by Calculated Risk on 6/01/2022 11:34:00 AM

Wednesday, June 01, 2022

Construction Spending Increased 0.2% in April

From the Census Bureau reported that overall construction spending increased:

Construction spending during April 2022 was estimated at a seasonally adjusted annual rate of $1,744.8 billion, 0.2 percent above the revised March estimate of $1,740.6 billion. The April figure is 12.3 percent above the April 2021 estimate of $1,553.5 billion.Private spending increased and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,394.7 billion, 0.5 percent above the revised March estimate of $1,387.9 billion. ...

In April, the estimated seasonally adjusted annual rate of public construction spending was $350.1 billion, 0.7 percent below the revised March estimate of $352.7 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 31% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential (blue) spending is 21% above the bubble era peak in January 2008 (nominal dollars).

Public construction spending is 8% above the peak in March 2009.

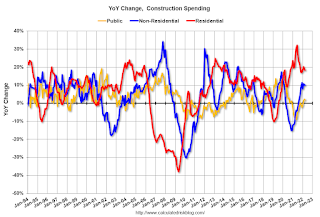

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 18.4%. Non-residential spending is up 10.1% year-over-year. Public spending is up 1.8% year-over-year.

BLS: Job Openings Decreased to 11.4 million in April

by Calculated Risk on 6/01/2022 10:13:00 AM

From the BLS: Job Openings and Labor Turnover Summary

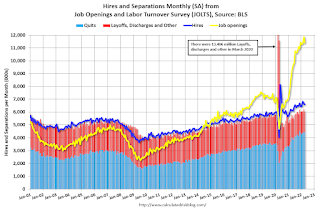

The number of job openings decreased to 11.4 million on the last business day of April, the U.S. Bureau of Labor Statistics reported today. Hires and total separations were little changed at 6.6 million and 6.0 million, respectively. Within separations, quits were little changed at 4.4 million, while layoffs and discharges edged down to a series low of 1.2 million.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for April, the employment report this Friday will be for May.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings decreased in April to 11.400 million from 11.855 million in March.

The number of job openings (yellow) were up 23% year-over-year.

Quits were up 10% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

ISM® Manufacturing index Increased to 56.1% in May

by Calculated Risk on 6/01/2022 10:06:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion. The PMI® was at 56.1% in May, up from 55.4% in April. The employment index was at 49.6%, down from 50.9% last month, and the new orders index was at 55.1%, up from 53.5%.

From ISM: Manufacturing PMI® at 56.1% May 2022 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in May, with the overall economy achieving a 24th consecutive month of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing expanded at a faster pace in May than in April. This was above the consensus forecast, although the employment index was weak in May.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The May Manufacturing PMI® registered 56.1 percent, an increase of 0.7 percentage point from the reading of 55.4 percent in April. This figure indicates expansion in the overall economy for the 24th month in a row after a contraction in April and May 2020. This is the second-lowest Manufacturing PMI® reading since September 2020, when it registered 55.4 percent. The New Orders Index reading of 55.1 percent is 1.6 percentage points higher than the 53.5 percent recorded in April. The Production Index reading of 54.2 percent is a 0.6-percentage point increase compared to April’s figure of 53.6 percent. The Prices Index registered 82.2 percent, down 2.4 percentage points compared to the April figure of 84.6 percent. The Backlog of Orders Index registered 58.7 percent, 2.7 percentage points higher than the April reading of 56 percent. The Employment Index went into contraction territory at 49.6 percent, 1.3 percentage points lower than the 50.9 percent recorded in April. The Supplier Deliveries Index reading of 65.7 percent is 1.5 percentage points lower than the April figure of 67.2 percent. The Inventories Index registered 55.9 percent, 4.3 percentage points higher than the April reading of 51.6 percent. The New Export Orders Index reading of 52.9 percent is up 0.2 percentage point compared to April’s figure of 52.7 percent. The Imports Index fell into contraction territory, decreasing 2.7 percentage points to 48.7 percent from 51.4 percent in April.”

emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 6/01/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 27, 2022.

... The Refinance Index decreased 5 percent from the previous week and was 75 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 14 percent lower than the same week one year ago.

