by Calculated Risk on 6/24/2022 01:32:00 PM

Friday, June 24, 2022

Q2 GDP Forecasts: Fairly Wide Range

From BofA:

We continue to track 1.5% qoq saar growth for 2Q, unchanged from last week. We continue to forecast 2.3% GDP growth for 2022 and expect growth to slow to 1.4% and 0.8% in 2023 and 2024, respectively as the lagged effects of tighter monetary policy and financial conditions cool the economy. [June 24 estimate]From Goldman:

emphasis added

Following today’s data, we boosted our Q2 GDP tracking estimate by 0.1pp to +2.9% (qoq ar) [June 24 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is 0.0 percent on June 16, unchanged from June 15 after rounding. [June 16 estimate]

May New Home Sales Increase, Over 5 Months of Inventory Under Construction

by Calculated Risk on 6/24/2022 11:23:00 AM

Today, in the Calculated Risk Real Estate Newsletter: May New Home Sales Increase, Over 5 Months of Inventory Under Construction

Brief excerpt:

The next graph shows the months of supply by stage of construction. “Months of supply” is inventory at each stage, divided by the sales rate.You can subscribe at https://calculatedrisk.substack.com/.

There are just over 0.68 months of completed supply (red line). This is about half the normal level.

The inventory of new homes under construction is at 5.0 months (blue line) - well above the normal level. This elevated level of homes under construction is due to supply chain constraints. This is close to the record set in 1980.

And a record 115 thousand homes have not been started - about 2.0 months of supply (grey line) - almost double the normal level. Homebuilders are probably waiting to start some homes until they have a firmer grasp on prices and demand.

New Home Sales Increase to 696,000 Annual Rate in May

by Calculated Risk on 6/24/2022 10:09:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 696 thousand.

The previous three months were revised up, combined.

Sales of new single‐family houses in May 2022 were at a seasonally adjusted annual rate of 696,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 10.7 percent above the revised April rate of 629,000, but is 5.9 percent below the May 2021 estimate of 740,000.

emphasis added

Click on graph for larger image.

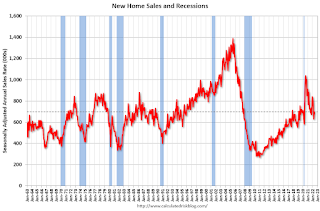

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales are now at pre-pandemic levels.

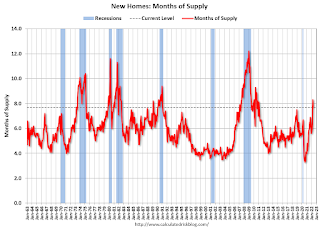

The second graph shows New Home Months of Supply.

The months of supply decreased in May to 7.7 months from 8.3 months in April.

The months of supply decreased in May to 7.7 months from 8.3 months in April. The all-time record high was 12.1 months of supply in January 2009. The all-time record low was 3.5 months, most recently in October 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of May was 444,000. This represents a supply of 7.7 months at the current sales rate."

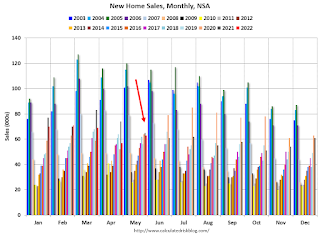

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In May 2022 (red column), 63 thousand new homes were sold (NSA). Last year, 65 thousand homes were sold in May.

The all-time high for May was 120 thousand in 2005, and the all-time low for May was 26 thousand in 2010.

This was above expectations, and sales in the three previous months were revised up, combined. I'll have more later today.

Black Knight: "Past-Due Mortgages Fall to Third Consecutive Record Low in May"

by Calculated Risk on 6/24/2022 08:30:00 AM

From Black Knight: Black Knight’s First Look: Past-Due Mortgages Fall to Third Consecutive Record Low in May; Serious Delinquencies, Foreclosure Starts See Continued Improvement

• The national delinquency rate fell five basis points from April to 2.75% in May, continuing the downward trend in overall delinquencies of the prior two months and marking yet another new lowAccording to Black Knight's First Look report, the percent of loans delinquent decreased 1.9% in May compared to April and decreased 42% year-over-year.

• Following typical seasonal patterns, early-stage delinquencies – borrowers who have missed a single mortgage payment – edged marginally higher (+0.2%) month over month

• While serious delinquencies saw strong improvement, falling 7% from April, the population of such loans (those 90 or more days past due but not yet in foreclosure) remains 45% above pre-pandemic levels

• Despite elevated serious delinquency levels, foreclosure starts dropped 12% from April and continue to hold well below pre-pandemic levels while active foreclosures edged slightly higher

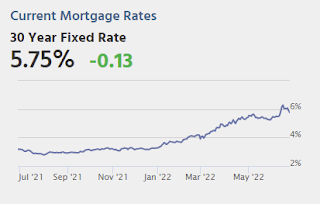

• Prepayment activity fell by 11.1% from the prior month and is now down 59.1% year over year on sharply higher interest rates

emphasis added

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 2.75% in May, down from 2.80% in April.

The percent of loans in the foreclosure process increased in May to 0.33%, from 0.32% in April. This is increasing from very low levels due to the foreclosure moratoriums.

