by Calculated Risk on 5/23/2022 02:46:00 PM

Monday, May 23, 2022

BofA: "High hurdles to rebalance the existing home market"

CR Note: This analysis is similar to many of my comments in What will Happen with House Prices?

A few excerpts from a BofA research note: High hurdles to rebalance the existing home market .

As the Fed now tries to slow the economy down, housing will be front and center as one of the main interest rate-sensitive sectors.Earlier this month I wrote:

As we have been writing, mortgage rates have spiked this year to around 5.5% creating a record affordability shock. This should lead to a major pullback in home sales and turnover. However, home prices will likely continue to move higher, and we recently revised up our home price appreciation forecast this year to 15%.

It is hard to understate how tight the housing market is right now. The key metric to gauge the supply-demand imbalance is existing homes months supply, which is at a historically low level of 2.2 months as of April. As we recently pointed out in Fed throwing shade on hot housing market, months supply has a strong historical inverse relationship with % mom home prices. The record tightness therefore helps explain the record gains in home prices.

Click on table for larger image.

Looking at the long history, a balanced market is likely closer to 5-7 months. To get from 2 months to 5 months would take some pretty big changes and swings in the existing home market. To assess this, we create a matrix for months supply with varying assumptions for weaker home sales and greater inventories. A combined 20% pullback in existing home sales and 20% increase in inventories, would add slightly over 1 month to months supply, bringing it up to 3.3 months. To get back to 5 months and the minimum threshold for a balanced market, it would take more severe moves in the range of 40% for both.

emphasis added

If sales decline to 5.0 million SAAR, inventory would have to increase to around 2.5 million units to reach 6 months-of-supply. This also might seem unlikely and would seem to argue for the slow house price growth scenario; however, I think there are reasons we might sales decline to around 5 million SAAR. We could see a wealth effect from the recent decline in the stock market and speculative assets. Also, my suspicion is household formation will slow (I think there was a sharp increase in household formation in 2021 that will slow later this year).I'll have more on household formation later this week.

Final Look at Local Housing Markets in April

by Calculated Risk on 5/23/2022 11:07:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in April

A brief excerpt:

And a table of April sales. Sales in these areas were down 9.5% YoY, Not Seasonally Adjusted (NSA). The NAR reported sales NSA in April (464,000) were 9.6% below sales in April 2021 (513,000). So, this sample of local markets is similar to the NAR report.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

The table doesn’t include California where sales were down 8.5% year-over-year.

Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle), North Texas (Dallas) and Santa Clara (San Jose), Mid-Florida (Tampa, Orlando), Jacksonville, Source: Northeast Florida Association of REALTORS®

3) Totals do not include Denver, Atlanta on Minneapolis (included in state totals).

I expect we will see further increases in inventory - and further decline in sales - in May due to higher mortgage rates (more than the usual seasonal increase in inventory).

Housing Inventory May 23rd Update: Inventory UP 8.2% Week-over-week

by Calculated Risk on 5/23/2022 09:19:00 AM

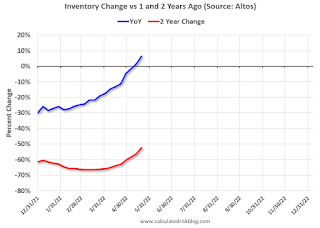

Altos reports inventory is up year-over-year!

Inventory usually declines in the winter, and then increases in the spring. Inventory bottomed seasonally at the beginning of March 2022 and is now up 43% since then.

This inventory graph is courtesy of Altos Research.

Inventory is still very low. Compared to the same week in 2021, inventory is up 6.4% from 324 thousand, however compared to the same week in 2020, and inventory is down 52.5% from 724 thousand. Compared to 3 years ago, inventory is down 63.3% from 938 thousand.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 52.5% according to Altos)

4. Inventory up compared to 2019 (currently down 63.3%).

Four High Frequency Indicators for the Economy

by Calculated Risk on 5/23/2022 08:49:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Note: Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

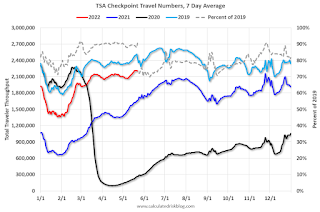

The TSA is providing daily travel numbers.

This data is as of May 22nd.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 9.5% from the same day in 2019 90.5% of 2019). (Dashed line)

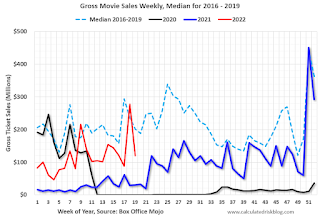

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $120 million last week, down about 40% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through May 14th. The occupancy rate was down 5.9% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

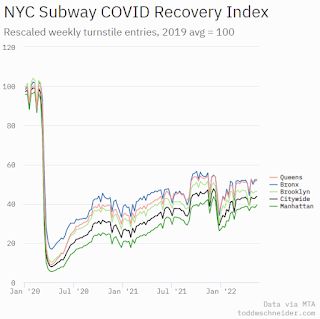

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, May 20th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, May 22, 2022

Sunday Night Futures

by Calculated Risk on 5/22/2022 07:26:00 PM

Weekend:

• Schedule for Week of May 22, 2022

• Quarterly Starts by Purpose and Design: "Built for rent" Increasing

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for April. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 33 and DOW futures are up 200 (fair value).

