by Calculated Risk on 6/04/2022 08:11:00 AM

Saturday, June 04, 2022

Schedule for Week of June 5, 2022

The key report this week is CPI.

Other key reports include the April trade balance and Q1 Flow of Funds.

No major economic releases scheduled.

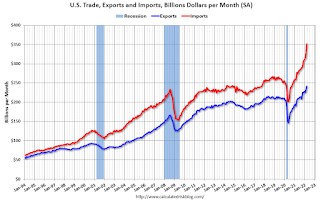

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. The consensus is the trade deficit to be $89.3 billion. The U.S. trade deficit was at $109.8 Billion in March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand up from 200 thousand last week.

12:00 PM: Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

8:30 AM: The Consumer Price Index for May from the BLS. The consensus is for 0.7% increase in CPI, and a 0.5% increase in core CPI.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for June).

Friday, June 03, 2022

COVID June 3, 2022: Hospitalizations Increasing

by Calculated Risk on 6/03/2022 09:01:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.7% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.4 | --- | ≥2321 | |

| New Cases per Day3 | 99,289 | 110,387 | ≤5,0002 | |

| Hospitalized3🚩 | 21,765 | 20,521 | ≤3,0002 | |

| Deaths per Day3 | 246 | 325 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

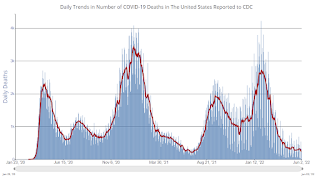

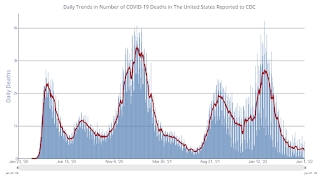

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Realtor.com Reports Weekly Inventory Up 11% Year-over-year

by Calculated Risk on 6/03/2022 03:14:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released this morning from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending May 28, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

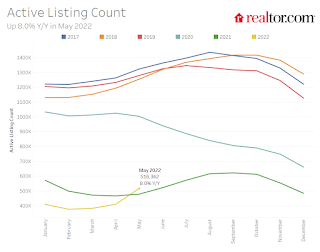

• Active inventory continued to grow, rising 11% above one year ago. In a few short weeks, we’ve observed a significant turnaround in the number of homes available for sale, going from essentially flat at the beginning of May weeks ago to +11% in this data from the last week of the month. This is helping to rebalance the housing market, but the trend must be understood in context. Our May Housing Trends Report showed that the active listings count remained nearly 50 percent below its level at the beginning of the pandemic. In other words, home shoppers continue to see a historically low number of homes for sale.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note: I corrected a sign error in the data for Feb 26, 2022.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note: I corrected a sign error in the data for Feb 26, 2022.Note the rapid increase in the YoY change, from down 30% at the beginning of the year, to up 11% YoY now. It will be important to watch if that trend continues.

The second graph is from the May Housing Trends Report referenced above.

Q2 GDP Forecasts: Around 3.0%

by Calculated Risk on 6/03/2022 03:00:00 PM

From BofA:

We continue to track 3.0% qoq saar growth for 2Q. Weaker than expected vehicle sales were offset by better inventories and capex spending [June 3 estimate]From Goldman:

emphasis added

We boosted our Q2 GDP tracking estimate by 0.2pp to +3.0% (qoq ar). [June 1 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is 1.3 percent on June 1, down from 1.9 percent on May 27. [June 1 estimate]

When will House Price Growth Slow?

by Calculated Risk on 6/03/2022 12:32:00 PM

Today, in the Calculated Risk Real Estate Newsletter: When will House Price Growth Slow?

A brief excerpt:

Most analysts expect house price growth to slow sharply in coming months. For example, a few weeks ago, I wrote: What will Happen with House Prices?Some answers in the article. You can subscribe at https://calculatedrisk.substack.com/

However, the most recent Case-Shiller report showed house prices were up a record 20.6% year-over-year (YoY). This report was for March (a three-month average of January, February and March prices).

And, according to Zillow research, house prices will be up even more YoY in the April Case-Shiller National Index (to be released on June 28th. The Zillow forecast is for the YoY change for the Case-Shiller National index to be a record 20.8% in April.

...

Why are prices still up sharply year-over-year?

Comments on May Employment Report

by Calculated Risk on 6/03/2022 09:31:00 AM

The headline jobs number in the May employment report was above expectations, however employment for the previous two months was revised down by 22,000. The participation rate and the employment-population ratio both increased slightly, and the unemployment rate was unchanged at 3.6%.

