by Calculated Risk on 6/11/2022 02:11:00 PM

Saturday, June 11, 2022

Real Estate Newsletter Articles this Week

At the Calculated Risk Real Estate Newsletter this week:

• 1st Look at Local Housing Markets in May, Inventory up Sharply

• Current State of the Housing Market

• Homebuilder Comments in May: “Builder metrics quickly deteriorating"

• The Home ATM Still Open in Q1 2022; Closing Soon

• 30-Year Mortgage Rates increase to 5.85%

• Black Knight Mortgage Monitor: "Housing costs to current income levels within a whisper of all time high in 2006"

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of June 12, 2022

by Calculated Risk on 6/11/2022 08:11:00 AM

The key reports this week are May Retail sales and Housing Starts.

For manufacturing, Industrial Production, and the NY and Philly Fed manufacturing surveys, will be released this week.

The FOMC meets this week, and they are expected to raise rates 50bp.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for May.

8:30 AM: The Producer Price Index for May from the BLS. The consensus is for a 0.8% increase in PPI, and a 0.6% increase in core PPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Retail sales for May is scheduled to be released. The consensus is for a 0.2% increase in retail sales.

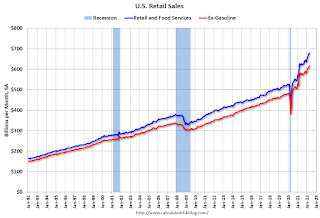

8:30 AM: Retail sales for May is scheduled to be released. The consensus is for a 0.2% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM: The New York Fed Empire State manufacturing survey for June. The consensus is for a reading of 4.5, up from -11.6.

10:00 AM: The June NAHB homebuilder survey. The consensus is for a reading of 68, down from 69 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate by 50bp at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215 thousand down from 229 thousand last week.

8:30 AM ET: Housing Starts for May.

8:30 AM ET: Housing Starts for May. This graph shows single and total housing starts since 1968.

The consensus is for 1.700 million SAAR, down from 1.724 million SAAR in April.

8:30 AM: the Philly Fed manufacturing survey for June. The consensus is for a reading of 5.3, up from 2.6.

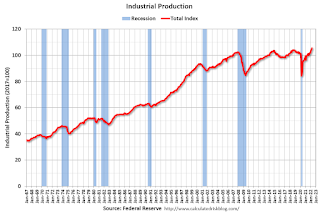

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 79.2%.

10:00 AM: State Employment and Unemployment (Monthly) for May 2022

Friday, June 10, 2022

COVID June 10, 2022: Cases, Hospitalizations and Deaths Increasing

by Calculated Risk on 6/10/2022 09:12:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.7% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.6 | --- | ≥2321 | |

| New Cases per Day3🚩 | 106,874 | 99,715 | ≤5,0002 | |

| Hospitalized3🚩 | 23,292 | 22,043 | ≤3,0002 | |

| Deaths per Day3🚩 | 291 | 262 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

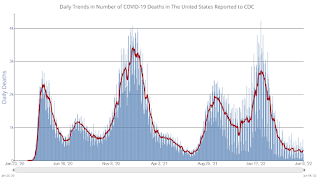

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

30-Year Mortgage Rates increase to 5.85%

by Calculated Risk on 6/10/2022 03:42:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 30-Year Mortgage Rates increase to 5.85%

A brief excerpt:

Mortgagenewsdaily.com reports that as of today, average 30-year fixed mortgage rates are at 5.85% for top tier scenarios. Rates increased today as a result of the inflation report released this morning. Here is a graph from Mortgagenewsdaily.com that shows the 30-year mortgage rate over the last 5 years.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

It is the sharp increase in monthly payments - due to sharply higher mortgage rates - that is impacting the housing market.

...

Yesterday, Sam Ro tweeted some analysis from Goldman Sachs on the median monthly payment. This analysis was before the sharp jump in rates today."The median monthly payment of a 30-year mortgage is up 56% year-over-year"

Q2 GDP Forecasts: Close to 3.0%

by Calculated Risk on 6/10/2022 02:29:00 PM

From BofA:

We revised down our 2Q qoq saar growth from 3.0% to 2.5%. [June 10 estimate]From Goldman:

emphasis added

We left our Q2 GDP tracking estimate unchanged at +3.0% (qoq ar). [June 7 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is 0.9 percent on June 8, unchanged from June 7 after rounding. [June 8 estimate]

Cleveland Fed: Median CPI increased 0.6% and Trimmed-mean CPI increased 0.8% in May

by Calculated Risk on 6/10/2022 12:13:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.6% in May. The 16% trimmed-mean Consumer Price Index increased 0.8% in May. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details here: "Fuel oil and other fuels" increased at 339% annualized rate in May!

