by Calculated Risk on 6/13/2022 08:48:00 PM

Monday, June 13, 2022

Goldman Expects 75bp Rate Hike

From Goldman Sachs chief economist Jan Hatzius

"We have revised our forecast to include 75bp hikes in June and July. This would quickly reset the level of the funds rate at 2.25-2.5%, the FOMC’s median estimate of the neutral rate."Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for May.

• At 8:30 AM, The Producer Price Index for May from the BLS. The consensus is for a 0.8% increase in PPI, and a 0.6% increase in core PPI.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.8% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.7 | --- | ≥2321 | |

| New Cases per Day3🚩 | 103,821 | 99,621 | ≤5,0002 | |

| Hospitalized3 | 21,746 | 22,956 | ≤3,0002 | |

| Deaths per Day3🚩 | 276 | 266 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

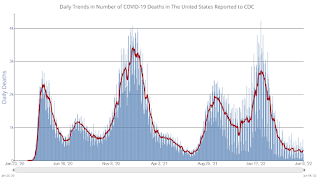

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

30-Year Mortgage Rates Increase to 6.13%

by Calculated Risk on 6/13/2022 03:21:00 PM

Bonds are in the midst of a full-blown capitulation move with 10yr yields currently up over 16bps at 3.32%. MBS are down roughly a full point. These aren't the biggest losses we've ever seen in a day, but they're extraordinarily big losses to be experiencing at the top of trend that has already covered as much ground as the one seen so far in 2022.

...

Long story short, the market is freaked out about what Friday means for the policy outlook. Wednesday continues to be one of the biggest flashpoints for bond volatility we've seen in a long time.

Click on graph for larger image.

Click on graph for larger image.This is a graph from Mortgage News Daily (MND) showing 30-year fixed rates from three sources (MND, MBA, Freddie Mac) over the last year.

2nd Look at Local Housing Markets in May, New Listings picking up

by Calculated Risk on 6/13/2022 12:10:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in May, New Listings picking up

A brief excerpt:

This is the second look at local markets in May. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

We are seeing a significant change in inventory, and maybe a pickup in new listings. So far, most of the increase in inventory has been due to softer demand - likely because of higher mortgage rates - but we need to keep an eye on new listings too.

On a national basis, we saw record low inventory levels over the Winter. Last year, inventory didn’t bottom seasonally until early April. This year inventory bottomed in February (normal seasonal timing), and recent data from Altos Research and Realtor.com, indicate active inventory was up year-over-year in May. I expect the local market reports will show inventory up year-over-year in May too.

...

And here is a table for new listings in May. For these areas, new listings were up 5.0% YoY. Last month, new listings in these markets were down 6.2% YoY. This could be a significant change, and the first sign of a pickup in new listings. If new listings increase, combined with less demand, we will see active inventory increase quickly.Notes for all tables:

1) New additions to table in BOLD.

2) Northwest (Seattle), North Texas (Dallas) and Santa Clara (San Jose), Mid-Florida (Tampa, Orlando), Jacksonville, Source: Northeast Florida Association of REALTORS®

3) Totals do not include Denver or Atlanta (included in state totals).

Housing Inventory June 13th Update: Inventory up 15.9% Year-over-year

by Calculated Risk on 6/13/2022 09:53:00 AM

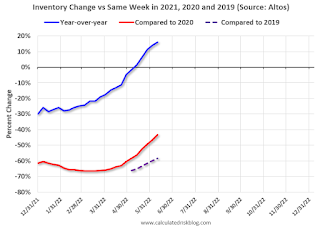

Altos reports inventory is up 15.9% year-over-year.

Inventory usually declines in the winter, and then increases in the spring. Inventory bottomed seasonally at the beginning of March 2022 and is now up 64% since then.

This inventory graph is courtesy of Altos Research.

Inventory is still very low. Compared to the same week in 2021, inventory is up 15.9% from 342 thousand, however compared to the same week in 2020 inventory is down 43.2% from 698 thousand. Compared to 3 years ago, inventory is down 58.3% from 950 thousand.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 43.2% according to Altos)

4. Inventory up compared to 2019 (currently down 58.2%).

Five High Frequency Indicators for the Economy

by Calculated Risk on 6/13/2022 08:26:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices. Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

The TSA is providing daily travel numbers.

This data is as of June 12th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 12.6% from the same day in 2019 87.4% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $185 million last week, down about 26% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through June 4th. The occupancy rate was down 12.1% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

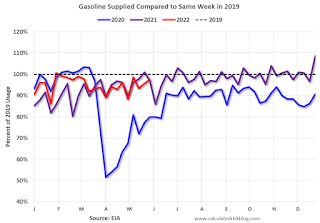

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of June 3rd, gasoline supplied was down 2.6% compared to the same week in 2019.

Recently gasoline supplied has been running somewhat below 2019 levels.

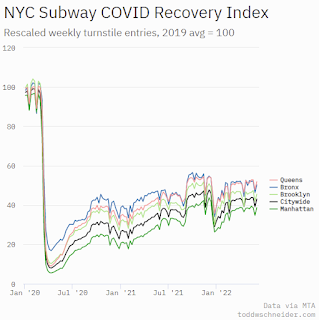

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, June 10th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, June 12, 2022

Sunday Night Futures

by Calculated Risk on 6/12/2022 07:09:00 PM

Weekend:

• Schedule for Week of June 12, 2022

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are down 37, and DOW futures are down 156 (fair value).

Oil prices were mixed over the last week with WTI futures at $118.73 per barrel and Brent at $120.00 per barrel. A year ago, WTI was at $69 and Brent was at $71 - so WTI oil prices are up 70% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $5.01 per gallon. A year ago prices were at $3.07 per gallon, so gasoline prices are up $1.94 per gallon year-over-year.

