory usually declines in the winter, and then increases in the spring. Inventory bottomed seasonally at the beginning of March 2022 and is now up 27% since then.

This inventory graph is courtesy of Altos Research.

Last year inventory bottomed seasonally in April 2021 - very late in the year. This year, by this measure, inventory bottomed seasonally at the beginning of March.

Inventory is still very low. Compared to the same week in 2021, inventory is down 1.6% from 310 thousand, but compared to the same week in 2020, and inventory is down 58.3% from 732 thousand. Compared to 3 years ago, inventory is down 66.1% from 902 thousand.

1. The seasonal bottom (already happened on March 4th for Altos)✅

2. Inventory up year-over-year (likely next week)

3. Inventory up compared to two years ago (currently down 58% according to Altos)

4. Inventory back to 1999 levels (currently down 66%).

For the second milestone, here is a table of the year-over-year change by week since the beginning of the year.

| Week Ending | YoY Change |

|---|---|

| 12/31/2021 | -30.0% |

| 1/7/2022 | -26.0% |

| 1/14/2022 | -28.6% |

| 1/21/2022 | -27.1% |

| 1/28/2022 | -25.9% |

| 2/4/2022 | -27.9% |

| 2/11/2022 | -27.5% |

| 2/18/2022 | -25.8% |

| 2/25/2022 | -24.9% |

| 3/4/2022 | -24.2% |

| 3/11/2022 | -21.7% |

| 3/18/2022 | -21.7% |

| 3/25/2022 | -19.0% |

| 4/1/2022 | -17.6% |

| 4/8/2022 | -14.8% |

| 4/15/2022 | -13.1% |

| 4/22/2022 | -11.2% |

| 4/29/2022 | -4.9% |

| 5/6/2022 | -1.6% |

Four High Frequency Indicators for the Economy

by Calculated Risk on 5/09/2022 08:27:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Note: Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

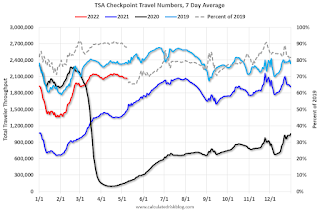

The TSA is providing daily travel numbers.

This data is as of May 8th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 11.7% from the same day in 2019 88.3% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $87 million last week, down about 70% from the median for the week.

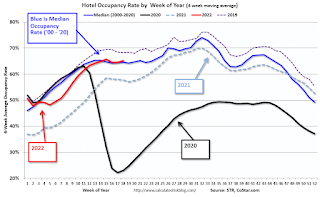

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

This data is through April 30th. The occupancy rate was down 3.4% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

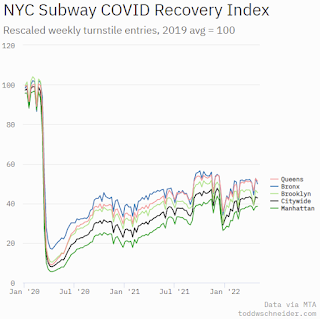

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, May 6th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".