by Calculated Risk on 6/30/2022 08:33:00 AM

Thursday, June 30, 2022

Weekly Initial Unemployment Claims at 231,000

The DOL reported:

In the week ending June 25, the advance figure for seasonally adjusted initial claims was 231,000, a decrease of 2,000 from the previous week's revised level. The previous week's level was revised up by 4,000 from 229,000 to 233,000. The 4-week moving average was 231,750, an increase of 7,250 from the previous week's revised average. The previous week's average was revised up by 1,000 from 223,500 to 224,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 231,750.

The previous week was revised up.

Weekly claims were higher than the consensus forecast.

Wednesday, June 29, 2022

Thursday: Personal Income & Outlays, Unemployment Claims, Chicago PMI

by Calculated Risk on 6/29/2022 08:31:00 PM

Thursday:

• Early, Census Bureau to Release Vintage 2021 Population Estimates (this might be delayed)

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 230 thousand up from 229 thousand last week.

• At 8:30 AM, Personal Income and Outlays, May 2022. The consensus is for a 0.5% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.4%. PCE prices are expected to be up 6.2% YoY, and core PCE prices up 4.7% YoY.

• At 9:45 AM: Chicago Purchasing Managers Index for June.

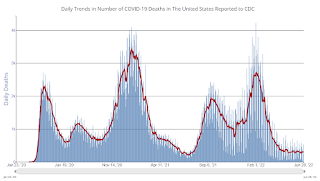

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.9% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 222.1 | --- | ≥2321 | |

| New Cases per Day3🚩 | 108,505 | 99,702 | ≤5,0002 | |

| Hospitalized3🚩 | 26,232 | 25,023 | ≤3,0002 | |

| Deaths per Day3🚩 | 321 | 283 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Update: Framing Lumber Prices Down 21% Year-over-year; Still up Sharply from Pre-pandemic Levels

by Calculated Risk on 6/29/2022 01:22:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME random length framing futures through June 29th.

Prices are still up sharply from the pre-pandemic levels of around $400.

Click on graph for larger image.

Click on graph for larger image.The slowdown in housing - and some supply improvement - has pushed down prices.

Several commodities are showing year-over-year price declines, and this will take some of the pressure off of inflation.

Worst Housing Affordability" since 1991 excluding Bubble; Real House Prices and Price-to-Rent Ratio in April

by Calculated Risk on 6/29/2022 10:00:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Worst Housing Affordability" since 1991 excluding Bubble

Excerpt:

I’ve put together my own affordability index - since 1976 - that is similar to the FirstAm approach (more of a house price index adjusted by mortgage rates and the median household income).

I used median income from the Census Bureau (estimated 2021 and 2022), assumed a 15% down payment, and used a 2% estimate for property taxes, insurance and maintenance. This is probably low for high property tax states like New Jersey and Texas, and too high for lower property tax states. If we were including condos, we’d also include HOA fees too (this is excluded).

For house prices, I used the Case-Shiller National Index, Seasonally Adjusted (SA). Also, for the down payment - there wasn’t a significant difference between 15% and 20%. For mortgage rates, I used the Freddie Mac PMMS (30-year fixed rates).

So here is what the index looks like (lower is more affordable like the FirstAm index):

Note that by this index, during the early ‘80s, homes were very unaffordable due to the very high mortgage rates. During the housing bubble, houses were also less affordable using 30-year mortgage rates, however, during the bubble, there were many “affordability products” that allowed borrowers to be qualified at the teaser rate (usually around 1%) that made houses seem more affordable.

In general, this would suggest houses are the least affordable since the housing bubble. And excluding the bubble - with all the “affordability products” - this is the worst affordability since 1989.

Look down to the second graph below (real house prices) and look what happened after 1989. It took more than a decade to return to 1989 prices in real terms.

Also, in April, the average 30-year mortgage rates were around 5.2%, and currently mortgage rates are close to 6.0% - so we already know the “Affordability Price Index” will increase further over the next couple of months (meaning houses are even less affordable).