In May, the year-over-year employment change was 6.5 million jobs.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today.

In May, the number of permanent job losers was unchanged at 1.386 million from 1.386 million in the previous month.

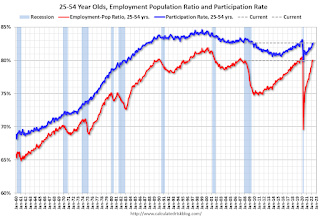

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 participation rate increased in May to 82.6% from 82.4% in April, and the 25 to 54 employment population ratio increased to 80.0% from 79.9% the previous month.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons increased by 295,000 to 4.3 million in May, reflecting an increase in the number of persons whose hours were cut due to slack work or business conditions. The number of persons employed part time for economic reasons is little different from its February 2020 level. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons increased in May to 4.328 million from 4.033 million in April. This is at pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.1% from 7.0% in the previous month. This is down from the record high in April 22.9% for this measure since 1994. This measure is close to the 7.0% in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.356 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.483 million the previous month.

This does not include all the people that left the labor force.

Summary:

The headline monthly jobs number was above expectations; however, the previous two months were revised down by 22,000 combined.

May Employment Report: 390 thousand Jobs, 3.6% Unemployment Rate

by Calculated Risk on 6/03/2022 08:44:00 AM

From the BLS:

Total nonfarm payroll employment rose by 390,000 in May, and the unemployment rate remained at 3.6 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in leisure and hospitality, in professional and business services, and in transportation and warehousing. Employment in retail trade declined.

...

The change in total nonfarm payroll employment for March was revised down by 30,000, from +428,000 to +398,000, and the change for April was revised up by 8,000, from +428,000 to +436,000. With these revisions, employment in March and April combined is 22,000 lower than previously reported.

emphasis added

Click on graph for larger image.

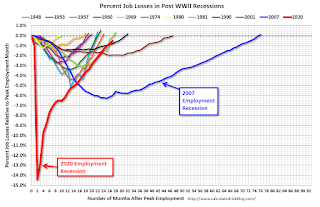

Click on graph for larger image.The first graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms.

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In May, the year-over-year change was 6.5 million jobs. This was up significantly year-over-year.

Total payrolls increased by 390 thousand in May. Private payrolls increased by 333 thousand, and public payrolls increased 57 thousand.

Payrolls for March and April were revised down 22 thousand, combined.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 62.3% in May, from 62.2% in April. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 62.3% in May, from 62.2% in April. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 60.1% from 60.0% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

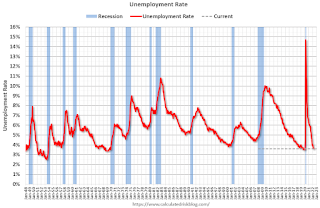

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in May at 3.6% from 3.6% in April.

This was above consensus expectations; however, March and April payrolls were revised down by 22,000 combined.

Thursday, June 02, 2022

Friday: Employment Report

by Calculated Risk on 6/02/2022 09:01:00 PM

My May Employment Preview

Goldman May Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for May. The consensus is for 320,000 jobs added, and for the unemployment rate to decline to 3.5%.

• At 10:00 AM, the ISM Services Index for May. The consensus is for a reading of 56.4, down from 57.1.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.7% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.4 | --- | ≥2321 | |

| New Cases per Day3 | 100,683 | 110,080 | ≤5,0002 | |

| Hospitalized3🚩 | 21,306 | 20,290 | ≤3,0002 | |

| Deaths per Day3 | 244 | 318 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Goldman May Payrolls Preview

by Calculated Risk on 6/02/2022 04:25:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose by 225k in May (mom sa), a slowdown from the +428k pace in both of the previous two months and below consensus of +323k. ... We estimate a one-tenth drop in the unemployment rate to 3.5%—in line with consensusCR Note: The consensus is for 320 thousand jobs added, and for the unemployment rate to decline to 3.5%.

emphasis added

Hotels: Occupancy Rate Up 3.2% Compared to Same Week in 2019

by Calculated Risk on 6/02/2022 03:50:00 PM

U.S. hotel performance dipped slightly from the previous week, according to STR‘s latest data through May 28.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

May 22-28, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 66.5% (+3.2%)

• Average daily rate (ADR): $151.73 (+22.2%)

• Revenue per available room (RevPAR): $100.97 (+26.2%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).