by Calculated Risk on 6/07/2022 12:22:00 PM

Tuesday, June 07, 2022

1st Look at Local Housing Markets in May, Inventory up Sharply

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in May, Inventory up Sharply

A brief excerpt:

From the Northwest MLS: Western Washington housing market "more balanced, and not so crazy - and that's a good thing"There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/"Home sellers really need to re-think their expectations," suggested Mike Larson, a member of the board of directors at Northwest Multiple Listing Service (NWMLS) when commenting on statistics summarizing May activity. ...Here is a summary of active listings for these housing markets in May. Inventory usually increases seasonally in May, so some month-over-month (MoM) increase is not surprising.

Inventory in these markets were down 28% YoY in February, down 4% YoY in March, up 10% YoY in April, and up 42% YoY in May! So, this is a significant change from earlier this year. This is another step towards a more balanced market, but inventory levels are still historically low.

Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle) and Santa Clara (San Jose)

Second Home Market: South Lake Tahoe in May

by Calculated Risk on 6/07/2022 10:29:00 AM

With the pandemic, there was a surge in 2nd home buying.

I'm looking at data for some second home markets - and I'm tracking those markets to see if there is an impact from lending changes like the FHFA Targeted Increases to Enterprise Pricing Framework, rising mortgage rates or the easing of the pandemic.

This graph is for South Lake Tahoe since 2004 through May 2022, and shows inventory (blue), and the year-over-year (YoY) change in the median price (12-month average).

Note: The median price is distorted by the mix, but this is the available data.

Following the housing bubble, prices declined for several years in South Lake Tahoe, with the median price falling about 50% from the bubble peak.

Currently inventory is still very low, but up from the record low set in February 2022, and up 50% year-over-year. Prices are up 16.1% YoY (but the YoY change has been trending down).

Used Vehicle Wholesale Prices Increased Slightly in May

by Calculated Risk on 6/07/2022 09:15:00 AM

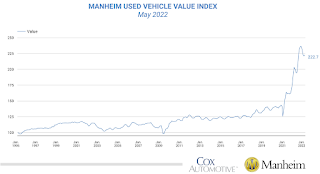

From Manheim Consulting today: Wholesale Used-Vehicle Prices Increase in May

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 0.7% in May from April. The Manheim Used Vehicle Value Index rose to 222.7, which was up 9.7% from a year ago. The non-adjusted price change in May was an increase of 1.1% compared to April, leaving the unadjusted average price up 12.1% year over year.

Manheim Market Report (MMR) values saw a shift in price trends in May with prices increasing in the first three weeks but declining over the last two.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Trade Deficit decreased to $87.1 Billion in April

by Calculated Risk on 6/07/2022 08:42:00 AM

From the Department of Commerce reported:

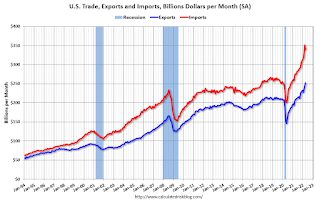

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $87.1 billion in April, down $20.6 billion from $107.7 billion in March, revised.

April exports were $252.6 billion, $8.5 billion more than March exports. April imports were $339.7 billion, $12.1 billion less than March imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports decreased in April.

Exports are up 22% year-over-year; imports are up 24% year-over-year.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

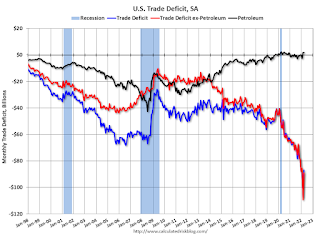

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China increased to $30.6 billion in April, from $25.5 billion a year ago.

Monday, June 06, 2022

Tuesday: Trade Deficit

by Calculated Risk on 6/06/2022 09:00:00 PM

From Matthew Graham at Mortgage News Daily: Rates Jump Up To Highest Levels in Nearly a Month

... rates moved quite a bit higher today, as far as single days go. The average lender is at least an eighth of a percent (0.125%) higher than they were on Friday. The average conventional 30yr fixed rate is once again back up to at least 5.5% depending on number of mid-day price changes made by any given lender. [30 year fixed 5.50%]Tuesday:

emphasis added

• At 8:30 AM ET, 8:30 AM: Trade Balance report for April from the Census Bureau. The consensus is the trade deficit to be $89.3 billion. The U.S. trade deficit was at $109.8 Billion in March.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.7% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.5 | --- | ≥2321 | |

| New Cases per Day3 | 98,513 | 106,339 | ≤5,0002 | |

| Hospitalized3 | 20,771 | 21,110 | ≤3,0002 | |

| Deaths per Day3 | 247 | 320 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

AAR: May Rail Carloads and Intermodal Down Year-over-year

by Calculated Risk on 6/06/2022 02:14:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

It was more of the same for U.S. freight rail traffic in May 2022: some commodities did pretty well, some did not so well, and some were in between.

