by Calculated Risk on 5/16/2022 04:39:00 PM

Monday, May 16, 2022

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 0.94% in April"

Note: This is as of April 30th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.94% in April

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 11 basis points from 1.05% of servicers’ portfolio volume in the prior month to 0.94% as of April 30, 2022. According to MBA’s estimate, 470,000 homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 6 basis points to 0.43%. Ginnie Mae loans in forbearance decreased 9 basis points to 1.29%, and the forbearance share for portfolio loans and private-label securities (PLS) declined 29 basis points to 2.15%.

“With the number of borrowers in forbearance decreasing to less than half a million, the pace of monthly forbearance exits reached its lowest level since MBA started tracking exits in June 2020,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Servicers are expected to continue making small incremental inroads to the remaining loans in forbearance.”

In addition to improvement in the overall forbearance rate, the percentage of borrowers who were current on their mortgage payments increased to the highest level of 2022, despite potential headwinds such as high inflation and stock market volatility.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time.

The share of forbearance plans is decreasing, and, at the end of April, there were about 470,000 homeowners in forbearance plans.

Lawler: Mortgage/Treasury Spreads Part II: “Decomposing” the Widening This Year

by Calculated Risk on 5/16/2022 12:51:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Mortgage/Treasury Spreads Part II: “Decomposing” the Widening This Year

A brief excerpt:

From housing economist Tom Lawler:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

From the end of last year to May 6th of this year 30-year fixed mortgage rates increased by about 237 basis points, the largest increase over such a short period of time since the early 1980’s. Over that same period other interest rates went up sharply as well, including Treasury rates, but the increases in Treasury rates was significantly lower than the rise in mortgage rates.

Click on graph for larger image.

During this same period, Fannie Mae’s required net yield on purchases of 30-year fixed-rate mortgages for delivery in 30-days, which is set based on prices of mortgage-backed securities, also increased by 233 basis points. As such, almost all of the “widening” in the spread between mortgage rates and Treasury rates reflected a widening in MBS yields relative to Treasury yields.

So: why did MBS yields increase by much more than Treasury yields over this period?

Housing Inventory May 16th Update: Inventory UP 1.5% Year-over-Year

by Calculated Risk on 5/16/2022 09:32:00 AM

Altos reports inventory is up year-over-year!

Inventory usually declines in the winter, and then increases in the spring. Inventory bottomed seasonally at the beginning of March 2022 and is now up 32% since then.

This inventory graph is courtesy of Altos Research.

Inventory is still very low. Compared to the same week in 2021, inventory is up 1.5% from 314 thousand, however compared to the same week in 2020, and inventory is down 56.4% from 729 thousand. Compared to 3 years ago, inventory is down 65.2% from 915 thousand.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 56% according to Altos)

4. Inventory up compared to 2019 (currently down 65%).

Four High Frequency Indicators for the Economy

by Calculated Risk on 5/16/2022 08:15:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Note: Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

The TSA is providing daily travel numbers.

This data is as of May 15th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 10.7% from the same day in 2019 89.3% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $277 million last week, up about 17% from the median for the week due to strong sales for Dr Strange.

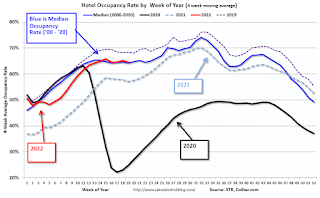

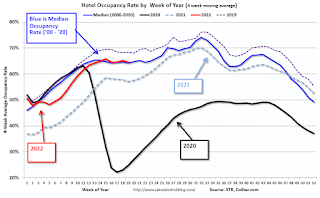

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through May 7th. The occupancy rate was down 6.1% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

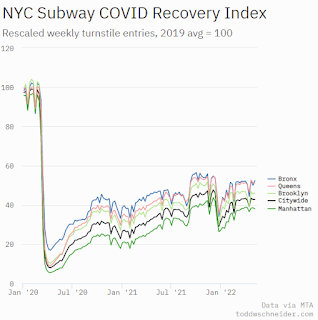

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, May 13th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, May 15, 2022

Sunday Night Futures

by Calculated Risk on 5/15/2022 07:24:00 PM

Weekend:

• Schedule for Week of May 15, 2022

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for May. The consensus is for a reading of 17.0, down from 24.6.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 12 and DOW futures are up 84 (fair value).