Q1 GDP Growth Revised down to minus 1.6% Annual Rate

by Calculated Risk on 6/29/2022 08:35:00 AM

From the BEA: Gross Domestic Product (Third Estimate), GDP by Industry, and Corporate Profits (Revised), First Quarter 2022

Real gross domestic product (GDP) decreased at an annual rate of 1.6 percent in the first quarter of 2022, according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2021, real GDP increased 6.9 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised down from 3.1% to 1.8%. Residential investment was unrevised at 0.4%.

The "third" estimate of GDP released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the decrease in real GDP was 1.5 percent. The update primarily reflects a downward revision to personal consumption expenditures (PCE) that was partly offset by an upward revision to private inventory investment

emphasis added

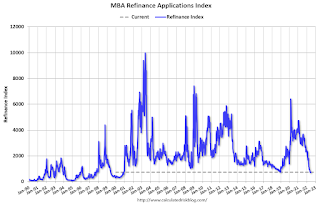

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 6/29/2022 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 24, 2022. This week’s results include an adjustment for the observance of the Juneteenth holiday.

... The Refinance Index increased 2 percent from the previous week and was 80 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 0.1 percent from one week earlier. The unadjusted Purchase Index decreased 21 percent compared with the previous week and was 24 percent lower than the same week one year ago.

“Mortgage rates continue to experience large swings. After increasing 65 basis points during the past three weeks, the 30-year fixed rate declined 14 basis points last week to 5.84 percent. Rates are still significantly higher than they were a year ago, when the 30-year fixed rate was at 3.2 percent,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The decline in mortgage rates led to a slight increase in refinancing, driven by an uptick in conventional loans. However, refinances are still 80 percent lower than a year ago and more than 60 percent below the historical average.”

Added Kan, “Overall purchase activity has weakened in recent months due to the quick jump in mortgage rates, high home prices, and growing economic uncertainty. Purchase applications were essentially flat last week but were supported by a 6 percent increase in government loans. The average purchase loan amount declined to $413,500, which is an ongoing downward trend since it hit a record $460,000 in March 2022.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 5.84 percent from 5.98 percent, with points decreasing to 0.64 from 0.77 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

According to the MBA, purchase activity is down 24% year-over-year unadjusted.

According to the MBA, purchase activity is down 24% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, June 28, 2022

Wednesday: GDP

by Calculated Risk on 6/28/2022 08:41:00 PM

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• 8:30 AM, Gross Domestic Product, 1st quarter 2022 (Third estimate). The consensus is that real GDP decreased 1.5% annualized in Q1, unchanged from the second estimate of a 1.5% decrease.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.9% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 222.1 | --- | ≥2321 | |

| New Cases per Day3🚩 | 110,353 | 92,772 | ≤5,0002 | |

| Hospitalized3🚩 | 25,549 | 24,923 | ≤3,0002 | |

| Deaths per Day3🚩 | 307 | 267 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

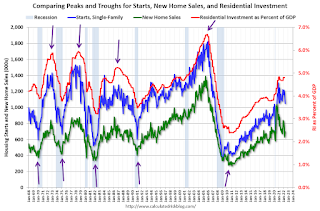

Predicting the Next Recession

by Calculated Risk on 6/28/2022 01:53:00 PM

The recession callers are back, and some like ARK's Cathie Wood and Home Depot's Ken Langone claim the US is already in a recession. I disagree. We did see negative real GDP growth in Q1, and we might see negative real GDP growth in Q2 - but this doesn't mean the US economy is in a recession.

In that 2013 post, I wrote:

The next recession will probably be caused by one of the following (from least likely to most likely):Unfortunately, in 2020, one of those low probability events happened (pandemic), and that led to a recession in 2020.