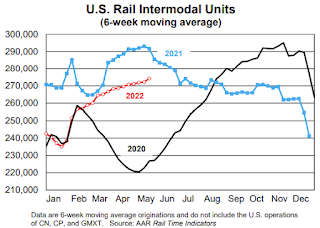

Total carloads on U.S. railroads were down 3.7% in May, their second straight year-over-year decline and the third in the first five months of 2022. ... In May, U.S. intermodal volume averaged 275,640 units per week. That’s the highest weekly average for any month since June 2021 and the third-best weekly average for intermodal for May in history. May 2022 was down 4.3% from May 2021, which was the best May ever for intermodal.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2020, 2021 and 2022:

Originated U.S. rail carloads totaled 928,742 in May 2022, down 3.7% (35,821 carloads) from May 2021. It’s the third year-over-year monthly decline in the first five months of 2022. Total carloads averaged 232,186 per week in May 2022. In our records that go back to 1988, only 2020 had a lower weekly average for May.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2020, 2021 and 2022: (using intermodal or shipping containers):Intermodal is not included in carloads. In May 2022, U.S. intermodal volume was 1.10 million containers and trailers, an average of 275,640 units per week. That’s the highest weekly average for any month since June 2021 and the third-best weekly average for intermodal for May in history. Still, it was down 4.3% from May 2021, which was the best May ever for intermodal. (May 2018 was also higher than May 2022.)

Black Knight Mortgage Monitor: "Housing costs to current income levels within a whisper of all time high in 2006"

by Calculated Risk on 6/06/2022 11:03:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor: "Housing costs to current income levels within a whisper of all time high in 2006"

A brief excerpt:

Note: Black Knights data on affordability goes back to 1996. This doesn’t include housing in the 1980 period when 30-year mortgage rates peaked at over 18%.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

And on the payment to income ratio:

• May marked the least affordable housing since July 2006, and ranked among the three least affordable months on recordDuring the housing bubble, there were “affordability products” with low teaser rates available. Excluding the bubble years, this is the worst affordability since at least the early ‘90s, maybe ‘80s.

• The monthly payment required to purchase the average price home with 20% down jumped another $100 through mid-May, and is now up nearly $600 (+44%) from the start of the year and $865 (+79%) from the start of the pandemic

• When comparing the rise in housing costs to current income levels, it now takes 33.7% of the median household income to purchase the average priced home, within a whisper of the 34.1% all time high at its peak in June 2006

Housing Inventory June 6th Update: Inventory UP 13.9% Year-over-year

by Calculated Risk on 6/06/2022 09:33:00 AM

Altos reports inventory is up 13.9% year-over-year.

Inventory usually declines in the winter, and then increases in the spring. Inventory bottomed seasonally at the beginning of March 2022 and is now up 56% since then.

This inventory graph is courtesy of Altos Research.

Inventory is still very low. Compared to the same week in 2021, inventory is up 13.9% from 329 thousand, however compared to the same week in 2020 inventory is down 46.8% from 706 thousand. Compared to 3 years ago, inventory is down 60.0% from 938 thousand.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 46.8% according to Altos)

4. Inventory up compared to 2019 (currently down 60.0%).

Four High Frequency Indicators for the Economy

by Calculated Risk on 6/06/2022 08:35:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Note: Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

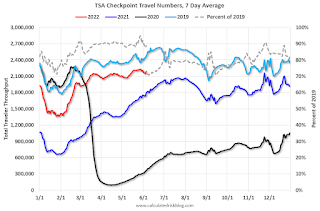

The TSA is providing daily travel numbers.

This data is as of June 5th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 12.4% from the same day in 2019 87.6% of 2019). (Dashed line)

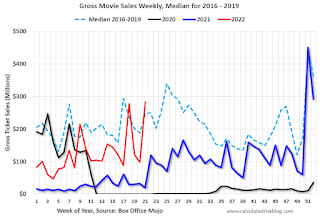

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $284 million last week, up about 15% from the median for the week - due primarily to the release of Top Gun.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through May 28th. The occupancy rate was up 3.2% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

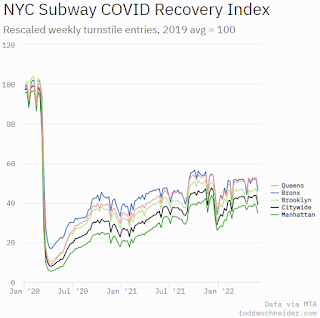

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, June 3rd.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, June 05, 2022

Sunday Night Futures

by Calculated Risk on 6/05/2022 06:07:00 PM

Weekend:

• Schedule for Week of June 5, 2022

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 DOW futures are up slightly (fair value).

Oil prices were up over the last week with WTI futures at $118.87 per barrel and Brent at $119.72 per barrel. A year ago, WTI was at $69 and Brent was at $71 - so WTI oil prices are up 70% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.86 per gallon. A year ago prices were at $3.04 per gallon, so gasoline prices are up $1.82 per gallon year-over-year.