The number of delinquent properties, but not in foreclosure, is down 1,050,000 properties year-over-year, and the number of properties in the foreclosure process is up 26,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| May 2022 | Apr 2022 | May 2021 | May 2020 | |

| Delinquent | 2.75% | 2.80% | 4.73% | 7.76% |

| In Foreclosure | 0.33% | 0.32% | 0.28% | 0.38% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,461,000 | 1,496,000 | 2,511,000 | 4,123,000 |

| Number of properties in foreclosure pre-sale inventory: | 174,000 | 173,000 | 148,000 | 200,000 |

| Total Properties | 1,635,000 | 1,669,000 | 2,659,000 | 4,323,000 |

Thursday, June 23, 2022

Friday: New Home Sales

by Calculated Risk on 6/23/2022 08:42:00 PM

Friday:

• At 10:00 AM ET, New Home Sales for May from the Census Bureau. The consensus is for 580 thousand SAAR, down from 591 thousand in April.

• Also, at 10:00 AM, University of Michigan's Consumer sentiment index (Final for June). The consensus is for a reading of 50.2.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.8% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.9 | --- | ≥2321 | |

| New Cases per Day3 | 97,430 | 103,175 | ≤5,0002 | |

| Hospitalized3🚩 | 24,831 | 24,358 | ≤3,0002 | |

| Deaths per Day3 | 255 | 285 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Fed: Banks Pass Annual Stress Test

by Calculated Risk on 6/23/2022 04:40:00 PM

From the Federal Reserve: Federal Reserve Board releases results of annual bank stress test, which show that banks continue to have strong capital levels, allowing them to continue lending to households and businesses during a severe recession

The Federal Reserve Board on Thursday released the results of its annual bank stress test, which showed that banks continue to have strong capital levels, allowing them to continue lending to households and businesses during a severe recession.Test results here.

All banks tested remained above their minimum capital requirements, despite total projected losses of $612 billion. Under stress, the aggregate common equity capital ratio—which provides a cushion against losses—is projected to decline by 2.7 percentage points to a minimum of 9.7 percent, which is still more than double the minimum requirement.

Realtor.com Reports Weekly Inventory Up 21% Year-over-year

by Calculated Risk on 6/23/2022 03:01:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released yesterday from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending June 18, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

• New listings–a measure of sellers putting homes up for sale–were up 6% above one year ago. Home sellers in many markets across the country continue to benefit from rising home prices and fast-selling homes. That’s prompted a growing number of homeowners to sell homes this year compared to last, giving home shoppers much needed options. We’ve seen more homes come up for sale this year compared to last year in 11 of the last 12 weeks.

• Active inventory continued to grow, rising 21% above one year ago. Inventory was roughly even with last year’s levels at the beginning of May and the gains have mounted each week. Still, our May Housing Trends Report showed that the active listings count remained nearly 50 percent below its level at the beginning of the pandemic. In other words, we’re starting to add more options, but the market needs even more before home shoppers have a selection that’s roughly equivalent to the pre-pandemic housing market.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note the rapid increase in the YoY change, from down 30% at the beginning of the year, to up 21% YoY now. It will be important to watch if that trend continues.

New Home Sales and Cancellations

by Calculated Risk on 6/23/2022 12:02:00 PM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales and Cancellations

Brief excerpt:

Here is a table of selected public builders and the currently reported cancellation rate (I’m still gathering data). There is some seasonality to cancellation rates. The only builder that reported a sharp increase recently was KB Home comparing the three months ended May 31, 2022, with the three months ended May 31, 2021.There is much more in the newsletter.“The cancellation rate as a percentage of gross orders was 17%, compared to 9%.”However, as KB Home noted on their conference call yesterday, a large portion of the increase in cancellations were on “unstarted homes”.

...

Currently cancellation rates are below normal for the home builders. As an example, Toll Brothers recently announced a cancellation rate of 3.8%, down from 4.3% the previous quarter, and well below their historical rate of 7%. During the housing bust, Toll Brothers cancellation rates peaked close to 40%.

You can subscribe at https://calculatedrisk.substack.com/.

June Vehicle Sales Forecast: Increase to 13.3 million SAAR

by Calculated Risk on 6/23/2022 10:11:00 AM

From WardsAuto: June U.S. Light-Vehicle Sales to Improve on May; Stay Softer than January-April (pay content). Brief excerpt:

"If the June forecast holds firm, volume will rise in Q2 from Q1, but the quarter will end at a 13.5-million-unit annualized rate, a drop from January-March’s 14.1 million ..."

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for June (Red).

The Wards forecast of 13.4 million SAAR, would be up about 5% from last month, and down 14% from a year ago (sales were starting to weaken in June 2021, due to supply chain issues).

Weekly Initial Unemployment Claims at 229,000

by Calculated Risk on 6/23/2022 08:36:00 AM

The DOL reported:

In the week ending June 18, the advance figure for seasonally adjusted initial claims was 229,000, a decrease of 2,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 229,000 to 231,000. The 4-week moving average was 223,500, an increase of 4,500 from the previous week's revised average. The previous week's average was revised up by 500 from 218,500 to 219,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 223,500.

The previous week was revised up.

Weekly claims were higher than the consensus forecast.