FOMC Preview: 50bp Hike

by Calculated Risk on 6/12/2022 09:41:00 AM

Update: From Goldman Sachs chief economist Jan Hatzius

"We have revised our forecast to include 75bp hikes in June and July. This would quickly reset the level of the funds rate at 2.25-2.5%, the FOMC’s median estimate of the neutral rate."Expectations are the FOMC will announce a 50bp rate increase in the federal funds rate at the meeting this week.

emphasis added

"We don’t expect major fireworks at the June FOMC meeting. Chair Powell and the Fed has communicated that they are likely to hike by 50bp at this meeting (as well as at the next meeting in July) and we expect them to deliver. What will be of interest will be the updated Summary of Economic Projections (SEP) and dot plot.Update: From Goldman Sachs:

...

In the press conference, we expect Chair Powell to reiterate that labor market momentum is still too strong, inflation remains a big problem, and that the Fed is committed to restoring price stability. We don’t expect any concrete forward guidance beyond the next meeting, with Powell noting a reassessment in the path of hikes in September dependent on convincing signs that inflation is slowing. If asked about a pause in September, he is likely to outright dismiss the idea."

The FOMC is likely to respond to the firmer inflation print and the rise in long-term inflation expectations with a resolutely hawkish message at the June meeting, in addition to the 50bp rate hike it is set to deliver. This should come across clearly in the statement, the economic projections, and the dots.

We expect the FOMC to revise the policy guidance in its statement to say that the Committee “anticipates that raising the target range expeditiously will be appropriate until it sees clear and convincing evidence that inflation is moderating,” implying a high bar for reverting to 25bp hikes.

Wall Street forecasts are being revised down for 2022 due to the ongoing negative impacts from the pandemic and the war in Ukraine. So, GDP for 2022 will likely be revised down.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Mar 2022 | 2.5 to 3.0 | 2.1 to 2.5 | 1.8 to 2.0 | |

The unemployment rate was at 3.6% in May. The question is: Will the slowdown in economic growth push up the unemployment rate? Or will the rate continue to decline? The projections for the unemployment rate will likely be mostly unchanged.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Mar 2022 | 3.4 to 3.6 | 3.3 to 3.6 | 3.2 to 3.7 | |

As of April 2022, PCE inflation was up 6.3% from April 2021. This was below the cycle high of 6.6%. Based on recent readings, inflation might stay elevated longer than expected. PCE inflation will likely be revised up for 2022.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Mar 2022 | 4.1 to 4.7 | 2.3 to 3.0 | 2.1 to 2.4 | |

PCE core inflation was up 4.9% in April year-over-year. This was below the cycle high of 5.3%. Core PCE inflation will also likely be revised up.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2022 | 2023 | 2024 | |

| Mar 2022 | 3.9 to 4.4 | 2.4 to 3.0 | 2.1 to 2.4 | |

Saturday, June 11, 2022

Real Estate Newsletter Articles this Week

by Calculated Risk on 6/11/2022 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• 1st Look at Local Housing Markets in May, Inventory up Sharply

• Current State of the Housing Market

• Homebuilder Comments in May: “Builder metrics quickly deteriorating"

• The Home ATM Still Open in Q1 2022; Closing Soon

• 30-Year Mortgage Rates increase to 5.85%

• Black Knight Mortgage Monitor: "Housing costs to current income levels within a whisper of all time high in 2006"

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of June 12, 2022

by Calculated Risk on 6/11/2022 08:11:00 AM

The key reports this week are May Retail sales and Housing Starts.

For manufacturing, Industrial Production, and the NY and Philly Fed manufacturing surveys, will be released this week.

The FOMC meets this week, and they are expected to raise rates 50bp.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for May.

8:30 AM: The Producer Price Index for May from the BLS. The consensus is for a 0.8% increase in PPI, and a 0.6% increase in core PPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

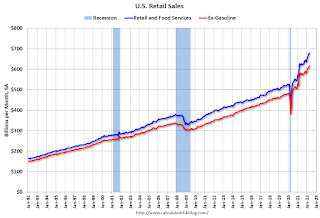

8:30 AM: Retail sales for May is scheduled to be released. The consensus is for a 0.2% increase in retail sales.

8:30 AM: Retail sales for May is scheduled to be released. The consensus is for a 0.2% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM: The New York Fed Empire State manufacturing survey for June. The consensus is for a reading of 4.5, up from -11.6.

10:00 AM: The June NAHB homebuilder survey. The consensus is for a reading of 68, down from 69 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate by 50bp at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215 thousand down from 229 thousand last week.

8:30 AM ET: Housing Starts for May.

8:30 AM ET: Housing Starts for May. This graph shows single and total housing starts since 1968.

The consensus is for 1.700 million SAAR, down from 1.724 million SAAR in April.

8:30 AM: the Philly Fed manufacturing survey for June. The consensus is for a reading of 5.3, up from 2.6.

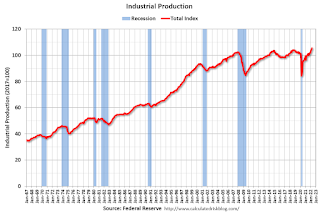

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 79.2%.

10:00 AM: State Employment and Unemployment (Monthly) for May 2022

Friday, June 10, 2022

COVID June 10, 2022: Cases, Hospitalizations and Deaths Increasing

by Calculated Risk on 6/10/2022 09:12:00 PM

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.7% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.6 | --- | ≥2321 | |

| New Cases per Day3🚩 | 106,874 | 99,715 | ≤5,0002 | |

| Hospitalized3🚩 | 23,292 | 22,043 | ≤3,0002 | |

| Deaths per Day3🚩 | 291 | 262 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.