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

emphasis added

2) Significant policy error. Two examples: not reaching a fiscal agreement and going off the "fiscal cliff" probably would have led to a recession, and Congress refusing to "pay the bills" would have been a policy error that would have taken the economy into recession.We've seen several policy errors, mostly related to immigration and trade during the previous administration, but none that would lead the economy into a recession.

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession.And this most common cause of a recession is the current concern. Since inflation picked up, mostly due to the pandemic (stimulus spending, supply constraints) and due to the invasion of Ukraine, the Fed has embarked on a tightening cycle to slow inflation.

Click on graph for larger image.

Click on graph for larger image.The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

New home sales and single-family starts turned down, but this was partly due to the huge surge in sales during the pandemic. Residential investment might be peaking.

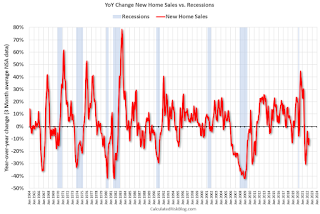

The second graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average) are down 10% year-over-year.

The second graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average) are down 10% year-over-year.Note: the New Home Sales data is smoothed using a three month centered average before calculating the YoY change. The Census Bureau data starts in 1963.

Some observations:

1) When the YoY change in New Home Sales falls about 20%, usually a recession will follow. An exception for this data series was the mid '60s when the Vietnam buildup kept the economy out of recession. Another exception was the recent situation - we saw a YoY decline in new home sales related to the pandemic and the surge in new home sales in the second half of 2020. Ignore this pandemic distortion!

2) It is also interesting to look at the '86/'87 and the mid '90s periods. New Home sales fell in both of these periods, although not quite 20%. As I noted in earlier posts, the mid '80s saw a surge in defense spending and MEW that more than offset the decline in New Home sales. In the mid '90s, nonresidential investment remained strong.

If the Fed tightening cycle will lead to a recession, we should see housing turn down first (new home sales, single family starts, residential investment). This might be happening, but this usually leads the economy by a year or more. So, we might be looking at a recession in 2023.

Comments on April Case-Shiller and FHFA House Price Increases

by Calculated Risk on 6/28/2022 11:18:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller National Index up 20.4% Year-over-year in April

Excerpt:

This graph below shows existing home months-of-supply (inverted, from the NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999 through April 2022).

Note that the months-of-supply is not seasonally adjusted.

There is a clear relationship, and this is no surprise (but interesting to graph). If months-of-supply is high, prices decline. If months-of-supply is low (like now), prices rise quickly.

In April, the months-of-supply was at 2.2 months, and the Case-Shiller National Index (SA) increased 1.50% month-over-month. The black arrow points to the April 2022 dot. In the May existing home sales report, the NAR reported months-of-supply increased to 2.6 months.Since inventory is now increasing quickly (but still low), we should expect price increases to slow. The normal level of inventory is probably in the 4 to 6 months range, and we will have to see a significant increase in inventory to sharply slow price increases, and that is why I’m focused on inventory!

This was slightly below expectations. There is a significant lag to this data, see: When will House Price Growth Slow? Since Case-Shiller is a 3-month average, and this report was for April (includes February and March closings), this included price increases when mortgage rates were significantly lower than today. This report includes some homes with contracts signed last December (that closed in February)!

Case-Shiller: National House Price Index Increased 20.4% Year-over-year in April

by Calculated Risk on 6/28/2022 09:29:00 AM

Note: S&P hasn't updated their data yet.

From Diana Olick at CNBC: Home price increases slowed for the first time in months in April, says S&P Case-Shiller

Prices rose 20.4% nationally in April compared with the same month a year ago, according to the S&P CoreLogic Case-Shiller Index. In March, home prices grew 20.6%. ...This was slightly below expectation.

The 10-city composite annual increase was 19.7%, up from 19.5% in March. The 20-city composite posted a 21.2% annual gain, up from 21.1% in the previous month.

Note that this monthly home price index release was for April, and "April" is a 3-month average of February, March and April closing prices. February closing prices include some contracts signed last December, so there is a significant lag to this data.