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Realtor.com Reports Weekly Inventory Up 13% Year-over-year

by Calculated Risk on 6/10/2022 09:43:00 AM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released yesterday from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending June 4, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

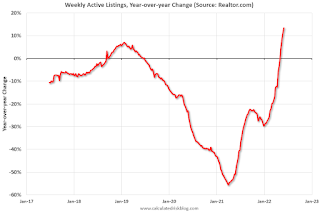

• Active inventory continued to grow, rising 13% above one year ago. The turnaround in the number of homes for sale continues and year over year growth signals that this is more than just a seasonal improvement. Inventory was roughly on par with last year’s levels at the beginning of May and is now up 13% at the beginning of June. Nevertheless, our May Housing Trends Report showed that the active listings count remained nearly 50 percent below its level at the beginning of the pandemic. In other words, we’re starting to add more options, but home shoppers continue to see a relatively low number of homes for sale.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note: I corrected a sign error in the data for Feb 26, 2022.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note: I corrected a sign error in the data for Feb 26, 2022.Note the rapid increase in the YoY change, from down 30% at the beginning of the year, to up 13% YoY now. It will be important to watch if that trend continues.

BLS: CPI increased 1.0% in May; Core CPI increased 0.6%

by Calculated Risk on 6/10/2022 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 1.0 percent in May on a seasonally adjusted basis after rising 0.3 percent in April, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 8.6 percent before seasonal adjustment.The consensus was for 0.7% increase in CPI, and a 0.5% increase in core CPI. Both were above expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The increase was broad-based, with the indexes for shelter, gasoline, and food being the largest contributors. After declining in April, the energy index rose 3.9 percent over the month with the gasoline index rising 4.1 percent and the other major component indexes also increasing. The food index rose 1.2 percent in May as the food at home index increased 1.4 percent.

The index for all items less food and energy rose 0.6 percent in May, the same increase as in April. While almost all major components increased over the month, the largest contributors were the indexes for shelter, airline fares, used cars and trucks, and new vehicles. The indexes for medical care, household furnishings and operations, recreation, and apparel also increased in May.

The all items index increased 8.6 percent for the 12 months ending May, the largest 12-month increase since the period ending December 1981. The all items less food and energy index rose 6.0 percent over the last 12 months. The energy index rose 34.6 percent over the last year, the largest 12-month increase since the period ending September 2005. The food index increased 10.1 percent for the 12-months ending May, the first increase of 10 percent or more since the period ending March 1981.

emphasis added

Thursday, June 09, 2022

Friday: CPI

by Calculated Risk on 6/09/2022 09:11:00 PM

Friday:

• At 8:30 AM ET, The Consumer Price Index for May from the BLS. The consensus is for 0.7% increase in CPI, and a 0.5% increase in core CPI.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for June).

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.7% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.6 | --- | ≥2321 | |

| New Cases per Day3🚩 | 109,032 | 100,915 | ≤5,0002 | |

| Hospitalized3🚩 | 23,341 | 21,693 | ≤3,0002 | |

| Deaths per Day3🚩 | 306 | 258 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Hotels: Occupancy Rate Down 12.1% Compared to Same Week in 2019

by Calculated Risk on 6/09/2022 04:17:00 PM

Note: This was lowered by the timing of the holiday.

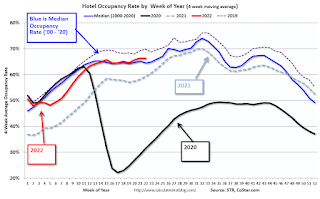

Reflecting an expected post-Memorial Day holiday slowdown, U.S. hotel performance fell from the previous week, according to STR‘s latest data through June 4.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

May 29 through June 4, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 63.2% (-12.1%)

• Average daily rate (ADR): $147.35 (+11.3%)

• Revenue per available room (RevPAR): $93.16 (-2.2%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).