by Calculated Risk on 6/06/2022 02:14:00 PM

Monday, June 06, 2022

AAR: May Rail Carloads and Intermodal Down Year-over-year

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

It was more of the same for U.S. freight rail traffic in May 2022: some commodities did pretty well, some did not so well, and some were in between.

Total carloads on U.S. railroads were down 3.7% in May, their second straight year-over-year decline and the third in the first five months of 2022. ... In May, U.S. intermodal volume averaged 275,640 units per week. That’s the highest weekly average for any month since June 2021 and the third-best weekly average for intermodal for May in history. May 2022 was down 4.3% from May 2021, which was the best May ever for intermodal.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2020, 2021 and 2022:

Originated U.S. rail carloads totaled 928,742 in May 2022, down 3.7% (35,821 carloads) from May 2021. It’s the third year-over-year monthly decline in the first five months of 2022. Total carloads averaged 232,186 per week in May 2022. In our records that go back to 1988, only 2020 had a lower weekly average for May.

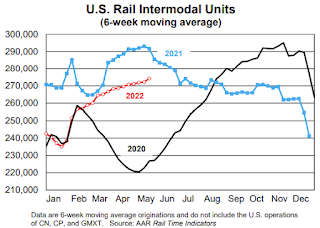

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):Intermodal is not included in carloads. In May 2022, U.S. intermodal volume was 1.10 million containers and trailers, an average of 275,640 units per week. That’s the highest weekly average for any month since June 2021 and the third-best weekly average for intermodal for May in history. Still, it was down 4.3% from May 2021, which was the best May ever for intermodal. (May 2018 was also higher than May 2022.)

Black Knight Mortgage Monitor: "Housing costs to current income levels within a whisper of all time high in 2006"

by Calculated Risk on 6/06/2022 11:03:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor: "Housing costs to current income levels within a whisper of all time high in 2006"

A brief excerpt:

Note: Black Knights data on affordability goes back to 1996. This doesn’t include housing in the 1980 period when 30-year mortgage rates peaked at over 18%.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

And on the payment to income ratio:

• May marked the least affordable housing since July 2006, and ranked among the three least affordable months on recordDuring the housing bubble, there were “affordability products” with low teaser rates available. Excluding the bubble years, this is the worst affordability since at least the early ‘90s, maybe ‘80s.

• The monthly payment required to purchase the average price home with 20% down jumped another $100 through mid-May, and is now up nearly $600 (+44%) from the start of the year and $865 (+79%) from the start of the pandemic

• When comparing the rise in housing costs to current income levels, it now takes 33.7% of the median household income to purchase the average priced home, within a whisper of the 34.1% all time high at its peak in June 2006

Housing Inventory June 6th Update: Inventory UP 13.9% Year-over-year

by Calculated Risk on 6/06/2022 09:33:00 AM

Altos reports inventory is up 13.9% year-over-year.

Inventory usually declines in the winter, and then increases in the spring. Inventory bottomed seasonally at the beginning of March 2022 and is now up 56% since then.

This inventory graph is courtesy of Altos Research.

Inventory is still very low. Compared to the same week in 2021, inventory is up 13.9% from 329 thousand, however compared to the same week in 2020 inventory is down 46.8% from 706 thousand. Compared to 3 years ago, inventory is down 60.0% from 938 thousand.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 46.8% according to Altos)

4. Inventory up compared to 2019 (currently down 60.0%).

Four High Frequency Indicators for the Economy

by Calculated Risk on 6/06/2022 08:35:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Note: Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

The TSA is providing daily travel numbers.

This data is as of June 5th.

Click on graph for larger image.

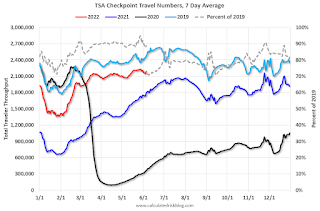

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 12.4% from the same day in 2019 87.6% of 2019). (Dashed line)

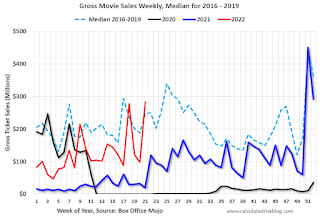

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $284 million last week, up about 15% from the median for the week - due primarily to the release of Top Gun.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through May 28th. The occupancy rate was up 3.2% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

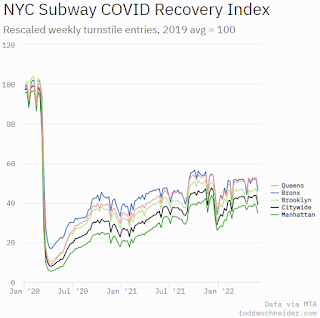

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, June 3rd.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, June 05, 2022

Sunday Night Futures

by Calculated Risk on 6/05/2022 06:07:00 PM

Weekend:

• Schedule for Week of June 5, 2022

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 DOW futures are up slightly (fair value).

