by Calculated Risk on 7/06/2022 10:04:00 AM

Wednesday, July 06, 2022

BLS: Job Openings Decreased to 11.3 million in May

From the BLS: Job Openings and Labor Turnover Summary

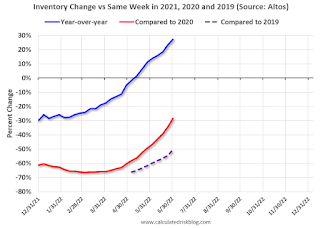

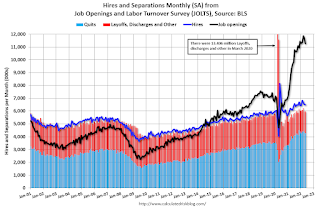

The number of job openings decreased to 11.3 million on the last business day of May, the U.S. Bureau of Labor Statistics reported today. Hires and total separations were little changed at 6.5 million and 6.0 million, respectively. Within separations, quits (4.3 million) and layoffs and discharges (1.4 million) were little changed.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the employment report this Friday will be for June.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings decreased in May to 11.254 million from 11.681 million in April.

The number of job openings (black) were up 17% year-over-year.

Quits were up 11% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 7/06/2022 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 1, 2022. This week’s results include a holiday adjustment to account for early closings the Friday before Independence Day.

... The Refinance Index decreased 8 percent from the previous week and was 78 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index increased 7 percent compared with the previous week and was 17 percent lower than the same week one year ago.

“Mortgage rates decreased for the second week in a row, as growing concerns over an economic slowdown and increased recessionary risks kept Treasury yields lower. Mortgage rates have increased sharply thus far in 2022 but have fallen 24 basis points over the past two weeks, with the 30-year fixed rate at 5.74 percent,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Rates are still significantly higher than they were a year ago, which is why applications for home purchases and refinances remain depressed. Purchase activity is hamstrung by ongoing affordability challenges and low inventory, and homeowners still have reduced incentive to apply for a refinance."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) decreased to 5.74 percent from 5.84 percent, with points increasing to 0.65 from 0.64 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

According to the MBA, purchase activity is down 17% year-over-year unadjusted.

According to the MBA, purchase activity is down 17% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, July 05, 2022

Wednesday: Job Openings, ISM Services, FOMC Minutes

by Calculated Risk on 7/05/2022 09:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• 10:00 AM, Job Openings and Labor Turnover Survey for May from the BLS. Jobs openings decreased in April to 11.400 million from 11.855 million in March.

• Also at 10:00 AM, the ISM Services Index for June. The consensus is for a reading of 54.5, down from 55.9.

• At 2:00 PM, FOMC Minutes, Meeting of June 14-15, 2022

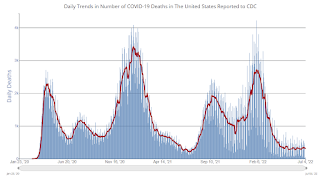

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.9% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 222.3 | --- | ≥2321 | |

| New Cases per Day3 | 94,345 | 113,184 | ≤5,0002 | |

| Hospitalized3 | 23,459 | 26,162 | ≤3,0002 | |

| Deaths per Day3 | 295 | 340 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

30-Year Mortgage Rates Decrease to 5.50%

by Calculated Risk on 7/05/2022 03:56:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 30-Year Mortgage Rates Decrease to 5.50%

Excerpt:

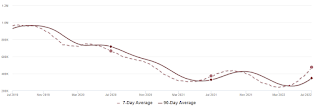

After reaching 6.28% on June 14th, 30-year mortgage rates have decreased to 5.50% today according to Mortgagenewsdaily.com. The 10-year Treasury yield has fallen to 2.82%, apparently on “recession fears”, even though it is pretty clear the economy is not in a recession.

... Here is a graph from Mortgagenewsdaily.com that shows the 30-year mortgage rate since 2010. Although mortgage rates have fallen sharply over the last 2 weeks, rates are still much higher than earlier this year.

...

The sharp increase in rates in mid-June was related to a stronger than expected CPI report. Since then, inflation readings have been closer to expectations.

Heavy Truck Sales Solid in June

by Calculated Risk on 7/05/2022 10:30:00 AM

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the June 2022 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all-time high of 570 thousand SAAR in April 2019.

Click on graph for larger image.

Click on graph for larger image.Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales really declined at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

CoreLogic: House Prices up 20.2% YoY in May

by Calculated Risk on 7/05/2022 08:00:00 AM

Notes: This CoreLogic House Price Index report is for May. The recent Case-Shiller index release was for April. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Data: National Home Price Gains Continue to Exceed 20% in May

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for May 2022.

Though U.S. home price growth relaxed slightly in May from April, it remained in double digits year over year for the 16th consecutive month. As in past months, all states and Washington, D.C. posted annual appreciation, with 13 states posting gains of more than 20%. While rising interest rates cooled overheated demand this spring and are expected to contribute to slowing price growth over the next year, motivated buyers may have less competition and more opportunities moving forward.

