by Calculated Risk on 5/25/2022 04:09:00 PM

Wednesday, May 25, 2022

Philly Fed: State Coincident Indexes Increased in 50 States in April

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for April 2022. Over the past three months, the indexes increased in all 50 states, for a three-month diffusion index of 100. Additionally, in the past month, the indexes increased in all 50 states, for a one-month diffusion index of 100. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index increased 1.1 percent over the past three months and 0.3 percent in April.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three-month change in the Philly Fed state coincident indicators. This map was all red during the worst of the Pandemic and also at the worst of the Great Recession.

The map is all positive on a three-month basis.

Source: Philly Fed.

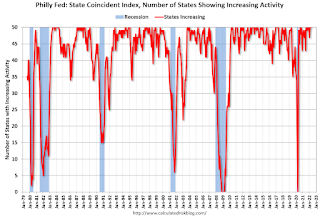

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. In April all 50 states had increasing activity including minor increases.

FOMC Minutes: "Risks to inflation were skewed to the upside"; 50bp increases likely appropriate at next couple of meetings

by Calculated Risk on 5/25/2022 02:07:00 PM

From the Fed: Minutes of the Federal Open Market Committee, May 3–4, 2022. Excerpt on the "Plans for Reducing the Size of the Balance Shee"t:

In their discussion of risks to the outlook, participants emphasized that they were highly attentive to inflation risks and would continue to monitor closely inflation developments and inflation expectations. They agreed that risks to inflation were skewed to the upside and cited several such risks, including those associated with ongoing supply bottlenecks and rising energy and commodity prices—both of which were exacerbated by the Russian invasion of Ukraine and COVID-related lockdowns in China. Also mentioned were the risks associated with nominal wage growth continuing to run above levels consistent with 2 percent inflation over time and the extent to which households' high savings since the onset of the pandemic and healthy balance sheets would support greater-than-expected underlying momentum in consumer spending and contribute to upside inflation pressures. In addition, some participants emphasized that persistently high inflation heightened the risk that longer-term inflation expectations could become unanchored; in that case, the task of returning inflation to 2 percent would be more difficult. Uncertainty about real activity was also seen as elevated. Various participants noted downside risks to the outlook, including risks associated with the Russian invasion and COVID-related lockdowns in China and the likelihood of a prolonged rise in energy and commodity prices.

Several participants who commented on issues related to financial stability noted that the tightening of monetary policy could interact with vulnerabilities related to the liquidity of markets for Treasury securities and to the private sector's intermediation capacity. A couple of participants pointed to increased risks in financial markets linked to commodities following Russia's invasion of Ukraine, which had led to higher prices and volatility across a wide range of energy, agricultural, and metal products. These participants observed that the trading and risk-management practices of some key participants in commodities markets were not fully visible to regulatory authorities and noted that central counterparties (CCPs) needed to remain capable of managing risks associated with heightened volatility or that margin requirements at CCPs could give rise to significant liquidity demands for large banks, broker-dealers, and their clients.

In their consideration of the appropriate stance of monetary policy, all participants concurred that the U.S. economy was very strong, the labor market was extremely tight, and inflation was very high and well above the Committee's 2 percent inflation objective. Against this backdrop, all participants agreed that it was appropriate to raise the target range for the federal funds rate 50 basis points at this meeting. They further anticipated that ongoing increases in the target range for the federal funds rate would be warranted to achieve the Committee's objectives. Participants also agreed that it was appropriate to start reducing the size of the Federal Reserve's balance sheet on June 1, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that would be issued in conjunction with the postmeeting statement. Participants judged that an appropriate firming of the stance of monetary policy, along with an eventual waning of supply–demand imbalances, would help to keep longer-term inflation expectations anchored and bring inflation down over time to levels consistent with the Committee's 2 percent longer-run goal.

All participants reaffirmed their strong commitment and determination to take the measures necessary to restore price stability. To this end, participants agreed that the Committee should expeditiously move the stance of monetary policy toward a neutral posture, through both increases in the target range for the federal funds rate and reductions in the size of the Federal Reserve's balance sheet. Most participants judged that 50 basis point increases in the target range would likely be appropriate at the next couple of meetings. Many participants assessed that the Committee's previous communications had been helpful in shifting market expectations regarding the policy outlook into better alignment with the Committee's assessment and had contributed to the tightening of financial conditions.