“Mortgage rates fell for the fourth time in five weeks, as concerns of weaker economic growth and the recent stock market sell-off drove Treasury yields lower. Mortgage applications decreased to its lowest level since December 2018, as the purchase market continues to struggle with supply and affordability challenges,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “With the 30-year fixed rate at 5.33 percent, the refinance market continues to shrink, led by larger decreases last week for FHA and VA refinance applications. The refinance index was 75 percent below last year’s level, when rates were more than 200 basis points lower.”

Added Kan, “Purchase applications last week were 14 percent lower than last year, with more activity in the larger loan sizes. Demand is high at the upper end of the market, and supply and affordability challenges are not as detrimental to these borrowers as they are to first-time buyers.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 5.33 percent from 5.46 percent, with points decreasing to 0.51 from 0.60 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate decreased from last week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

According to the MBA, purchase activity is down 14% year-over-year unadjusted.

According to the MBA, purchase activity is down 14% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, May 31, 2022

Wednesday: Job Openings, ISM Mfg, Construction Spending, Beige Book, Vehicle Sales

by Calculated Risk on 5/31/2022 09:01:00 PM

From Matthew Graham at Mortgage News Daily: MBS Live Morning: Sharp Losses Reinforce Last Week's Yield Floor

10yr yields bounced at or near 2.72% for 4 straight days heading into the end of last week. Now this morning, they're sharply higher and already above the next major technical level at 2.83%. Even as bonds rallied in recent weeks, we've been expecting the gains to give way to a more volatile, sideways range. [30 year fixed 5.25%]Wednesday:

emphasis added

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for April from the BLS.

• Also at 10:00 AM, ISM Manufacturing Index for May. The consensus is for the ISM to be at 54.5, down from 55.4 in April.

• Also at 10:00 AM, Construction Spending for April. The consensus is for a 0.5% increase in construction spending.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

• All day, Light vehicle sales for May. The consensus is for light vehicle sales to be 14.5 million SAAR in May, up from 14.3 million in April (Seasonally Adjusted Annual Rate). Wards Auto is forecasting a decline in sales to 13.4 million SAAR.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.7% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.3 | --- | ≥2321 | |

| New Cases per Day3 | 94,260 | 104,396 | ≤5,0002 | |

| Hospitalized3 | 18,915 | 19,653 | ≤3,0002 | |

| Deaths per Day3🚩 | 301 | 288 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in April

by Calculated Risk on 5/31/2022 04:11:00 PM

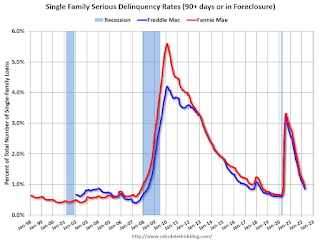

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 0.94% in April from 1.01% in March. The serious delinquency rate is down from 2.38% in April 2021. This is almost back to pre-pandemic levels.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (1% of portfolio), 2.98% are seriously delinquent (down from 3.12% in March).

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

The pandemic related increase in delinquencies was very different from the increase in delinquencies following the housing bubble. Lending standards had been fairly solid over the previous decade, and most of these homeowners had equity in their homes - and the vast majority of these homeowners have been able to restructure their loans once they were employed.

Freddie Mac reported earlier.

Update: Framing Lumber Prices Down 50% Year-over-year; Still up Sharply from Pre-pandemic Levels

by Calculated Risk on 5/31/2022 01:17:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through May 31st.

Prices are still up sharply from the pre-pandemic levels of around $400.

Click on graph for larger image.

Click on graph for larger image.The slowdown in housing - and some supply improvement - has pushed down prices.

Comments on March Case-Shiller and FHFA House Price Increases; New Record Monthly Increase

by Calculated Risk on 5/31/2022 09:40:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller National Index up 20.6% Year-over-year in March; New Record Monthly Increase

Excerpt:

This graph below shows existing home months-of-supply (inverted, from the NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999 through March 2022).

Note that the months-of-supply is not seasonally adjusted.

There is a clear relationship, and this is no surprise (but interesting to graph). If months-of-supply is high, prices decline. If months-of-supply is very low (like now), prices rise quickly.

