by Calculated Risk on 5/30/2022 12:42:00 PM

Monday, May 30, 2022

Lawler: Large Builders Acquired Lots of Lots over the Last Year

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Large Builders Acquired Lots of Lots over the Last Year

A brief excerpt:

Over the last year some of the nation’s largest home builders acquired an enormous number of lots – either owned outright or “controlled” via land purchase option or other contracts – over the last year in anticipation of a continuation of a strong and perhaps even over-heated economy. Here are the number of lots owned or “controlled” for the three largest home builders.There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

...Obviously, the land/lot acquisition strategy of these (and other) builders over the last 15 months reflected an assumption that the exceptionally strong (frothy?) housing market over that period would continue throughout this year. If, in fact, housing demand slows considerably this year, then there could be some serious weakness in the land/lot markets.

Housing Inventory May 30th Update: Inventory UP 5.7% Week-over-week

by Calculated Risk on 5/30/2022 10:06:00 AM

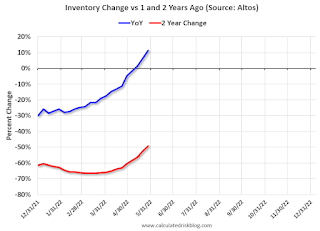

Altos reports inventory is up 11.4% year-over-year.

Inventory usually declines in the winter, and then increases in the spring. Inventory bottomed seasonally at the beginning of March 2022 and is now up 51% since then.

This inventory graph is courtesy of Altos Research.

Inventory is still very low. Compared to the same week in 2021, inventory is up 11.4% from 327 thousand, however compared to the same week in 2020 inventory is down 49.4% from 719 thousand. Compared to 3 years ago, inventory is down 61.6% from 948 thousand.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 49.4% according to Altos)

4. Inventory up compared to 2019 (currently down 61.6%).

Four High Frequency Indicators for the Economy

by Calculated Risk on 5/30/2022 08:40:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Note: Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

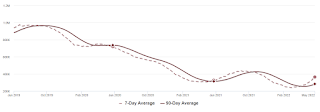

The TSA is providing daily travel numbers.

This data is as of May 29th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 9.5% from the same day in 2019 90.5% of 2019). (Dashed line)

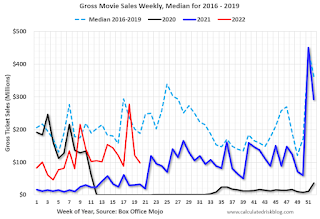

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $98 million last week, down about 48% from the median for the week.

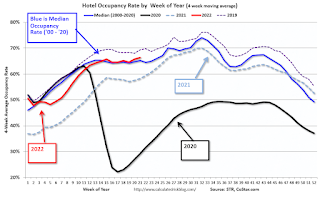

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through May 21st. The occupancy rate was down 3.5% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, May 27th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, May 29, 2022

Energy expenditures as a percentage of PCE

by Calculated Risk on 5/29/2022 02:14:00 PM

During the early stages of the pandemic, energy expenditures as a percentage of PCE hit an all-time low of 3.3% of PCE. Then energy expenditures increased to 2018 levels by the end of last year.

This graph shows expenditures on energy goods and services as a percent of total personal consumption expenditures. This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA.

In general, energy expenditures as a percent of PCE has been trending down for decades. The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

Saturday, May 28, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 5/28/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• The Household Mystery: Part II

• April New Home Sales Decline Sharply, almost 6 Months of Inventory Under Construction

• Final Look at Local Housing Markets in April

• Update: Delinquencies, Foreclosures and REO

• Realtor.com Reports Weekly Inventory Up 9% Year-over-year

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of May 29, 2022

by Calculated Risk on 5/28/2022 08:11:00 AM

The key report scheduled for this week is the May employment report.

Other key reports include the March Case-Shiller house prices, May ISM Manufacturing and Service surveys, and May Vehicle Sales.

All US markets will be closed in observance of Memorial Day.

9:00 AM: S&P/Case-Shiller House Price Index for March.

9:00 AM: S&P/Case-Shiller House Price Index for March.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 20.0% year-over-year increase in the Comp 20 index for March.

9:00 AM: FHFA House Price Index for March 2022. This was originally a GSE only repeat sales, however there is also an expanded index.

9:45 AM: Chicago Purchasing Managers Index for May.

10:00 AM: Dallas Fed Survey of Manufacturing Activity for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

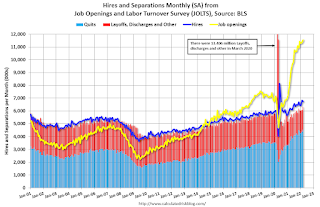

10:00 AM ET: Job Openings and Labor Turnover Survey for April from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for April from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased slightly in March to 11.549 million from 11.344 million in February. The number of job openings (yellow) were up 36% year-over-year.

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 54.5, down from 55.4 in April.