All participants supported the plans for reducing the size of the balance sheet. This reduction, starting on June 1, would work in parallel with increases in the target range for the policy rate in firming the stance of monetary policy. A number of participants remarked that, after balance sheet runoff was well under way, it would be appropriate for the Committee to consider sales of agency MBS to enable suitable progress toward a longer-run SOMA portfolio composed primarily of Treasury securities. Any program of sales of agency MBS would be announced well in advance. Regarding risks related to the balance sheet reduction, several participants noted the potential for unanticipated effects on financial market conditions.

Participants agreed that the economic outlook was highly uncertain and that policy decisions should be data dependent and focused on returning inflation to the Committee's 2 percent goal while sustaining strong labor market conditions. At present, participants judged that it was important to move expeditiously to a more neutral monetary policy stance. They also noted that a restrictive stance of policy may well become appropriate depending on the evolving economic outlook and the risks to the outlook. Participants observed that developments associated with Russia's invasion of Ukraine and the COVID-related lockdowns in China posed heightened risks for both the United States and economies around the world. Several participants commented on the challenges that monetary policy faced in restoring price stability while also maintaining strong labor market conditions. In light of the high degree of uncertainty surrounding the economic outlook, participants judged that risk-management considerations would be important in deliberations over time regarding the appropriate policy stance. Many participants judged that expediting the removal of policy accommodation would leave the Committee well positioned later this year to assess the effects of policy firming and the extent to which economic developments warranted policy adjustments.

emphasis added

The Household Mystery: Part II

by Calculated Risk on 5/25/2022 09:51:00 AM

Today, in the Calculated Risk Real Estate Newsletter: The Household Mystery: Part II

Brief excerpt:

Recently there have been two papers that shed some light on this mystery.You can subscribe at https://calculatedrisk.substack.com/.

From SF Fed economist John A. Mondragon and Professor Johannes Wieland: Housing Demand and Remote Work. The authors showed that areas with more work from home (WFH) saw larger house price increases.In this paper we show that the shift to remote work caused a large increase in housing demand. In turn, this increase in housing demand caused house prices and rents to increase sharply. Based on our cross-sectional estimates controlling for migration spillovers, we argue that remote work accounts for at least one half of the 24% increase in house prices from December 2019 to November 2021.And from Federal Reserve economists Daniel García and Andrew Paciorek: The Remarkable Recent Rebound in Household Formation and the Prospects for Future Housing Demand

emphasis added ©Mondragon and WielandThis note updates our previous work on household formation and living arrangements from the summer of 2020. At that early stage in the pandemic, the data showed a dramatic decline in headship rates as millions of Americans changed their living arrangements, many by remaining with or moving back in with parents and older relatives. …Putting these two papers together - it is very possible that work-from-home drove some of the likely sources of household formation over the last 18 months.

In contrast, over the past year and a half there has been a remarkable rebound in the headship rate, driven in large part by a return to the pre-pandemic rates at which younger adults lived with parents or older family members. This rebound has been an important contributor to a huge increase in housing demand.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 5/25/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 20, 2022.

... The Refinance Index decreased 4 percent from the previous week and was 75 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 0.2 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 16 percent lower than the same week one year ago.

“The 30-year fixed rate declined for the second straight week to 5.46 percent but remains well above what borrowers were used to over the past two years. Most refinance borrowers continue to remain on the sidelines as a result, and refinance applications have fallen in nine of the past 10 weeks. Compared to January 2022, refinance activity is down 66 percent,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Higher mortgage rates are also impacting purchase market conditions, as the purchase index remained close to lows last seen in the spring of 2020 when a significant portion of activity was put on hold due to the onset of the pandemic. Currently, higher rates, low inventory, and high prices are keeping prospective buyers out of the market.”

The refinance share of mortgage activity decreased to 32.3 percent of total applications from 33.0 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 9.4 percent of total applications.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 5.46 percent from 5.49 percent, with points decreasing to 0.60 from 0.74 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

According to the MBA, purchase activity is down 16% year-over-year unadjusted.