Oil prices were up over the last week with WTI futures at $118.87 per barrel and Brent at $119.72 per barrel. A year ago, WTI was at $69 and Brent was at $71 - so WTI oil prices are up 70% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.86 per gallon. A year ago prices were at $3.04 per gallon, so gasoline prices are up $1.82 per gallon year-over-year.

Vehicle Sales Mix and Heavy Trucks

by Calculated Risk on 6/05/2022 12:13:00 PM

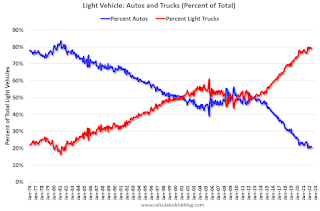

This graph shows the percent of light vehicle sales between passenger cars and trucks / SUVs through May 2022.

Over time the mix has changed more and more towards light trucks and SUVs.

Over time the mix has changed more and more towards light trucks and SUVs.Only when oil prices are high, does the trend slow or reverse.

The percent of light trucks and SUVs was at 78.9% in May 2022 - just below the record high percentage of 80.0% last October.

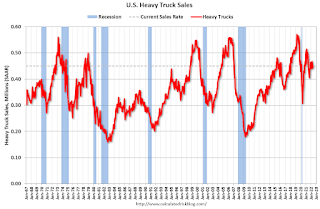

The second graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the May 2022 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all-time high of 563 thousand SAAR in September 2019.

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all-time high of 563 thousand SAAR in September 2019.Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales really declined at the beginning of the pandemic, falling to a low of 299 thousand SAAR in May 2020.

Saturday, June 04, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 6/04/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• When will House Price Growth Slow?

• Rent Increases Up Sharply Year-over-year, Pace is slowing

• Worst Housing Affordability" since 1991 excluding Bubble

• Case-Shiller National Index up 20.6% Year-over-year in March; New Record Monthly Increase

• Lawler: Large Builders Acquired Lots of Lots over the Last Year

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of June 5, 2022

by Calculated Risk on 6/04/2022 08:11:00 AM

The key report this week is CPI.

Other key reports include the April trade balance and Q1 Flow of Funds.

No major economic releases scheduled.

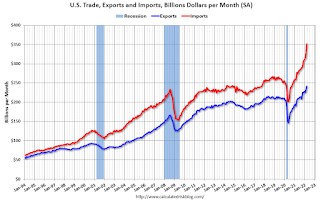

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. The consensus is the trade deficit to be $89.3 billion. The U.S. trade deficit was at $109.8 Billion in March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand up from 200 thousand last week.

12:00 PM: Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

8:30 AM: The Consumer Price Index for May from the BLS. The consensus is for 0.7% increase in CPI, and a 0.5% increase in core CPI.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for June).

Friday, June 03, 2022

COVID June 3, 2022: Hospitalizations Increasing

by Calculated Risk on 6/03/2022 09:01:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.7% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.4 | --- | ≥2321 | |

| New Cases per Day3 | 99,289 | 110,387 | ≤5,0002 | |

| Hospitalized3🚩 | 21,765 | 20,521 | ≤3,0002 | |

| Deaths per Day3 | 246 | 325 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

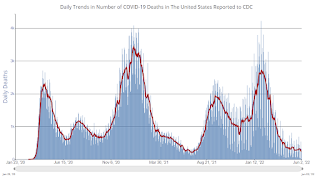

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Realtor.com Reports Weekly Inventory Up 11% Year-over-year

by Calculated Risk on 6/03/2022 03:14:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released this morning from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending May 28, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

• Active inventory continued to grow, rising 11% above one year ago. In a few short weeks, we’ve observed a significant turnaround in the number of homes available for sale, going from essentially flat at the beginning of May weeks ago to +11% in this data from the last week of the month. This is helping to rebalance the housing market, but the trend must be understood in context. Our May Housing Trends Report showed that the active listings count remained nearly 50 percent below its level at the beginning of the pandemic. In other words, home shoppers continue to see a historically low number of homes for sale.

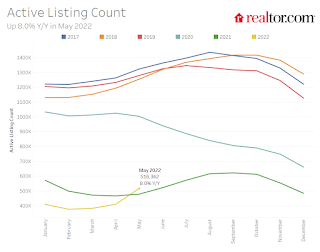

Here is a graph of the year-over-year change in inventory according to realtor.com. Note: I corrected a sign error in the data for Feb 26, 2022.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note: I corrected a sign error in the data for Feb 26, 2022.Note the rapid increase in the YoY change, from down 30% at the beginning of the year, to up 11% YoY now. It will be important to watch if that trend continues.

The second graph is from the May Housing Trends Report referenced above.