10:00 AM: Construction Spending for April. The consensus is for a 0.5% increase in construction spending.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

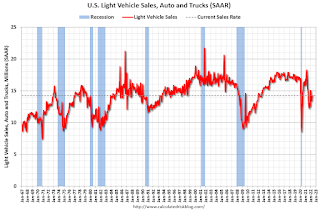

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 14.5 million SAAR in May, up from 14.3 million in April (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 14.5 million SAAR in May, up from 14.3 million in April (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the sales rate for last month.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 280,000 payroll jobs added in May, up from 247,000 in April.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand unchanged from 210 thousand last week.

8:30 AM: Employment Report for May. The consensus is for 320,000 jobs added, and for the unemployment rate to decline to 3.5%.

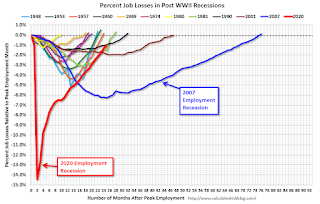

8:30 AM: Employment Report for May. The consensus is for 320,000 jobs added, and for the unemployment rate to decline to 3.5%.There were 428,000 jobs added in April, and the unemployment rate was at 3.6%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 25 months after the onset, has recovered quicker than the previous two recessions.

10:00 AM: the ISM Services Index for May. The consensus is for a reading of 56.4, down from 57.1.

Friday, May 27, 2022

Q2 GDP Forecasts: Around 3.0%

by Calculated Risk on 5/27/2022 04:35:00 PM

From BofA:

We are tracking 3.0% qoq saar for 2Q GDP. Next week's trade data will be a big swing factor. [May 27 estimate]From Goldman:

emphasis added

The normalization in the trade balance was even larger than our previous assumptions, and we boosted our Q2 GDP tracking estimate by two tenths to +2.8% (qoq ar). [May 27 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is 1.9 percent on May 27, up from 1.8 percent on May 25. After this morning's releases from the US Bureau of Economic Analysis and the US Census Bureau, an increase in the nowcast of second-quarter real net exports was partially offset by a decrease in the nowcast of second-quarter real gross private domestic investment. [May 27 estimate]

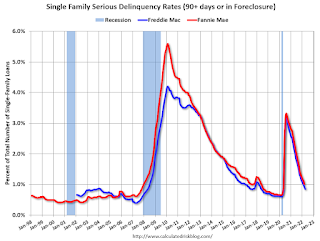

Freddie Mac: Mortgage Serious Delinquency Rate decreased in April

by Calculated Risk on 5/27/2022 03:33:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in April was 0.85%, down from 0.92% March. Freddie's rate is down year-over-year from 2.15% in April 2021.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report but are not reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once (if) they are employed.

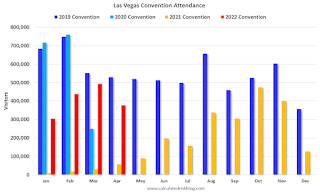

Las Vegas April 2022: Visitor Traffic Down 4.5% Compared to 2019

by Calculated Risk on 5/27/2022 12:34:00 PM

Note: I like using Las Vegas as a measure of recovery for both leisure (visitors) and business (conventions).

From the Las Vegas Visitor Authority: April 2022 Las Vegas Visitor Statistics

The pandemic recovery continued in April with strengthening visitation as the destination hosted nearly 3.4M visitors, roughly 31% ahead of last April and less than 5% behind April 2019.

Overall hotel occupancy reached 84%, up approx. 18.4 pts YoY and down only 7 pts vs. April 2019. Weekend occupancy exceeded 93% (up 9.7 pts YoY and down 3.5 pts vs. April 2019) and Midweek occupancy exceeded 79% (up 21.5 pts YoY and down 9.5 pts vs. April 2019).

Breaking the previous monthly record set just this past October, ADR exceeded $177, 62% ahead of last April and nearly 36% above pre‐COVID levels of April 2019 while RevPAR approached $149 for the month, dramatically ahead of April 2021 (+107.4%) and 25.4% over April 2019.

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (dark blue), 2020 (light blue), 2021 (yellow) and 2022 (red)

Visitor traffic was down 4.5% compared to the same month in 2019.

Note: There was almost no convention traffic from April 2020 through May 2021.

Update: Delinquencies, Foreclosures and REO

by Calculated Risk on 5/27/2022 10:22:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Update: Delinquencies, Foreclosures and REO

A brief excerpt:

Last year, I pointed out that the foreclosure moratorium, combined with the expiration of a large number of forbearance plans, would NOT lead to a surge in foreclosures and impact house prices (as happened following the housing bubble).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is some data on REOs through Q1 2022 …

...

We will probably see an increase in REOs in 2022.

This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) increased slightly from $779 million in Q4 2021 to $788 million in Q1 2022. (Probably declined in 2020 and 2021 due to foreclosure moratoriums, forbearance programs and house price increases).

...

The bottom line is there will be an increase in foreclosures this year (from record low levels), but it will not be a huge wave of foreclosures as happened following the housing bubble. The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.