According to the MBA, purchase activity is down 16% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, May 24, 2022

Wednesday: Durable Goods, FOMC Minutes

by Calculated Risk on 5/24/2022 09:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.6% increase in durable goods orders.

• At 2:00 PM, FOMC Minutes, Minutes Meeting of May 3-4, 2022

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.6% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.0 | --- | ≥2321 | |

| New Cases per Day3🚩 | 104,480 | 95,207 | ≤5,0002 | |

| Hospitalized3🚩 | 19,218 | 16,424 | ≤3,0002 | |

| Deaths per Day3 | 279 | 284 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

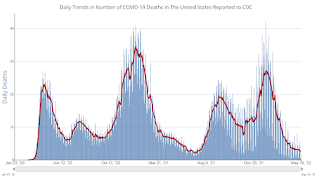

Click on graph for larger image.

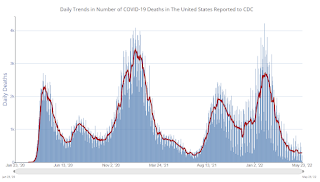

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

FDIC: Problem Banks Declined, Residential REO Increased Slightly in Q1 2022

by Calculated Risk on 5/24/2022 02:09:00 PM

The FDIC released the Quarterly Banking Profile for Q1 2022 this morning:

Net income fell by $17.0 billion (22.2 percent) to $59.7 billion in first quarter 2022 from the year-ago quarter.

...

Total assets increased $253.9 billion (1.1 percent) from fourth quarter 2021 to $24.0 trillion. Cash and balances due from depository institutions declined $183.5 billion (5.2 percent) from fourth quarter 2021. Total loan and lease balances increased $109.9 billion (1.0 percent), federal funds sold increased 48.3 billion (8.1 percent), and securities rose $14.6 billion (0.2 percent). Growth in U.S. Treasury securities (up $37.9 billion, or 2.6 percent) continued to drive the quarterly increases in total securities. The proportion of securities to total assets declined slightly to 26.1 percent from the QBP high of 26.3 percent reported in fourth quarter 2021.

Loans and leases 90 days or more past due or in nonaccrual status (noncurrent loan balances) declined (down $4.5 billion, or 4.5 percent) from fourth quarter 2021, supporting a 5 basis point reduction in the noncurrent rate to 0.84 percent. The noncurrent rate was just 14 basis points above the historical low reported in second quarter 2006. Noncurrent 1–4 family residential real estate loan balances declined most among noncurrent loan categories (down $4.8 billion, or 10.5 percent).

emphasis added

Click on graph for larger image.

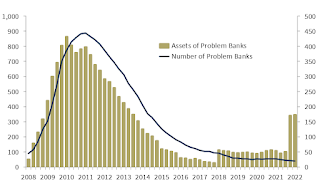

Click on graph for larger image.The FDIC reported the number of problem banks declined to 40.

The number of FDIC-insured institutions declined from 4,839 in fourth quarter 2021 to 4,796. In first quarter, 3 banks opened and 44 institutions merged with other FDIC-insured institutions. The number of banks on the FDIC’s “Problem Bank List” declined by 4 from fourth quarter to 40, the lowest level since QBP data collection began in 1984. Total assets of problem banks increased $3.0 billion to $173.1 billion.11 No banks failed in the first quarter.This graph from the FDIC shows the number of problem banks and assets at problem institutions.

Note: The number of assets for problem banks increased significantly back in 2018 when Deutsche Bank Trust Company Americas was added to the list. An even larger bank was added to the list last year, although the identity of the bank is unclear.

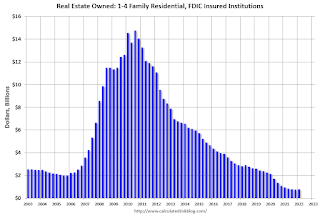

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) increased slightly from $779 million in Q4 2021 to $788 million in Q1 2022.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) increased slightly from $779 million in Q4 2021 to $788 million in Q1 2022. This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

U.S. Births increased Slightly in 2021, First increase since 2014

by Calculated Risk on 5/24/2022 12:16:00 PM

From the National Center for Health Statistics: Births: Provisional Data for 2021. The NCHS reports:

The provisional number of births for the United States in 2021 was 3,659,289, up 1% from 2020 and the first increase in the number of births since 2014.Here is a long-term graph of annual U.S. births through 2021.