Oil prices were up over the last week with WTI futures at $111.19 per barrel and Brent at $112.21 per barrel. A year ago, WTI was at $66 and Brent was at $70 - so WTI oil prices are up 70% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.46 per gallon. A year ago prices were at $3.02 per gallon, so gasoline prices are up $1.44 per gallon year-over-year.

Q2 GDP Forecasts

by Calculated Risk on 5/15/2022 12:28:00 PM

From BofA:

We forecast 2.7% GDP growth this year given wealth and liquidity remain supportive. We expect growth to slow to 1.8% next year, with a sequential slowdown to just 1% by 4Q as a restrictive Fed takes its toll. [Q2 3.5% May 13 estimate]From Goldman:

emphasis added

We are downgrading our Q2 GDP tracking estimate by 0.4pp to +2.5% (qoq ar), below consensus of +3.0%. The downgrade to US auto production schedules over the last month and the pickup in core goods inflation in the CPI and PPI reports is consistent with supply chain disruptions from the Russia-Ukraine War and the China covid lockdowns. [May 14 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is 1.8 percent on May 9, down from 2.2 percent on May 4. [May 9 estimate]

Saturday, May 14, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 5/14/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• What will Happen with House Prices?

• Realtor.com Reports Weekly Inventory Up Slightly Year-over-year

• 2nd Look at Local Housing Markets in April

• Mortgage Originations by Credit Score and Age

• Homebuilder Comments in April: “Demand is slowing", "Investors pulling back" Clear signs of a market shift

• Housing Market: Where it's at. Where it's going.

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

The blog will continue as always!

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of May 15, 2022

by Calculated Risk on 5/14/2022 08:11:00 AM

The key reports this week are April Retail Sales, Housing Starts and Existing Home Sales.

For manufacturing, April Industrial Production, and the May NY and Philly Fed manufacturing surveys will be released.

Fed Chair Powell speaks on Tuesday.

Note: The Census Bureau is expected to release "National, State, and County housing units" from the 2020 Census sometime in May.

8:30 AM: The New York Fed Empire State manufacturing survey for May. The consensus is for a reading of 17.0, down from 24.6.

8:30 AM ET: Retail sales for April is scheduled to be released. The consensus is for 0.8% increase in retail sales.

8:30 AM ET: Retail sales for April is scheduled to be released. The consensus is for 0.8% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales were up 0.7% in March.

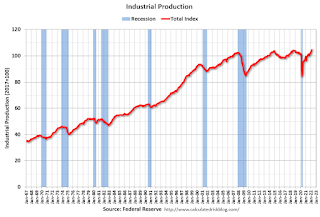

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 78.5%.

10:00 AM: The May NAHB homebuilder survey. The consensus is for a reading of 75 down from 77 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

2:00 PM: Discussion, Fed Chair Jerome H. Powell, Conversation with Nick Timiraos, At the Wall Street Journal Future of Everything Festival, New York, New York

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Housing Starts for April.

8:30 AM ET: Housing Starts for April. This graph shows single and total housing starts since 1968.

The consensus is for 1.773 million SAAR, down from 1.793 million SAAR in March.

During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand up from 203 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for May. The consensus is for a reading of 16.7, down from 17.6.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 5.62 million SAAR, down from 5.77 million.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 5.62 million SAAR, down from 5.77 million.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: State Employment and Unemployment (Monthly) for April 2022

Friday, May 13, 2022

COVID May 13, 2022: New Cases and Hospitalizations Increasing

by Calculated Risk on 5/13/2022 09:11:00 PM

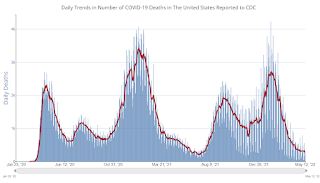

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.4% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 220.5 | --- | ≥2321 | |

| New Cases per Day3🚩 | 87,382 | 67,403 | ≤5,0002 | |

| Hospitalized3🚩 | 14,604 | 12,795 | ≤3,0002 | |

| Deaths per Day3 | 272 | 322 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

Hotels: Occupancy Rate Down 6.1% Compared to Same Week in 2019

by Calculated Risk on 5/13/2022 02:31:00 PM

U.S. hotel occupancy declined from the previous week, while average daily rate (ADR) increased slightly, according to STR‘s latest data through May 7.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

May 1-7, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 63.9% (-6.1%)

• verage daily rate (ADR): $147.24 (+12.0%)

• evenue per available room (RevPAR): $94.10 (+5.1%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).