In March, the months-of-supply was at 1.9 months, and the Case-Shiller National Index (SA) increased 2.09% month-over-month. The black arrow points to the March 2022 dot. In the April existing home sales report, the NAR reported months-of-supply increased to 2.2 months.

This month was very likely the peak YoY growth rate - just above the peak last August. Since inventory is now increasing year-over-year (but still low), we should expect price increases to slow.

The normal level of inventory is probably in the 4 to 6 months range, and we will have to see a significant increase in inventory to sharply slow price increases, and that is why I’m focused on inventory!

Since Case-Shiller is a 3-month average, and this report was for March (includes January and February), this included price increases when mortgage rates were significantly lower than today. In January, the Freddie Mac PMMS averaged 3.4% for a 30-year mortgage, and 3.8% in February. Currently mortgage rates are around 5.25%.emphasis added

Case-Shiller: National House Price Index increased 20.6% year-over-year in March

by Calculated Risk on 5/31/2022 09:11:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3-month average of January, February and March prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Reports Annual Home Price Gain Of 20.6% In March

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 20.6% annual gain in March, up from 20.0% in the previous month. The 10-City Composite annual increase came in at 19.5%, up from 18.7% in the previous month. The 20-City Composite posted a 21.2% year-over-year gain, up from 20.3% in the previous month.

Tampa, Phoenix, and Miami reported the highest year-over-year gains among the 20 cities in March. Tampa led the way with a 34.8% year-over-year price increase, followed by Phoenix with a 32.4% increase, and Miami with a 32.0% increase. Seventeen of the 20 cities reported higher price increases in the year ending March 2022 versus the year ending February 2022.

...

Before seasonal adjustment, the U.S. National Index posted a 2.6% month-over-month increase in March, while the 10-City and 20-City Composites posted increases of 2.8% and 3.1%, respectively

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 2.1%, and the 10-City and 20-City Composites posted increases of 2.2% and 2.4%, respectively.

In March, all 20 cities reported increases before and after seasonal adjustments.

“Those of us who have been anticipating a deceleration in the growth rate of U.S. home prices will have to wait at least a month longer,” says Craig J. Lazzara, Managing Director at S&P DJI. “The National Composite Index recorded a gain of 20.6% for the 12 months ended March 2022; the 10- and 20-City Composites rose 19.5% and 21.2%, respectively. For both National and 20-City Composites, March’s reading was the highest year-over-year price change in more than 35 years of data, with the 10-City growth rate at the 99th percentile of its own history.

“The strength of the Composite indices suggests very broad strength in the housing market, which we continue to observe. All 20 cities saw double-digit price increases for the 12 months ended in March, and price growth in 17 cities accelerated relative to February’s report. March’s price increase ranked in the top quintile of historical experience for every city, and in the top decile for 19 of them.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 2.2% in March (SA).

The Composite 20 index is up 2.4% (SA) in March.

The National index is 60% above the bubble peak (SA), and up 2.1% (SA) in March. The National index is up 117% from the post-bubble low set in February 2012 (SA).

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 19.5% year-over-year. The Composite 20 SA is up 21.2% year-over-year.

The National index SA is up 20.6% year-over-year.

Price increases were above expectations. I'll have more later.

Monday, May 30, 2022

Tuesday: Case-Shiller House Prices, Chicago PMI, Dallas Fed Mfg

by Calculated Risk on 5/30/2022 09:03:00 PM

Weekend:

• Schedule for Week of May 29, 2022

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for March. The consensus is for a 20.0% year-over-year increase in the Comp 20 index for March.

• Also at 9:00 AM, FHFA House Price Index for March 2022. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 9:45 AM, Chicago Purchasing Managers Index for May.

• At 10:00 AM, Dallas Fed Survey of Manufacturing Activity for May.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 9 and DOW futures are up 12 (fair value).

Oil prices were up over the last week with WTI futures at $116.53 per barrel and Brent at $121.15 per barrel. A year ago, WTI was at $66 and Brent was at $69 - so WTI oil prices are up 75% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.59 per gallon. A year ago prices were at $3.04 per gallon, so gasoline prices are up $1.55 per gallon year-over-year.