The general fertility rate was 56.6 births per 1,000 women aged 15–44, up 1% from 2020 and the first increase in the rate since 2014. The total fertility rate was 1,663.5 births per 1,000 women in 2021, up 1% from 2020. Birth rates declined for women in age groups 15–24, rose for women in age groups 25–49, and was unchanged for adolescents aged 10–14 in 2021. The birth rate for teenagers aged 15–19 declined by 6% in 2021 to 14.4 births per 1,000 females; rates declined for both younger (aged 15–17) and older (aged 18–19) teenagers.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Births had declined for six consecutive years following increases in 2013 and 2014.

Note the amazing decline in teenage births.

With fewer births, and less net migration, demographics are not as favorable as once expected.

There is much more in the report.

April New Home Sales Decline Sharply, almost 6 Months of Inventory Under Construction

by Calculated Risk on 5/24/2022 10:54:00 AM

Today, in the Calculated Risk Real Estate Newsletter: April New Home Sales Decline Sharply, almost 6 Months of Inventory Under Construction

Brief excerpt:

The next graph shows the months of supply by stage of construction. “Months of supply” is inventory at each stage, divided by the sales rate.You can subscribe at https://calculatedrisk.substack.com/.

The inventory of completed homes for sale was at 38 thousand in April, up from the record low of 32 thousand in several months in 2021 and early 2022. That is just over 0.8 months of completed supply (red line). This is lower than the normal level.

The inventory of new homes under construction is at 5.9 months (blue line) - well above the normal level. This elevated level of homes under construction is due to supply chain constraints. This is close to the record set in 1980.

And 118 thousand homes have not been started - about 2.4 months of supply (grey line) - almost double the normal level. Homebuilders are probably waiting to start some homes until they have a firmer grasp on prices and demand.

New Home Sales Decrease Sharply to 591,000 Annual Rate in April

by Calculated Risk on 5/24/2022 10:11:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 591 thousand.

The previous three months were revised down.

Sales of new single‐family houses in April 2022 were at a seasonally adjusted annual rate of 591,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 16.6 percent below the revised March rate of 709,000 and is 26.9 percent below the April 2021 estimate of 809,000

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales are now below pre-pandemic levels.

The second graph shows New Home Months of Supply.

The months of supply increased in April to 9.0 months from 6.9 months in March.

The months of supply increased in April to 9.0 months from 6.9 months in March. The all-time record high was 12.1 months of supply in January 2009. The all-time record low was 3.5 months, most recently in October 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of April was 444,000. This represents a supply of 9.0 months at the current sales rate."

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In April 2022 (red column), 53 thousand new homes were sold (NSA). Last year, 74 thousand homes were sold in April.

The all-time high for April was 116 thousand in 2005, and the all time low for April was 30 thousand in 2011.

This was well below expectations, and sales in the three previous months were revised down sharply. I'll have more later today.

Monday, May 23, 2022

Tuesday: New Home Sales, Richmond Fed Mfg

by Calculated Risk on 5/23/2022 08:45:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Moving Up to Start New Week

Mortgage rates are coming off their best 2 weeks in quite some time--a feat that sounds more impressive than it is by the time we consider the precursors. Namely, the improvement in rates was heavily dependent on vastly bigger movement in the stock market. Stocks and rates don't always move in unison, but when stocks fall enough, it can indicate that investors are seeking safer havens for cash (i.e. moving away from risk). [30 year fixed 5.36%]Tuesday:

emphasis added

• At 10:00 AM ET, New Home Sales for April from the Census Bureau. The consensus is for 750 thousand SAAR, down from 763 thousand SAAR in March.

• Also at 10:00 AM: Richmond Fed Survey of Manufacturing Activity for May.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.5% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 220.9 | --- | ≥2321 | |

| New Cases per Day3🚩 | 102,940 | 93,377 | ≤5,0002 | |

| Hospitalized3🚩 | 17,432 | 15,982 | ≤3,0002 | |

| Deaths per Day3🚩 | 281 | 276 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.