Oil prices were down over the last week with WTI futures at $110.28 per barrel and Brent at $112.55 per barrel. A year ago, WTI was at $66 and Brent was at $69 - so WTI oil prices are up about 70% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.58 per gallon. A year ago prices were at $3.02 per gallon, so gasoline prices are up $1.56 per gallon year-over-year.

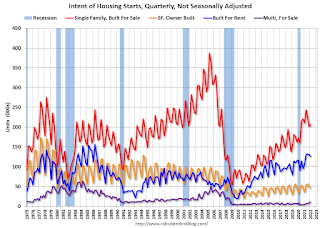

Quarterly Starts by Purpose and Design: "Built for rent" Increasing

by Calculated Risk on 5/22/2022 11:48:00 AM

Along with the monthly housing starts for April last week, the Census Bureau released Housing Units Started by Purpose and Design through Q1 2022.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale (red) were down 2% in Q1 2022 compared to Q1 2021.

Owner built starts (orange) were up 28% year-over-year.

Condos built for sale increased and are still low.

The 'units built for rent' (blue) and were up 19% in Q1 2022 compared to Q1 2021.

Saturday, May 21, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 5/21/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Lawler: The Sharp increase in Monthly Payments in Selected Metro Areas

• NAR: Existing-Home Sales Decreased to 5.61 million SAAR in April

• April Housing Starts: All-Time Record Housing Units Under Construction

• 3rd Look at Local Housing Markets

• A Slowdown in Showings

• Lawler: Mortgage/Treasury Spreads Part II: “Decomposing” the Widening This Year

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of May 22, 2022

by Calculated Risk on 5/21/2022 08:11:00 AM

The key reports this week are the second estimate of Q1 GDP, April New Home Sales, and Personal Income and Outlays for April.

For manufacturing, the May Richmond and Kansas City Fed manufacturing surveys will be released.

Note: The Census Bureau is expected to release "National, State, and County housing units" from the 2020 Census sometime in May.

8:30 AM ET: Chicago Fed National Activity Index for April. This is a composite index of other data.

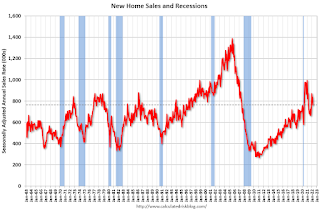

10:00 AM: New Home Sales for April from the Census Bureau.

10:00 AM: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 750 thousand SAAR, down from 763 thousand SAAR in March.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.6% increase in durable goods orders.

2:00 PM: FOMC Minutes, Minutes Meeting of May 3-4, 2022

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand up from 218 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2021 (Second estimate). The consensus is that real GDP decreased 1.3% annualized in Q1, up from the advance estimate of -1.4%.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 1.9% decrease in the index.

11:00 AM: the Kansas City Fed manufacturing survey for May.

8:30 AM ET: Personal Income and Outlays, April 2021. The consensus is for a 0.6% increase in personal income, and for a 0.7% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 6.3% YoY, and core PCE prices up 4.9% YoY.

10:00 AM: University of Michigan's Consumer sentiment index (Final for May). The consensus is for a reading of 59.1.

Friday, May 20, 2022

Q2 GDP Forecasts: 2.5% to 3.0%

by Calculated Risk on 5/20/2022 01:21:00 PM

From BofA:

We have revised down our GDP forecast for 2022 and 2023 to 2.6% and 1.5% from 2.7% and 1.8% previously. [Q2 3.0% revised down from 3.5%] [May 20 estimate]From Goldman:

emphasis added

we left our Q2 GDP tracking estimate unchanged at +2.6% (qoq ar) and our past-quarter GDP tracking estimate for Q1 unchanged at -1.5%. [May 19 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is 2.4 percent on May 18, down from 2.5 percent on May 17. [May 18 estimate]

Lawler: The Sharp increase in Monthly Payments in Selected Metro Areas

by Calculated Risk on 5/20/2022 10:31:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: Lawler: The Sharp increase in Monthly Payments in Selected Metro Areas

Excerpt:

According to Mortgage News Daily, the interest rate on a 30-year fixed-rate mortgage for a prime borrower putting 20% down increased to 5.45% earlier this week from 3.14% a year ago. Such an increase would result in a 31.6% jump in the monthly principal and interest (P&I) payment on a mortgage with a fixed dollar amount. However, the increase in the monthly P&I payment for a typical home bought today compared to a year ago would be massively higher than 31.6%, as home prices nationally are up by over 20% from a year earlier, and by much more in many markets. In addition, that means a 20% down payment has risen sharply as well.There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

Below is a table showing the year-over-year increase in a 20% down payment and the P&I payment for a 30-year FRM for the US and for several metro areas on a “typical” single-family home. ...

Click on table for larger image.

...

It is not the absolute mortgage rate, rather the change in monthly payments that is causing the slowdown in the housing market.