“Slowing home price growth reflects the dampening consequence of higher mortgage rates on housing demand, which was the intention,” said Selma Hepp, deputy chief economist at CoreLogic. “With monthly mortgage expenses up about 50% from only a few months ago, fewer buyers are now competing for continually limited inventory. And while annual home price growth still exceeds 20%, we expect to see a rapid deceleration in the rate of growth over the coming year. Nevertheless, the normalization of overheated buying conditions should bring about more of a balance between buyers and sellers and a healthier overall housing market.”

...

U.S. home prices (including distressed sales) increased 20.2% in May 2022, compared to May 2021. On a month-over-month basis, home prices increased by 1.8% compared to April 2022.

...

Annual U.S. home price gains are forecast to slow to 5% by May 2023 as rising mortgage rates and affordability challenges are expected to cool buyer demand.

emphasis added

Monday, July 04, 2022

Tuesday: CoreLogic House Prices

by Calculated Risk on 7/04/2022 11:25:00 PM

Weekend:

• Schedule for Week of July 3, 2022

• House Price Declines: How Long for Real Prices to Recover?

• Housing Inventory July 4th Update: Inventory Almost Double from March Low

• Recession Measures and NBER

Tuesday:

• At 8:00 AM ET, Corelogic House Price index for May.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are up 24, and DOW futures are up 132 (fair value).

Oil prices were up over the last week with WTI futures at $110.66 per barrel and Brent at $113.50 per barrel. A year ago, WTI was at $73 and Brent was at $78 - so WTI oil prices are up 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.78 per gallon. A year ago, prices were at $3.11 per gallon, so gasoline prices are up $1.67 per gallon year-over-year.

House Price Declines: How Long for Real Prices to Recover?

by Calculated Risk on 7/04/2022 01:39:00 PM

Today, in the Calculated Risk Real Estate Newsletter: House Price Declines: How Long for Real Prices to Recover?

Excerpt:

Housing economist Tom Lawler sent me some old FHFA research from 2009: A Brief Examination of Previous House Price Declines. ... A conclusion from the research:First, house price downturns have tended to be long. The median time required to return to prior peak prices was 10½ to 20 years. Second, it tends to take longer for prices to rise from the trough to their former peak than it takes prices to decline from peak to trough. While the difference is small for Census Divisions and states, FHFA’s Metropolitan Statistical Area and Division (MSA) indexes suggest that the time from peak to trough tends to be about 3¾ years, whereas the median recovery period (from trough to prior peak) was 6⅔ years.

emphasis added... Here is a similar look at national prices using the real Case-Shiller index (adjusted for inflation).

The real return following the ‘79 peak was 6.5 years. It took 11 years for real prices to reach the previous peak following the peak in ‘89.

And it took 14.5 years to return to the real peak reached during the housing bubble.

This is a little premature, but following a downturn, it typically takes a long time for prices to return to the previous real price peak. Of course, homeowners think in nominal terms, and if prices just “stall”, they usually don’t notice the inflation adjusted price decline.

Housing Inventory July 4th Update: Inventory Almost Double from March Low

by Calculated Risk on 7/04/2022 09:40:00 AM

Inventory is increasing rapidly. Inventory bottomed seasonally at the beginning of March 2022 and is now up 97% since then. Almost double!

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 27.4% according to Altos)

4. Inventory up compared to 2019 (currently down 50.5%).

Five High Frequency Indicators for the Economy

by Calculated Risk on 7/04/2022 08:04:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices. Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

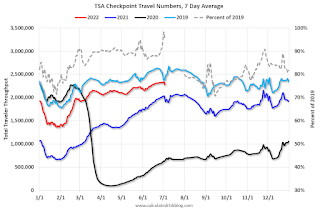

The TSA is providing daily travel numbers.

This data is as of July 3rd.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 5.1% from the same day in 2019 (94.9% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $206 million last week, down about 39% from the median for the week.

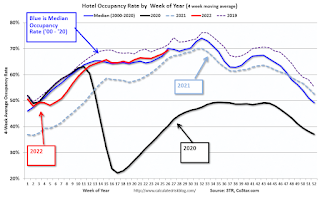

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through June 25th. The occupancy rate was down 4.1% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of June 24th, gasoline supplied was down 5.7% compared to the same week in 2019.

Recently gasoline supplied has been running somewhat below 2019 levels.

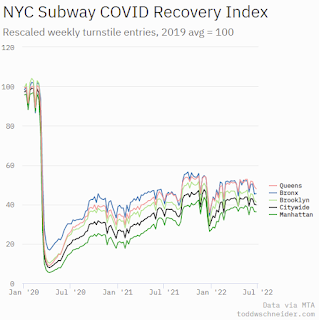

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This data is through Friday, July 1st.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".